DRINKS IN CHINA

making sugar cane drink

Up until 30 year ago Chinese drank mostly four things: tea, beer, Baijiu (essentially grain alcohol), and, when they were sick, tepid boiled water. As China has opened up a number of other drinks have become available. They include things like snake bile wine, fresh-squeezed cucumber juice, creamed marzipan beverage and health elixirs made from vinegar and Sprite as well as a wide variety of conventional soft drinks and alcoholic drinks like those found everywhere.”Dou jiang” is soy drink purchased by the cup in local markets. “Dou zhir” is a tofu-based drink known for its peculiar odor.

Tea is very popular and high in caffeine. Many people drink tea in a bowl without a handle. Throughout China you will see people on the go with thermoses and water bottles with leafy, unstrained tea, which is consumed all day long. Among the popular teas in southern China are jasmine “heung pin”, slightly bitter “sau mei”, earthy black “bo lei” and chrysanthemum tea. Many people recommend the “pu-er”, oolong and green teas. Shanghai gok fa cha ice tea is served with sugar. Hot tea is usually served plain, or with sugar or milk. Coffee is relatively uncommon — usually instant coffee made from a package mix with sugar and creamer — but is becoming increasingly popular. A number of Starbuck’s and Starbucks imitations have appeared on recent years.

Fruit drinks made with mango, pineapple, watermelon, and various tropical fruits are available in some parts of southern China. Ones made with unboiled water sometimes give traveler’s health problems. Soft drinks such as Coke, Pepsi, Orange Crush and Fanta are also widely available and cheap. The tap water is unsafe to drink. Bottled water is widely available but usually found in small liter bottles. China's bottled water king Zhong Shanshan was the richest man in China in 2020 with a net worth of $91.7 billion in January 2021.

See Separate Articles: TEA IN CHINA factsanddetails.com ; KINDS OF CHINESE TEA factsanddetails.com ; TEA DRINKING AND CULTURE IN CHINA factsanddetails.com ; ALCOHOLIC DRINKS IN CHINA factsanddetails.com ; WINE IN CHINA factsanddetails.com ; DOMESTIC CHINESE WINES AND WINE-MAKING IN CHINA factsanddetails.com ; BEER IN CHINA factsanddetails.com ; BANQUETS, PARTYING AND DRINKING CUSTOMS IN CHINA factsanddetails.com ; FOOD, DRINKS AND CANNABIS IN ANCIENT CHINA factsanddetails.com

Human Breast Milk Popular Drink among Shenzhen Rich

In July 2013, Chris Luo wrote in the South China Morning Post, “While many Chinese parents continue to struggle to find safe and trusted milk powder for their babies, some in Shenzhen are paying to enjoy a new “nourishment” – human breast milk – and a few of them are doing so by breast feeding, according to Chinese media. Increasing numbers of adults have been hiring wet nurses so they can consume breast milk for its nutritional value, Lin Jun, a manager of Xinxinyu Household Service Company in the southern city of Guangdong, told the Southern Metropolis Daily . Lin went on to say that his company is promoting and expanding its breast milk supply business from babies to adults, the newspaper reported. [Source: Chris Luo, South China Morning Post, July 2, 2013 **]

“Clients can choose to consume breast milk directly through breastfeeding … but they can always drink it from a breast pump if they feel uncomfortable,” the paper quoted Lin as saying. He claimed breast milk was now popular among adults with high incomes and high-pressure jobs and who suffered from poor health. “Quite a few of our clients hire in-house wet nurses to ensure a supply of fresh breast milk on a daily base,” Lin said in the report, adding “wet nurses rarely raise objections as long as the price is right.” **

“A spokesperson for the company who refused to be identified claimed the report was entirely false, insisting his company’s household services did not include recommending wet nurses. The allegations were malicious gossip aimed at driving his company out of business, he told the South China Morning Post. However, Xinxinyu Household Service Company’s advertisements can be seen on a number of marketing websites, promoting the high quality services of its wet nurses, as well as its nannies, stewards, confinement nurses and tutors. The advertisements state that the company’s wet nurses can provide services to adults in poor health. Photos online show wet nurses and staff with what appear to be company logos on the walls. **

“According to the newspaper report, a wet nurse who provides breast milk to adults can earn an average monthly wage of 16,000 yuan (HK$20,238). A healthy and attractive wet nurse can earn even more, the paper was told. The claims seem to be supported by adverts placed by Xinxinyu on at least one recruitment website for positions of wet nurses with monthly salaries of between 12,000 to 20,000 yuan. “Consuming human breast milk is quite popular among my social circle … spending 10,000 to 20,000 yuan hiring a wet nurse is not uncommon at all,” Southern Metropolis Daily also quoted an anonymous client as saying, “although only a few people would suck breast milk directly from a wet nurses’ nipples.” **

