OIL AND JAPAN

Oil storage tanks Japan is the third largess oil consumer after the United States and China. It relies on oil for about half of its energy needs. Oil consumption in 2002: 1. 935 billion barrels, compared to 7.2 billion barrels in the United States.

Japan has dozens of large oil storage tanks for a strategic oil reserves that could keep Japan going if imports were suddenly to dry up. It has stockpiles of 570 million barrels enough to last for 172 days.

The demand for petroleum products in projected to fall by 16 percent between 2010 and 2015 as result of aging population, declining population and environmental awareness.

Energy Industry Sites: Oil and Gas Industry in Japan www.mbendi.com ; Federation of Electric Power Companies fepc.or.jp ;Japan Petrochemical Industry Association jpca.or.jp ; Tokyo Electric Power Co, TEPCO tepco.co.jp ; Osaka Gas osakagas.co.jp ; Tepco Electric Energy Museum tokyo-cci.or.jp

Links in this Website: OIL, COAL, NATURAL GAS AND ENERGY IN JAPAN Factsanddetails.com/Japan ; NUCLEAR ENERGY IN JAPAN Factsanddetails.com/Japan ; SOLAR, WIND AND ALTERNATIVE ENERGY IN JAPAN Factsanddetails.com/Japan ; NATURAL RESOURCES AND JAPAN Factsanddetails.com/Japan ; WATER IN JAPAN Factsanddetails.com/Japan ; INFRASTRUCTURE AND PUBLIC WORKS IN JAPAN Factsanddetails.com/Japan

Sources of Oil for Japan

kerosene vending machine Japan is the world's second largest importer of foreign oil. Japan uses about 4.5 million barrels of oil a day, and 99.7 percent of Japan's oil is imported. Much of the oil industry is controlled by the state-owned Japan National Oil Corp.

As 2004, Japan got 90 percent of its oil from the Middle East, compared with 86 percent in 2003 and 70 percent in 1991. Japan pays $1.50 a barrel for shipping costs from the Middle East. About 80 percent of Japan’s oil exports pass through the Straits of Malacca.

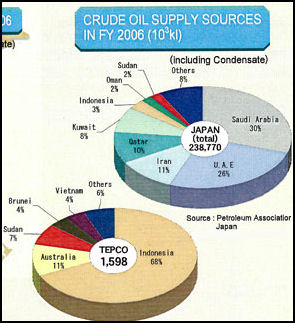

Sources of oil in 2006: 1) Saudi Arabia (31.1 percent); 2) United Arab Emirates (25.4 percent); 3) (Qatar 10.2 percent); 4) Iran (11.5 percent); 5) Kuwait (8.2 percent); 6) Indonesia (2.8 percent); 7) Sudan (2.9 percent); 8) Oman (1.5 percent); 9) Iraq (1 percent); Other (4.8 percent).

Japan gets much of its oil from Saudi Arabia and the United Arab Emirates. In Japan, there are worries that UAE will give preferential treatment to China. In December 2007, Japan said it would lend $3 billion to debt-ridden Abu Dhabi as part its effort to secure a reliable supply of oil.

In 2004, Saudi Arabia promised to supply Japan and South Korea with oil no what the situation was on the world market. In return Saudi Arabia wants help from Japan and South Korea developing infrastructure in Saudi Arabia.

Japan also gets large amounts from oil and natural gas Indonesia and Malaysia and hopes to increase it supplies from Russia and Central Asia. Japan’s effort to secure oil supplies overseas has experienced a number of set backs. The has been problems with the Sakhalin 2 project in Russia, the Azadegan oil fields in Iran and the Kashagan oil field in Kazakhstan,

Oil, See Terrorism

Middle East and Establishing a Stable Oil Supply

Hideyuki Ioka wrote in the Yomiuri Shimbun, The Japanese government “is placing greater emphasis on ties with oil-producing countries, as the Great East Japan Earthquake has increased the nation's reliance on thermal power generation, as opposed to nuclear. On a trip the Middle East in October 2011, Economy, Trade and Industry Minister Yukio Edano has secured promises from the United Arab Emirates and Saudi Arabia to provide a stable supply of crude oil. [Source: Hideyuki Ioka, Yomiuri Shimbun, October 13, 2011]

“Saudi Arabian Petroleum and Mineral Resources Minister Ali Al-Naimi told Edano that Japan is an especially important partner of the kingdom, and that Saudi Arabia will supply crude oil to this nation without fail. The Japanese government plans to import resources from Saudi Arabia and the UAE, and strengthen trade ties by increasing exports to those countries.

