NONALIGNED MOVEMENT AND THE G-77

Umana yana, site of a 1972

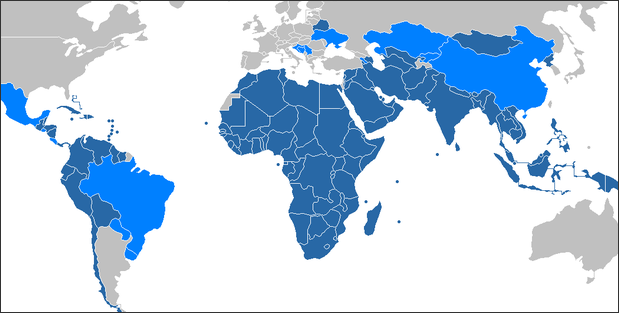

Nonaligned Movement meeting in Guyana The Nonaligned Movement has 115 members. The non-aligned movement of Third World nations was founded by Indonesia’s first president Nkrumah Sukarno at the height of the Cold War as a nonaligned middle ground between the the United States and the Soviet Union.

In 1955, Sukarno hosted the groundbreaking Afro-Asian Conference in Bandung, Indonesia that later grew into the non-aligned nation's movement. Among the third world leaders in attendance were Egypt's Gamal Abdel Nasser, China's Zhou Enlai, India's Jawharlal Nehru, Yugoslavia's Tito and Ghana's Kwame Nkrumah.

Third World countries that met in Bandung declared they were going to take path differing from that of both the United States and the Soviet Union. The meeting was filled with anti-first-world theories and terms like "anti-imperialism" and "anti-colonialism." Sukarno said it was time to wipe away legacy of Western colonialism and called for the 20th century to be "the century of the awakening of the colored people" and "the century of intervention."

The Nonaligned Movement is still active. It held a meeting attended by 50 heads of state — including the leaders of Iran and Venezuela — in Havana in 2006. Some participants used the meeting as an opportunity to bash the United States and the United Nations.

The G-77 — a group with more 130 countries — is a group of developing nations. Other groupings include the IBSA (India, Brazil and South Africa), BASIC (Brazil, South Africa, India and China), G-24 developing country finance ministers and BRICs (Brazil, Russia, India and China).

Rise of the Developing World and Decline of the Developed World?

Moises Naim wrote in the Washington Post, “Many poor countries now sit atop coffers full of money, while many rich nations have become international mendicants. The countries that used to give the lectures are now the ones that must get their fiscal houses in order and carry out tough reforms. Consider this: Since 2000, the economies of developing countries have grown by an average of 6.1 percent every year; in contrast, the advanced economies have grown by a meager 1.8 percent on average. As a result, while in 2000 developing nations accounted for one-fifth of the global economy, today their share has grown to more than a third of the world’s total output. [Source: Moises Naim, Washington Post, April 8, 2011. Naim, a former executive director of the World Bank, is a senior associate at the Carnegie Endowment for International Peace]

Economists agree that these trends will continue and that fast-growing emerging markets such as China and India have already surpassed or will soon surpass the traditional economic powerhouses. This dizzyingly fast growth has lifted millions out of poverty and is rapidly expanding these nations’ middle classes.

Moreover, emerging markets such as China, India, Brazil and Indonesia weathered the recent financial crash much better than the rich countries. They are not mired in a long and deep recession like Spain; they have not been forced to bail out their banking systems like the United States; they do not plead for international help like Ireland or Portugal; and they have not made draconian cuts in their public expenditures like the United Kingdom. Investment bankers are now lining up in the corridors of central banks and finance ministries in Beijing, Brasilia and New Delhi.

G-7

Red Cross StrykerIn 1975, the Group of Six (G6) formally came into being, comprising the United States, UK, France, Germany, Japan, Italy, with Canada being added to form G7 the next year. Basically G7 leaders met regularly and decided most of the decisions for the international monetary system. The G7 accounted for roughly half of world GDP, but essentially ran the global financial system.

