BEER IN CHINA

Beer is the most popular alcoholic beverage in China in terms of the total volume of the beverage consumed. About 30 percent of the total alcohol consumed is in the form of beer; 67 percent is in the form of spirits. Beer It is generally pretty cheap, especially the local brands. A large bottle of beer can cost as little as 50 cents. In the 2000s, you could still find some local beers that sold l for as little as 12 cents a bottle.Tiangsao has long been the most popular brew. But it isn't any more. Locally-made foreign brands such as Pabst Blue Label, Carlsberg and San Miguel are also fairly cheap. Beer is often served warm. Many American order beer with ice, the only way the know to get a cold beer.

Angie Eagan and Rebecca Weiner wrote in “CultureShock! China”: In China, pi jiu (beer) is a very common social drink, quantities of large bottles are consumed in small hole-inthe-wall neighbourhood restaurants to accompany threehour dinners complete with drinking games and toasts. The Germans introduced beer brewing to their concession city of Qingdao. The tradition of brewing and drinking beer has since spread across China. [Source: “CultureShock! China: A Survival Guide to Customs and Etiquette” by Angie Eagan and Rebecca Weiner, Marshall Cavendish 2011]

Beer for the most part was introduced to China by the Western colonial powers, who introduced their regional tastes, with some adaptions for local preferences. Beer sales in China rose 29 percent between 2006 and 2011 to 50 billion liters, more than double the consumption in the United States, the next biggest market. Over the same period the value of the beer rose 63 percent to 454 billion yuan. It is estimated the value will rise 72.6 in the five years to 2016. Much of the rise is attributed to the rise of China’s middle class. [Source: The Times]

In 2007, China was the world’s largest beer consumer for the forth straight year, with consumption increasing 11.8 percent from the previous year to 29.13 million kiloliters. China replaced the United States as the world largest beer consumer in 2002. It surpassed Germany to move up from No. 3 to No. 2 in the mid 1990s. Beer drinking took off in China in the 1980s and 1990s. China produced 118 million barrels of beer in 1995, a fifteen-fold increase from 1980.

Annual beer consumption: 29 liters (2018, compared to 143.3 liters in the Czech Republic; 74.8 liters in the United States; and 2 liters in Sri Lanka). About 30 percent of all of the alcohol that Chinese consume is in the form of beer. [Source: Kirin Holdings Company 2016, Wikipedia Wikipedia ]

Average beer consumption in China was about 28 liters per person per year in 2008 but the figure has been rowing fast. It was about 18 liters a year per capita in the 1990s, compared to 84 liters in the United States and 75 liters in western Europe. By comparison Britons currently consume almost 100 liters per person per year and about Japanese about 70 liters. [Source: Richard Wray, The Guardian November, 21, 2008]

Top beer producers in 2003: 1) China (25.1 million kiloliters, 17.1 percent of the world’s production, 7 percent increase from the previous year); 2) the United States (23.08 million kiloliters, 15.6 percent of the world’s production, 1.6 percent decrease from the previous year); 3) Germany (10.53 million kiloliters, 6 percent of the world’s production, 2.1 percent decrease from the previous year). [Source: Kirin Brewery]

See Separate Articles: ALCOHOLIC DRINKS IN CHINA factsanddetails.com ; PASSED-OUT CADRES AND DRINKING IN CHINA factsanddetails.com ; WINE IN CHINA factsanddetails.com ; DOMESTIC CHINESE WINES AND WINE-MAKING IN CHINA factsanddetails.com ; BANQUETS, PARTYING AND DRINKING CUSTOMS IN CHINA factsanddetails.com ; FOOD, DRINKS AND CANNABIS IN ANCIENT CHINA factsanddetails.com

Websites and Sources: Alcohol Use in China oxfordjournals.org ; Warrior Tours warriortours.com ; Wikipedia article on Mao Tai Wikipedia ; Mao tai blog piece /endogenousretrovirus.blogspot.com ; Wikipedia article on Beer in China Wikipedia ; China Wine Info wines-info.com ;Gluckman on wine Gluckman.com ;