“If idled nuclear reactors in the nation are not reactivated, demand for fuel for thermal power generation in fiscal 2012 will reach 40.96 million kiloliters, triple the fiscal 2010 level of 13.51 million kiloliters, according to the Institute of Energy Economics, Japan. In fiscal 2010, Japan imported 214.32 million kiloliters of crude oil. Of that, 29 percent was from Saudi Arabia and 21 percent from the UAE. Combined, the two countries accounted for 50 percent of Japan's total crude oil imports.

“As Japan's reliance on the Middle East for crude oil will likely rise in the near future, maintaining stable ties with Saudi Arabia and the UAE is a priority. One concern is that pro-democracy movements could cause instability in the political situation in the Middle East.

Japan Looks Mainly to Russia as It Seeks Oil and Gas Diversification

Yasuhiro Takizawa wrote in the Yomiuri Shimbun: “The agreement between Japan and Russia to jointly develop a Siberian oil field is expected to accelerate expansion of crude oil procurement from that country and help diversify Japan's supply of energy resources. Japan relies on the Middle East for more than 90 percent of crude oil imports. [Source: Yasuhiro Takizawa, Yomiuri Shimbun, June 25, 2012]

“Japan Oil, Gas and Metal National Corporation (JOGMEC) and Russia's Gazprom Neft announced last week they would jointly develop an oil field in eastern Siberia, a region believed to have abundant natural reserves. The oil field is expected to yield a daily output of tens of thousands of barrels, which is equivalent to 1 percent to 2 percent of Japan's total crude oil imports. JOGMEC is conducting research in other mining blocs in eastern Siberia with the aim of reaching joint development agreements with other companies.

“A pipeline connecting the eastern Siberian area with Russia's Far East will be completed in the autumn of 2012. If the joint development of the oil field accelerates in the wake of the agreement, it is possible the quantity of crude oil transported to Japan will rise significantly. Another benefit of the agreement is that transportation from Russia to Japan takes only two days. "Japan will be able to import crude much more rapidly than from the Middle East, which takes about 40 days, and at a lower cost," an oil industry source said.

“Under the agreement with Russia, the Japanese side will secure a nearly equal stake to that of the Russians in the project. This means Japan will be able to exercise a certain degree of initiative in the project and obtain a stable supply of crude oil. Japanese electric power companies have imported natural resources at prices higher than average world market prices. If the eastern Siberian oil development project works out smoothly, a senior official of the Economy, Trade and Industry Ministry said, "Japan will be in a good negotiating position with oil-producing countries.”

“In past joint projects, Japanese companies have not had much luck. Japanese firms in the Sakhalin-2 project, which started producing natural gas in 2009, secured only a 22.5 percent stake. In a project to develop Iran's Azadegan oil field, which has one of the world's largest oil reserves, the Japanese side initially took a 75 percent stake. However, Japan had to withdraw from the project after the international community strengthened sanctions against Iran over its suspected nuclear weapons development program.

“The Japanese government has tried hard to diversify crude oil supplies and secure reasonably priced natural gas. As its relations with Western nations deteriorated, Iran threatened to block the Strait of Hormuz, through which much of the oil destined for Japan moves. "This made us realize the unstable nature of Japan's crude oil procurement," a government source said.In addition to Russia, Japan wants to strengthen ties in energy supplies with such countries as the United States and Australia. In Darwin, Australia, INPEX Corp. is involved in the Ichthys LNG project, which aims to supply about 10 percent of Japan's LNG imports in the future.