The grouping was only widened in 1997 when the heads of the United Nations, World Bank, IMF and WTO were invited to join the regular G7 meetings. In 1998, Russia was added to form the G-8 (Group of Eight industrialized nations). Later Russia was kicked out for annexing part of Ukraine. Many think it is time to replace the G-7 with the G-20.

Ramesh Thakur wrote in the Daily Yomiuri, The G-7 "is fast becoming a historical anachronism and should be put quietly to rest. The United Nations finds it difficult to rise above petty squabbling and point scoring, and generates more cynicism than hope these days. If the G-20 fails to come to terms with what needs to be done and become the forum for finding collective solutions and deciding on coordinated action for dealing with the world's most pressing global challenges and imbalances, it is hard to see what other forum could do so.

G-20

The G-20 was formed in 1999 after the Asian Financial crisis in 1997-98. It collectively accounts for 85 percent of world GDP and two-thirds of the world population. Explaining what it is and what it isn’t, World Bank President Robert B. Zoellick wrote in the Washington Post, “Not even close. There are no votes, no charter of rights or responsibilities, no compulsory actions. The G-20 is a forum for economic diplomacy — an informal steering committee that shares views, reports and recommendations, while seeking consensus for action. Its members also draw on multilateral institutions to push ideas and execute policies with the help of nations that are not in the G-20. [Source: Robert B. Zoellick, Washington Post, October 28 2011]

With a disparate group such as the G-20, meaningful action is most likely achieved by first forging agreements in smaller groups and then seeking to expand coalitions, preferably with support from both developing and developed countries, or with backing across regions. (For example, a proposal shared by the United States and China or India would clearly be influential.) In the end, though, all big decisions still rest with national governments, which as sovereign representatives must decide whether, when and how to cooperate.

On the advantages of the G-20, Ramesh Thakur wrote in the Daily Yomiuri, “First, it is a summit of leaders, not ministers, a forum for them to come together, talk directly and get to know one another. Ministers represent the interests of particular portfolios. The biggest global deadlocks require tradeoffs across, not within, portfolios. Only leaders can trade apples for oranges, with an emphasis on diffuse reciprocity and equivalence of benefits instead of a strict quid pro quo on every individual item.” [Source: Ramesh Thakur, Daily Yomiuri, November 26, 2010]

When asked if the G-20 served as a mechanism of adjustment in a shifting world order Henry Kissinger told the Christian Science Monitor, “Yes, the G-20 is the forum for this adjustment. But it will be a big and difficult effort for it to do so. There is no certainty of success, but the effort is critical if we want a stable world. There has not been a truly global system before. After the Napoleonic Wars the Europeans tried to build an international system for Europe. But there is no precedent for a truly global system that has tried to relate both political and economic order on a global scale in the same organization. There has never been that need before.The alternative, as you suggest, would be regional blocs and competing alliances. That is a dangerous outcome because when there are so few players, the system loses flexibility and is more prone to conflict instead of compromise and stable relations. So, making the G-20 work is as essential as it is unprecedented and difficult. [Source: Nathan Gardels, November 3, 2011]

.png)

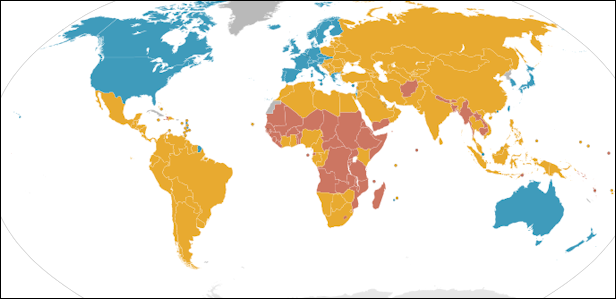

G-20 countries

History of the G-20

On the birth of the G-20, Zoellick wrote in the Washington Post, “Though it achieved prominence in the aftermath of the collapse of Lehman Brothers in the fall of 2008, the G-20 was created in 1999, after the Asian financial crisis that spread to other emerging markets. At that time, a collection of finance ministers, led by Canada’s, argued that developing nations needed to have a greater voice in global debates over economic policy. [Source: Robert B. Zoellick, Washington Post, October 28 2011]

