WORLD BANK AND THE IMF

![]()

World Bank icon

The World Bank and the International Monetary Fund (IMF) are two institution that were set up to help fight poverty and improve life for people in developing countries by directing money from the rich countries to the poor ones. The decision-making power of the countries that fund the IMF and World Bank is weighted by wealth and the economic power of these countries, which means the United States plays a dominate role.

The World Bank, the World Food Program and the U.N. Food and Agriculture Organization (FAO) were all founded after World War II along with the United Nations. The primary goal of the World Bank is to reduce poverty in developing countries.

The World Bank, International Monetary Fund, Asian Development Bank are all staffed by economists who have deep respect for the free markets. They often try to get many of their projects outsourced to the private sector.

World Bank

The World Bank is the largest fiancier of anti-poverty programs in developing countries. Funded by developed countries, it has a portfolio of $7 billion and has traditionally provided funding to developing countries to develop infrastructure and improve agriculture, industry, health and education. It is governed by a 24-member executive committee and employs more than 1,200 PhDs. Its staff is regarded as knowledgeable and well-meaning but somehow many programs end up being misguided or inefficient or at least poorly evaluated.

The World Bank has been issuing debt since 1947 and has had a triple-A credit rating for more than 50 years. It issued about $30 billion in debt in the first 10 months of 2011 to investors ranging from central banks to insurance companies, pension funds and asset managers.

The World Bank has traditionally been headed by and American while the International Monetary Fund has been haded by a European, with the No.2 position at the fund traditionally going to an American. The arrangement dates back to a gentleman's agreement made after the organizations were created at the end of World War. The convention is not written down in the Fund’s Articles of Agreement or anywhere else.

International Monetary Fund (IMF)

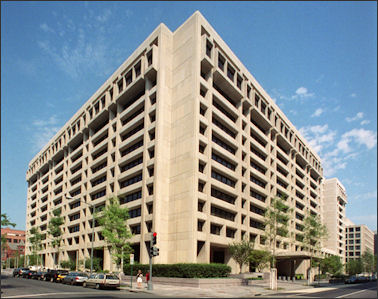

IMF headquarters The International Monetary Fund (IMF) has traditionally lent money to governments in developing countries to help them improve their economies. In return for bail out loans the IMF often requires countries to reduce subsidies, shut down money-sucking government industries and take other belt-tightening measures. These measures are often difficult for the countries to implement because they are so poor and desperate. In some cases when the harsher measures are implemented riots, political upheaval and the collapse of public services result.

The IMF oversees global financial stability and is known for bailing out countries when they are experiencing a financial crisis. In 2011 its members who paid dues of around $375 billion. At that time it was counting on member nations to finally enact a doubling of IMF member country dues, totaling $750 billion, which have already been approved in principle. Approvals by national parliaments are expected in early 2012.

The headquarters of the International Monetary Fund is on 19th and H streets in Northwest Washington D.C. As of 2011, 187 nations were members of the IMF. The IMF’s Board of Governors is the fund’s highest decision-making body. The head of the IMF, the managing director, serves a five-year term.

Payments are made in Special Drawing Rights (SDRs), the IMF’s unit of account. A member must pay its subscription in full upon joining the Fund: up to 25 percent must be paid in SDRs or widely accepted currencies (such as the U.S. dollar, the euro, the yen, or the pound sterling), while the rest is paid in the member's own currency. Each IMF member’s votes are comprised of basic votes plus one additional vote for each SDR 100,000 of quota.

These days the IMF offers advise to governments around the world but has little influence or power to persuade them. It is mainly called in these days to help countries on the verge of economic collapse and offer them monetary aid and loan packages along with lectures about making sacrifices and reforms to get back on their feet again.