Japanese Firms Invest in Shale Oil and Shale Gas

Daisuke Segawa wrote in the Yomiuri Shimbun: “An increasing number of development projects focused on shale oil — a product drawing increased attention as an alternative to conventional crude oil — are under way in the United States, and some Japanese trading firms are looking to cash in on them. Itochu Corp. acquired a 25 percent stake in Samson Investment Co. at the end of 2011 to take advantage of the growing resource. Samson produced 23,000 barrels of crude oil, mainly shale oil, a day in 2011. It also produced natural gas, also mainly shale gas, equivalent to 67,000 barrels of crude oil a day. Samson plans to increase its production of gas and crude oil to 120,000 barrels a day each by 2021. In particular, the firm plans to increase shale oil production by more than five times the current volume, which would account for about 2 percent of crude oil production in the United States. [Source: Daisuke Segawa, Yomiuri Shimbun, February 18, 2012]

“Other Japanese trading companies are also taking an interest in the resource development. Marubeni Corp. acquired a 30 percent interest in an oil and gas field on the Colorado and Wyoming border in April last year. The trading house also obtained a 35 percent stake in an oil and gas field rich in shale oil in Texas last month. It has already been confirmed shale oil is available in areas outside of the United States, including China, Europe and Africa. Full-scale shale oil production on a global basis may significantly change the current energy situation, which is greatly influenced by the Middle East.

“Japanese trading companies are closely watching moves in the United States, hoping that securing not only shale gas but also shale oil will contribute to the stable procurement of fossil fuels in the future. Mitsubishi Corp. and Mitsui & Co. plan to import 12 million tons a year of U.S. shale gas to Japan in the form of liquefied natural gas starting in 2016. Sumitomo Corp. and Tokyo Gas Co. also plan to import to Japan 2.3 million tons of U.S. shale gas in the form of LNG starting in 2017.

“Tatsuya Watanabe and Tamaki Aikyo wrote in the Yomiuri Shimbun, A revolution in the methods for producing shale gas in the United States has burst the global natural gas market wide open, with Japanese firms moving to take advantage of the expanding market. Sumitomo Corp. obtained the rights to explore for shale gas in Texas in December, while Mitsui & Co. has acquired the rights to produce shale gas in Pennsylvania. Mitsubishi Corp. and Sojitz Corp. have also entered the U.S. market. While these joint ventures are aimed at producing gas to be consumed in the United States, a similar venture to supply shale gas to Japan could occur at any time due to the world's abundant reserves of the gas. [Source: Tatsuya Watanabe and Tamaki Aikyo, Yomiuri Shimbun, October 5, 2011]

Oil Companies in Japan

In December 2008, Nippon Oil, Japan’s largest oil distributer, announced it world merge with the Nippon Mining to form the world’s 8th largest oil company and the 4th largest company in Japan. The new company will have $130 billion in combined sales and a 33 percent share of gasoline sales in Japan, double its nearest rival, Exxon-Mobile. Nippon Oil was created by the merger of Mitsubishi Oil and Nippon Oil in 1999. It operates 10,000 Eon gas stations and has 12,700 employees. Nippon Mining operated 3,500 Jomo gas stations and has 10,000 employees.

Impex Corp. is Japan’s largest oil exploration company. It is 29 percent owned by the government and has annual sales of around $10 billion to $20 billion.

In October 2010, ExxonMobile announced it was pulling out Japan . It had been considering the move since 2005 because of declining demand for gasoline and light oil as a result of increased energy efficiency and use of fuel-stingy cars, . The company operated gas stations in Japan under names Esso, Mobile and General. These were sold on an area by area basis. There is a good chance that refining operations will also be sold in the future.

Oil Refineries in Japan

Japan has large refining capacity. It exports light diesel oil to China, Taiwan and Singapore and kerosene to the United States.

JX Holding is Japan’s largest oil company. It has refining capacity of 1.8 million barrels a day, as of 2008. It reduced its output to 1.4 million barrels a day in 2010. It has 8 refiners, at one time they reached 90 percent of capacity. As of 2010 they were operating at around 70 percent of capacity.

As gasoline consumption has declines, Japan has had to reduce it refining capacity as demand falls and is stuck with a glut of gas stations.

