ART SALES AND ART MARKET IN CHINA

China surpassed the United States in reported art sales in 2011. According to the New York Times. “In a country that barely had an art market in the early 1990s reported auction revenues in 2012 were up 900 percent over 2003 — to $8.9 billion. (The United States auction market for 2012 was $8.1 billion.). Concern about fraud and a cooling economy seem to have tempered enthusiasm in the Chinese art market somewhat. After peaking in 2011, reported revenues dropped off 24 percent in 2012, according to Arts Economics, a research company that studies the international market. This year is expected to be modestly better than 2012. [Source: David Barboza, Graham Bowley and Amanda Cox, New York Times, October 28, 2013]

In 2014, China was the largest art auction market in the world, making up 37.2 percent of the world’s art sales volume, followed by the U.S. with 32.1 percent and U.K. with 18.9 percent, according to a report released by Artron and Artprice. [Source: Zoe Li, Artnews, March 19, 2015]

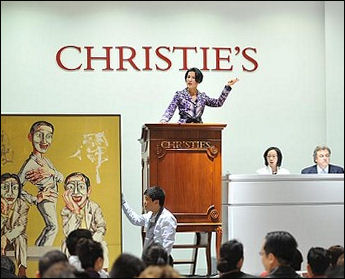

Multiple-estimate auction prices for stand-out Imperial pieces — as well as the sheer volume of other smaller transactions — have helped turn the trade in Chinese art and antiques into a worldwide business with an annual value of more than $10 billion. Asian and Chinese art is becoming increasingly fashionable among collectors. Christie’s recorded $364 million in sales in Hong Kong in 2006, a fivefold increase from 2001.

Determining the authenticity, date and value of Chinese antiques remains a challenge for auctioneers. In February, Duke’s auction house announced the discovery of a Yongle period (1403-1424) blue and white “moonflask” vase that it estimated was worth as much as much $1.5 million. . Even though authorities were split as to whether this is an early Ming vase or later a telephone bidder bought it for $170,000. [Source: Scott Reyburn Bloomberg News May 21, 2011]

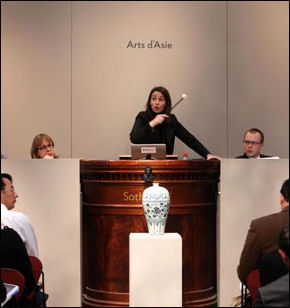

According to AFP: “The demand for Chinese antiquities has exploded, helping propel Hong Kong to third spot in the global auction market behind London and New York as collectors slap down eye-popping sums for a piece of the country's history. Helping drive the boom is a growing class of super-rich Chinese looking for opportunities to exploit their net worth while also "reclaiming" parts of Chinese history from Western collectors.Auction houses Sotheby's and Christie's together raised over $460 million from sales of Chinese antiquities and art works in 2011. [Source: AFP, February 2012]

Franz Lidz wrote in Slate: ““Many got rich quick on the back of their country's huge export trade and construction boom. The new elite is eager to build collections quickly, even at a premium. Impatience helps account for the soaring prices. “Too many people are chasing too few goods,” says Lark Mason, an expert in Asian art who appears frequently on PBS’ Antiques Roadshow. “During the 1980s, ’90s, and into the new century, there was ample Chinese material available because there were not enough buyers to drive the prices up and create scarcity. Today, vastly more people are capable of and interested in buying, but there’s not enough material on the market to satisfy them.” [Source: Franz Lidz, Slate, April 4, 2012]

See Separate Articles: 20TH CENTURY CHINESE ARTISTS: QI BAISHI ZHANG, DAQIAN AND OTHERS factsanddetails.com ; MAO ERA ART factsanddetails.com ; MODERN ART IN CHINA factsanddetails.com ; CHINESE MODERN ARTISTS: CAI GUO-QIANG, ZENG FANZHI, WANG GUANGYI AND OTHERS factsanddetails.com ; AI WEI WEI: HIS LIFE, ART AND POLITICAL ACTIVITIES factsanddetails.com ; CHINESE SHOCK ART, BODY PARTS, PHOTOGRAPHERS AND VIDEO AND GRAFFITI ARTISTS factsanddetails.com ; LOOTING CHINESE ART AND ARTIFACTS AND TRYING TO GET THEM BACK factsanddetails.com ; FORGING, BREAKING AND COPYING CHINESE ART factsanddetails.com ; HIGH PRICES PAID FOR CHINESE ART factsanddetails.com