Illustrating the ad hoc nature of the new group, the G-20's membership still reflects some oddities of the initial self-selection process: South Africa and Saudi Arabia wanted to take part, for instance, but Egypt and Nigeria did not sign up. Even so, the creation of the G-20 was an early signal that the era of the G-7 — the old club of developed nations comprising Britain, Canada, France, Germany, Italy, Japan and the United States — was waning.

Apart from a 2004 agreement on tax matters, the G-20 served largely as a discussion group in its early years. In October 2008, however, President George W. Bush wanted to assure finance ministers and central bankers assembled in Washington for the World Bank-IMF annual meetings that his administration was committed to preventing a global economic breakdown. He met first with the G-7 but recognized that the changed world called for a broader group, so he asked to speak to officials from the G-20 nations, chaired that year by Brazil. Then, urged on by President Nicolas Sarkozy of France and others, he convened the first G-20 summitin Washington the following month.

At a gathering in Washington in November 2008 the scheduled Group of 20 finance ministers meeting in was upgraded to a leaders summit by U.S. President George W. Bush. In Pittsburgh in 2009 the world's top leaders declared the G-20 would be the world's premier forum for international economic governance. The group met again in Seoul on November 2010 in its first summit in a non-Western country, a symbolic passing of the torch of global leadership to the new kids on the block in the global neighborhood.

Non-Aligned Movement map

G-20 Members

The G-20 is made up of the finance ministers and central bank governors of 19 countries: Argentina, Australia, Brazil, Canada, China, France, Germany, India, Indonesia, Italy, Japan, Mexico, Russia, Saudi Arabia, South Africa, Republic of Korea, Turkey, United Kingdom and United States of America. The European Union, who is represented by the rotating Council presidency and the European Central Bank, is the 20th member of the G-20.

On the G-20 having 20 members, World Bank President Robert B. Zoellick wrote in the Washington Post, “The Group of 20 is a group for our times: The numbers don’t add up. The host governments usually invite additional countries, whether to represent particular regions or assuage complaining neighbors. So there are usually about 25 nations present, plus the heads of international organizations such as the World Bank, the International Monetary Fund and the United Nations. (The European Union has the most seats, usually with six or seven countries as well as representatives of the president of the European Council, the presidency country and the European Commission.)[Source: Robert B. Zoellick, Washington Post, October 28 2011]

Of course, the bigger developed economies — especially the United States — carry considerable weight, though their troubled performance in recent years lessens their pull. The views of large developing countries, such as China and India, are also important, but midsize economies can punch above their weight by mobilizing others around a specific issue.

On why the G-20 is a particularly good grouping of countries, Ramesh Thakur wrote in Daily Yomiuri, “The G-20 brings together the world's leading economies from both developed and developing countries... The G-20--and only it--brings together all the countries that count. The Group of 8 excludes two of the three Asian giants (China and India). So too does the U.N. Security Council (Japan and India are not permanent members). Three other significant regional Asia-Pacific actors also are not present in either of these premier forums of global governance: Australia, Indonesia and South Korea. Other continents and regions are similarly unrepresented in the G-8 and the U.N. Security Council, an indictment of both as key sites of global governance. [Source: Ramesh Thakur, Daily Yomiuri, November 26, 2010]

G-20 Policy

On whether the G-20 was a lot of talk and little action, Zoeller wrote: “The jury is still out on this one. There certainly is lots of talk: The summits and meetings of finance ministers and central bank chiefs are now accompanied by occasional sessions for ministers of agriculture, development and labor, with all the requisite “working groups” meeting in advance. As with the G-7, there is a real risk of bureaucracy taking over; a larger group may be more representative, but size also impedes deliberations, turns frank discussions into more formal (and less useful) presentations of positions and makes it harder to take action. [Source: Robert B. Zoellick, Washington Post, October 28 2011]

But some important action has emerged. The London G-20 summit in 2009 produced a $1.1 trillion global recovery plan, featuring national stimulus efforts, calls for increased IMF resources and greater financing for trade. But as fiscal deficits have since surged, it has proved easier for world leaders to spend large sums than to tighten belts.