In 2010 and 2011 the IMF began moving beyond its traditional role of helping developing countries to bale out countries in the developed world as the European financial crises worsened. In 2011 the IMF had about $630 billion in usable resources; about two-thirds of that could be lent under IMF rules. At that juncture it sought $1.3 trillion in lending power to assure markets that it has the muscle to deal with deepening problems in Europe. In addition, the IMF was considering selling bonds in private markets on short notice, a move that could bolster its safety net beyond $1.3 trillion but something it had before. [Source: Ian Talley, Wall Street Journal, September 30 2011]

Evolution of the International Monetary System

World Bank building in Washington

Andrew Shang of the Asia News Network wrote, “Most people think of the international monetary system as an architecturally designed system made in Bretton Woods at the end of the Second World War. This may be true for the international financial institutions like the International Monetary Fund or the World Bank, but the existing system is a messy legacy of rules, regulations and foreign exchange systems and institutions that facilitate trade and payments between countries. [Source: Andrew Shang, Asia News Network, October 29, 2011. Sheng is president of the Fung Global Institute. ]

Unlike a national monetary system, where there is one currency issued by the national central bank and national agencies responsible for financial stability, there is currently no global central bank, no global financial regulator and no global finance ministry. In short, we have global financial markets, but no global mechanism to deal with periodic crises, except through the (sporadic) consensus views of national policy-makers.

In the immediate post-war period, there was a shortage of US dollars. Hence, the IMF was created to provide liquidity and foreign exchange reserves for the post-war reconstruction. The United States ran current account surpluses, held most of the world's gold reserves and everyone wanted dollars.

This was not a problem when the United States was the dominant power in the 1950s and 1960s. But this changed when the United States dropped the link to gold in 1971. From then on, the international monetary system was largely driven by decisions between the United States and Europe, which collectively owned the majority of the voting power in the IMF. Needless to say, the emerging markets had little say, since they were the major beneficiaries of aid and funding from the IMF and the World Bank.

The reason why the international monetary system is not functioning smoothly is that decision-making lies in the hands of sovereign nations, not the global institutions. A unipolar system is alright as long as the dominant power is stable. This is not necessarily true in a multipolar system, because even obvious decisions cannot have consensus, because of different national interests.

IMF Quotas

Bono of U2 at an IMF meeting in Prague in 2000 Voting power and financial contributions within the IMF are determined based on a quota system with Europe holding a 32 percent quota, and the United States, 18 percent. According to the IMF website, “Quota subscriptions are a central component of the IMF’s financial resources. Each member country of the IMF is assigned a quota, based broadly on its relative position in the world economy. A member country’s quota determines its maximum financial commitment to the IMF, its voting power, and has a bearing on its access to IMF financing. [Source: IMF, September 13, 2011]

When a country joins the IMF, it is assigned an initial quota in the same range as the quotas of existing members that are broadly comparable in economic size and characteristics. The IMF uses a quota formula to guide the assessment of a member’s relative position.

The current quota formula is a weighted average of GDP (weight of 50 percent), openness (30 percent), economic variability (15 percent), and international reserves (5 percent). For this purpose, GDP is measured as a blend of GDP based on market exchange rates (weight of 60 percent) and on PPP exchange rates (40 percent). The formula also includes a “compression factor” that reduces the dispersion in calculated quota shares across members.

Quotas are denominated in Special Drawing Rights (SDRs), the IMF’s unit of account. The largest member of the IMF is the United States, with a current quota of SDR 42.1 billion (about $68 billion), and the smallest member is Tuvalu, with a current quota of SDR 1.8 million (about $2.9 million).

A member's quota delineates basic aspects of its financial and organizational relationship with the IMF, including: 1) Subscriptions (quota share). A member's quota subscription determines the maximum amount of financial resources the member is obliged to provide to the IMF. 2) Voting power (voting share). The quota largely determines a member's voting power in IMF decisions. The 2008 reform fixed the number of basic votes at 5.502 percent of total votes. The current number of basic votes represents close to a tripling of the number prior to the effectiveness of the 2008 reform. 3) Access to financing. The amount of financing a member can obtain from the IMF (its access limit) is based on its quota. For example, under Stand-By and Extended Arrangements, a member can borrow up to 200 percent of its quota annually and 600 percent cumulatively. However, access may be higher in exceptional circumstances.

Reforming the IMF

In November 2010, the IMF shifted six percent of IMF voting power away from the richest developed countries to “dynamic merging-market developing countries” such as China, India and Brazil.

On December 15, 2010,the Board of Governors, the Fund’s highest decision-making body, approved a package of far-reaching reforms of the Fund’s quotas and governance, completing the 14th General Review of Quotas. Once the reform package is approved by member countries (it includes an amendment to the Articles of Agreement that requires acceptance by three-fifths of the members having 85 percent of the total voting power) and implemented, it will result in an unprecedented 100 percent increase in total quotas and a major realignment of quota shares to better reflect the changing relative weights of the IMF’s member countries in the global economy.