Websites and Sources: Art Scene China Art Scene China ; Artron en.artron.net ; Saatchi Gallery saatchi-gallery.co.uk ; Graphic Arts washington.edu ; Yishu Journal yishujournal.com ; Asia Society asiasociety.org ; Art in Beijing Factory 798 in Beijing Wikipedia Wikipedia; Communist China Posters Landsberger Posters ; More Posters chinaposters.org ; More Posters still Ann Tompkins and Lincoln Cushing Collection ; Chinese Modern Artists Cai Guo Qiang.com caiguoqiang.com Guggenheim Show guggenheim.org ; Wikipedia article Wikipedia ; Zhang Xiaogang Saatchi Gallery saatchi-gallery.co.uk Wikipedia article ; Wikipedia ; Various works artnet.de ; Yue Minjun Works artnet.com

RECOMMENDED BOOKS: “A Modern History of China's Art Market” by Kejia Wu Amazon.com; “Chinese Antiquities: An Introduction to the Art Market (Handbooks in International Art Business) by Audrey Wang Amazon.com; “Collecting Chinese Art” by Sam Bernstein Amazon.com; “Collecting Chinese Art: Interpretation and Display” by Stacey Pierson Amazon.com; “Private Passions: Connoisseurship in Collecting Chinese Art” by Sam Bernstein Amazon.com; “The Compensations of Plunder: How China Lost Its Treasures” by Justin M. Jacobs Amazon.com ;

Growth of the Chinese Art Market

David Barboza, Graham Bowley and Amanda Cox wrote in the New York Times: “Even when you factor in faulty revenue reporting, the rise in art buying over the past decade has been meteoric, with Chinese banks, state-owned companies and business tycoons continuing to invest in the boom. Art has become a kind of currency, and collecting is so popular in China now that auctions are often mobbed. On Chinese television, more than 20 programs offer tips on collecting and on identifying cultural relics, and late-night infomercials promise quick riches to viewers who purchase a $2,500 collection of works by former students of renowned masters. Purchase today, the ad declares, and you can immediately secure a profit of $100,000. With so much at stake, Chinese art dealers have rushed to Europe and America to buy back Chinese relics. There has also been a rash of museum thefts involving Chinese antiquities. And a black market in artifacts has emerged, with so-called tomb raiders digging up buried treasures that they can sell. [Source: David Barboza, Graham Bowley and Amanda Cox, New York Times, October 28, 2013]

Even in the early 2000s, “the Chinese art market was still quite sleepy, a legacy of the Cultural Revolution when luxury items were viewed as bourgeois and the Red Guards raided homes, seizing and destroying art. Ma Weidu, a major collector based in Beijing, recounted how easy it still was in the 1980s to secure small artifacts. People gave them to him for nothing, he said, or traded them for a few cigarettes. Occasionally, he would pay a small fee. “They’d say: ‘Take it all. All I want is a washing machine,’” he recalled.

“The auctioning of art remained rare until the early 1990s, when the government lifted restrictions on the sale of cultural relics. Still, the art market did not begin to take off until 2004, fueled by rising incomes.” In 2013, there were “more than 350 Chinese auction houses that deal in fine arts. The two largest — Poly International Auction company, and China Guardian — are billion-dollar enterprises with offices in several cities, including Tokyo and New York, and close ties to the country’s ruling elite.

“But as the market has grown, so has its dark underbelly. Price manipulation is rampant, analysts say, as collectors and investors, perhaps an art investment fund with large holdings in a particular artist, bid up a work to boost the value of their entire inventory. Sometimes, experts say, auction houses themselves throw in fake bids. The Chinese have a name for the price-boosting process. They call it “stir frying.”