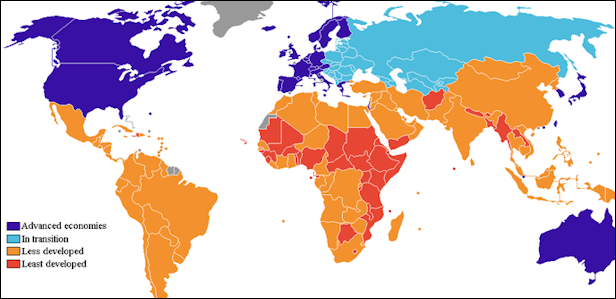

Developed and developing countries

Even when the summits do not produce headline-grabbing plans, smaller efforts can yield results over time. The London summit also transformed the Financial Stability Forum — a loose grouping founded by the G-7 — into a more influential Financial Stability Board open to all G-20 nations and tasked with guiding new financial regulatory policies; it has already led to accords on standards and monitoring. The G-20 summits in Pittsburgh, Toronto and Seoul, as well as the preparations under France’s chairmanship this year, have achieved agreements on exempting emergency food supplies from export bans and on agricultural assistance for Africa. Also, France has used the G-20 to spark debate on what a future international monetary system might look like.

On what the G-20 gatherings are like, Ramesh Thakur wrote in Daily Yomiuri, “The G-20 is informal. Notes need not be taken, there is no official record (although a communique is issued), leaders talk to each other on a first-name basis in a relaxed setting, there is no formal agenda, and there is no secretariat. This comparative advantage too will be diluted and risk being lost if membership is not strictly restricted. [Source: Ramesh Thakur, Daily Yomiuri, November 26, 2010]

BRICS

The BRICS -- Brazil, Russia, India, China and South Africa -- now account for roughly 18 per cent of the world's GDP, 40 per cent of its population, 15 per cent of global trade and hold 40 per cent of global currency reserves.With a combined GDP totalling nearly $14 trillion, their economies have accounted for 30 percent of global economic growth since Goldman Sachs coined the BRIC acronym in 2001. Intra-BRICS trade, which stood at $230 billion in 2010, now amounts to eight percent of global trade. [Source: AFP, January 4, 2012]

Originally there were four is BRIC nations. Brazil, Russia, India, China. The term was coined by Goldman Sachs economists to describe a new category of emerging market powerhouses that were regarded as good places to invest money because they had stable political leadership and relative international stability.

The five BRIC nations embrace nearly half the world’s population, 20 percent of its land area and are rich in natural resources. It is estimated that the BRIC nations will produce 60 percent of the world’s growth between 2010 and 2014. In 2000, the BRICs accounted for 16 percent of the local GDP. In 2009 that number rose to 22 percent and is expected to keep getting bigger. There is a key difference between the four nations. Russia and Brazil rely chiefly on commodities export to spur their economies while China and India rely more on trade and are large consumers of commodities rather than producers of them.

The main aim of the BRICS is to forge a common emerging-market negotiating stance on issues from climate change to world trade and to act as a counterweight to the West in settings such as the Group of 20 forum of advanced and developing economies. [Source: AFP, January 4, 2012]

The London-based Centre for Economics and Business Research (CEBR) said in a report last month that Brazil has supplanted Britain as the sixth largest economy behind the United States, China, Japan, Germany and France. And before the end of the decade, Russia and India are expected to move into fourth and fifth place respectively ahead of Brazil, according to CEBR and the International Monetary Fund.