The reform package builds on the 2008 reforms, which became effective on March 3, 2011. The 2008 reforms strengthen the representation of dynamic economies, many of which are emerging market countries, through ad hoc quota increases for 54 member countries, and enhance the voice and participation of low-income countries through a near tripling of basic votes.

The 14th General Review of Quotas will: 1) double quotas from approximately SDR 238.4 billion to approximately SDR 476.8 billion, (about US$767 billion at current exchange rates). 2) shift more than 6 percent of quota shares from over-represented to under-represented member countries. 3) shift more than 6 percent of quota shares to dynamic emerging market and developing countries (EMDCs). 4) significantly realign quota shares. China will become the 3rd largest member country in the IMF, and there will be four EMDCs (Brazil, China, India, and Russia) among the 10 largest shareholders in the Fund, and preserve the quota and voting share of the poorest member countries.

IMF Planning to Set up New Lending Facility

In 2011 the International Monetary Fund said it would create a new short-term lending facility to reign in the financial crisis in Europe. Under the envisioned lending facility, the IMF is likely to provide funds to countries such as Italy and Spain where government bond yields remain at high levels to help reconstruct their public finances, sources said. [Source: Yomiuri Shimbun, September 30, 2011]

According to the scheme the IMF will extend to financially strapped countries loans of up to 500 percent of their contribution to the IMF. Countries likely to be affected by the ongoing crisis will basically be able to obtain short-term loans immediately after applying for them. For example, Italy, whose contribution to the IMF totals about 12.6 billion dollars, would be eligible to receive short-term loans of up to 63 billion dollars, or 4.8 trillion yen. The annual yield of the Italian government bond is currently at a high 6 percent. If the yield rises further and Italy faces funding difficulties, it will be easier for the country to request financial assistance from the IMF as it will not be forced to carry out tough structural reforms.

In the late 1990s, the IMF called for strict implementation of structural reforms as a condition for loans to financially troubled countries, including South Korea which was facing a currency crisis. This requirement made countries reluctant to request assistance from the IMF. The IMF then established a scheme in which the fund would extend to countries with relatively healthier public finances one- to two-year loans of up to 1,000 percent of their contribution to the IMF without strict conditions. However, countries were only given a credit line after the IMF approved loans and they were not able to withdraw funds unless the crisis facing them worsened.

IMF Leaders

.jpg)

Christine Lagarde and Dominique Strauss-Kahn Harold James wrote in the Christian Science Monitor, “How the mighty International Monetary Fund has fallen. More than a decade ago, the French magazine Paris Match carried a picture of the Fund’s then Managing Director, Michel Camdessus, with the title: “The Most Powerful Frenchman in the World.” Today, his successor, Dominique Strauss-Kahn (DSK), handcuffed and grave in ubiquitous front-page photos, is the most humiliated Frenchman in the world. [Source: Harold James, Christian Science Monitor, May 17, 2011. James is Professor of History and International Affairs at Princeton University and Professor of History at the European University Institute, Florence. His most recent book is The Creation and Destruction of Value: The Globalization Cycle.]

About half of the IMF’s past managing directors have been either weak or overly political — or both. The IMF’s first two managing directors, the Belgian Camille Gutt and the Swede Ivar Rooth, were both weak figures. Indeed, the Fund almost disappeared into complete oblivion during their tenure.

The IMF’s two most recent managing directors before DSK, a German and a Spaniard, were also weak. Horst Köhler, appointed in 2000, got the millennium started on a bad note. He had been an influential state secretary in Germany’s finance ministry, before becoming the head of the associations of savings banks. Germany’s then chancellor, Gerhard Schröder, pressed hard for a German appointee to lead the Fund, but Köhler was always an implausible second-choice candidate. He resigned in 2004 to run as Angela Merkel’s candidate for the largely ceremonial office of President of the German Federal Republic, a job he performed capriciously until he abruptly resigned.

Köhler’s successor, Rodrigo Rato, had been the leader of Spain’s center-right party, which was unexpectedly defeated in the 2004 general election by current Prime Minister José Luis Rodríguez Zapatero. He was sent to Washington as a consolation prize, and was never very happy there. The IMF’s influence dwindled, and he resigned in 2007 “for personal reasons.”