“While some collectors care deeply about their art, even exhibiting it in their own elaborate private museums, many buyers are primarily investors looking to flip a work for profit, experts say. Objects are sold and resold. One painting by Qi Baishi, “Fish and Shrimp,” sold four times at auction in the 10 years ending last December, the price climbing to $794,000 from $30,000 in 2002, before trailing off last year to $552,000.

“Resale opportunities are a priority for many buyers. At an auction in Beijing last month, four men from Guangzhou bought several paintings worth tens of thousands of dollars. “Most people you see here, we don’t have a real job, we are traders,” said one of the men, in a white bomber jacket. “We buy them and resell them to educated, wealthy people.” Analysts say that flipping artwork contributes to the market’s nonpayment problem. Before an auction, a buyer might find a collector interested in a piece and bid successfully for it, but refuse to pay if the deal with the collector falls through.

“Even with the fraud and fakery, many collectors and investors say there is too much excitement and profit in the market to warrant dropping out, especially when new money keeps showing up at auctions, ready to buy. “In the newspapers, there are always stories of someone buying something for a dollar and selling it for a million,” said Rui Zhang, who runs the art market and management programs at Tsinghua University in Beijing. But Jiang Yinfeng, an artist, critic and curator, said that the people who suffer in such an overheated market are often those with little experience in such matters. “Some of my friends use their houses as collateral to buy art items,” he said. “Some of them take high-interest loans.”

“One engine driving the Chinese art market has been the culture of gift-giving, which prompts provincial officials to arrive en masse in Beijing during the Mid-Autumn Festival in September, further clogging the congested streets as they ferry presents of art, alcohol and other items to senior government officials.

Main Chinese Auction Houses

work by Cai Guo Qiang Chinese auction houses are now selling works at a pace formerly associated with those in London and New York. One company that tracks the fine-art market, Artprice, reported that they were responsible for some $8.3 billion in sales in 2010, which would make them the world leader at that time.

Beijing Poly Auction is part of China Poly Group Corporation, a state owned Chinese business group among 102 central state owned enterprises under the supervision of State-owned Assets Supervision and Administration Commission of the State Council (SASAC). China Poly Group is a major a representative for Chinese defense manufacturing industry and the world's third largest art auction house (behind Sotheby's and Christie's). A profile of the company in The New York Times pointed that a visitor’s to the company’s headquarters in Beijing could buy a painting on the third floor and a missile system on 27th. Poly Technologies was formed in 1984 as an arms-manufacturing wing of the People's Liberation Army. [Source: Wikipedia]

China Guardian Auctions , or simply China Guardian is a mainland Chinese auction house that specialises in the auction of Chinese artwork of all types, with a particular emphasis on sale of Chinese calligraphy and ink paintings. Founded in May 1993 by Chen Dongsheng, China Guardian is China's oldest art-auction firm. It the a leader of the Chinese art auction market until Beijing Poly Auction arrived on the scene in the mid-2000s. China Guardian is now considered to be Mainland China's 'number 2 auctioneer' behind Beijing Poly International Auction. China Guardian was reported as the world's 4th largest auction house as of November 2012 after Sotheby's, Christie's and Beijing Poly. The CEO and managing director of the company, Hu Yanyan, who named in 2015 by the Financial Times as one of the five most powerful women in the Asian art world. Aside from its headquarters in Beijing and offices in Shanghai and Guangzhou, China Guardian also has offices in Hong Kong, Taiwan, Japan, New York and Canada

When China Guardian was established in 1993, it focused primarily on the Mainland Chinese market, It expanded into Hong Kong in 2012. China Guardian has sold porcelain, furniture, sculptures, rare books, rubbings, jewellery and watches but around 60 percent of China Guardian's sales are in ink painting and calligraphy. As of July 2016, China Guardian owned a 24 percent stake in Taiking Life Insurance Co., which in turn, owned 13.5 percent stake in the British auction house Sotheby's. Taiking Life Insurance Co and China Guardian were both founded by Chen Dongsheng.