Three major Japanese oil refiners posted huge extraordinary losses in fiscal 2010-2011 due to damage to refineries and other facilities caused by the March 11 earthquake and tsunami. JX Holdings Inc lost ¥ 126 billion due to damage to its refineries in disaster-hit Sendai in Miyagi Prefecture and Kamisu in Ibaraki Prefecture. Idemitsu Kosan lost ¥ 5.3 billion due to damage to its oil tank in Shiogama in Miyagi Prefecture, while Cosmo Oil Co lost ¥5.7 billion due to damage to its refinery in Ichihara, Chiba Prefecture. [Source: Kyodo, May 13, 2011]

However, Idemitsu and Cosmo logged increased group sales owing to strong sales of gasoline and kerosene due to hot spells in summer and severe cold in winter. Idemitsu’s group net profit jumped 915 percent from the previous year to ¥60.68 billion, aided by improved margins on oil products. In its first earnings report for a whole business year, JX Holdings, created through the management integration of Nippon Oil Corp and Nippon Mining Holdings Inc in April 2010, said it posted a group net profit of ¥311.74 billion yen sales of 9.63 trillion yen.

Around the same time JX Holding, Japan’s largest oil company, said it mulling closing its Negishi Refinery, one of the largest such facilities in Japan with a capacity of 270,000 barrels. It too cited shrinking future demand.

Thermal plant

Natural Gas and Japan

Japan is the world’s largest importer and consumer of natural gas, importing 97 percent of its supplies. Natural gas is used to fuel power plants and in home for cooking and heating. Japan wants to shift even more from oil to natural gas, increasing the percentage natural gas of total energy consumption from 13 percent to 23 percent (2002). The price of natural gas in Japan is more double the price in Europe and almost four times that of the United States.

“Natural gas sources: 1) Malaysia (20.7 percent); 2) Australia (18.8 percent); 3)Indonesia (18.3 percent); 4) Qatar (10.9 percent); 5) Russia (8.5 percent); 6) Brunei (8.4 percent); 7) UAE (7.2 percent); and 8) Others (5.8 percent). [Source: Japan’s Fiscal Year 2009 Annual Energy Report]

Japan is the world’s largest importer of LNG. It has about a 100 LNG power plants. There are LNG facilities around Tokyo Bay, Osaka Bay, Kitakyushu and other places. Some worry about the catastrophic impact of an LNG tanker explosion. Sometimes LNG tankers pass very close to densely populated areas and heavily industrialized areas.

Japan gets between 20 percent and 40 percent of its LNG from Indonesia. It wants to strike a deal with Indonesia to ensure the supply is stable. Starting in 2011, Indonesia plans to reduce export to Japan to less than one forth of current levels to meet increased domestic demand.

Qatar has abundant natural gas reserves but is notorious for trying to make as much money as it can from its gas. Supplies from Sakhalin, Russia are delayed from 2008 to spring of 2009 and those from Gorgon, Australia may but not arrive until 2012. Japan is helping to develop gas fields in Britain, Iran Vietnam and elsewhere in Southeast Asia.

Osaka gas has developed a portable device that can transform natural gas extracted from offshore oil wells into naphtha liquid fuel and hopes to begin sales of the device around 2015. Transforming natural gas into naphtha cuts greenhouse emissions and helps companies make money from gas they would normally burn off. Natural gas extracted from land-based oil wells is typically transported by pipelines and then used. On offshore there usually is no alternative but to burn it off.

Big LNG Tanks and Tankers: Japan Uses More Natural Gas After the Fukushima Crisis

LPG ship Japan's LNG imports began rising at a record pace in 2011 as utilities ramp up gas-fired power generation to offset a near-record low in nuclear plant utilisation in the wake of the Fukushima radiation crisis.

In August 2011, Reuters and Kyodo reported: Osaka Gas Co , Japan's second-biggest city gas distributor, said it would build one of the world’s largest liquefied natural gas (LNG) tanks at its Senboku LNG terminal 1 to meet rising demand for natural gas. The company aims to start construction of the tank with capacity of 230,000 cubic meters in September 2012 and complete it in November 2015. It will cots between ¥10 billion and ¥20 billion.

