RETIREMENT IN CHINA

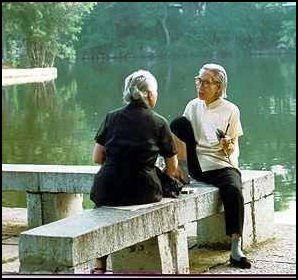

In China, men currently can retire at 60 years of age, while women who work in factories can retire as early as 50. Female public-sector workers can retire at 55. Each year 3 million Chinese retire. Many retirees have a lot of time and limited resources. They like to hang out in the streets chatting with their friends or congregate in parks doing tai chi, ballroom dancing or some other activity. One elderly man told the New York Times, “Many old Chinese loving fly kites because it can take up much time, and its cost is free.”

Angie Eagan and Rebecca Weiner wrote in “CultureShock! China”: Step out early any morning to any public park virtually anywhere in China and you will see some of the liveliest use of communal space. The parks are thronged with people in the morning — all ages, from children, but especially retirees — dancing, singing, practising martial arts or tai chi, climbing hills, swinging from trees (believed in traditional Chinese medicine to help strengthen the lungs as well as the arms), strolling, or just gossiping. Life after work is still very much a central part of Chinese society, and most Chinese look forward to a physically and socially active retirement full of community involvement. In addition to the public parks, there are also community centres and chess clubs, neighbourhood associations and volunteering, part-time job opportunities and of course grandchildren to look forward to, family planning policies or not. In China’s poorest areas, of course, there is no retirement, just a struggle for subsistence that lasts till people drop. But increasingly, in most of China and especially in the booming coastal regions, growing national wealth has allowed the beginnings of social safety nets. Maintaining community services and public spaces for retirees tends to be a relatively high priority among these, and the benefits of that are clear to see. [Source: “CultureShock! China: A Survival Guide to Customs and Etiquette” by Angie Eagan and Rebecca Weiner, Marshall Cavendish 2011]

In 2005, only 1 percent of Chinese older than 80 were in elder care facilities, compared to 20 percent in the United States. There are only 10 nursing home beds for every 1,000 elderly who need them. There is an effort to open more private retirement homes and provide for the means for people to pay for them. Some elderly live happily in small profit-making retirement homes that cost $1,000 to get into and charge $90 a month. Residents do tai chi in the morning and receive frequent visits form their grandchildren.

See Separate Articles: ELDERLY IN CHINA factsanddetails.com ; NEGLECT AND PROBLEMS SUFFERED BY ELDERLY PEOPLE IN CHINA factsanddetails.com ; FAMILIES IN CHINA factsanddetails.com ; TRADITIONAL CHINESE FAMILY factsanddetails.com ; CHINESE FAMILY IN THE 19TH CENTURY factsanddetails.com ; CONFUCIANISM, FAMILY, SOCIETY, FILIAL PIETY AND RELATIONSHIPS factsanddetails.com

Good Websites and Sources: People’s Daily article peopledaily.com ; China Daily article chinadaily.com ; China.org article china.org.cn ;

Exercise and Elderly Entertainers in China

Early each morning millions of elderly Chinese gather in parks to exercise and socialize. A 1995 nationwide fitness program helped establish some 30,000 recreation areas, where the elderly and others can congregate. The elderly do tai chi, calisthenics and various kinds of dances and exercises. One 82-year-old regular at Shanghai’s Fuxing Park told National Geographic, “I dance rumba and cha-cha for my physique, but more importantly because it makes me happy.” One study involving 37,000 elderly in China found that regular exercise among people 80 or older reduced the risk of mortality by 20 percent.