“The anonymous client said he paid 15,000 yuan to a wet nurse and had her live at his home for a month, according to the report. Legal experts have warned that the practice may be a form of sexual service. “There is an essential difference between sucking on a breast and drinking from a pump, as the former largely exceeds the necessity of diet,” Guangdong lawyer Mei Chunlai said. But Shenzhen police told the paper that it would be difficult to prove if the act was a sex crime as it was hard to acquire evidence. **

Coffee in China

Coffee was once condemned as "the tail of capitalism." In recent years it has become a popular drink. Coffee houses have sprung up in Shanghai, Chengdu, Guangzhou and other cities. There was a Starbucks in the Forbidden City before nationalist fervor forced it to be closed down. Airlines in China report that on many flights coffee is as popular as tea.

Coffee was once condemned as "the tail of capitalism." In recent years it has become a popular drink. Coffee houses have sprung up in Shanghai, Chengdu, Guangzhou and other cities. There was a Starbucks in the Forbidden City before nationalist fervor forced it to be closed down. Airlines in China report that on many flights coffee is as popular as tea.

Annual coffee consumption per capita: 0.04 kilograms (compared to 12 kilograms in Finland, 4.2 kilograms in the United States and .35 kilograms in Thailand). [Source: helgilibrary.com ]

Retail sales of coffee in China grew more than 90 percent between 2007 and 2012, hitting 7 billion yuan ($1.15 billion) last year, according to data from Euromonitor. Nestle has noted the huge potential of the Chinese coffee market with only three cups per person currently drunk per year compared with 168 cups in Hong Kong and 99 in Taiwan. [Source: Adam Jourdan, Reuters, October 21, 2013]

The Chinese middle class taste for coffee has global repercussions as rising demand for coffee in China has created a rise in coffee production world wide. Coffee production in China is also growing. On Hainan Island and in Yunnan and other southern provinces farmers are growing beans that are catching the eyes of serious coffee drinkers. Some Arabicas produced in Yunnan are said to be particularly good. Around 15,000 tons of arabica beans are harvested in Yunnan every year.

At coffee stands in Shanghai foreigners tend to get their coffee to take away while Chinese like to sit down and socialize or carry out business with the coffee they order. In some ways coffee culture is more popular than coffee itself with sales at the coffee stands of non-coffee beverages such as fruit juice often higher than coffee drinks. In 1996, a coffee boom was predicted and government coffee traders bought up 12,000 tons of coffee beans, five times the previous year's total imports. The coffee market crashed and the government was left with warehouses full of coffee beans.

Starbucks in China

Starbucks has about 500 outlets in China. The Seattle-based company entered China in 1999 and had 250 outlets in 21 cities in 2007 and more than 570 stores in 48 cities in 2012. By 2015, it planned to have over 1,500 stores in 70-plus cities, though that would still only account for about half of China's major cities and would be just a fraction of the 10,800 cafes in the United States.

Starbucks estimates China will be its second-biggest market after the United States by 2014, The rise of China's cafe culture helped the China-Asia Pacific region top the sales growth table for Starbucks in 2012, and has prompted the company to consider opening 600 new outlets in the region this year, targeting 1,500 stores in China alone by 2015. Starbucks had a profit margin of 32 percent in China-Asia Pacific in its second quarter of 2013, compared to 21 percent in the Americas and 2 percent in Europe, Middle East and Africa, said the CCTV report.

Lisa Baertlein and Terril Yue Jones of Reuters wrote: "Starbucks Corp is on the rise in China with ambitious expansion plans but like any big new emerging market there are teething problems, not least of which is that customers love it so much, they stay for hours and hours and sometimes don't even buy a drink. Chief Executive Howard Schultz expects mainland China to overtake Canada as Starbucks' second-largest market by 2014 and some analysts believe it could one day rival the United States as the company's biggest market. [Source: Lisa Baertlein and Terril Yue Jones, Reuters, April 18, 2012]

“And while Starbucks' China cafes contribute less than 5 percent of company revenue, their store operating profit margins, at around 22 percent, are higher than U.S. cafes because they charge essentially U.S. prices in a market famed for its low labor and other costs. "For a decade the core business was expats and tourists. Without question, the core business today is Chinese nationals," Schultz told Reuters.

“But even with that big silver lining, there are big impediments to growth including low incomes, rising costs and the fact that most Chinese don't have a coffee habit. The market is still small, with specialist coffee shops such as Starbucks booking sales of $358 million from mainland China in 2010, although that was up from $104 million in 2005, according to Euromonitor International. By comparison, the United States accounts for $8 billion in revenue for Starbucks.