RECOMMENDED BOOKS: Chinese National Alcohols: Baijiu and Huangjiu by Baoguo Sun, Jihong Wu, et al. Amazon.com; “Drunk in China: Baijiu and the World's Oldest Drinking Culture” by Derek Sandhaus Amazon.com; “Baijiu: The Essential Guide to Chinese Spirits” by Derek Sandhaus Amazon.com; “Science and Engineering of Chinese Liquor (Baijiu): Microbiology, Chemistry and Process Technology” by Yan Xu Amazon.com; “Baijiu by Definition: What Is Baijiu?” by Arlo Q Sterling Amazon.com; Chinese Wine (Introductions to Chinese Culture) by Zhengping Li Amazon.com

Beer Brewed in China 5000 Years Ago

In May 2016, archaeologists announced they had discover evidence of a 5,000-year-old beer concoction and the earliest known occurrence of barley in China at Mijiaya, a Yangshao archaeological site in China's Shaanxi province. The researchers found yellowish remnants in wide-mouthed pots, funnels and amphorae excavated from the site that suggested the vessels were used for beer brewing, filtration and storage.

According to Live Science: Stoves found nearby were probably used to provide heat for mashing the grains, according to the archaeologists. The beer recipe used a variety of starchy grains, including barley, as well as tubers, which would have added starch for the fermentation process and sweetness to the flavor of the beer, the researchers said. The prehistoric brewery at the Mijiaya site consisted of ceramic pots, funnels and stoves found in pits that date back to the Neolithic (late Stone Age) Yangshao period, around 3400 to 2900 B.C., said Jiajing Wang, a Ph.D. student at Stanford University in California and lead author the paper on the research, published in May 23, 2016 edition of the journal Proceedings of the National Academy of Sciences. [Source: Tom Metcalfe, Live Science, May 23, 2016 +]

he researchers said it is unclear when beer brewing began in China, but the residues from the 5,000-year-old Mijiaya artifacts represent the earliest known use of barley in the region by about 1,000 years. They also suggest that barley was used to make beer in China long before the cereal grain became a staple food there, the researchers noted...Wang said that some Chinese scholars had suggested several years ago that the Yangshao funnels might have been used to make alcohol, but there had been no direct evidence until now. In the summer of 2015, the Stanford researchers traveled to Xi'an and visited the Shaanxi Institute of Archaeology, where the artifacts from the Mijiaya site are now stored. The scientists extracted residues from the artifacts, and their analysis of the residues turned out to prove their hypothesis: that "people in China brewed beer with barley around 5,000 years ago," Wang said.

See Separate Article FOOD, DRINKS AND CANNABIS IN ANCIENT CHINA factsanddetails.com

Beer Business in China

The Chinese beer market grew tenfold in the 1990s yet it is still not very profitable. It suffers from overcapacity and low prices and has been described as “a very low margin, fragmented business.” A large bottle of beer can cost as little as 25 cents. Analyst say branding efforts are not very well developed and beer companies often make deals with restaurants and entertainment centers that are favorable to the restaurants but produce minimal profits for the beer companies.

The three largest brewers in China, which control 45 percent of the market, made only $100 million in profits in 2004, a seventh of what Heineken made and 5 percent what Anheuser-Basuch made

Most Chinese drinkers stick with local brews. China has a clutch of super-brewers such as Beijing Yanjing Brewery and Tsingtao Brewery and western companies are increasingly getting involved with local partners as they look to offset slowing growth in more mature markets.

Beijing Yanjing Brewery is China’s No. 2 brewery. It controls the market in northern China and has been trying to expand into wealthy eastern coastal regions. It markets beers that sell for only 30 cents a bottle and are popular with cost-conscious Chinese. Other popular Beijing brands of beer include Zhujiang Five Star and Three Ring, two small Beijing-based brewers who are working hard to become national brands.

Publically traded beer companies other than Tsingtao Brewery include Beijing Yanjing Brewery, Chongqing Brewery, Lanzhou Huanghe Enterprise and Xinjiang Hops. Blue Sword is quite popular in central and western China, particularly Sichuan.