Laurie Burkitt and Josh Chin wrote in the Wall Street Journal, In China “elderly exhibitionists have become something of an entertainment phenomenon, even spawning a new genre on Chinese video sites called laolaiqiao. That translates, loosely from the Mandarin, as "old people doing young things that even young people wouldn't do." [Source: Laurie Burkitt and Josh Chin, Wall Street Journal, January 19, 2013 /]

“In May 2011, Bai Shuying, then 65 years old, shot to the top of the laolaiqiao charts when she turned out an uncanny impersonation of Michael Jackson, pelvic thrusts and all, on the popular reality show "China's Got Talent." "I saw him on TV and I knew our fates were connected," says Ms. Bai of Mr. Jackson. Four months later, a choir of elderly amateurs went viral with an adorably choreographed rendition of Lady Gaga's "Bad Romance" as part of a national mid-Autumn festival broadcast. /

“Henan Satellite Television hosts a weekly talent show featuring vibrant seniors. One of them is 74-year-old Zheng Xueming, who can juggle a tennis ball on his knees for hours. The show's producer says it was tough at first to find gifted geriatric types. But after several episodes aired, applications began pouring in. More than 700 seniors, he says, have tossed their names in the hat to appear on "Golden Dream Stage." /

“So what is behind this proliferation of outgoing elderly people? According to Peng Xizhe, a scholar at Fudan University in Shanghai who studies issues around aging, it is an outgrowth of the cultural diversification unleashed in China after the country first broke the seal on its once walled-off society in the late 1970s.Chinese people in their 60s and 70s are like baby boomers in the U.S., says Mr. Peng, drawing parallels between the post-Mao enrichment of Chinese society and the American postwar economic boom. "Like with the baby boomers, the cultural ideas of older people in China now are very different from their parents," he says. /

Uber-Driving Retiree

“With more than 20 years driving experience, Sheng Rongdi, 60, a retiree from Shanghai, started driving for Uber in February after her daughter told her “it must be fun.” She used to play Mahjong every day to kill time after retirement, even though she could not stand the cigarette smokers at the nearby Mahjong club. After she picked up driving for Uber as a new hobby, she gave up Mahjong totally. Zheping Huang wrote in Quartz: “

“Sheng gets up at 6am every day, prepares breakfast for her husband and daughter, drives her daughter to work, and then starts her full-time job as a Uber driver from 8.30am to 6.30pm. After that, she goes to the market to buy food and goes home to cook for the family. In an Uber promotional event for breast cancer awareness in Shanghai, Sheng was selected as a face for the sixties. She says she feels happy when a passenger recognizes her and says “I’m in a celebrity’s car.”

“Sheng said passengers often tell her siting in her car is “not like hailing a taxi, but like siting in a family car, very heartwarming.” She has become friends with many passengers her age — one has turned into aUber driver, too, on her recommendation. The two often drink coffee and go traveling together outside Shanghai. Another, who is also a Mahjong player, chitchats with Sheng on the phone regularly, complaining about her unsatisfactory future daughter-in-law.

Retirement Age in China

China has some of the lowest retirement ages in the world: In China, men currently can retire at 60 years of age, while women who work in factories can retire as early as 50. Female public-sector workers can retire at 55. This is way below international standards and China is beginning to pay for it, Vivian Wang and Joy Dong wrote in the New York Times: “China has been hurtling toward a retirement age crisis for years. The current standards were set in the 1950s, when the average citizen was expected to live until only his or her early 40s. But as the country has swiftly modernized, life expectancy has reached nearly 77 years, according to World Bank data. Birthrates have also plummeted, leaving China’s population distinctly top-heavy. More than 300 million people, about one-fifth of the population, are expected to be over 60 by 2025, according to the government. The result is what experts call a serious threat to China’s continued economic growth and ability to compete. In Japan and many European nations, residents become eligible for pensions at 65 or later. You Jun, China’s deputy minister of human resources and social security, said China risked a “waste of human resources.”