“Consumers in China drink an average of just three cups of coffee per year, according to an industry study, while for many Starbucks prices are simply out of reach. Based on average wages in China, it would take 1.3 hours of work in the more affluent east of China to buy a Starbucks tall (12-ounce) caramel macchiato. That goes up to 1.6 hours in the west and 1.9 hours in central China, says Bernstein Research analyst Sara Senatore.

“Affordability remains a top concern for analysts, who worry that as Starbucks' expansion progresses beyond the country's biggest cities it will be less able raise prices to protect margins. But CEO Schultz said income has not been a barrier to growth, adding that Starbucks' shops in non-core markets perform "as well or better" than stores in cities like Beijing and Shanghai, helped by pent-up demand. Attracting quality employees when competition for skilled workers is intensifying as other chains also seek to expand, is also very difficult, says Paul French, chief China analyst for market research firm Mintel. To that end, Starbucks has announced plans to launch a training program called Starbucks China University next year. It also will unveil a 1 million yuan ($159,000) fund that will provide emergency financial assistance for Starbucks employees.

In November 2010, Starbucks said it was going to start growing coffee beans on its own coffee farms in southwestern China. The company said it would hire coffee growers in Yunnan Province to plant Arabica plants that would be ready to harvest by 2014.

Lingering Customers and Other Problems for Starbucks in China

Caffè ginseng Lisa Baertlein and Terril Yue Jones of Reuters wrote: “The world's biggest coffee chain is a symbol of Western affluence in a nation of tea drinkers. But the tendency for Chinese visitors to linger in cafes and their lower income levels means sales volumes are much smaller than the United States and other markets where taking drinks to go is the norm. [Source: Lisa Baertlein and Terril Yue Jones, Reuters, April 18, 2012]

“Xu Baoli, a 51-year-old stock trader in Beijing, said he visits Starbucks at least 10 times a month but doesn't go for the coffee. He is taking a break, surfing the Internet and meeting with clients. Observers note that Chinese customers will bring sometimes their own food to Starbucks and Xu admits that every so often he doesn't bother to buy anything at all. "I like the concept," said Xu. "Chinese people used to think you needed a spoon and saucer to drink coffee. Now, walking around with a Starbucks cup in your hand has become a fashion statement for Chinese." With the U.S. market maturing, few prizes are as enticing as China and its population of more than 1.3 billion.

A number of imitators with similar green logos have also appeared. In January 2006, a Chinese court sided with Starbucks in a battle with a Shanghai company that used the same Chinese name (Xingbake) and ordered it to pay Starbucks $62,000 in damages. Coke won a similar suit against a company that gave one its drink a similar name to Coke’s Qoo fruit drink.

A Starbucks opened in the Forbidden City in 2000 in a building where court officials used to wait for a morning audience with the Emperor. Starbucks had been invited to open up there by palace managers who wanted to raise money for the upkeep of the 72-hectare site. In 2007, the Starbucks in the Forbidden City was closed down — in part because of an Internet protest that claimed the presence of the coffee chain “undermined the solemnity of the Imperil Palace” and was “a symbol of low-end U.S. food culture” and “an insult to Chinese civilization.”

Starbucks Is Criticized by Chinese State Media for Higher Prices

In October 2013, Laurie Burkitt wrote in the Wall Street Journal, “China's government-controlled television broadcaster criticized Starbucks Corp. for its prices in China, the latest attack by state media on a foreign company. China Central Television, in a 20-minute broadcast called "Starbucks: Expensive in China," said the company charges as much as 50 percent more for some of its products in China than in the U.S., the U.K. and India. The report said the company's profit margin in China was excessive, as high as 32 percent in China and the Pacific region, compared with 21.1 percent in the U.S. and 1.9 percent in Europe, the Middle East and Africa. [Source: Laurie Burkitt, Wall Street Journal, October 21, 2013 |:| ]

“Starbucks said the figures didn't accurately represent the company's Chinese operations because they included financial results from other Asian-Pacific countries in addition to China. The Seattle-based company doesn't break out its financial information by country. The company "understands the concerns raised by recent Chinese media," Starbucks said. Starbucks said its prices vary by market because of different costs, such as for labor, commodities, real estate and infrastructure investment. |:|

The CCTV broadcast on Starbucks was criticized by domestic media and Chinese citizens, with some saying the report didn't account for the reasons that Starbucks charges more in China.A user on Chinese microblogging site Sina Weibo said Chinese consumers "buy the world's most expensive houses, drive the world's most expensive cars, fill up with gasoline with the fastest-increasing prices, eat the world's most unsafe food, enjoy the largest number of illness-related bankruptcies caused by the medical system, use expensive, slow and disgusting Internet connections…and you ignore all this to tell me not to drink the world's most expensive cup of coffee that I won't drink even five times a year." |:|