Forces Behind the Surge of Buying Asian Art

The main driver behind the new arrivals in the market is simple: hundreds of thousands of Chinese people now have serious money to spend. According to the Hurun Rich List, the Chinese equivalent of the Forbes or Sunday Times rich lists, there are now 875,000 Chinese people worth over a million US dollars. And almost 200 of these are billionaires. But the real number is likely far higher.[Source: AFP, January 28, 2011]

“China probably now has the largest number of billionaires anywhere in the world,” Rupert Hoogewerf, founder and compiler of the list, told AFP. “We already know of 189 US dollar billionaires in China this year, but you can safely say that we have missed at least the same again, meaning there are between 400 and 500 US dollar billionaires today.”The average wealth on the list is $577 million, more than enough cash to dip a toe in the art market.

Chan Fo-kwong is one of the few to actually show his collection to the public — in his own museum in Hong Kong. The businessman bought much of his $128 million collection in auction houses in the US and Britain. He says patriotism is a force behind the sales. “These antiques originally belonged to China and it would be regretful to leave them overseas,” he told AFP, as he proudly showed off a sample of his works at a shopping mall in the city. “And that’s why I want to bring as many pieces as I can back to their home soil.”

Auction houses such as Sotheby’s and Christies are trying to figure out their tastes. One Sotheby executive told the Times of London,” A major part of our global strategy is to focus on how we deal with market in China.” A Christie’s executive said China collectors “are coming to the market with a new sensibility and a slightly different taste but with really deep pockets. The China have already changed the market.” [Source: Times of London]

Chinese Art Collectors

Christie's Hong Kong office “We have seen exponential growth by mainland Chinese buyers who were brought up during the Cultural Revolution,” Henry Howard-Sneyd, Sotheby’s vice chairman for Asian art, told New York Times. “These are successful business people with huge amounts of money at their disposal.” [Source: Scott Reyburn Bloomberg News May 21, 2011]

“The number of new millionaires in Asia is shooting up,” Charles Dupplin, a partner at the London-based insurer Hiscox Plc, told Bloomberg, ‘so too is the number of them who want to buy art. I can’t see anything that will hold this back. The client base that buys Old Masters is pretty constant and there is a problem with supply.” [Source: Scott Reyburn Bloomberg News May 21, 2011]

The current Chinese influx is fueled by the sort of new wealth that has made the country home to the world’s largest number of billionaires, according to the Hurun Rich List 2010, China’s version of the Forbes 400. The number of Chinese billionaires is expected to increase 20 percent each year through 2014, according to Artprice.

Christie’s Asia president Francois Curiel says Chinese collectors who want to repatriate works of art are now a huge factor in the global market. The firm sold $882.9 million in Asian art globally. Curiel predicts that the market for Chinese artworks will be the same as that for European and North American works by 2015. “I believe that we are just seeing the beginning here of the development of the art market,” he says. “There are more and more rich people. Art has become a new way of putting money away.” [Source: AFP, January 28, 2011]

In June 2010, a Chinese buyer paid $66 million for an 11th century calligarphy scroll. But it is not just Chinese works that are commanding high prices thanks to the last raised hand at an auction belonging to an Asian buyer. An anonymous telephone bidder, believed to be Chinese, paid a world record $106.5 million for Pablo Picasso’s “Nude, Green Leaves and Bust” at a Christie’s sale in New York in May. It was expected to sell for $80 million.

“Mainland Chinese are our main buyers, not only in Hong Kong where they are about 80 percent of our buyers, but also in New York, in London, in Geneva, in Paris,” said Curiel “They are absolutely everywhere now when there is a piece of fine Asian contemporary art, Chinese works of art, Chinese calligraphy and even Western art.”

Wealthy Chinese are also buying Chinese antiquities in record numbers, driving up prices to record levels. In 2007, a Chinese collector named Cai Mingchao paid $15 million for an early Ming, gilt-bronze Buddha, the highest price ever paid for a Chinese artwork. Cai told the Times of London he felt he got a bargain, “In the last century too many antiques left the country but now more are becoming available on international markets.” Christie’s reported that the four main buyers of Chinese art in Hong Kong were mainland Chinese. One of the biggest buyers, Xu Qiang, made a fortune from selling eels, and reportedly spends $4 million a year on porcelain, bronze and furniture.

