JAPAN AT ITS PEAK IN THE 1970s AND 80s

Japanese cars

arrive in

America Economic growth continued at a robust rate through the 1970s and 80s, with the growth in the 1980s about 5 percent a year, about half the growth rate that China experienced in the 2000s. With the help of the oil embargo Japan captured 21 percent of the world's automobile market by the mid 1970s.

By the 1980s, Japan had built up such huge trade surpluses and the yen had become so strong that Japanese businessmen were buying up properties all over the world and Japanese tourists were fanning out to every corner of the globe. Many people thought Japan was poised to dominate the world economically and Japan bashing became a popular conversation topic in the United States and elsewhere.

Jean-Pierre Lehmann wrote in Forbes: “The 1970s were a bit more challenging as Japan was hit by the so-called oil shock, following OPEC’s steep rise, accompanied by the “Nixon shock” when the then president took the dollar off the gold standard, resulting, among other things, in the massive appreciation of the yen. Prognostics for Japan were grim. But it turned out to be in many ways Japan’s finest hour: Government and the public undertook dynamic adjustments. Consumption of energy plummeted, and production boomed as energy-saving measures were introduced and Japanese industry gained competitive advantages in miniaturization.” [Source: Jean-Pierre Lehmann, Forbes, April 24, 2016 ***]

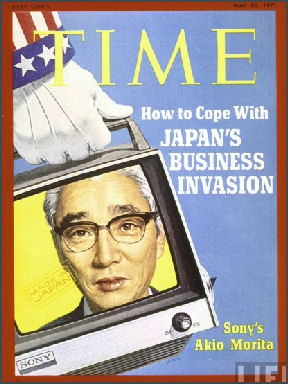

“The 1980s “was when the “Japan as No. 1" syndrome emerged. As the U.S. was economically struggling it was looked upon with scorn, in fact contempt, as was vividly illustrated by the publication of the hubristic book The Japan That Can Say No, coauthored by Sony cofounder and chairman Akio Morita and leading political figure Shintaro Ishihara, who was also known for staunchly denying that the 1937 Nanjing massacre had occurred.” ***

Websites and Resources

Good Websites and Sources: Economic History and Economy of Japan applet-magic.com ; Google E-Book: Economic History of Japan 1600-1990 books.google.com/books ; Google E-Book: Emergence of Economic Society in Japan 1600-1990 books.google.com/books ; Economic History Links let.leidenuniv.nl/history

Bubble Economy, Its Collapse and Recession: ; The Japan Bubble Economy lewrockwell.com/thornton ; Stock Market Bubble researchmag.com ; Bubble Economy and the Bank of Japan allacademic.com ; IMF Paper on the 1980s Asset Price Bubble pdf fileimes.boj.or.jp/english ; Land Prices Between 1974 and 2007 tochi.mlit.go.jp ; Global Property Report on Japan foreclosured.blogspot.com ; Lessons the Recession in Japan in the 1990s rjones2818.blogspot.com ; Book; The Holy Grail of Macroeconomics, Lessons from Japan’s Great Recession wiley.com/WileyCDA ; Bubble Burst and Recession — 1990s grips.ac.jp/teacher/oono Ambitious Bubble Era Amusements that Closed Wild Blue Yokohama on Aaron’s World sfsjapan.blogspot.com Lalasport Ski Dome (closed in 2002) on Wikipedia Wikipedia Phoenix Seagaia Resort Sheraton

Good Websites and Sources on Economics: Ministry of Economy, Trade and Industry meti.go.jp/english ; Ministry of Finance of Japan mof.go.jp/english ; Japan Economy News and Blog japaneconomynews.com ; Japan Economy Watch japanjapan.blogspot.com ; Japan Center for Economic Research jcer.or.jp/eng ; Japan Inc. Economic and Business News japaninc.com ; Google E-Book: Japan in the 21st Century, Environment, Economy and Society (2005) books.google.com/books