Beer market share (1999): 1) Tsingtao Beijing (4.5 percent); 2) Yanjing Beijing (4 percent); 3) Imports (3 percent); 4) Guangzhou Zhujang (2.3 percent); 5) Sichian Blue Sword (2.1 percent); Other Chinese beers (84.1 percent).

China’s Snow Lager, the World's Best-Selling Beer

In 2008, a Chinese lager called Snow surpassed Bud Light to become the world's best-selling beer. The ascension of Snow is due to Snow’s popularity in China and to the growing thirst of Chinese drinkers for beer. [Source: Richard Wray, The Guardian November, 21, 2008]

In 2007, Bud Light sold 5.18 billion liters — about 9 billion pints — while Snow sold 5.12 billion liters, according to industry statistics provider Plato Logic. In the first nine months of 2008, Snow has sold 5.1 billion liters, according to the third-quarter results of its maker, China Resources Snow Breweries (CR Snow). And while sales of Snow are growing at about 20 percent, sales of Bud Light, according to industry estimates, are down in the first nine months of this year in its biggest market, the US.

It will mark a meteroric rise for Snow's brewer. Since it was founded in 1994, CR Snow, has grown from a regional brewer with a single plant, in Shenyang in the north-eastern Liaoning province, to one of China's biggest drinks companies. CR Snow is a joint venture between China Resources Enterprise and UK-based brewer SABMiller, owner of Grolsch and Pilsner Urquell in the UK. It now has more than 30 brands and more than 60 breweries in China. Snow’s succession to the throne marks a significant success for SABMiller.

A 640ml bottle of Snow costs less than 30 US cents. How about the taste? Snow. Reviewers at the monthly beer magazine Beeradvocate gave it a D describing it as “unimpressive” and “extremely drinkable, like water?.

Tsingtao Beer

Tsingtao (pronounced CHING-dow) is China's first and most well known beer. Produced by a brewery based in Qingdao, a city in Shandong Province on China's east caost, it is made with mineral water piped in from nearby Laoshan Mountain, according to a German recipe.

Tsingtao was first produced by a joint German-British venture at a brewery in the German concession of Qingdao in 1903. The original brewery sits across a park where German soldiers were once quartered. Tsintgao was once owned by the Kuomintang. The beer was produced through the Maoist years. In 1979, when China began opening up to the outside world, it was one of the first products to be officially exported and is now a mainstay of Chinese restaurants around the world.

Today Tsingtao is made with barely imported from Canada and a mixture of rice and hops from northern China. The water still comes from an icy spring that flows out of granite rock at Laoshan. Tsingtao's taste has been described as crisp and slightly sweet.

See Separate Article QINGDAO AREA OF SHANDONG PROVINCE factsanddetails.com

Tsingtao Beer and Business

Tsingtao had 14 percent of beer market in 2007. In the 1990s it controlled 70 percent of China's beer export market but only 2 percent of the domestic market. This is partly because its competitors had been much more aggressive pushing and distributing their products. One Tsingtao representative told the New York Times, "Our sales agents tended to focus on fancy restaurants while ignoring the needs of the common drinker."

Tsingtao was one of the first mainland Chinese companies allowed to sell shares on the Hong Kong stock exchange. When Tsingtao stocks were first issued their price jumped to $30. Then it dropped to $4 after money was siphoned away by the government. As part of an effort to quadruple beer production, the Tsingtao Brewery had raised $190 million by selling stocks then used half the money on investments and to prop up troubled state enterprises rather than plant expansion?which was why the brewery was given the money?and failed to give an explanation to stock holders.

While the Chinese beer market grew tenfold in the 1990s, Tsingtao only grew 20 percent. From 1994 to 1996 the company lost money, hurt by competition from cheaper Chinese brands and expensive foreign brands. In 1996, most of the senior staff was fired and a new leadership was installed.

