JAPANESE ELECTRONICS INDUSTRY

Sony PlayStation Portable from the 2000s Japanese companies are the world leaders in the production of compact disc players, video cameras, laptop computers, fax machines, photocopiers, cell phones and various key computer components.

Japan is regarded as proving ground for a wide variety of new products and technologies. Japanese electronic manufacturers are known for producing a wide variety of products lines, including televisions, mobile phone handsets and personal computers even if they have a low market share for each product.

Consumer electronics account for a third of Japan’s economic output. In today's marketplace products like computers are made up of components that are often produced or assembled in a dozen or more countries. One thing that has kept many Japanese companies strong is the fact that declining sales in final products like cameras and DVD players have been offset by the strong sales of important components (like CD ROM players, memory chips, liquid crystal display screens and batteries for notebook computers) and production and manufacturing machinery (like robots and machine tools).

With operating resources spread very thinly across the industry and global competitive strength of Japanese manufacturers on the wane, “selection and focus” are becoming keywords in the electronics industry. Increased competition and the expense of making products in Japan has forced many companies to rely on outsourcing especially for flat-screen televisions and semiconductors. The computer software business is known for its high profits. Traditionally, its profit margins have been around 15 percent, compared to 7 percent for oil companies.

Japanese companies are finding it hard to compete against lower-priced rivals from South Korea and China. Competition has become so fierce in the electronic industry — both between Japanese companies and against foreign rivals mostly in South Korea, China and Taiwan — in some cases engineers, technicians and workers were unable to take their usual summer holidays in 2010.

CEATAC is Asia’s largest electronics show. Held in early October at the Makuhari Messe convention center, it is a great place to see cutting edge technology. In 2008 a total of 804 companies and groups, of which 289 were from overseas, displayed cool stuff and gadgets in 3,121 booths during the five-day event. Among the highlights were robots that rode on unicycles and bicycles, organic, light-emitting televisions as thin as a map, 3-D full-definition home theater systems and the latest WiMax next generation high-speed technology. Among the showstoppers at the 2009 CEATEC were liquid crystal and plasmas televisions capable of showing 3-D images, single lens 3-D cameras and liquid crystal television with depth-creating back lights that used light-emitting diodes.

The CEATEC technology and electronic trade show in October 2010 drew 616 companies and groups, with 196 of them from overseas. Among the biggest attention-getters were the latest 3-D technologies, including a 3-D theater that simulated being in a futuristic city, Toshiba’s 3-D television that doesn’t require glasses and new Hitachi liquid crystal screens that require less energy and allow users to read screens longer without charging batteries, CEATEC stands for Combined Exhibition of Advanced Technologies.

Websites and Resources

Good Websites and Sources: Japanese Electronics and Information Technology Industries Association (JIETA) jeita.or.jp/english ; Google E-Book: The Japanese Electronics Industry books.google.com/books ; JETRO Report on Japanese Consumer Electronics jetro.org/content ; Nikkei Electronic Asia techon.nikkeibp.co.jp ; Gadgets and Consumer Electronics Blogs blogged.com/directory/shopping/consumer-electronics ; Companies Listed by Industry mizuho-sc.com ; Japan Shuffle, a blog with info on electronics japanshuffle.blogspot.com

Links in this Website: JAPANESE ELECTRONICS INDUSTRY Factsanddetails.com/Japan ; JAPANESE ELECTRONICS COMPANIES Factsanddetails.com/Japan ; CANON, SHARP AND TOSHIBA Factsanddetails.com/Japan ; SONY Factsanddetails.com/Japan ; SONY PRODUCTS Factsanddetails.com/Japan ; PANASONIC Factsanddetails.com/Japan ; INDUSTRIES IN JAPAN Factsanddetails.com/Japan ; JAPANESE COMPANIES Factsanddetails.com/Japan ; TRADE AND OVERSEAS BUSINESS IN JAPAN Factsanddetails.com/Japan ; TECHNOLOGY IN JAPAN Factsanddetails.com/Japan ; GADGETRY AND INVENTIONS IN JAPAN Factsanddetails.com/Japan ; COMMUNICATIONS IN JAPAN Factsanddetails.com/Japan ; CELL PHONES IN JAPAN Factsanddetails.com/Japan ;