IMF Advanced and Least-developed nations in 2008

Rubens Barbosa, a former Brazilian ambassador to the United States and Britain, believes that BRICS did reasonably well in 2011. "I think that individually BRICS member countries fared well considering the economic crisis and compared with developed countries in Europe and USA and Japan," he told AFP Monday. Brazil, he noted, is now perceived as being "on an equal footing with the other three (China, India and Russia)."

With 50 million people and an economy worth only around $500 billion, South Africa, Africa's leading economy which joined BRICS only in 2010, is the junior partner, dwarfed by its more powerful and more populous partners. But with foreign investors increasingly looking to mineral-rich Africa as the next frontier, South Africa has positioning itself as both the gateway to one of the world's fastest-growing regions and the voice of its one billion people.

While critics see BRICS as riven by rivalry and conflicting interests, the club has shown resilience and thrived on the complementarity of its members. China and India get access to the huge mineral, energy and farm resources of Russia, Brazil and South Africa to meet the needs of their people and fast-growing economies.

BRIC Meetings

The BRICS caucus is a work in progress. The meeting in April 2011 was only its third summit and the first to include South Africa. The group brings together five countries that, though frequently united in their disinclination to do the West's bidding, are a political and economic mosaic. "Our economic potential, political influence and our development prospects as an alliance are exceptional," Russian President Dmitry Medvedev said. [Source: Abhijit Neogy and Alexei Anishchuk, Reuters, April 14, 2011]

In July 2009, the leaders of the four countries held their first meeting, in Yekaterinbrug, Russia, in part to work together and increase their leverage. During their second summit meeting in Brasilia in April 2010 the BRICs discussed ways they could start using local currency for trades instead of relying on the American dollar. In 2011 the BRICs talked about coordination and handling of commodity price fluctuations. In a blow to the dollar they have worked out ways to settle accounts using their own currencies.

In a meeting in April 2011 on the southern Chinese island of Hainan, Reuters reported, the BRICS group of emerging-market powers kept up the pressure for a revamped global monetary system that relies less on the dollar and for a louder voice in international financial institutions. The leaders of Brazil, Russia, India, China and South Africa also called for stronger regulation of commodity derivatives to dampen excessive volatility in food and energy prices, which they said posed new risks for the recovery of the world economy.

What was needed, they said in a statement, was "a broad-based international reserve currency system providing stability and certainty" -- thinly veiled criticism of what the BRICS see as Washington's neglect of its global monetary responsibilities. The BRICS are worried that America's large trade and budget deficits will eventually debase the dollar. They also begrudge the financial and political privileges that come with being the leading reserve currency.

"The world economy is undergoing profound and complex changes," Chinese President Hu Jintao said. "The era demands that the BRICS countries strengthen dialogue and cooperation." In another dig at the dollar, the development banks of the five BRICS nations agreed to establish mutual credit lines denominated in their local currencies, not the U.S. currency.

Third world countries map from the 1990s

The leaders reviewed the global role of the Special Drawing Right, the IMF's accounting unit and reserve asset, which some experts believe could grow into a partial substitute for the dollar. But they stepped around the issue of whether the yuan should join the SDR, saying only that they welcomed discussion of the composition of the SDR's basket of currencies.The SDR now comprises the dollar, the euro, the Japanese yen and the British pound.

Emerging economies have already won more say in the way the IMF is run, but the BRICS leaders said they were still under-represented."We ... agreed on the need for the reform of international financial institutions in order to promote a just economic order," South African President Jacob Zuma said. Swings in commodity prices are also a prime area of concern for the BRICS. China is the world's biggest importer of many commodities; the other BRICS members are major exporters of natural resources.

Image Sources: Wikimedia Commons

Text Sources: New York Times, Washington Post, Los Angeles Times, Times of London, Yomiuri Shimbun, The Guardian, National Geographic, The New Yorker, Time, Newsweek, Reuters, AP, Lonely Planet Guides, Compton’s Encyclopedia and various books and other publications.

Last updated January 2012