Tsingtao began buying up breweries, marketing its flagship brands more aggressively and producing low cost local beers for everyday drinkers. Tsingato reclaimed its No. 1 position in 1999 and now runs 22 breweries scattered across the country and also makes wine, oolong tea, Japanese-style green tea and milk tea. The company is 27 percent owned by Anheuser-Busch.

Foreign Beers in China

A lot of Western brewers went into China in the 1990s and built breweries, expecting to make a killing with their premium brands. They met with limited success because price is so critical in a country where almost one person in five lives on less than $1 a day .A 640ml bottle of a typical beer costs less than 30 US cents and, as a result, the premium beer sector is only worth about 2 percent of the entire Chinese market.” [Source: Richard Wray, The Guardian November, 21, 2008]

In 1994 only four foreign beer companies had invested in China. In 1999, there were more than 60. Some have built breweries in China and splashed the country with advertising and marketing campaigns.

Foreign beers have had a rough ride in China. They account for only about 7 percent of Chinese market. Popular foreign beers available in China include Asahi and Kirin from Japan, Foster's of Australia, Beck's of Germany and Pabst and Budweiser from the U.S.

A number of foreign beer producers have begun local production with Chinese breweries. Profits have been minimal. One analyst told the New York Times, “Everybody wants a seat at the movie even though they nothing going to be playing for 20 years.

Foreign Beer Companies in China

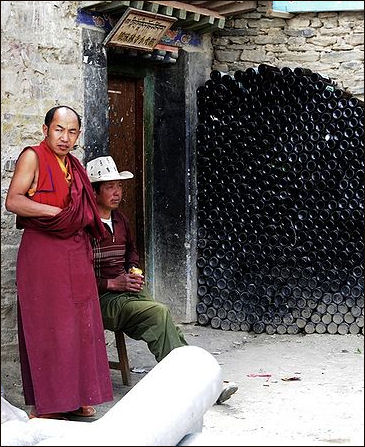

Lhasa Beer

San Miguel is one of the top three selling brands of beer in Asia and the largest selling foreign beer in China. There is a San Miguel brewery in Hong Kong. San Miguel’s China operation accounted for 5 percent of its $2.5 billion sales in 2002. The Chinese operation remains unprofitable.

Although Budweiser is popular Anheuser-Busch's sales are too small and its production costs are too high to make a profit. In 2003, Anheuser-Busch increased its share of Tsingtao from 4.5 percent to 9.9 percent, and increased it to 27 percent in 2004. Also in 2004, Anheuser-Busch beat South-Africa-based SABMiller in a bid to obtain Harbin Brewery for $694 million.

SABMIller, the world’s second largest brewer owns 47 breweries in 13 provinces in China and sells Snow brand beer nationwide. It operates through China Resources Snow of which it is a 49 percent owner. In January 2007, it paid $320 for Sichuan’s Blue Sword, giving SABMiller better access to markets in the interior of China. A month earlier it acquired two breweries in northern China for $22.4 million In 2004, SABMiller purchased three unprofitable breweries in China from Australia's Lion Nathan for $71 million.

In December 2005, InBev, the world’s largest beer producer, acquired Fujian Sedrin Brewery, one of China’s largest beer producers, for $750 million. The acquisition was one of the largest ever for a foreign company operating in China. Brussels-based InBev beat out several rivals to win the bid. Analyst were surprised that such a high price was paid for Fujian Sedrin, which is China’s 8th largest beer company.

Carlsberg has been producing beer in China since 1991. In 2003 it purchased Dali beer, the largest brewer Yunnan, and took over Kunming Huashi Brewery. Heineken also has a stake in a large Chinese beer producer.

Belgian brewer Interbrew paid $35 million for 70 percent of the brewing operations of K.K. Group in 2003. In 2002, it bought 24 percent of Zhujiang Brewery.

The Japanese brewer Suntory has a strong position in the Shanghai market. In June 2006, it acquired the outstanding shares of Shanghai Foster’s Brewery. With the acquisition, Suntory increased its share the Shanghai beer market from 54 percent to nearly 60 percent and increased production from 700,000 kiloliters to 800,000 kiloliters.