Good Websites and Sources on Industry: Good Photos at Japan-Photo Archive japan-photo.de ; Companies Listed by Industry mizuho-sc.com ; Ministry of Economy, Trade and Industry meti.go.jp/english ; Statistical Handbook of Japan Manufacturing Chapter stat.go.jp/english/data/handbook ; 2010 Edition stat.go.jp/english/data/nenkan ; News stat.go.jp

History of Japanese Electronics

1960 Sony all-transistor TV The Japanese have produced hundreds of popular products based on American inventions. In the 1950s U.S. companies failed to fully utilize transistors because they wanted to protect their investments in vacuum tubes. This paved the way for companies like Sony to make transistor radios. In the 1950s and 60s many Japan companies pirated their designs almost directly from foreign products. Canon and Nikon cameras were modeled after German Leicas

The Japanese have made advances in lasers, diodes, CD players, screen technology, video recorders, and music synthesizers based in many cases on physics and chemistry discoveries made at U.S. laboratories like Bell Labs and RCA.

The mass production of radios began soon after the first radio broadcasts in 1925. Televison mass production began in 1953. In the 1960s, the goal of many Japanese families was to obtain the “the three divine appliances”: the television, the refrigerator and washing machine. It wasn’t long before this was replaced by obtaining the three Cs: a color television, a car and a cooler (air conditioner).

The total number of appliances increased from 68.1 million units in 1955 to 9.35 trillion in 1997. At one point Japan was producing 52 million calculators a year.

In the 1970s there was battle the Sony-backed Beta system and the Panasonic-backed VHS system over which one would be the standard for VCRs. Sony invested heavily in the Beta system, which was introduced in 1975, but lost out to VHS.

The Japanese electronic industry was arguably at the height of its dominance in the 1980s. In 1985, Japan shipped 13.4 million color televisions, compared to only 3.5 million in 1994. The top five television producers (televisions per year) in the late 1980s were: 1) Japan (13,275,000); 2) the United States (12,084,000); 3) former USSR (8,578,000); 4) South Korea (7,641,000); and 5) China (6,840,000).

Japanese electronics companies did very well in the late 1990s as worldwide demand for electronic gadgetry was peaking, use of personal computers and the Internet was exploding in Japan and the value of the yen was declining. Japanese companies were leaders in digital cameras, cell phones, car navigation systems, DVD machines and flat-panel liquid crystal and plasma television.

During the economic crisis in 2008 and 2009 companies were hurt by the yen appreciation and a fall in demand for their products.

Specialized Technology Companies

Kyoritsu is an Ibaraki-based company that holds 60 percent of the domestic market and 40 percent of the global market for hydraulic spools — cylindrical metal components used in hydraulic valves that are essential to the operation of various kinds of machinery. One of the keys to making quality hydraulic spools is making their surface smooth. Kyoritsu is able to make surfaces with protuberances a maximum of 0.001 millimeter.

Gunma-based Nishi Industry went from producing fabric-making machines to being a world leader in making devices for manufacturing polarizing plates used in liquid crystal displays. The company’s textile background turned out to be well suited for making these plates which involves taking resin and stretching it until t is very, very thin and pasting it together with film. Textile technologies used to avoid wrinkled and irregularities have applications in making plates.

Chiba-based ABI Co. is a leader in producing quick freezing machines that don’t destroy the taste and freshness of food. Conventional quick freezing methods freeze the water first, thus killing the cells of the food and destroying the taste, ABI machines uses CAS (Cells Alive System) freezing technology that keeps water molecules in the food moving, preventing cell damage. The machines are widely used on tuna fishing boats and are capable of even freezing fresh cream, something that was once thought to be impossible. The company has plans to sell its own line of food frozen with the CAS method.

Decline of Japanese Electronics

There has been some talk that Japan is on the decline in the electronics industry as evidenced by critiques of products by Japanese companies at the International Electronics Show in Las Vegas in 2010 and the growing strength of South Korea electronic companies, namely Samsung, in the U.S. market place. In 2009 in the U.S., Samsung had an 80 percent share of LED televisions and a 75 percent share of the market for televisions that accessed the Internet. In 2010, Samsung is expected to be first put of the blocks with a 3-D television.

“Monozukuri”, the Japanese obsession with craftsmanship, has been described as an outmoded idea in electronics. A representative with one U.S. electronics maker told Japanese pop culture expert Roland Kelts, that monozukuri was a virtue of the product-oriented “analog era” but it is a liability in the digital era, “where emphasis is on network effects, and advantages flowing from connections across various platforms.” Based on the wow-factor of some Samsung products, one CES headline said the there was “passing of the torch” as “the gadget world’s balance of power shifts from Japan to Korea.”