On the same story Reuters reported: “Starbucks Corp has been charging customers in China higher prices than other markets, helping the company realize thick profit margins, a report by the official China Central Television (CCTV) said.The report by CCTV aired on Sunday and said a medium-size latte at the U.S. coffee house in Beijing costs 27 yuan ($4.43), or one-third more than at a Chicago store in the United States. "Starbucks has been able to enjoy high prices in China, mainly because of the blind faith of local consumers in Starbucks and other Western brands," Wang Zhendong, director of the Coffee Association of Shanghai, told CCTV. The report echoed a separate critique by the official China Daily newspaper published last week. [Source: Adam Jourdan, Reuters, October 21, 2013]

Starbuck’s Pricing System in China

Purple back begonia tea

Reuters reported: “Starbucks' pricing strategy in China is tied to local business costs such as labor and commodity costs, infrastructure investment, currency and real estate, the company said in a statement emailed to Reuters. "Each Starbucks market is unique and has different operating costs, so it would be inaccurate to draw conclusions about one market based on the prices in a different market," the company said. Starbucks Corp has been charging customers in China higher prices than other markets, helping [Source: Adam Jourdan, Reuters, October 21, 2013 +++]

“Imported products often cost more in China because of high import duties and tax rates. Roasted coffee beans, for example, draw an import duty of 15 percent and a sales tax of an additional 17 percent, according to DutyCalculator.com. Analysts said while Chinese consumers were becoming increasingly price aware, the latest reports were unlikely to dull demand for high street coffee in China anytime soon. +++

"Consumers are increasingly aware of these prices differences...it's become a very hot (topic) and is really common knowledge at this point," said James Button, Shanghai-based senior manager at SmithStreetSolutions. "But branded coffee is something people are treating as a luxury and they are willing to pay for that luxury experience." China's influential netizens seemed to support Starbucks. "Those who are saying Starbucks is expensive are probably those who don't drink much coffee," said user Wang Shuo on China's Twitter-like microblog Sina Weibo. "The prices are competitive and the quality makes people feel safe." +++

Laurie Burkitt wrote in the Wall Street Journal, “In addition to citing domestic media and China-based experts, CCTV referred to a Wall Street Journal blog post in September that referred to consumer complaints about Starbucks's prices in China. The item attributed the higher cost of a Starbucks coffee in China to such factors as labor and ingredients. The post also noted that Chinese consumers' preferences for larger stores raised the company's real-estate costs. [Source: Laurie Burkitt, Wall Street Journal, October 21, 2013 |:| ]

Pricing has been a sensitive topic in China. Rapid economic growth over the last decade has fueled inflation that has led to protests and social instability. Regulators in recent months have cracked down on what they see as unfair pricing in industries such as dairy, pharmaceuticals and automobiles. Many foreign infant-formula makers lowered their prices in China after the government in July began an investigation of their competitive practices. |:|

Soft Drinks in China

Non-alcoholic drinks sold in China include fresh-squeezed cucumber juice, creamed marzipan beverage and health elixirs made from vinegar and Sprite as well as a wide variety of conventional soft drinks and alcoholic drinks found everywhere. For a while Sprite was called Beverage No. 1 because it was President Jiang Zemin's favorite drink.

The Chinese are fond of sugary soft drinks, both American brands and locally produced ones. A variety soft drinks made with fruit flavours such as apple, pear, lichee, watermelon, grape, peach, and coconut are popular and widely available at convenience stores and elsewhere. Popular soft drinks include Future Cola, marketed by the Hangzhou Wahaha Group; Asia, by Xiangxue Pharmaceuticals. Huiyuan, produced in Henan Province sold under the name Juizee Pop; Ice Peak, produced in Xian; Jianlibao, an orange flavoured soft drink; Laoshan Cola, produced using waters from Mt. Laoshan in Shandong province; Nongfu Spring water; Smart, made by Coca-Cola Company; Wang Lao Ji, local herbal drink; [Source: List of soft drinks by country Wikipedia Wikipedia ]

In 2002, Coca-Cola had a 45 percent share of China’s soft drink market; Pepsi had a 21 percent share. Coke, Fanta, Sprite and Pepsi are all available, in both genuine and counterfeit versions. Consumption of carbonated soft drinks (gallons per person in 2000): 1.5, compared to 55.8 in the United States. The soft drink market grew by 50 percent between 1992 and 1994 and has expanded 15-fold between 1979 and 1994.