Motivation, Taste and Sophistication of Chinese Art Collectors

More and more wealthy people are turning to buying artwork as they think about how to spend their money, according to art market expert Zhao Li. “Ancient Chinese works are their favorite because of their scarcity, plus, the value would be steady compared with contemporary ones.”

Robin Pogrebin wrote in the New York Times, “To some extent, auction experts say, the Chinese regard art not only as a sound way to diversify their portfolios but also as a tested means to project status as they interact with international business executives “the Arnaults and the Pinaults of the world,” said François Curiel, the president of Christie’s Asia, referring to the French billionaires Bernard Arnault and François Pinault. “They see works of art on their walls,” Mr. Curiel said, “and think, “If I want to be not just a millionaire but someone who plays with the big boys, I’d better be someone who collects art.” [Source: Robin Pogrebin, New York Times September 6, 2011]

Hong Kong art dealer Anthony Lin, who regularly bids at auctions on behalf of wealthy clients, says buyers from the People’s Republic of China (PRC) are usually collecting as an investment. “Patriotism is one popularly stated reason,” he told AFP. “But investment is probably the more pronounced objective. “There are limited opportunities in the PRC — the stock market and property sector are volatile areas. There are no commodity markets, futures or currency markets or the various funds readily available outside the PRC.”

The surge in Chinese collecting is not just a reflection of new wealth, experts say, but also a reaction to the repressive Mao years when the country was denied culture. For the Chinese, who watched art disparaged as a frivolous exercise except when put to didactic use, the freedom to explore simple aesthetic pleasures, to repossess historical works and to show off recent affluence has been liberating. “They have an interest in reclaiming their culture and their history,” Mr. Howard-Sneyd said.

The tide of buying is in some ways an effort to make up for lost time. “In China, for 50 or 60 years, nothing happened,” said Vishakha N. Desai, the president of Asia Society. “That’s a big break. The last 250 years were years of humiliation. They now feel an obligation to prize art again and bring it back.”

Robin Pogrebin wrote in the New York Times, “Because of that history, Chinese art buying “particularly the public display associated with an auction “is still a nascent phenomenon. Chinese collectors are only beginning to develop an artistic eye and expertise. “They don’t necessarily have the cultural or education background “they don’t have the context,” said Jehan Chu, an art consultant whose Hong Kong-based company, Vermillion Art Collections, helps buyers build their holdings. “There were no museums, no galleries until recently and not so much access to information.” [Source: Robin Pogrebin, New York Times September 6, 2011]

Some rich Chinese art collectors and members of the Communist party have been able to buy valuable art works from Western sources that were taken from China by foreigners. These collectors feel a great sense of pride restoring art work, regarded as stolen, to their homeland. In a widely publicized buy, the Poly Group--a former commercial branch of the People's Liberation Army and China’s most lucrative arms trading business--paid $4 million for three bronze heads — from a monkey, an ox and a tiger — that were taken by a colonial expeditionary from the zodiac fountain at Summer Palace in 1860. Now the heads sits in a small antique museum run by the Poly Group in Beijing.

Bribery and the Chinese Art Market

David Barboza, Graham Bowley and Amanda Cox wrote in the New York Times: “Art is also used in more elaborate bribery schemes. In some cases, an official will receive a work of art with instructions to put it up for auction; a businessman will use it as the currency for a bribe, purchasing the art at an inflated price and giving the official a tidy profit. “Unlike cash, the value is less obvious,” said Zhang Pingjie, a curator at the Himalayas Art Museum in Shanghai. [Source: David Barboza, Graham Bowley and Amanda Cox, New York Times, October 28, 2013]

Whether the given work is real often doesn’t matter, experts say, because the buyer intends to spend lavishly anyway. And were the scheme to be discovered, the minimal value of a fake would mean a lesser punishment.“The bribery of public officials with art is so widespread that the Chinese have coined a term to describe this kind of aesthetic corruption. They call it “yahui” or “elegant bribery.”