Despite their technological prowess, neither Japan's analog high-definition broadcasting system nor its mobile phone technology are used in Europe or the United States, forcing Japanese companies to fight tough competitors in global markets. Roland Kelts wrote in the Yomiuri Shimbun, “Be it Japanese pop culture, consumer electronics, flagship airlines or even national government, plug in the problems and you get the same result: a clear picture of a staggering Japan en route to irrelevance. Is it any wonder so many Japanese youth see their homeland as a hopeless enclave, plagued by has-been paradigms and unable to evolve? Why else would a dynamic culture relegate its younger resources to the margins, where they are withdrawing and shrinking away from engagement, while its neighbors race ahead on silver-streaked water skis?”

Apple and Japan's Decline as Tech Innovator

Hiroko Tabuchi wrote in the New York Times in May 2010, “First came ''iPod shock,'' which knocked Japan's favorite gadget - the Walkman from Sony, and its line of successors - off its long-held perch at the top of the tech-savvy wish list. Then came ''iPhone shock,'' which sent Japan's cellphone companies - long used to scoffing at the clunky offerings from their overseas peers - scrambling to develop similar smartphones. On Friday, ''iPad shock'' hit Japan, threatening to bring upheaval to an ever-widening slew of industries in a nation once proud of being on the cutting edge of technology. [Source: Hiroko Tabuchi, New York Times, May 29, 2010]

A flood of orders in Japan for the iPad caused Softbank, the exclusive phone carrier of the iPad in Japan, to stop accepting them after three days. About 1,200 people lined up for the release of the iPad at an Apple Store in central Tokyo. ''Apple never fails to wow me, time after time,'' Sayuri Aruga, a 38-year-old singer in rock band told the New York Times. Ms. Aruga, who said she owned multiple iPods, an iPhone and a MacBook Air, flew to San Francisco in April just to get her hands on the Wi-Fi model of the iPad but now wants a 3G model, she said. She arrived at the store at 4 a.m., four hours before it opened. ''I'm going to do everything on it - read, write music,'' she said. ''The possibilities are endless.''

Michihiko Ueno, a 26-year-old design student who had joined the line at 9 the previous night, said he felt sad that a Japanese company had not come up with a device like the iPad first. ''This makes me feel America's way ahead,'' he said. ''It's a new device, or even like a new way of thinking.''

“The hype around the iPad in Tokyo highlights what has become a sobering reality for a country once considered the technological trend-setter,” Tabuchi wrote, “Japan now frequently looks overseas for innovation....Made-in-Japan electronics have lost their innovative edge to American companies like Apple. The iPod now leads the digital music player market in Japan. And despite initial skepticism from critics - who said the iPhone lacked many of the functions that Japanese were used to, like mobile TV - it has been wildly successful among Japanese. Shipments of the iPhone more than doubled, to 1.69 million units, in the year ended in March, giving Apple a 72 percent share of the country's smartphone market, according to the MM Research Institute.

Sony said at a news conference at the time the Ipad was released that it would create an electronic book reader and online content distribution platform in Japan, China and three other markets, to add to its offerings in the United States, Canada and a number of countries in Europe. ''Competition is heating up in this business, not just in Japan but around the world,'' said Fujio Noguchi, senior vice president at Sony Electronics. ''We feel that the market is going to take off all at once, and it's a natural time for us to make a move.''

Competition from South Korea, Taiwan and China

Hiroko Tabuchi wrote in the New York Times in May 2010, “Japan's electronics makers, like Sony and Panasonic, have been usurped on one end by rivals elsewhere in Asia, which have overtaken the Japanese by making cheaper versions of the products Japan long dominated. Samsung Electronics of South Korea now leads the global television market with an almost 25 percent share in flat-panel TVs, according to DisplaySearch. Acer, based in Taiwan and the world's No. 2 vendor of personal computers after Hewlett-Packard, now has twice the market share of Japan's top PC company, Toshiba, according to IDC. [Source: Hiroko Tabuchi, New York Times, May 29, 2010]

Increasingly Japanese electronics firms are being out competed by South Korean firms. In 2010, a number of Japanese companies including Sony, Panasonic and Sharp, released 3-D televisions and other devices but some of their buzz was taken by South-Korea-based Samsung that introduced similar devices and cheaper prices. In 2009, Samsung made more in operating profit than Japan’s nine electric companies combined. Some say South Korea’s success is a product of its technological know-how combined with clever marketing and good sense of timing.