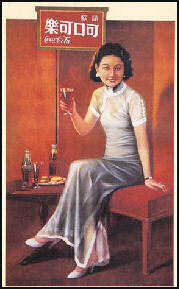

Coca Cola in China

The Coca-Cola Co. dominates the carbonated beverage market. Coca-Cola was introduced to China in 1927 and was banned under the Communists. The Chinese name for Coca Cola?"Ke-koy-ke-le" — means "tasty and reason to celebrate."

Coke returned to China in 1978 and by 1995 controlled 19 percent of the Chinese soft drink market (outselling Pepsi 3 to 1). A can of Coke sells for about 40 cents in China. It estimated that if China's 1.3 billion people drank as much coke as the average American then the Coca-Cola Company would double in size.

Because Coca-cola is difficult for Chinese to pronounce and the word "Coca-cola" sounds like "bite the wax tadpole" in Chinese, the company changed the name of the soft drink to ke-kou-ke-le. The slogan "Coke Adds Life" was also changed after Chinese interrupted the slogan as a claim to bring the people back from the dead. In China, Coca Cola used the slogan "thirsty mouth, happy mouth" for a while.

The Coca-Cola Co. also makes Xingmu, (meaning "eye-catching"), a line of drinks that come in bright psychedelic colors: neon green apple soda, pink watermelon soda, a milky, fizzy white coconut drink and peach and orange beverages. One fan of the drinks told the Washington Post, "The taste is so so, but I like the colors."

In 2017, Warren Buffet became face of Coke in China. AFP reported: “The likeness of billionaire Warren Buffett is gracing Cherry Coke cans in China, where the company's largest investor enjoys a legendary reputation. Coca-Cola announced over the weekend that a grinning cartoon portrait of the American business magnate would adorn cans and bottles of his favorite flavor after it was introduced in the country on March 10. Berkshire Hathaway, Buffett's investment firm, is Coca-Cola's biggest shareholder with a 9.3 percent stake valued at about US$17 billion. "Incidentally, there is no compensation involved, " Buffett told Yahoo Finance of the use of his image for "a limited promotional period." The 86-year-old investor and philanthropist has been photographed on numerous occasions taking a swig of Cherry Coke, earning him the title of "best-known fan" from Coca-Cola chief executive Muhtar Kent. In Communist-ruled China, where Chairman Mao portraits are as ubiquitous as brand-name logos, Buffett's business acumen has made him a celebrity and inspired thousands of Chinese investors to reportedly flock to Omaha, Nebraska, for Berkshire Hathaway's annual meeting last year.[Source: AFP April 6, 2017]

Coca Cola Business in China

Coca Cola spent $1.6 billion between 1979 and 2008 on marketing, advertising, setting up distribution networks and plants and other costs. As of 2009, Coca Cola was selling more than 1 billion bottles of Coke a year and was marketing Sprite and Minute Maid products in China.

Coca Cola established the Innovation and Technology Center in Shanghai. The facility cost $90 million and houses about 600 employees. In March 2008, the company announced it planned to spend $2 billion in China over the next three years on new plants, distribution infrastructure, marketing and research and development.

In September 2008 Coca Cola offered $2.4 billion to buy the juice maker China Huiyuan Juice Group in what was slated to be the largest deal ever in China’s food and beverage industry and biggest foreign takeover of a Chinese company. Huiyuan is China’s leading maker of pure fruit juices and nectars with 31 production facilities, a 10 percent share of the Chinese fruit and vegetable drink market and $380 million in sales in 2007. Coca cola hoped to develop the Huiyan brand and take advantage of its extensive distribution and supply network.

Huiyuan welcomed the deal as way to better market itself and develop new products. Its green cartons of orange, apple, pear and grape juice are already found almost everywhere.

In March 2009, the Chinese government rejected the takeove r bid on antitrust grounds, saying the deal would allow Coca-Cola to dominate a huge share of the beverage market. A statement released by the Chinese commerce ministry said, it was worried Coke would ‘set up exclusive terms to restrict competition in the juice market.” Afterwards a spokesman for the government said that the decision had nothing to do with trade protectionism and foreign investors were as welcome as always.

There is lot of resistance o the deal, much of it stirred by cybernationalists on the Internet. Many Chinese worried about a foreign company taking over a Chinese company that dominated its market.