The tank will 60 meters high and have an external diameter of 90 meters, making it almost as long as a football field, and will be able to store the annual consumption of 330,000 households. Terminal 1 handled 1.1 million tonnes of LNG in the year ended in March, the company said in a statement.

In August 2011, Kyodo reported, Tokyo Gas Co. unveiled its new liquefied natural gas tanker, one of the world's largest. The 300-meter-long, 143,000-ton Energy Horizon, currently berthed near an LNG plant in Chiba Prefecture, can transport around 80,000 tons of LNG in its spherical tanks, enough to meet annual gas demand from some 270,000 households, the firm said. The new ship, co-owned by a Tokyo Gas subsidiary and major shipping firm Nippon Yusen K.K., will travel mainly between Japan and Australia. [Source: Kyodo, August 25, 2011]

Tokyo Gas intends to expand its LNG business because utilities are expected to step up thermal power generation in the face of the nuclear crisis, which has left numerous reactors shut down. Tokyo Gas imported 10 million tons of LNG out of a total 70 million tons shipped to Japan in 2010.

Major companies such as Mitsubishi Corp., Tokyo Gas Co. and Osaka Gas Co. are studying the prospect of building a large liquefied natural gas plant on the Pacific coast of Canada to tap shale gas are aimed at ensuring a stable supply of natural gas, global demand for which is rising sharply. As part of its effort to reduce its dependence on nuclear-based electric power, shale gas is increasingly looking like a good alternative especially with North America being a major source rather than areas with high geopolitical risk, such as the Middle East and Russia.

Natural Gas in Waters Between Japan and China

Osaka Gas imports There are large undersea natural gas fields in waters claimed by both China and Japan in the East China Sea about halfway between Okinawa and the Chinese mainland. The Chunxiao and Tianwaitian natural gas fields lie in China’s exclusive economic zone. The Chunxiao field covers 8,500 square miles and holds up to 9 trillion cubic feet of gas, enough to meet China’s needs for seven years.

The area is near a group of disputed islands claimed by Japan and China known as the Senkaku to the Japanese, Diaoyu to the Chinese and Tiaoyutai to the Taiwanese. The actual line of demarcation of the boundary of the exclusive economic zones (EEZ) between China and Japan is a matter of dispute. Japan wants to make a deal but China seems more intent and trying to get away with as much as it can without actually violating international law. China so far has drilled only waters in its EEZ but it has angered Japan because these areas are so close to the disputed border.

See Separate Article SENKAKU-DIAOYU ISLANDS DISPUTE BETWEEN JAPAN AND CHINA factsanddetails.com

Japanese Energy Sources Abroad

The State-owned Japanese oil companies Impex Corporation and Japan Petroleum Exploration (Japex) Company are the two large oil exploration companies in Japan. Japex is surveying for oil in Iraq and has invested in oil sand projects in Canada.

Senkaku islands Impex is the successor of the Japan National Oil Corporation, which has an almost unrivaled history of failure. During its 38 years of existence it engaged in 305 projects around the world, most of them yielding nothing. When it disbanded it was $7 billion in debt.

Japanese companies are involved in exploring for and producing oil and natural gas in the Middle East. Japan lost the right to pump oil from a neutral zone between Kuwait and Saudi Arabia. The Tokyo-based Arabian Oil Co. had rights to drill in the Kafji oil field in Saudi Arabia until the plug was pulled on the project because Saudi Arabia wanted Japan to build a mineral-carrying railroad but Japan couldn't afford to.

Japan has aggressively set up join ventures in Texas and other places to take advantage of new technologies to extract natural gas from shale.

The trading houses Mitsubishi and Mitsui are involved in a number of energy projects including one to develop natural gas deposits above the Arctic Circle on the Yamal Peninsula in northwestern Siberia. By some estimates 30 percent of the world’s natural gas reserves lie in the Arctic.

In February 2010, INPEX announced that had acquired development rights of part of the Orinoco oil field in eastern Venezuela.