Japanese and South Korean companies are not only facing off against each other in the United States and Europe there are also battling in developing countries such as Brazil and Vietnam and in the Middle East. Hitachi was outbid by a South Korea on firm in its bid to build a nuclear power plan in the United Arab Emirates. Jeeva Raj, director of a major retailer in Singapore, told the Yomiuri Shimbun, “South Korean firms are giving consumers better bang for their buck than their Japanese counterparts. Chinese brands, such as Haier and TCL are on their way up too.”

Japanese firms are also increasingly being out-competed by Chinese firms, who are beginning to approach Japanese quality at much lower price. One shopper in Shanghai told the Yomiuri Shimbun that she decided to buy flat-panel television from the Chinese company Hisense because “I can also watch movies that I download from the Internet. I could only watch TV on the same-priced Sony. Japanese products are good, but the Chinese products aren’t so different anymore.”

The same is also true with appliances such as washing machines and refrigerators. Japanese drum-style washing machines tend to be 10 percent to 30 percent more expensive than their Chinese-made counterparts. Nobuo Kurhashi of Mizuho Investors Securities told the Yomiuri Shimbun, “In terms of making products at low prices, the South Koreans and Chinese are way ahead are way ahead of Japan.” In response Japan is making products with fewer functions and are focusing on lower prices.

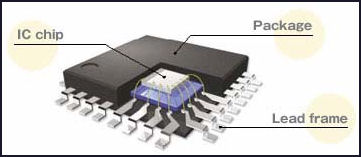

Semiconductor Industries in Japan

NEC chip American companies created the semiconductor manufacturing equipment and materials industry decades ago. Japan took over several critical areas of the market in the 1980s and today is the leading supplier of several key pieces of equipment, including lithography machines that miniaturize circuitry design and use light waves to transfer them onto silicon wafers.

In the 1980s the Japanese dominated the global computer chip industry in may cases at the expense of American companies. Japanese companies produced 51 percent of the world’s semiconductors and the three top chipmakers — NEC, Toshiba and Hitachi — were Japanese. During the 1980s, semiconductors were dubbed the "rice of industry" due to their indispensability.

Today Japanese global market share (28 percent) is about half of what it used to be and Japanese companies is being outperformed by American as well as South Korean, Taiwanese and even Chinese companies, In 2006 Intel and Samsung had a combined share of the market that was as large as Japan’s 20 largest chipmakers.

After sharply falling off in 2008 and 2009, the semiconductor industry picked up in 2010 both in terms of volume and prices, driven by strong demand for cell phones, computers and other electronic devices, with total sales of semiconductors expected to top $310 billion for the year.

DRAM makers, market share in sales (2010 July -September quarter): 1) Samsung, South Korea (40.4 percent); 2) Hynix Semiconductors, South Korea, (19.8 percent); 3) Elpida, Japan (16.1 percent); 4) Mircon Technology, U.S. (12 percent); 5) Nanya Technology (4.2 percent); 6) Powerchip Technology, Taiwan (2.6 percent); 7) ProMOS Technologies, Taiwan (1.8 percent). [Source: DRAMeXchnage survey]

Japanese Chipmakers

Fujitsu chip The major Japanese chip makers — Toshiba, NEC, Hitachi, Mitsubishi Electronic and Fujitsu — dominated the chip market in 1980s. The have been slow to respond to changes in the chip market and have had trouble competing against their rivals. The chip industry is led by Intel and Samsung. Chipmakers in other Asian countries are challenging Japanese chipmakers, which have laid off more than 54,000 employees in recent years.

Japanese chipmakers are having a hard time competing with rivals from South Korea and Taiwan, who can harness the kind of scale and investment needed to get ahead. Japanese companies also rely too much on the Japanese market for sales and don’t put enough money into updating factories. Japanese chipmakers have lost money and as they have they have spun off their chip operations as separate companies that are too small to make the kind of advancements necessary to keep up with their overseas rivals.