[Source: Vivian Wang and Joy Dong, New York Times, April 27, 2021]

China has some of the lowest retirement ages in the world: In China, men currently can retire at 60 years of age, while women who work in factories can retire as early as 50. Female public-sector workers can retire at 55. This is way below international standards and China is beginning to pay for it, Vivian Wang and Joy Dong wrote in the New York Times: “China has been hurtling toward a retirement age crisis for years. The current standards were set in the 1950s, when the average citizen was expected to live until only his or her early 40s. But as the country has swiftly modernized, life expectancy has reached nearly 77 years, according to World Bank data. Birthrates have also plummeted, leaving China’s population distinctly top-heavy. More than 300 million people, about one-fifth of the population, are expected to be over 60 by 2025, according to the government. The result is what experts call a serious threat to China’s continued economic growth and ability to compete. In Japan and many European nations, residents become eligible for pensions at 65 or later. You Jun, China’s deputy minister of human resources and social security, said China risked a “waste of human resources.”

[Source: Vivian Wang and Joy Dong, New York Times, April 27, 2021]

Angie Eagan and Rebecca Weiner wrote in “CultureShock! China”: To better manage the profitability of state-run companies, China lowered its retirement ages. Some people who are viewed as indispensable in their skills are not forced to retire — usually these people are leaders in their specialised field and can work well into their 80s. While they continue working, they are not subject to the same demands of others, and quite often are treated deferentially. In some cases, people come to their homes to consult with them and seek advice rather than require them to go to the workplace on a regular basis. Most Chinese people look forward to retirement. Chinese are very active retirees, it is a newly won badge of aging honour and commands further respect. It is a time to pursue hobbies, spend time with grandchildren and play a stronger role in community. [Source: “CultureShock! China: A Survival Guide to Customs and Etiquette” by Angie Eagan and Rebecca Weiner, Marshall Cavendish 2011]

According to SupChina: “In 1978, China introduced the current retirement age limits. By keeping the age unusually young — in comparison, the typical American leaves the workforce at age 63 — China was hoping to bring more young people into the workforce and capitalize on their fresh ideas and healthy bodies. Meanwhile, at that time, short life expectancies ensured that the pension taxes collected by the country were sufficient to cover the benefits it had to offer. [Source: Jiayun Feng, SupChina, November 11, 2020]

Raising the Retirement Age in China

Most Chinese workers retire by 60. But with the population aging and pension funds running low, the government says that must change. China is quickly fulfilling the oft-repeated adage that "China is becoming old before it becomes rich." China’s demographic dividend — a reference to speedy economic expansion due to an increase of the proportion of Chinese who are working — is forecast by official economists to decline sharply from around 2013. And by 2039, less than two Chinese taxpayers may have to look after one retiree.

One solution to the aging problem in China is to defer retirement for several years, but this would mean fewer opportunities for young people entering the job market. Many companies want employees to retire early so more positions become available for young people. One proposed measure to deal with this problem is raising the retirement age from 55 to 60 for women and from 60 to 65 for men, which would bring China more in line with international norms. In March 2021, China said it would “gradually delay the legal retirement age” over the next five years.” Vivian Wang and Joy Dong wrote in the New York Times: “The idea, though, is deeply unpopular.” As of April 2021 the government had yet to release details of its plan, but older workers have already decried being cheated of their promised timelines, while young people worry that competition for jobs, already fierce, will intensify. The announcement was made during the annual meeting of the national legislature, and afterward retirement-related topics trended for days on Chinese social media, racking up hundreds of millions of views and critical comments. [Source: Vivian Wang and Joy Dong, New York Times, April 27, 2021]

“Around the world, raising the retirement age has emerged as one of the thorniest challenges a government can take on. Russia’s attempt to do so in 2018 led to President Vladimir V. Putin’s lowest approval ratings in years. Mr. Putin eventually pushed the plan through but granted concessions, a rare move for him.A pension reform plan in France prompted a prolonged transportation strike last year, forcing the government to shelve the proposal.

“The Chinese government itself abandoned a previous effort to raise retirement ages in 2015, in the face of a similar outcry. This time, it seems determined to follow through. But it has also acknowledged the backlash. Officials appear to be treading gingerly, leaving the details vague for now but suggesting that the threshold would be raised by just a few months each year. “They’ve been talking about it for a long time, ” said Albert Francis Park, an economics professor at the Hong Kong University of Science and Technology who has studied China’s retirement system. “They’ll have to really exercise quite a bit of resolve to push it through.”