Recent appointments to head the IMF have all been pushed through after high-level bargaining among European governments. There is now a need to break decisively with the discredited political logic that drives such decisions. The convention that the IMF’s managing director needs to be a West European is not written down anywhere, least of all in the Fund’s Articles of Agreement. Indeed, even back in 1973, there was substantial support for a non-European candidate, Roberto Alemann, the distinguished economist and former Argentine economics minister.

Per Jacobsson, the Swedish economist who brought the Fund back from obscurity in the 1950's, had been an official at the Bank for International Settlements in Basel. As the BIS’s chief economist in the 1930's, Jacobsson knew how to use economic analysis as a basis for influence. Jacques de Larosière and Michel Camdessus were French civil servants who combined high-level technical and managerial expertise with a vision of how the world economy should operate.

Dominique Strauss-Kahn

.jpg)

Dominique Strauss-Kahn amd Bob Geldof Dominique Strauss-Kahn, a former finance minister of France who was widely seen as a contender to become president of France, became head of the IMF in 2007. He played a central role in tackling the global financial crisis of 2008 and 2009.

Harold James wrote in the Christian Science Monitor, Strauss-Kahn (DSK) “tried to remake the IMF into a doctor of global finance, rather than a policeman. In mitigating or even preventing financial crises, however, sometimes policemen are needed. At the moment, the combination of excesses still evident in the financial sector and in public finance in many countries calls for some fairly tough police action.” Strauss-Kahn pushed through changes in voting power that benefited mainly larger emerging economies like China, India and Brazil, but not as much as they had wanted.

“DSK, too, began his tenure at the IMF as a politician-in-exile, after emerging as French President Nicolas Sarkozy’s most formidable domestic opponent. Sarkozy and his strategists, no doubt, thought that sending DSK to the Fund, which before the global financial crisis looked unimportant and marginal, was a brilliant coup. They may have even calculated that his private life might cause a stir in a country that is both more prudish and prurient than France. But when the IMF reemerged after 2008 as a central global institution, with DSK appearing to reorient it with substantial political and economic skill, he started to look again like a threat to Sarkozy’s re-election bid.

Michael Spence wrote in the Christian Science Monitor, “The IMF has always had tremendous analytic depth. It has gained strength under the gifted leadership of Strauss-Kahn as a better capitalized, motivated, and high-performance institution. In the post-crisis period its functions have expanded to include greater “surveillance” of the economic health of systemically important countries. Crucially, it has evolved into an expert secretariat serving the G20 as the latter strives to coordinate policy in pursuit of stability, growth, and sustainability in a world where national interests still reign. [Source: Michael Spence, Christian Science Monitor, June 1, 2011, Michael Spence received the Nobel Prize in Economic Sciences in 2001 and is the author of “The Next Convergence: The Future of Economic Growth in a Multispeed World.” He is an adviser to the 21st Century Council.

Dominique Strauss-Kahn’s Sexual Assault Case

In May 2011, Strauss-Kahn was arrested and taken from his Paris-bound flight at New York City's John F. Kennedy International Airport minutes before takeoff and charged with sexual assault and attempted rape made of a 32-year-old hotel maid, Nafissatou Diallo, at the Sofitel New York Hotel that same month. The charges were ultimately dismissed at the request of the prosecution which pointed out serious doubts in Diallo's credibility and inconclusive physical evidence. In a TV interview in September, Strauss-Kahn admitted that his sexual encounter with the maid was “a moral fault” and described it as “inappropriate” but that it “did not involve violence, constraint or aggression”. Is Diallo an immigrant asylee from the West African state of Guinea. [Source: Wikipedia]

Strauss-Kahn was indicted by a grand jury and after posting $1 million bail and pleading not guilty. Bail was set at $1 million with 24-hour home detention and an electronic monitoring ankle bracelet.After Strauss-Kahn turned over his passport and posted an additional $5 million bail bond, he was placed under house arrest in a residence in Lower Manhattan. In July, prosecutors told the judge that they had reassessed the strength of their case in the light of the housekeeper's diminished credibility, and the case against him was near collapse. In August the judge formally dismissed all charges based on the prosecutors' assertions, including that the maid's "pattern of lies" had "made it impossible to trust her."