China Shuts Coke Plant after Chlorine Reports

In April 2012, AFP reported: “Coca-Cola has been ordered to temporarily halt production at a bottling plant in northern China after media reports of chlorine in its products, according to a government statement.Shanxi province ordered an investigation after reports that a batch of drinks contained water with chlorine, the province's quality bureau said in a statement. "An on-site inspection, product testing, consultation of records, interviewing workers and other methods confirmed media reports about the situation were fact," it said. [Source: AFP, April 29, 2012]

A spokesperson for Coca-Cola said that the production suspension, which was temporary, was unrelated to food safety or chlorine levels, and arose from other issues found by the government inspection. "The chlorine levels are well below the WHO (World Health Organization), EU, North American and China standards for drinking water," she said. Chlorine is commonly used in water treatment to kill bacteria, but high levels can be hazardous to human health.

Coca-Cola said it was moving to address the issues raised by the government, which included restricting access between production and cleaning areas. "The quality and production issues being addressed at our bottling plant in Shanxi, China, are isolated to that one location, and the company is moving quickly to resolve them," said a statement provided to AFP. "At no time did these issues affect the safety of our products in the market."

The incident occurred in February when water with small amounts of chlorine accidentally flowed into water used for drinks during maintenance work, the official Xinhua news agency said. An anonymous company whistle-blower told local media that nine batches of products were affected, it said.

China is one of Coca-Cola's most important growth markets, accounting for around seven percent of its global volume last year, according to the US company. Coca-Cola has said it plans to invest more than $4 billion in China over the next three years starting from 2012. The company has more than 40 bottling plants in China, where it cooperates with Chinese food giant COFCO and Hong Kong conglomerate Swire Pacific.

Pepsi in China

In November 2011, Reuters reported: “PepsiCo Inc agreed to sell its interest in 24 soft drink bottlers in China to Hong Kong-listed Tingyi Holdings Corp, an acknowledgment that its strategy in China was not working. PepsiCo will initially receive only 5 percent of Tingyi-Asahi Beverages (TAB), Tingyi's joint venture with Japan's Asahi Group Holdings Ltd, a stake the companies valued at about $55 million. PepsiCo has the option of increasing its stake to 20 percent by 2015, when China is projected to become the world's largest market for bottled drinks. [Source: Rachel Lee and Martinne Geller, Reuters, November 5, 2011]

PepsiCo's bottling business in China, which has a book value of $600 million, has lost money for the past two years amid soaring raw material costs and intense competition from Coca-Cola Co, whose share of the Chinese market is more than triple that of Pepsi. Coca-Cola's sales volume rose 11 percent in China in the most recent quarter, fueled by its Minute Maid Pulpy, a drink Coke developed specifically for China that recently crossed the $1 billion sales threshold.

"Obviously, Coke is winning," said Michael Yoshikami, CEO of YCMNET Advisors. "When you're in China, Coke is very, very dominant." He said Pepsi likely realized the boost its brands would get from linking up with Tingyi was a better way forward than "slugging it out with Coke." "Is this a sign that Pepsi is retreating; that they can't contend with Coke one-on-one in a face-off to take over the biggest market in the world” Well, it sure looks that way," said Bevmark Consulting CEO Tom Pirko.

Analysts said the deal was good for Tingyi, since it lets the maker of Master Kong instant noodles and bottled tea expand its beverage offerings without hurting its balance sheet.They also said it was good for PepsiCo, since it broadens its distribution, allows it to unload those loss-making operations and gives it a stake in a company poised for faster growth than Pepsi alone.

A combined Pepsi and Tingyi would control about 20 percent of the Chinese soft drink market, according to data from Euromonitor International, overtaking Coke, which has market share of nearly 17 percent. PepsiCo is currently fourth with a 5.5 percent stake. "But (it) could also be viewed as a capitulation, as PepsiCo is surrendering some of the upside in one of its key growth markets and admitting the need for a partner," Levy said.She also noted the similar arrangement PepsiCo has in Japan with Suntory Holdings Ltd has not resulted in significant market share in that market.

The Pepsi/Tingyi tie-up marks a rare case in the consumer sector of a Chinese company acquiring a foreign stake within its own borders and not the other way around, as brands seek to seize market share and tap China's growing middle class, widening tastes and purchasing power.Lois Olson, a marketing professor at San Diego State University who specializes in China, said the deal could be seen as evidence of the growing power of Chinese companies."There is an increasing power, leverage and sheer might in Chinese companies. They're getting a lot better at what they do," she said.

Tingyi, which owns the Master Kong brand of instant noodles, drinks and snacks, has a market capitalization of $15 billion after a roughly 20-fold increase in its share price in the past 10 years on rising consumer demand in China. PepsiCo said last year it would invest $2.5 billion in its food-and-beverage businesses in China over the next three years. It had said it planned to open 10-12 new plants in China to manufacture soft drinks, noncarbonated beverages and snacks and would install additional production lines at existing facilities.