Iraqi and Iranian Oil and Gas and Japan

Japan has a $5 billion deal with Iran and Qatar to search for and develop natural sites in the Persian Gulf. The sites are the Iranian-owned Pars South and adjacent Qatar-owned North Field, the largest and second largest gas fields in the world. Pars has 13 million cubic meters. North Field has 9.8 trillion cubic meters.

leaders of Japan and Iran Japanese efforts in Iran are hampered by U.S. restrictions on doing business there. In March 2006, the United States asked Japan to suspend its plans to develop Iran’s promising Azadegan field partly to support the United States efforts to isolate Iran on the nuclear weapons issue.

The Osaka-based Tomen Company has a $2.5 billion deal with Iran to develop a large oil field that could provide Japan with 300,000 barrels of oil a day for two decades. Some think China might take advantage of the situation and take Japan’s

Japan has had problems developing the Azadegan oil field in Iran. In October 2006, Inpex, which is partly owned by the Japanese government, announced t was going to reduce its share in the Azadegan project from 75 percent to 20 percent.

Stakes in Iranian fields that Japanese oil companies gave up because of political pressure from the United States have been snatched up Chinese oil companies.

Several Japanese companies have contracts to develop oil fields in Iraq. Japan Petroleum Exploration and Malaysian Oil Company are working with South Oil, an Iraqi government firm, to develop a field in Garraf in southern Iraq.

In June 2009 it was announced that Nippon Oil Corp. Was expected to be given the rights to develop part of the Nassiriyah oil field in southern Iraq. The plots are expected to yield 600,000 barrels of oil a day — about 10 percent of what Japan consumes each day — two years after development begins. If the deal goes through it will be the largest field developed independently by a Japanese company. Before the largest field developed was in the Khafji oil field in the Persian Gulf. Nippon Oil will develop Nassiriyah with JGS, an oil exploration company, as part of a $100 billion project that also includes construction of an oil refinery and power plant.

Russian Oil and Gas and Japan

Japan is looking to Russia for the future for its energy needs. Oil rigs near Japan could supply Japan with 250,000 barrels of oil a day. There are also large deposits in Siberia that could be directed towards Japan. There are also concerns. Russia has been aggressive and uncompromising in sales of gas to Europe.

A number of Japanese energy are involved in projects in Siberia and Far East Russia. Japan Oil, Gas and Metals National Corporation (JOGMEC) is conducting feasability studies in eastern Siberian oil fields, Itochu, Marubeni, Mitsui, Mitsubishi and other are involved with Sakhalin 1 and 2. Japanese companies are sought for their expertise and money. Having them and the Japanese government involved in these projects is viewed by the Russians and others involved as a way of reducing risk and having a reliable market for its oil.

The first shipment of Sakhalin-2 gas arrived in Japan in April 2009. It takes three to four days to ship LNG from Sakhalin, considerably less time than from the Middle East.

About 60 percent of the gas from Sakhalin 2 is earmarked for Japan with the remainder going to the United States and South Korea. Sakhalin 2 gas will account for 7 percent of Japan’s annual gas imports and reduce its dependence on the Middle East for energy. The plan is to sell Japan five million tons of liquified gas a year for 24 years, starting in 2009.

Mobile Exxon is the leading investor in the Sakhalin project. It own 30 percent. Japanese companies own 30 percent in part ensure that gas from the project ends up in Japan. There are an estimate reserves of 485 billion cubic meters in the Exxon Mobile project, enough to supply Japan’s gas needs for six years.

Japan also wants to get some more of Russia’s Siberian oil. The shipping cost for Russian oil is about a third of the $1.50 a barrel it spends for shipping Middle East oil. Mitsui is negotiating with Gazprom to develop some of the worlds largest gas fields in eastern Siberia and the Barents Sea.

There are hopes that a deal over oil and gas between Russian and Japan might also lead the countries to a settlement over the Kurile Island dispute which has hampered relationships between the countries since the end of World War II.