“Delaying retirement also risks undermining another major government priority: encouraging couples to have more children, to slow the aging of the population. In part because of inadequate child-care resources, the vast majority of Chinese rely on grandparents to be the primary caretakers for their children. Now, social media users are asking what will happen if the older generation is still working. Lu Xia, 26, said the prospect of later retirement made it impossible to consider having a second child. More children would eventually mean more grandchildren to care for, even as she was expected to keep working. “With delayed retirement, it’s hard to imagine what we’ll have to face by the time that we are grandparents, ” said Ms. Lu, who lives in the city of Yangquan, southwest of Beijing. Unless China increases support for child care, new parents may leave the work force or postpone childbirth until their parents retire, exacerbating the labor shortage, Feng Jin, an economist at Fudan University, told a state-backed labor publication.

“Still, experts maintain that the cost of inaction would be too high. A 2019 report by the Chinese Academy of Social Sciences predicted that the country’s main pension fund would run out by 2035, in part because of the dwindling work force. “That has alarmed some young people, who wonder where their own pensions will come from if nothing changes.

The China Economic Weekly reported (in Chinese) in 2020: two possibilities are under serious consideration among China’s leadership. According to Y áng Lìxióng, a professor at the School of Labor and Human Resources at Renmin University, the first option is to make the retirement age same for men and women and then lift the age for collecting state pensions for both men and women. The other plan is to firstly raise the age for the two genders separately and eventually take an extra step to make the retirement age the same for women as it is for men. Yang told the magazine that he was in favor of the first method because raising women’s retirement age was a matter of acute urgency. “For now, some women retire at 50, which I think is too soon, ” Yang said. “It’s imperative that we apply the same rule to men and women first. Moving forward, we can make the changes for women more drastic.” [Source: Jiayun Feng, SupChina, November 11, 2020]

Workers Aren’t Happy About Raising the Retirement Age

Vivian Wang and Joy Dong wrote in New York Times: “For Meng Shan, a 48-year-old urban management worker in the Chinese city of Nanchang, retirement can’t come soon enough. Mr. Meng, who is the equivalent of a low-level, unarmed law-enforcement official, often has to chase down unlicensed street vendors, a task he finds physically and emotionally taxing. Pay is low. Retirement, even on a meager government pension, would finally offer a break. [Source: Vivian Wang and Joy Dong, New York Times, April 27, 2021]

“So Mr. Meng was dismayed when the Chinese government said it would raise the mandatory retirement age, which is currently 60 for men. He wondered how much longer his body could handle the work, and whether his employer would dump him before he became eligible for a pension. “To tell the truth, ” he said of the government’s announcement, “this is extremely unfriendly to us low-level workers.”

“Workers with blue-collar or physically demanding jobs like Mr. Meng’s, who still make up the majority of China’s labor force, say they’ll be worn down, left unemployed or both. “The backlash has underscored a host of other anxieties in Chinese society about issues such as job security, the social safety net and income inequality.

“The hypercompetitive environment that defines many white-collar workplaces in China is already grinding on Naomi Chen, a 29-year-old financial analyst in Shanghai. She has often discussed with friends her wish to retire early to escape the pressure, even if it means living more modestly. The government’s announcement only confirmed that desire. China already struggles to provide enough well-paid white-collar jobs for its ballooning ranks of university graduates. With fewer retirees, Ms. Chen worries, she would be left working just as hard but with less prospect of a payoff. “Getting promoted will definitely be slower, because the people above me won’t retire, ” she said.

“In reality, older workers may suffer more. China has modernized so quickly that they tend to be much less skilled or educated than their younger counterparts, making some employers reluctant to retain them, Professor Park said. In several industries, including tech, 35 is seen as the age ceiling for being hired.