Large Japanese chipmakers are responding to the challenge by focusing on a few kind of chips the same way that Intel and Texas Instruments did in the United States. Japanese companies are also joining together with other Japanese companies In February 2006, Toshiba, Sony and NEC said they would jointly produce cutting edge microchips with a circuitry width of 45 nanometers.

Toshiba Flash Memory Chips

Toshiba employee Fujio Masuoka invented the flash memory chips — circuits that prevent data from being erased when power is turned off that are widely used in a variety of devises — in the 1980s. They are like mini hard drives but more durable because they have no moving parts.

Masuoka complained that he was never properly compensated by Toshiba for his invention, sued the company and won an ¥87 million judgment from Toshiba in 2006. Toshiba is estimated to have earned ¥20 billion from the devises. Masuoka was given ¥6 million from the company for his invention when he retired in the 1987. He demanded ¥8 billion for his work. The flash chip market is worth around ¥2 trillion worldwide.

Toshiba and Samsung are in a bitter battle for control of the flash memory business. Toshiba has new sophisticated plant on Yokkaicha Japan that makes the devises and is very secretive about what actually goes on there. While Toshiba invented the chips Samsung has used bigger production volumes and cheaper prices to become the market leader. It had 50 percent of the market in 2005 while Toshiba had 22 percent.

Describing the part of the factory he got to see Martin Fackler wrote in the New York Times: “Inside the windowless plant...tiny cranelike robots shuffle along automated production lines, moving stacks of silicon wafers the size of dinner plates. Masked technicians watch as rows of tall machines grind the wafers and etch circuits on their surfaces.” The factory produces 48,750 wafers a month, each with hundreds of NAND chips.

Chip Espionage

In the early 2000s, Sony, Toshiba and IBM collaborated to make a revolutionary computer chip — the superfast Cell chip — for Sony’s PlayStation 3. In his book on creating the chip “The Race for a New Game Machine”, IBM computer engineer David Shippy documented how IBM secretly provided Microsoft with the same chip for its Xbox 360 game.

Shippy said one of the hardest obstacles to overcome to in creating the Cell chip was heat. In his book he wrote: “game consoles are smaller than PCs and have less capacity to keep the chips cool, and games are very compute-intensive functions that tend to max out the processor usage. Higher power on the PlayStation 3 would lead to more costly thermal control techniques like fans and heat sinks...We had to invent a new animal that ran like cheetah, roared like a lion, and ate like a kitten.”

On handing the chip over to Microsoft, Shippy wrote: “Though three STI partners (Sony, Toshiba and IBM) previously agreed to the use of parts of the Cell chip in future derivative [products] and it certainly was within IBM’s right to do so it never occurred to anyone that this would happen before the Cell chip was completed and the PlayStation3 launched. So it wasn’t illegal, but it reeked of unsportsmanlike behavior...Keeping secrets from the Japanese engineers who had worked side by side with us for the last two years...didn’t feel right to any of us.”

Japanese Electronics in the 2000s

Fujitsu server The market for popular electronic items like digital cameras, cell phones, and flat screen televisions is very competitive and cut throat. To save money many Japanese companies have moved their manufacturing operations to China and other countries where labor costs are low.

Japanese electronics makers didn’t do so well in the early 2000s as people obtained all the computers and electronic gadgetry they wanted and competitors from other countries were putting out products almost as good as the Japanese but at a considerably cheaper price.

Sharp, Seiko Epson, Toshiba, Panasonic, NEC, Hitachi, Samsung, LG Philips and several other Japanese, South Korean and Taiwanese companies were being investigated in late 2006 for forming a cartel to control the price of liquid crystal displays (LCDs).

In recent years consumers have begun spending more money and a larger share of their income on electronic and communication items such as cells phones, MP3 players and flat screen televisions. As of 2006, 55 percent of U.S. households owned a high-definition television. Many manufacturers have suffered as result of stiff competition and low prices.

Over the last few years people have been replacing there boxy, tube TVs with flay screen televisions and Japanese companies from profited albeit with their profits limited by competition. The next big televison technology is expected to be laser projection screens. Developed by Mitsubishi, they uses colored lasers to display bright deep images on large, thin, lightweight screens, surpassing images seen in film.

The Japanese seem to have lost their ability to come up with the next cool thing as they did with the Walkman. Apple’s iPods and iPhones have sold well in Japan as they have everywhere. Sony and other companies have scrambled to come up with products that can compete with them. Japanese like to buy accessories for their iPods as they do for their cell phones.