RELATED ARTICLES IN THIS WEBSITE: MODERN HISTORY factsanddetails.com; ECONOMIC HISTORY factsanddetails.com; ECONOMIC HISTORY OF JAPAN FROM A.D 578 TO WORLD WAR II: THE WORLD'S OLDEST COMPANY, MEIJI PERIOD MODERNIZATION AND ZAIBATSU factsanddetails.com; JAPAN AFTER WORLD WAR II: HARDSHIPS, MACARTHUR, THE AMERICAN OCCUPATION AND REFORMS factsanddetails.com; JAPAN'S POST-WORLD-WAR II ECONOMY AND THE ECONOMIC MIRACLE OF THE 1950s AND 60s factsanddetails.com; JAPAN INTHE 1950s, 60s AND 70s UNDER YOSHIDA, IKEDA, SATO AND TANAKA factsanddetails.com; JAPAN IN THE 1980s AND EARLY 1990s: NAKASONE AND THE PRIME MINISTERS THAT FOLLOWED HIM factsanddetails.com; MACROECONOMICS IN JAPAN Factsanddetails.com/Japan ; JAPAN INC. AND REFORMS Factsanddetails.com/Japan JAPANESE BUBBLE ECONOMY IN THE 1980s AND ITS COLLAPSE IN THE 1990s factsanddetails.com; RECESSION, DEFLATION AND DECLINE FOLLOWING JAPAN'S BUBBLE ECONOMY COLLAPSE factsanddetails.com; JAPAN AND ITS PRIME MINISTERS AND GOVERNMENT IN THE 1990s AND EARLY 2000s factsanddetails.com; JUNICHIRO KOIZUMI factsanddetails.com; ECONOMIC REFORMS AND RECOVERY IN THE 2000s IN JAPAN factsanddetails.com; JAPAN, THE GLOBAL ECONOMIC CRISIS IN 2008 AND AFTERWARDS: HARD TIMES, STIMULUS AND SLIGHT RECOVERY factsanddetails.com; IMPACT OF THE MARCH 2011 EARTHQUAKE AND TSUNAMI ON THE JAPANESE ECONOMY, FACTORIES AND COMPANIES factsanddetails.com; ECONOMY AFTER THE MARCH 2011 TSUNAMI: RECOVERY AND SLOWDOWN IN 2012 factsanddetails.com; JAPAN'S DECLINE factsanddetails.com ABENOMICS: SHINZO ABE’S POLICIES TO TURN THE JAPANESE ECONOMY AROUND factsanddetails.com; SUCCESSES OF ABENOMICS factsanddetails.com; ABENOMICS OBSTACLES AND FAILURES factsanddetails.com

RECOMMENDED BOOKS: “Ashes to Awesome- Japan's 6,000-Day Economic Miracle” by Hiroshi Yoshikawa and Fred Uleman (2021) Amazon.com; “America and the Japanese Miracle: The Cold War Context of Japan's Postwar Economic Revival, 1950-1960 by Aaron Forsberg Amazon.com; “Inventing Japan: 1853-1964" by Ian Buruma (Modern Library, 2003) Amazon.com; “The Making of Modern Japan” by Marius B. Jansen Amazon.com; “The Cambridge History of Japan, Vol. 6: The Twentieth Century” by Peter Duus Amazon.com; “Hirohito and the Making of Modern Japan” by Herbert P Bix Amazon.com; “Embracing Defeat: Japan in the Wake of World War II” by John Dowser of Massachusetts Institute of Technology, who won the Pulitzer Prize for nonfiction in 1999. Amazon.com; “Japan Rearmed: The Politics of Military Power” by Sheila A. Smith (2019) Amazon.com; “Japan in Transformation, 1945–2020 by Jeff Kingston Amazon.com; “Blood and Rage: The Story of the Japanese Red Army (1990) by William R. Farrell Amazon.com