In March 2008, Japan’s Natural Resources and Energy Agency made an agreement Rosneft, the Russian state-run oil company, to developed fields on Sakhalin island and eastern Siberia. Mitsubishi and Mitsui companies are likely to get stakes to the Sakhalin 3 site, which is believed to have the largest oil and gas reserve of the three Sakhalin sites.

LNG from Sakhalin is transported in huge tankers with large tanks collectively able to carry 65,000 tons of LNG. The trip from Sakhalin to Tokyo Bay takes about a week.

Pipeline from Siberia to Japan

crude oil suppliers There are plans to build a 2,500-mile (4,150-kilometer) pipeline — the world’s longest — between Angrask and Taychet near Lake Baikal in eastern Siberia to the Vostochny, near the Russian port of Nakhodka on the Japan Sea, where oil would shipped by tanker to Japan. The pipeline will be the longest and most expensive ever built. If built it will be three times longer than the trans-Alaska pipeline and carry 1 million barrels a day through its 1.2 meter (four foot) in diameter pipe and increase Russia’s oil-carrying capacity by a third. It could take a decade to complete.

The pipeline is expected to cost around $12 billion and has been described as the biggest project in Russia since the Trans-Siberian Railroad. The pipeline was originally supposed to cost only $6 billion but high steel prices, environmental concerns and problems presented by permafrost have pushed up the price. Japan is expected to shoulder 80 percent of the costs and get most of the oil, although a lot will be sold on the open market to any country.

In December 2004, it was decided to switch the terminus of the pipeline from the industrial port of Vostochny to Perevoznaya, a tranquil bay known its wildlife and beaches. It is a popular retreat for people from Vladivostok. The pipeline could go through areas inhabited by rare Amur leopards. Tankers would steam through Russia’s only maritime park, a cluster of islands home to 3,000 species of birds. Environmental groups strongly oppose the plan

Work on the pipeline was due to begin in 2005, with the first section from Tayshet to Skovorodino, near the Chinese border, to be completed by 2008. Work however was suspended in 2005 due to ecological concerns. Among them was the fate of the Amur leopard, whose territory would be bisected by the pipeline, and Lake Baikal. Work was ordered halted within 1.6 kilometers of Lake Baikal..

There are still many doubts about the project: foremost among them is whether or not there is enough oil in the Siberian fields to justify such an expensive project.

As of May 2010, the pipeline between the East Siberian oil field to Vladivostok was about half done.

Pipeline from Sakhalin to Japan

There are plans to build a 930-mile undersea pipeline to move the gas from Sakhalin Island to Japan. The cost of the pipeline is estimated at $16 billion. Japan has not committed itself to the project. Japan needs the gas but not badly enough to justify paying such a high price. One of the main obstacles for Japan is that its fishermen want to be compensated for losses.

The Sakhalin pipeline will cross 24 major fault lines and more than 200 salmon-spawning rivers. The oil companies have proposes building bridges over seven of the salmon streams. Russian government experts want to see 29 bridge crossings. If the pipeline were to rupture in an earthquake it could cause serious long term damage to these streams.

Competition Between Japan and China Over Russian Oil and Gas

Both China and Japan have been courting Russia for a pipeline that would bring oil from eastern Siberia to them. In the fall of 2004, the Russian government made it clear was going go through with pipeline that help Japan, who offered Russia $7 billion in financing for the pipeline and oil development projects. The Russians prefer this pipeline anyway over the one to China because oil could be sold to a number of buyers — Japan, South Korea, maybe the United States — whereas the other deal is to a single buyer — China — and gives them too much leverage over price. The Chinese were appeased with the promise that Russia would increase its exports to China by rail by 300,000 barrels a day.

There is one plan to build a branch pipeline off the pipeline from Angarsk to Nakhodka that would go to Daqing in China. The costs of the branch would be between $2.5 billion and $3 billion. This plan was given a major setback when Yukos president was jailed in June, 2003 and Japan provided Russia with lucrative financial considerations for an alternative pipeline through Siberia that bypassed China. The Japanese promised to spend $12 billion to cover construction cost and provide money for private companies for oil exploration.