Japanese companies make 80 percent of the components for the iPod, with many of the components made in China. They are also doing good business supplying electronics for automobiles.

Japanese Electronics Companies

Sanyo factory The famous Japanese electronics giants Sony and, Panasonic are among the most famous companies in the world. Other Japanese electronic appliance makers include Hitachi, NEC, Fujitsu, Toshiba, Kyocera, Sharp, Sanyo, TDK, and Pioneer.

Japanese electronic companies no longer dominate their fields as they once did. They suffer from high production costs, increased competition from abroad and being too heavily diversified, making everything from chips to submarine cables. Japanese electronic companies got their butts kicked by Taiwan in the flat-panel display market and by South Korea in the memory chip market..

Japanese electronic companies were hit hard by a slump and decline of prices of chips, computers and telecommunications equipment in 2001. The Big Five electronic firm (NEC, Toshiba, Hitachi, Fujitsu and Mitsubishi Electronics) posted losses of $12 billion in fiscal 2001-2002. Bloated and losing business to Asian rivals, they underwent restructuring.

Many Japanese electronic companies have moved production overseas to take advantage of cheap labor. Sony and Panasonic have had plants in Mexico since the 1980s that produce goods for the United States market. These days may companies have factories, suppliers or partners in China.

Japanese Electronics Giants Struggle in 2011

Yu Toda and Etsuo Kono wrote in the Yomiuri Shimbun, “Many of the nation's electronics giants are having to rethink their future strategy, as downturns in their business reports show, but some are keeping their heads above water as far as their core businesses are concerned. Sony and Panasonic have racked up huge losses. Panasonic incur a net loss of 420 billion yen for the year ending in March as it plans to implement drastic restructuring measures, such as halting production at its Amagasaki No. 3 factory in Hyogo Prefecture. [Source: Yu Toda and Etsuo Kono, Yomiuri Shimbun, November 4, 2011]

“Sharp Corp., which has maintained a strong presence in the electronics market, has seen its group sales and operating profits drop because of stagnant TV sales and a solar battery price war. Fujitsu Ltd. saw the results of its ordinary operations fall into the red for the first time in two years. Kazuhiko Kato, a Fujitsu executive vice president, said, "Our electronic parts business has deteriorated significantly" as demand for digital household appliances has declined.

“In contrast, companies that have focused more on industrial machinery, electronics parts and infrastructure-related businesses have reported relatively robust performances, despite suffering from the adverse effects of the March 11 disaster. Hitachi, Ltd. projects a net profit of 200 billion yen for the current fiscal year as its production of industrial machinery and other infrastructure-related business have expanded along with demand in emerging economies. Toshiba Corp. expects its core flash memory business to rapidly grow as the popularity of smartphones increases. Demand in emerging countries has also helped Mitsubishi Electric Corp. register strong business performances in industrial machinery and electronic parts. "Manufacturers' poor earnings results stem from firms depending on unprofitable consumer products," said Masaharu Sato, a senior analyst of Daiwa Securities Capital Markets Co.

Japanese Electronics Retail Sector

In July 2012, Yamada Denki Co., the largest electronics retail store operator in Japan announced it would Best Denki Co., the seventh-largest firm. This decision follows a move the previous month by Bic Camera Inc., the largest electronics retail store operator in Japan, to make Kojima Co. a subsidiary. In the early 1990s Kojima was the largest electronics retail store operator in Japan.

“Even though the market for home electronic products, especially flat-screen TV sets, has been shrinking, economists predict large electrical appliance retail companies will continue to expand. The focus of attention is how smaller companies in the industry will cope with the deteriorating situation. Realignment of industry expected as competition may wipe out all but large firms. [Source: Takashi Asako and Yasuaki Nakane, Yomiuri Shimbun, July 16, 2012]

Image Sources: 1) 2) Sony 3) NEC 4) 5) Fujitsu 6) Canon 7) xorsyst blog 8) Sharp 9) Panasonic 10) Sanyo

Text Sources: New York Times, Washington Post, Los Angeles Times, Daily Yomiuri, Times of London, Japan National Tourist Organization (JNTO), National Geographic, The New Yorker, Time, Newsweek, Reuters, AP, Lonely Planet Guides, Compton’s Encyclopedia and various books and other publications.

Last updated July 2012