Nestle, though, is currently eyeing a possible $2.6 billion deal to buy candy maker Hsu Fu Chi International Ltd. And Diageo, the world's largest spirits group, took a major step forward in June toward taking control of Sichuan Shuijingfang Co Ltd, China's fourth-largest white spirits group.

Chinese Soft Drinks

Local brands of soft drinks account for 70 percent of the market in the mid 1990s. One Chinese company made a cola-like drink from the flowering peony plant called TianFu Cola. Anther made a Coke knockoff called Future Cola. Foreigners usually like China's lychee-flavored carbonated soft drinks.

Hangzhou Wahaha Group Co. is China’s largest drink maker. It sells a number of drinks and China’s best-selling brand of bottled water. The company is run by Zong Qinghou, ranked by Forbes in 2007 as China’s 23rd richest person. Hangzhou Wahaha has joint venture with Paris-based Danone, which has been characterized by legal action and accusations of secret profits and tyranny.

The primary accusation is that Zong set up a number of dummy companies that sold the joint venture’s drinks but kept profits from going to Danone. Danone said the scheme cost it around $100 millions. Zong was forced to resign but before he did he charged Danone with using hostile methods to take over Wahaha. A Chinese court ruled against Danone and in favor of Wahaha in August 2008.

Jianlibao used to be the largest soft drink manufacturer in China. Partly owned by teh military it makes a honey-flavored soda, which some say tastes like liquid metal, and a Gatorade-like drink, which Hillary Clinton and Tipper Gore were photographed drinking at a reception in New York.

Executives at Jianlibao have many privileges not enjoyed by executives of other countries. Their cars have military license plates, which allows them ignore red lights and pass through toll booths without paying. State officials predicted that Jianlibao would remain the number one drink in China even when Pepsi and Coca Cola launched their full-scale marketing campaigns because "the Chinese people feel that Jianlibao brought them great glory." [Source: U.S. News and World Report]

Water and China’s Richest Man

The average per capita consumption of bottled water in 2019 was 84.2 liters. China is biggest and most profitable bottled water market. The unit price for domestic bottled water, according to Euromonitor data, rose from 2 yuan per bottle (assuming a single bottle capacity is 500 ml). In 2010 too 4,1 yuan in 2018. Consumption of bottled water was around four liters in 2000 in China, compared to 40 liters in the United States. The sale of bottled water in China rose by 250 percent between 1999 and 2004. The rate of consumption has increased so much in China presumably because of increased affluence and health concerns. [Source: Daxue Consulting, 2020; Euromonitor International]

The four largest bottled water companies are 1) Nongfu Spring with a 26.4 percent market share; 2) China Resources Beverage with a 20.9 percent market share; 3) Ganten, with a 9.6 percent market share; and 4) Master Kong, with a 9.3 percent market share;

Zhong Shanshan, the chairman of Hangzhou-based Nongfu Spring, was the richest man in China as of early 2021 and had more money and assets than Warren Buffett. Zhong had a net worth: $68.9 billion, mostly from beverages and was the sixth richest man in the world. According to Forbes: The September 2020 IPO of his bottled-water firm, Nongfu Spring, drove up his fortune by 3,345 percent, making him the year’s biggest percentage gainer and China’s new richest person. Zhong also chairs Beijing Wantai Biological Pharmacy, which went public on the Shanghai Stock Exchange in April 2020. [Source: Jennifer Wang. Forbes, April 6, 2021]

Nongfu Spring bottled water is ubiquitous in China. Zhong was 66 in 2021. According to the Bloomberg: “Nicknamed locally as the “Lone Wolf” for avoiding involvement in clubby business groups or politics, Zhong dethroned India’s Mukesh Ambani as Asia’s wealthiest person and is close to entering the rarefied realm of individuals worth more than $100 billion.

China Still Tests Bottled Drinking Water Using 'Soviet Standards'

Patrick Boehler wrote in the South China Morning Post: “China still follows regulations adopted from the Soviet Union to test bottled drinking water, the Beijing News reported. "When the World Health Organisation updated its detection methods, [we] updated the standard for tap water, but not for bottled water," an unnamed expert with the Institute for Environmental Health and Related Product Safety in Beijing told the paper.According to these arcane regulations, China's national health inspectors do not test bottled drinking water for acidity, or pH level, or for substances including mercury and silver. [Source: Patrick Boehler, South China Morning Post, May 2, 2013]

More than five times more indicators are used to test running water than bottled drinking water, the paper said. "Bottled drinking water regulation is lagging behind," Wang Xiuyan, an adviser on mineral water for the Beijing Mining Industry Association, told the paper. "We should follow international standards. The bottled water market in the country is booming amid a general anxiety over tainted food productions and environmental degradation. Sales of bottled water grew from US$1 billion in 2000 to US$9 billion in 2012, according to Euromonitor