On raising the retirement age, Wang Guohua, a 29-year-old blogger in Hebei Province, “I think this is pretty fair. “If people are still alive but there’s no more money, that will affect social stability.” “Mr. Wang added that he did not see the appeal of retiring at 60, given how much life expectancy had increased: “You won’t have anything to do.”

“Indeed, Bian Jianfu, who retired recently from his job as a manager at a state-owned enterprise in Sichuan Province, said he would not have minded working a few years longer. His pension would have increased, too. Mr. Bian receives about $1,000 a month, more than double the average for urban retirees. He praised the government for consistently raising pension payments over the past decade though some experts have acknowledged the strain that doing so has added to the system. “The Chinese government treats retirees very well, ” he said.

“But that security is unevenly distributed, and it is likely to remain so even if the government shores up its pension funds. Mr. Meng, the urban management worker, is paid about $460 a month, one-tenth of which he pays toward pension and basic medical insurance funds. When he finally retires, he expects to draw $120 to $150 a month. He acknowledged that it was barely enough to live on. But he said he could make it work — even if he was now increasingly unsure when the date would come. “All I can do is hold on, ” Mr. Meng said. “Keep holding on until I’ve reached the right age.”

China’s Unsuccessful 2015 to Raise the Retirement Age

In March 2015, Chun Han Wong of the Wall Street Journal wrote: “After hinting for years that China’s workers would need to delay retirement, Beijing has finally set a timeline for the move — a gradual, multiyear process aimed at easing social and fiscal pressures stemming from the country’s rapidly aging population. Yin Weimin, the country’s minister in charge of human resources and social security, said his ministry proposed to raise the retirement age by a few months each year, taking a steady approach to the first revision of China’s official retirement policy since the 1950s, Mr. Yin said at a news briefing on the sidelines of an annual parliamentary meeting. [Source: Chun Han Wong, China Real Time, Wall Street Journal, March 10, 2015]

“There is currently no societal consensus on this issue,” Mr. Yin said in 2015. In an effort to assuage public unease, increases to the retirement age would be implemented in “small, gradual steps” that help citizens adjust to the change, he added.State researchers have suggested raising the retirement age by three months every year over the next decade. Mr. Yin said one potential scenario might involve a two-month increase in the first year followed by another four months the following year. Some analysts say the government may first raise retirement ages for females, bringing them level with their male counterparts before making further changes.

“Different approaches would be taken for different sectors, so as to ensure a smooth implementation,” said Qiao Jian, a labor expert at the China Institute of Industrial Relations in Beijing. “Female teachers and public servants would lead the way, and females workers would eventually follow. Regardless how the government eventually implements its plans, the social media reaction to Mr. Yin’s comments suggests that officials would have a tough time winning over hearts and minds on the matter. On the Weibo microblogging service, dissenting voices appeared to outnumber those that support delaying retirement. “Raising the retirement age is a silly idea,” a Weibo user wrote. “We should be raising youth-employment rates instead; if the elderly don’t retire, how will young people find job opportunities?” “The outcry ended up so fierce the effort to raise retirement ages in 2015 was shelved, with the government trying again in 2021 and being more discreet about its plans.

Elderly and Pensions in China

In the 2000s, fewer than 30 percent of urban dwellers had pensions and virtually none of the 700 million in the countryside had them. At that time only 15 percent of those that retired had pensions and the existing state pension system covered only a sixth of the work force and was already saddled with liabilities more than China’s GDP. Rural peasants have traditionally not received any pensions. They are taken care of by their families. Elderly couples in Beijing in the 2000s that received a pension lived on a combined pension of around $180 a month. Many outside Beijing received much less than that.