Oil Embargo and Growth in Japan in the 1970s

Japan had the world’s second largest economy for 42 years from 1968 to 2010. Prime Minister Tanaka Kakuei’s Basic Economic and Social Plan (February 1973) forecast continued high growth rates for the period 1973--1977. However, by 1973 domestic macroeconomic policy had resulted in a rapid increase in the money supply, which led to extensive speculation in the realestate and domestic commodity markets. In 1973 the Japanese economy was suffering an inflation spiral caused mainly by surging land prices triggered by a nationwide development boom. Japan was already suffering from double-digit inflation when the outbreak of war in the Middle East led to an oil crisis.

In October 1973, war broke out in the Middle East and Arab oil-producing nation cut supplies to countries that supported Israel. Oil prices quadrupled, consumption declined and high raw material costs hit companies hard. In 1974 and 1975 after the Arab oil embargo Japan went into a severe recession. GDP shrunk 0.5 percent in fiscal 1974 and 4 percent in fiscal 1975 with the worse drop of 13.1 percent occurring the January-March 1974 quarter.

Energy costs rose steeply and the yen’s exchange rate, which had not reflected its true strength, was shifted to a floating rate. The consequent recession lowered expectations of future growth, resulting in reduced private investment. Economic growth slowed from the 10 percent level to an average of 3.6 percent during the period 1974--1979, and 4.4 percent during the decade of the 1980s. [Source: Web-Japan, Ministry of Foreign Affairs, Japan]

“A second oil crisis in 1979 contributed to a fundamental shift in Japan’s industrial structure from emphasis on heavy industry to development of new fields, such as the VLSI semiconductor industry. By the late 1970s, the computer, semiconductor, and other technology and information-intensive industries had entered a period of rapid growth. As in the high-growth era, exports continued to play an important role in Japan’s economic growth in the 1970s and 1980s. However, the trade friction that accompanied Japan’s growing balance of payments surplus brought increasingly strident calls for Japan to further open domestic markets and to focus more on domestic demand as an engine of economic growth.

Japanese Economy in the 1980s

Again in 1980 Japan suffered from high inflation and recession mainly due to large hikes in the price of imported oil. The exchange rate reaches 360 yen to the dollar in the 1970s.

Even so economic growth continued at a robust rate through the 1970s and 80s, with the growth in the 1980s about 5 percent a year, about half the growth rate that China experienced in the 2000s. With the help of the oil embargo Japan captured 21 percent of the world's automobile market by the mid 1970s.

Japan overtook Germany to become the world’s second largest economy in the 1970s. By the 1980s, Japan had built up such huge trade surpluses and the yen had become so strong that Japanese businessmen was buying up properties all over the world, and Japanese tourists were fanning out to every corner of the globe. Many people thought Japan was poised to dominate the world economically and Japan bashing became a popular conversation topic in the United States and elsewhere.

Japanese Economy Peaks in the Late 1980s

“The original Asian success story, Japan rode one of the great speculative stock and property bubbles of all time in the 1980s to become the first Asian country to challenge the long dominance of the West,” the New York Times reported. “In the 1980s, a mighty — and threatening—“Japan Inc.” seemed ready to obliterate whole American industries, from automakers to supercomputers. With the Japanese stock market quadrupling and the yen rising to unimagined heights, Japan’s companies dominated global business, gobbling up trophy properties like Hollywood movie studios (Universal Studios and Columbia Pictures), famous golf courses (Pebble Beach) and iconic real estate (Rockefeller Center).

There was was even talk of Japan’s economy some day overtaking that of the United States. In 1979 Ezra Vogel, a Harvard academic, wrote a book entitled “Japan as Number One: Lessons for America” in which he portrayed Japan, with its strong economy and cohesive society, as the world’s most dynamic industrial nation.