At the time of the alleged attack, Strauss-Kahn was considered to be a leading candidate for the 2012 French Presidency. Four days after his arrest, he voluntarily resigned his post at the IMF. There was widespread speculation in France after his arrest that he was the victim of a conspiracy, with that speculation being renewed after a detailed report providing new facts was published in late November, 2011.

Before he was officially arraigned DSK spent two nights in New York’s Rikers Island prison. one of America's most notorious jails. The subject of TV dramas and home to gang members and thousands of other inmates accused of serious crimes, the Rikers jail complex sits on a 400-acre (1.65 sq km) island on the East River, near LaGuardia airport, between the boroughs of Queens and the Bronx. Built in the 1930s, the facility is a chaotic maze of cells in 10 separate facilities that cater for men, women, adolescents and those in need of medical attention.The Rikers complex holds about 11,000 inmates on any given day. It houses suspects denied bail pending trial as well as those serving sentences of less than a year.

Strauss-Kahn was kept in virtual isolation and under 24-hour watch, in large part for his own protection from inmates who might relish the opportunity to attack someone famous. His cell measured 11ft by 13ft (3.35m by 4m), law enforcement officials told the Reuters news agency. The New York Times reports that the IMF chief is being held in protective custody in a single-person cell in the prison's West Facility - normally home to prisoners with contagious diseases or drug problems.

The BBC's Tom Burridge said DSK is likely to have been be woken at 6:00am, with lights out around 2300. He was required to remain in his cell at all times, was escorted by a guard when outside; and was allowed an hour of recreational time each day. Although he had no TV or internet access, Strauss-Kahn was able to peruse a limited number of books, magazines and newspapers. As well as regular visits from his legal team, he was allowed three visits from family and friends. breakfasts at Rikers is comprised of fruit and cereal, while staple fare for main meals includes ground turkey with rice and beans, battered fish and cabbage or curried chicken. [Source: BBC, May 18, 2011]

Christine Lagarde

Christine Lagarde In June 2011, French Finance Minister Christine Lagarde was selected to take DSK’s place as head of the IMF, keeping the international lender in the hands of a European. She is the woman to head the IMF. Reuters reported, “Her skills as a tough negotiator with a reputation for sealing deals under pressure will carry weight as she moves from defending France's economic interests to overseeing a global institution that must be seen as a neutral player around the world. [Source: Lesley Wroughton, Reuters, June 28, 2011]

Lagarde was the 11th European to hold the job since 1946, and the fifth from France. The succession race was one of the most hotly contested in IMF history as emerging market nations expressed displeasure with the 64-year tradition of having a European head the IMF and an American lead its sister institution, the World Bank. White House advisor David Lipton was given the No. 2 position, continuing the tradition that an American be given that job

Lagarde is a French lawyer and has been the managing director of the International Monetary Fund since July 2011. Previously, she held various ministerial posts in the French government: she was Minister of Economic Affairs, Finances and Industry and before that Minister of Agriculture and Fishing and Minister of Trade in the government of Dominique de Villepin. Lagarde was the first woman ever to become minister of Economic Affairs of a G8 economy, and is the first woman to ever head the IMF. A noted antitrust and labour lawyer, Lagarde made history as the first female chair of the international law firm Baker & McKenzie. On November 2009, The Financial Times ranked her the best minister of finance of the Eurozone. [Source: Wikipedia]

Lagarde was born in January 1956 in Le Havre, a city in the Haute-Normandie region in France. He maiden name was Lallouette. Her father Robert Lallouette was a Professor of English at the Faculty of Rouen; her mother Nicole worked as a teacher. After graduation in 1974 at the Lycée François 1er in Le Havre, she went on a scholarship to the Holton-Arms School, a girls' school in Bethesda, Maryland in the U.S. Then she graduated from law school at University Paris X Nanterre, near Paris, France, and obtained a Master's Degree in political science from the Institut d'études politiques d'Aix-en-Provence (Sciences Po Aix).Since 2010, she has presided over the Institute's board of directors.

anti-IMF march Lagarde worked as an intern at the United States Capitol, as William Cohen's congressional assistant. As a teenager, Lagarde was a member of the French national synchronised swimming team. She is divorced and has two sons, Pierre-Henri Lagarde (born 1986) and Thomas Lagarde (born 1988). Since 2006, her partner has been the entrepreneur Xavier Giocanti from Marseille. She is a vegetarian and never drinks alcohol. Her hobbies are yoga, scuba diving, swimming and gardening. The fashion magazine Vogue profiled her in September 2011.