China’s pension system was introduced in 1952. According to the “Encyclopedia of Aging”. In the 1990s China aimed to provide the "Five Guarantees" of food, clothing, shelter, medical care, and a funeral for old persons who are childless, disabled, and have no close relatives to rely on. According to the 1992 survey of the elderly, only 5.9 percent of the rural elderly age sixty and over were pension recipients, in contrast to 73.7 percent in the urban areas. The rural elderly have almost no social security coverage. This is a strategically important issue to be considered by policy makers; the old age insurance system should be made universal and strengthened as soon as possible. [Source: Zeng Yi, “Encyclopedia of Aging”, Gale Group Inc., 2002]

Many elderly have been denied the comfortable pensions they thought the had been promised. One former rocket scientist who was forced to work as a bookkeeper at a restaurant to make ends meet told the Los Angeles Times, “I gave my youth to my country and did everything the party asked of me to do. Now I’m old and have no sense of security.. If I stayed home and dwelt on my resentment, I might die early from heartache. It’s better to work and do something with my time.”

China does not yet have a cohesive and comprehensive social security system. The absence of an adequate safety net slows consumption as Chinese save heavily to pay for health care, schooling, retirement and care for their parents. The government is creating a special welfare program including pensions, health care and other programs to deal with the rising number of elderly. The government has said that as China becomes increasingly affluent it is its responsibility to operate such programs.

Chun Han Wong of the Wall Street Journal wrote: To address the problem of China’s shrinking labor pool and the strain of this on China’s pension system the government plans to " expand the coverage of social insurance and boost returns on the country’s pension fund. Yin Weimin, the country’s minister in charge of human resources and social security, said , “We will look at some opportunities with higher returns but will contain risks.” [Source: Chun Han Wong, China Real Time, Wall Street Journal, March 10, 2015]

“In recent years, the government has sought to rapidly expand senior medical benefits, and nearly 95 percent of the elderly receive some pension, Tao Liqun, a researcher with the Gerontological Society of China, told the the Los Angeles Times. "An urban retiree may receive $500 to $1,000 a month, but payments in rural areas may be less than $10. "The elderly situation is much better in the cities.” [Source: Julie Makinen, Los Angeles Times, July 29, 2013]

See Welfare System

China’s Pension Fund

China's pension fund will come under tremendous pressure to break even in coming years and by some calculation will go broke in 2035 unless something is done. In 2015, Reuters reported: “Analysts have long warned about China's state pension crisis and the severe funding shortage, with some estimating that the cash shortfall could rise to as high as nearly $11 trillion in the next 20 years. Yin Weimin, minister of human resources and social security, “Yin said the finances were not as dire for the moment, but warned about challenges ahead. "The pension fund faces tremendous pressure in terms of breaking even in future, " he told reporters at a news briefing on the sidelines of the annual meeting of China's parliament. [Source: Reuters, March 10, 2015]

“The fund's income stood at 2.3 trillion yuan ($367.3 billion) in 2014, exceeding its expenditure of 2 trillion yuan for the year, ending the year with a net fund size of 3.06 trillion yuan, the minister said. he said. But in coming years, the proportion of Chinese over the age of 60 will rise to 39 percent of the population, from 15 percent now, Yin said. That would depress the dependency ratio — the ratio of the number of people younger than 15 or older than 64 to the working age population — to 1.3 from the current 3.04, he said. And as China's economy slows to an expected 25-year low of around 7 percent this year, Yin cautioned that the country's labor market will also face greater pressure.

Chun Han Wong of the Wall Street Journal wrote:“For years, critics have accused the government of shortcomings in its management of China’s national pension fund, raising the risk that current workers and future retirees who’ve already paid into the system won’t be able to receive payments. In a recent study, a researcher at the state-backed Chinese Academy of Social Sciences said the pension fund could have earned billions of dollars more if the government had put its money to better use, instead of just depositing them in banks and investing a small portion in government bonds.” [Source: Chun Han Wong, China Real Time, Wall Street Journal, March 10, 2015]

Image Sources: 1) Posters, Landsberger Posters http://www.iisg.nl/~landsberger/; 2) Photos, Beifan and Julie Chao

Text Sources: New York Times, Washington Post, Los Angeles Times, Times of London, National Geographic, The New Yorker, Time, Newsweek, Reuters, AP, Lonely Planet Guides, Compton’s Encyclopedia and various books and other publications.

Last updated October 2021