Angie Eagan and Rebecca Weiner wrote in “CultureShock! China”: Do not drink unboiled tap water. Although many local people happily drink it, tap water in China is still a health risk. Water for tea has been boiled, and once water hits its boiling point, 99 percent of the germs that can hurt you would have been eliminated. Typically, if Chinese order plain water, it is hot. It is a preference but there is also hygienic logic behind this. If you want to drink room temperature or cold water, be sure to order bottled water, and in more remote places, watch them put the bottle on the table and assure that it is sealed. There are rumours that enterprising individuals collect used water bottles and refill them with tap water. [Source: “CultureShock! China: A Survival Guide to Customs and Etiquette” by Angie Eagan and Rebecca Weiner, Marshall Cavendish 2011]

Milk and Dairy Products in China

Chinese drink 1.3 ounces of milk a day, compared to 25 ounces a day by Americans. However, milk consumption in China is rising about 15 percent a year as the government promotes it as a heath drink for children and this is beginning to have global impact on milk supplies. Many Chinese villagers have never seen or tasted cheese. On her experience working at a French specialty foods shop in Beijing, a villager from rural Hubei province told the Los Angeles Times, “I like the lamb chops and the salami...But the cheeses, I don't like any of them. I can't think of anything I've ever tasted that's so horrible." [Source: Benjamin Haas, Los Angeles Times, May 19, 2011]

The Chinese have traditionally not liked dairy products. Traditional Chinese dishes rarely have cheese, milk, cream sauces, or butter or other dairy products in them. Many Chinese will eat dog meat but not touch any dairy products. They find the smell very offensive, and can smell it even on people’s clothes. Benjamin Haas, Los Angeles Times, “Except for a small number of ethnic Mongolians and Tibetans, China has no tradition of cheese making, and an estimated 90 percent of the population is lactose intolerant.Exacerbating the issue, Chinese are especially wary of dairy products amid a continuing problem with tainted milk that has killed dozens of people.”

Some Chinese who consume dairy products get cramps and diarrhea became they lack an enzyme in their intestines that helps them digest lactose (the predominant sugar in milk). Depending on the region, between 70 and 100 percent of Chinese have a lactose deficiency. The unpleasant consequence of consuming milk products can be negated by eating fermented forms of milk such as yoghurt and cheese, in which the lactose is broken down into more easily-digestible sugars.

Consumption of milk has increased in recent years in part because of a government directive issued in 1998 for children to drink one glass of milk a day in school at lunch to address a lack of calcium in the traditional Chinese diet. There have been dramatic increases in the consumption of milk, yoghurt, cheese and fast food and pizza with cheese, and milk for lattes and coffees.

Cartons and bottles of milk as well as yoghurt and individually-wrapped cheese slices are fixtures of even small local supermarkets. Big chains like Carrefour and Wal-mart offer wedges of blue cheese and Camembert and wheels of Gouda and Edam. Products from the Chinese dairy giant Mengniu are touted as the official drink of the Chinese space program and a product that will “fortify the Chinese people.”

See Food Safety: Melamine-tainted Milk

Chinese Yogurt Drinks

Yoghurt drinks are becoming popular among the Chinese middle class. Howard Schneider wrote in the Washington Post, “Dressed in a Minnie Mouse costume to promote a drinkable yogurt branded with Disney characters, she ticked off the benefits of the flavors blended with fruit, vegetables and grains to try to suit the local palate. Stretching across an entire back wall at a Wal-Mart Supercenter were pumpkin and oat yogurt, pineapple and barley, red bean and mulberry, aloe, lichi and grape, yogurt with tuckahoe (an herb considered good for the spleen) and yogurt mixed with gelatinized donkey skin (said to have been an emperor’s favored energy drink).” [Source: Howard Schneider, Washington Post May 22, 2011]

According to reports from the U.S. Foreign Agriculture Service, Chinese yogurt sales grew 15 percent in 2009, and dairy consumption overall is expanding 10 percent a year. Since dairy consumption remains low by the standards of the developed world, the report noted, it is expected to continue growing fast. The government plans to double dairy production by 2013, adding millions of cows to the dairy herd.

Image Sources: Wiki Commons, Columbia University, University of Washington,

Text Sources: New York Times, Washington Post, Los Angeles Times, Times of London, National Geographic, The New Yorker, Time, Newsweek, Reuters, AP, Lonely Planet Guides, Compton’s Encyclopedia and various books and other publications.

Last updated October 2021