“One such bribery case occurred several years ago when the city of Chongqing cracked down on the gangsters who controlled its buses, taxis and gambling parlors. In 2009, the authorities detained the man who had protected the criminals: the city’s own deputy police chief, Wen Qiang. Searches of Mr. Wen’s properties turned up watches, wine and other items typical of graft around the world, including $3 million in cash wrapped in oil paper and submerged in a fish pond.

“But investigators also discovered a surprisingly expansive and expensive collection of art at Mr. Wen’s mountainside villa and another home he kept at the Crabapple Moon Residences. He had been given, they said, more than 100 works, including fine ivory sculptures and a Buddha head carved from stone. Valuable calligraphy scrolls were stored in a ceramic container. A painting attributed to Zhang Daqian rested on a bookshelf. Mr. Wen was executed for his crimes the next year.

Hong Kong a Major Center in the Art World

Hong Kong has played a key role in Asia's art market boom. Its auction market turnover -- anchored by Sotheby's and Christie's -- skyrocketed 300 percent from 2009 to 2010, powered by a wave of Chinese millionaires buying art with avid fervor. "Hong Kong has became the sales centre of the world," said Patti Wong, chairman of Sotheby's Asia, with revenue in the former British colony on par with New York and London. [Source: James Pomfret and Lisa Yuriko Thomas, Reuters, December 18, 2011]

“Hong Kong has become the world's third largest auction hub after New York and London, thanks to the rising political and economic prowess of China, with mainland millionaires regularly among top bidders,” Ben Hoyle wrote in the Times of London: “Rich Chinese are increasingly becoming major players in the art world and they are getting that way. The amount spent by Chinese buyers at Sotheby’s increased 278 percent between 2008 and 2010. In 2007 no of buyers of work priced over $14 million were Chinese but by 2010 more than 10 percent were. Asian buyers are snatching up Western art as well Asian art. Christie’s said that four out five of the top lots at lots Impressionist and Modern sale in June 2010 were East Asian bidders. At Christie’s June auction in 2008 the top buyers of Victorian art were East Asian collectors.” [Source: Times of London]

Chinese Art as an Investment and Safe Haven

““A majority of Chinese people do not trust the Chinese stock market,” Melanie Ouyang Lum, a consultant on Chinese art, told the New York Times. “The housing boom has slowed tremendously. A lot of people are looking to art for investment.” [Source: David Barboza, Graham Bowley and Amanda Cox, New York Times, October 28, 2013]

James Pomfret and Lisa Yuriko Thomas of Reuters wrote, “While art often comes straddled with hefty commission, storage and insurance costs, it can serve as a fun portfolio diversifier, mixing decent returns with aesthetic pleasure.Even as the euro zone debt crisis rages and buffets regional stock markets, the Mei Moses Global Art Index, a widely tracked art indicator, showed an 11.8 percent rise in 2011 to November. [Source: James Pomfret and Lisa Yuriko Thomas, Reuters, December 18, 2011]

"It may not be a good time for sellers but it's an excellent time for buyers. During late 2008 and 2009, I highly advised clients to buy," said Bobby Mohseni, director of MFA Asia, an art consultancy. "With Chinese contemporary art, some prices have gone exceptionally high and that's just over a decade ... so it's best to look at upcoming or mid-tier artists."

While stocks on the S&P 500 have outperformed Western art over the past 25 years, according to Mei Moses data, top Chinese and Asian art is still comparatively cheap compared with Western impressionists or American contemporary art. A Mei Moses index for traditional Chinese art showed a 24 percent jump in the first three quarters this year.

Owners of Hong Kong's art galleries, many of them crammed along the winding Hollywood Road in the Central district, say timing is the key. "If you get good works of art, then without any question it is (a safe haven) but it doesn't have the liquidity. That's the difficulty," said Sundaram Tagore, whose galleries in Hong Kong and the United States feature a stable of culture-bridging artists. "If you're trying to sell at the wrong time it becomes part of the distressed market but if you're selling at the right time then you could make 100 times more, maybe more than property or any bonds can provide you."