China has had discussions with Exxon Mobile about buying gas from their fields off Sakhalin Island, which Japan assumed was going to go to them. Exxon Mobile is somewhat angry with Japan for not moving faster to build a pipeline from Sakhalin to Japan. Disruptions on the Sakhalin projects and promises by Exxon to give China gas from Sakhalin 1 may mean that Japan gets less natural gas.

Coal and Japan

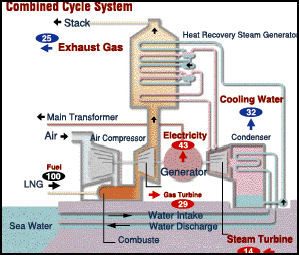

thermal combined system During the 1950s, Japan relied on coal to fire its growing economy. In 1960, Japan's 600 coal mines produced 55 million tons of coal a year. Over the years companies switched to oil and imported coal. By 1979 there were only 102 coal mines left, and by 1985 only 11.

Coal accounts for 23 percent of Japan’s energy consumption. Despite also its claims to be a green society and at the forefront of saving energy and reducing greenhouse gas emissions Japan burned twice as much coal in 2008 as it did in 1998.

Japan (198 million tons) and South Korea (98 million tons) are the largest coal importers. Japan gets 63 percent of its coal from Australia. It also gets a lot of coal from Vietnam.

Japan is a leader in producing energy-efficient, coal-power technology. With global demand for coal power expected to remain high in years to come — and with that demand for low-emission and high efficiency coal power generation also expected to remain high — producers of cutting-edge coal power generation are increasingly looking abroad for sales. Hitachi and Toshiba are finding markets for steam turbines in China and India and other countries, Electric Power Development Co., better known as J-Power, is building power plants in China.

Japan is a leader in clean coal technology such as IGCC (integrated gasification combined cycle), in which coal is turned into gas to remove impurities before combustion; and IGFC (integrated gasification fuel combined cycle), in which gasified coal achieves high power generation efficiency with a triple system of fuel cells. gas turbines and steam turbine. These systems are still largely experiential at this stage yet Japan is introducing the technology to China, India and other countries.

Coal Supplies and Japan

Japan effectively terminated its domestic coal production in 1990 as the high value of the yen made it much cheaper to import coal. The last coal mine, the Taiheiyo Tanko coal mine in Kushiro, Hokkaido, closed in January 2002. Located 800 meters offshore and 700 meters under the sea, it was a state-of-the-art facility that produced coal at about three times the world price. The mine couldn't compete with cheap import coal, and nationwide power plants were switching from coal to cleaner oil and natural gas. The mine closed when its $1 billion a year government subsidies were cut off.

Japan imports 99 percent of its coal. Most of Japan’s coal is imported from Australia, Canada, China and Vietnam. The amount that Japan imports is roughly equal to a forth of all the coal traded internationally. Because Japan imports many kinds of coal from man different sources it very good at evaluating the energy efficiency of different kinds of coal.

Australia is Japan’s largest coal supplier, supplying it with 179.16 million tons of coal a year. This amounts 59 percent of Japan’s coal imports, which is more or less the same thing as Japan’s coal consumption since Japan doesn’t produce any coal of its own any more.

An upsurge in energy prices that has spread to coal (the price of coking coal imported to Japan from Australia jumped from $100 a ton to $300 a ton between 2006 and 2007) spurred Japanese coal companies to reopen mines. Hokkaido Electric Power Company doubled its coal order in 2008 from Hokkaido mines from 500,000 to 1 million tons.

Image Sources: 1) Jun from Goods in Japan 2) 3) Japan Nuclear Power Program 4) 5) 10) 13) 14) TEPCO 6) Doug Mann Photomann, 7) 8) Osaka Gas, 11) Office of Prime Minister of Japan, 12)

Text Sources: New York Times, Washington Post, Los Angeles Times, Daily Yomiuri, Times of London, Japan National Tourist Organization (JNTO), National Geographic, The New Yorker, Time, Newsweek, Reuters, AP, Lonely Planet Guides, Compton’s Encyclopedia and various books and other publications.

Last updated October 2012