Lagarde joined Baker & McKenzie, a large Chicago-based international law firm, in 1981. She handled major antitrust and labor cases, was made partner after six years and was named head of the firm in Western Europe. She joined the executive committee in 1995 and was elected the company's first ever female Chairman in October 1999. In 2004, Lagarde became president of the global strategic committee. Lagarde lived in the United States for six years, from 1999 to 2005. According to the New York Times, “The stint earned her the moniker “l’Américaine” among French who did not necessarily see an American tour as a plus.

As France's Trade Minister between 2005 and May 2007, Lagarde prioritized opening new markets for the country's products, focusing on the technology sector. On 18 May 2007, she was moved to the Ministry of Agriculture as part of the government of François Fillon. The following month she joined François Fillon's cabinet in the Ministry of Economic Affairs, Industry and Employment to become the first woman to ever be in charge of economic policy in France.

Lagarde was interviewed in the documentary film “Inside Job” (2010), which later won an Academy Award for Best Documentary Feature. She was portrayed by actress Laila Robins in the 2011 HBO movie “Too Big to Fail”, which was based on the popular book of the same name by New York Times journalist Andrew Ross Sorkin. Lagarde, acting as the French Finance Minister, has a scene criticizing her American counterpart Hank Paulson. On her economic philosophy, Lagarde has described herself as "with Adam Smith — that is, liberal."

Protests Against the World Bank and IMF and Why They are Now Uncommon

Vampire World Bank protest In the late 1990s and early 2000s large, sometimes violent, protests were staged at the semi-annual meetings of the International Monetary Fund (IMF) and the World Bank, regularly held in early April. Moises Naim wrote in the Washington Post, “The marchers — many traveling to Washington from faraway places — came to voice their fury against free markets, world poverty, environmental decay or U.S. foreign policy. They often had specific demands: Stop imposing unpopular economic reforms (fiscal austerity, privatization, trade liberalization, deregulation) on poor countries in exchange for IMF and World Bank funding. Cancel the debts poor countries owe to international banks. Stop free-trade agreements. Protect the environment. Boost aid to Africa. In general, stop pushing policies that, according to the protesters, promoted savage capitalism and heartless globalization. [Source: Moises Naim, Washington Post, April 8, 2011. Naim, a former executive director of the World Bank, is a senior associate at the Carnegie Endowment for International Peace]

Now these protests are largely a thing of the past. Explaining why Naim wrote: “The apparent demise of the anti-IMF/World Bank protests is a reflection of broader transformations in the international economy, transformations that have rendered these global financial institutions less fearsome and less relevant. First off, the economic policies and loan conditions that the two agencies once imposed on poor nations are no longer so controversial. Many developing countries have embraced pro-market reforms on their own, while the IMF and the World Bank have become less dogmatic. At this year’s meeting, for example, the IMF is adopting a far more flexible posture concerning the controls on international capital movements that some countries impose — controls it used to adamantly condemn. Similarly, global negotiations over free-trade agreements, long a sore point for activist groups, have been going nowhere for more than a decade.

In addition, the new realities of the global economy have forced a fundamental change in the roles and agendas of the international financial institutions as well as their critics. Since the late 1980s and for most of the following decade, developing countries would come to the meetings of the IMF/World Bank (one session in the spring and another in the fall) to obtain new loans and negotiate the policy changes they would have to enact to get the money. Top U.S. and European economic policymakers would lecture them about the importance of swallowing the bitter medicine of unpopular reforms and offer foreign aid to soften the blow. Private bankers would sit in posh hotels while a parade of central bank presidents and economic ministers made their pitches, extolling their countries’ attractiveness to foreign investors.

Image Sources: Wikimedia Commons

Text Sources: New York Times, Washington Post, Los Angeles Times, Times of London, Yomiuri Shimbun, The Guardian, National Geographic, The New Yorker, Time, Newsweek, Reuters, AP, Lonely Planet Guides, Compton’s Encyclopedia and various books and other publications.

Last updated January 2012