Market for Stamps, Wine, Gems and Other Collectables

work by Mao Xuhui

Even for those with less purchasing muscle, experts say bargains can still be had in less spotlighted categories, including modern Filipino and Indonesian painters, as well as photography, and Chinese snuff bottles, to name a few, James Pomfret and Lisa Yuriko Thomas of Reuters wrote. "Collect what other people aren't collecting," Tony Miller, a former top Hong Kong government official and long-standing collector of scholars' objects and Chinese art, told Reuters. "If you can't afford Qi Baishi paintings and they're going at HK$2 million a throw, well, go for prints." Qi is one of the masters of inkbrush paintings and his pieces sell for millions of dollars. [Source: James Pomfret and Lisa Yuriko Thomas, Reuters, December 18, 2011]

The search by Asian investors for alternative assets has extended beyond art into wine, gems, watches, postage stamps and other memorabilia -- the rarer and more exclusive, the better. With about two-thirds of the world's stamp collectors in Asia, the stamps and collectibles market has surged, says Geoff Anandappa of stamp and memorabilia retailer Stanley Gibbons. Hong Kong-based InterAsia Auctions -- which specialises in Asian stamps -- broke world records for Chinese stamps in September, raking in $12.6 million over four days. A 1941 Dr Sun Yat-Sen inverted centre stamp fetched $221,000, up 66 percent from a similar sale a year ago.

Chinese and Asian buyers have cornered the fine wine market, with a Hong Kong Acker Merrall & Condit wine auction in December bringing in $9 million, including a single superlot of 55 Romanee Conti vintages that fetched a record-breaking $813,000. Similarly, Asian buying is behind the boom for diamonds and gems. China is on course to become the world's top diamond buyer and retailers in Hong Kong report a rise in the number of men coming to buy loose diamonds for investments.

A Hong Kong jewellery retailer recently raised $2 billion in one of the city's biggest initial public offerings this year to fund expansion in the region. "It's not the old days of 'safe as houses', put your money in the bank and that will sort you out," said Jon Reade of the Art Futures Group, a Hong Kong-based art investment firm. "Those are the days probably of my parents' generation ... people are getting more creative with their money."

Western Auction Houses Woo Chinese Buyers But Make Them Show They Have Money

work by Cai Guo Qiang The auction market is responding to the new demand. Last year Sotheby’s held its first exhibition for the private sale of art specifically for the Asian market. It featured Picassos, Monets and Chagalls that sold for $2 million to $25 million. This year Christie’s appointed Chinese representatives in both New York and London to develop new clients in Asia and manage relations with Christie’s most important private collectors from mainland China and Asia. “Chinese buyers are now recognized in the art world and auction world as the most important area of business development,” said Lawrence Chu, a collector based in Hong Kong who runs BlackPine Private Equity Partners. [Source: Robin Pogrebin, New York Times September 6, 2011]

Auction houses are mindful of the non-payment issues raised by an 18th-century Imperial vase that was bid to a record 51.6 million pounds at Bainbridges, west London, in November 2010. These concerns were highlighted at auctions in Europe and Asia in the ping of 2011. In Hong Kong, Chinese mainlanders wanting to buy an 18th- century Imperial vase and other designated “premium lots” at Sotheby’s sale of the Meiyintang collection were asked for deposits of as much as $500,000, dealers said. As a result, 30 percent of the 77 lots in the ceramics sale were left unsold, including a vase valued at more than HK$180 million ($23 million). It later was sold in a private transaction for HK$200 million, Sotheby’s said. [Source: Scott Reyburn Bloomberg News May 21, 2011]

Christie’s is also preparing to introduce selective payment protection. “Deposits and/or other security may be required at the time of registration for certain high value lots,” the London- based auction house said in an e-mail.

Image Sources: 1) Palace Museum in Taipei ; Others Christie's, Sotheby's and Wiki Commons

Text Sources: New York Times, Washington Post, Los Angeles Times, Times of London, National Geographic, The New Yorker, Time, Newsweek, Reuters, AP, Lonely Planet Guides, Compton’s Encyclopedia and various books and other publications.

Last updated November 2021