In 2008, China's ministry of commerce approved the acquisition of Budweiser's owner Anheuser-Busch by InBev and both companies are already involved in the country's brewing industry. At that time Anheuser-Busch had a 27 percent stake in Tsingtao Brewery, while Inbev owned 28.56 percent of Zhujiang Brewery. Neither company will be allowed to increase their stakes or get involved in either Beijing Yanjing or CR Snow for fear of reducing competition in the market.” [Source: Richard Wray, The Guardian November, 21, 2008]

Beer Piracy in China

Pabst Blue Ribbon beer experience a "product tampering scare" when a Chinese newspaper announced that at least one person had died from drinking "fake" Pabst Blue Ribbon beer. Pabst told the Wall Street Journal that "reports originated from a single incident in which home-brewed beer was poured into empty Pabsts bottles and resold. No one died."

China's only international brand of beer, Tsingtao, has been the target of bootleggers in Taiwan and Korea. The Taiwan Gold Mountain Wine and Spirits produced a beer called "Tsingitao" and South Korea's Chosun Brewery made a beer whose name "Ching Shan Tao" had all but one of Chinese characters used in the Tsingtao name. Both pirated beers had labels similar to the Tsingtao label.

$40 Bottle of Pabst Blue Ribbon in China

Evan Osnos wrote on The New Yorker website: “That reliably blue-collar Milwaukee lager, later adopted by unbearable hipsters on the coasts, has turned up in China. And P.B.R. [Pabst Blue Ribbon] , best known in the U.S. for being the cheapest beer on the grocery-store shelf, has?like so many expatriates before it?taken the move as an opportunity to change its image. For a beer, that appears to involve an elegant glass bottle and a fantastically ridiculous price tag. One bottle: forty-four dollars.” [Source: Evan Osnos, The New Yorker website, July 19 and 21, 2010]

According to Danwei P.B.R. has been reborn as “Blue Ribbon 1844" beer in China. It is advertised in magazines as a “world famous spirit” to be savored from a champagne flute. As a recent advertisement in Window of the South magazine put it: “It’s not just Scotch that’s put into wooden casks. There’s also Pabst Blue Ribbon Beer 1844. Many world-famous spirits Are matured in precious wooden casks Scotch whisky, French brandy, Bordeaux wine? They all spend long days inside wooden casks.”

Osnos wrote that Pabst license was snatched up by “a clever Chinese distributor... knowing full well about the Chinese fondness for trophies and ribbons.” In the July issue of All About Beer magazine brewmaster Alan Kornhauser of Pabst China says the new high-end Pabst aims to be “the first specialty beer in Mainland China.” He said: “There’s almost no ale in China: I had to smuggle the yeast into the country. I formulated a special high-gravity ale called “1844.” It’s all malt, and we use caramel malts from Germany. The initial aging is dry-hopped rather heavily. Then we do a secondary aging in new uncharred American oak whiskey barrels. We bought 750 brand new barrels to the tune of $100,000. This is a very special beer; it’s retailing for about over $40 U.S. for a 720 ml bottle. Jesse Rodriguez, the Letter’s newly appointed beer correspondent, said, “Traditional P.B.R. is light and fizzy with a distinct cloying malt profile, while the B.R. 1884 has a rounder mouthfeel with a notable hop presence on the front palate and finish. Is it worth the money? Probably not, but it’s definitely not a P.B.R.”

different bottles of Tsingtao

On the potential market for the beer, All About Beer magazine reported: “There’s the nouveau riche, and in China, perception is everything?look at me, I?m rich. Then also, there is another group that may be part of our market, and that’s state banquet dinners. Normally, you?d drink brandy, and this beer kind of has the look of brandy?it’s a reddish-brown color, but it won’t hurt you as much.”

Image Sources: University of Washington, Beer Companies

Text Sources: New York Times, Washington Post, Los Angeles Times, Times of London, National Geographic, The New Yorker, Time, Newsweek, Reuters, AP, Lonely Planet Guides, Compton’s Encyclopedia and various books and other publications.

Last updated October 2021