In the United States there was a lot of hostility towards Japan’s success. American auto workers smashed Japanese cars. In June 1982, a Chrysler supervisor and his son, who had been laid off at a Michigan auto plant, killed a Chinese American man thinking he was Japanese. In a 1991 ABC News-NHK survey 60 percent of American aid they viewed Japan’s economic strength as a threat to the United States. In 1992, Senator Paul Tsongas, who was running for U.S. president at the time, said, "The Cold War is over, and Japan and Germany have won."

1985 Plaza Accord and its Aftermath

What became the Japanese Bubble Economy was set in motion in 1985, when U.S. Secretary of the Treasury James A. Baker III got together with the finance ministers of Britain, France, West Germany and Japan in an effort to reduce the value of the dollar to increase the export of American goods. The plan — now referred to as the 1985 Plaza Accord — worked but it also doubled the purchasing power of the yen. When Japan allowed the yen to double in value its trade surplus for the most part didn’t change but the amount of high-value yen did.

Following the 1985 Plaza Accord, the yen’s value rose sharply, reaching 120 yen to the U.S. dollar in 1988 — three times its value in 1971 under the fixed exchange rate system. A consequent increase in the price of Japanese export goods reduced their competitiveness in overseas markets, but government financial measures contributed to growth in domestic demand. Corporate investment rose sharply in 1988 and 1989. With higher stock prices, new equity issues swiftly rose in value, making them an important source of financing for corporations, while banks sought an outlet for funds in real estate development. Corporations, in turn, used their real estate holdings as collateral for stock market speculation, which during this period resulted in a doubling in the value of land prices and a 180 percent rise in the Tokyo Nikkei stock market index. In May 1989, the government tightened its monetary policies to suppress the rise in value of assets such as land. [Source: Web-Japan, Ministry of Foreign Affairs, Japan]

“However, higher interest rates sent stock prices into a downward spiral. By the end of 1990, the Tokyo stock market had fallen 38 percent, wiping out 300 trillion yen (US $2.07 trillion) in value, and land prices dropped steeply from their speculative peak. This plunge into recession is known as the “bursting” of the “bubble economy.”

Trade Battles Between Japan and the United States

Trade battles were a big part relationship between Japan and the United States in 1980s and 90s. The pattern of these battles was often like this: the U.S. complained that Japan was using unfair trade practices and Japan retaliated by accusing the U.S. of being a bully and meddling in the affairs of other countries; the U.S. then threatening economic sanctions with Japan responding with some threats of its own; and just before something serious happened a deal was struck.

The first trade battles were in 1970s over textiles. After that Japan and the United States battled over everything from baseball caps to jet-fighters. Kodak complained of unfair trade practices by Fuji film which keep Kodak from claiming it rightful share of the Japanese film market. In the 1990s, Japanese Prime Minister Hashimoto said that U.S. Trade Representative Mickey Kantor was "even more aggressive than my wife when I come home drunk."

Trade representatives from Japan and the United States had a major showdown in 1995 over Japan’s refusal to reduce tariffs on American automobile parts. Fed up with Japanese inaction, the United States government imposed 100 percent tariffs on 13 popular luxury Japanese cars in an effort to bring down Japanese trade barriers on automobiles and automobile parts. Japan had 37 percent of American auto parts market while the United States had only a 1.2 percent share in the Japanese market.

In 1997, the U.S. refused to let Japanese ships dock in American ports in disputes over access of American ships to Japan ports and the procedures for American ships docking in Japan. The United States government threatened to block Japanese airlines freight hauling flights unless Federal Express was allowed to fly through Japan.

Image Sources: 1) Toyota 2) Time magazine

Text Sources: New York Times, Washington Post, Los Angeles Times, Daily Yomiuri, Times of London, Japan National Tourist Organization (JNTO), National Geographic, The New Yorker, Time, Newsweek, Reuters, AP, Lonely Planet Guides, Compton’s Encyclopedia and various books and other publications.

Last updated August 2016