VALUE AND PRICE OF DIAMONDS

Diamonds aren’t as rare as many people think. About 35,000 kilograms of them were mined worldwide in 2006. They are deemed valuable because people regard them as valuable and supplies are carefully controlled so the market doesn’t collapse.

The price of diamonds peaked in the late 1980s when the price for a D-color, near flawless diamond sold for $5,200 for a half carat, $23,000 for a carat, and $165,000 for three carats. In 2001, the price for the same diamonds were $3,900 for a half carat, $16,500 for a carat, and $122,000 for three carats.

High quality gems are still rare and very valuable but small, imperfect diamonds used in consumer jewelry are not as rare as their producers and marketers want you t believe. Their high prices and perception of value is manly the work of De Beers.

Some economists insist that the high price of diamonds is entirely artificial. They argue that if the laws of supply and demand were allowed to do their thing that the value of diamonds would be considerably less. The monopoly maintained by De Beers keeps diamond prices high.

On the value of diamonds, a New York diamond dealer told National Geographic, "Diamond are not really a commodity like gold or silver. You won’t but a stone from a jeweler and then sell it back to him for the same price but they definitely the easiest way to move value around." He said he knew one man who had to escape from Iran with virtually no warning. he had not time to sell his property or visit the bank but he time t pick up $30 million worth of diamonds and leave."

Mark van Bockstael, a member of the Diamond High Council in Antwerp told National Geographic, "They are a form of currency. They back international loans, pay debts, pay bribes, by arms. In many cased they are better than money."

In the United States, the Gemological Institute of America appraised and graded diamonds according to their clarity and color. In 2005 the appraised reported that four of its employees were fired because they appraised gems more than they were valued after the were bribed by a small group of diamond dealers.

Websites and Resources on Gems: All About Gemstones allaboutgemstones.com ; Minerals and Gemstone Kingdom minerals.net ; International Gem Society gemsociety.org ; Wikipedia article Wikipedia ; Gemstones Guide gemstones-guide.com ; Gemological Institute of America gia.edu ; Mineralogy Database webmineral.com ;

Websites and Resources Diamonds: Info-Diamond info-diamond.com ; Diamond glossary and FAQ heart-in-diamond.com ; Diamond Facts diamondfacts.org/about/index ; Diamond Mining and Geology khulsey.com/jewelry/kh_jewelry_diamond_mining ; Diamond Mine mining-technology.com/projects/de_beers ; Costellos.com costellos.com.au/diamonds ; DeeBeers debeers.com/page/home/ ; Wikipedia article Wikipedia ; American Museum of natural History amnh.org/exhibitions/diamonds ;

Book: “The Heartless Stone: A Journey Through the World of Diamonds, Deceit and Desire” by Tom Zoellner.

Diamond Business

In 2001, the diamond industry produced rough diamonds with a market value of $7.9 billion. This was converted into jewelry worth $54 billion.

The diamond trade grew from $20 billion in 1985 to $50 billion in 1998 and now employs around two million people worldwide, many of them involved with industrial diamonds. The gem diamond market is essentially broken into two tiers: one for top-quality large stones two carats or larger; and a second market for smaller stones used into the commercial jewelry business. In general, this business is characterized by large turnovers and thin profits.

More than 800 million stones of gem and industrial quality are produced every year. Most are only a fraction of a carat. Natural industrials called port account for 70 percent of all diamonds mined. The top tow consumers of gem-quality diamonds are the United States (48 percent) and Japan (19 percent).

In 2001, about 120 million carats of rough diamonds were mined globally. Together they weigh less than 24 tons and would easily fit in the bed of one large dump truck. The cost of mining these diamonds was around $2 billion. They were sold to producers about $7 billion. By the time they reach customers their worth mushroomed to $50 billion, with a lot of people along the way getting a cut or being paid a wage.

Doing Business in the Diamond Business

The diamond market is very tricky. There are all kinds of different grades and specifications. High-quality stones are defined as those above five carats with few flaws or inclusions (spots caused by graphite). The market is largely controlled by top gem-quality diamond dealers and manufacturers known as diamantaires.

Most diamonds fresh from the mine are sold through diamond bourses, or diamond trading clubs. In the early 1980s there were 16 clubs in ten countries with about 1,800 members. Members say that trust is the bedrock of the business and deals involving hundreds of thousands of dollars are often struck with no more collateral than a handshake.

The big money is made with the large carat stones. Much of this business in the United States is controlled by Hasidic Jews. Andrew Cockburn wrote in National Geographic, The diamond businesses "revolves around personal contacts and connections, thrives on rumor and gossip and cherishes secrecy. Multimillion -dollar deals are clinched with a handshakes and the word “mazal” , Hebrew for "good luck." Van Bockstael told National Geographic, "Nothing is what it seems in the diamond business, and half the time you don't even know if that is true."

Antwerp diamond district shops The diamond business is regarded as a tough nut to crack. A Tel Aviv diamond merchant told the New York Times magazine, “The diamond company is usually a family company. People accumulate wealth slowly, over generations.” Many diamond businesses have tight security. Some have systems in their offices that photograph and fingerprint every person who enters.

In late 2008, demand for top-quality diamonds drove up prices of such stones to record highs with a 10-carat, “D” flawless diamond selling for $155,000, up from $110,000 just six months earlier. Prices were pushed up by the rapid growth and increasing number of rich people in China, India, Russia and the Middle East as well as by shortages of supplies of big stones, What was s remarkable about the price rise was that it occurred when sales were declining in the United States, the world’s biggest diamond market.

Much of the buying took place among diamantairs — top gem-quality diamond dealers and manufacturers. Diamond analyst and buyer Martin Rapaport told Reuters, “many diamantaires, having lost confidence in the dollar and expecting increasing large diamond prices due to consistent imbalances between supply and demand, now prefer to keep their wealth in diamonds instead of dollars.

Diamond Market

Tom Zoellner wrote in the Washington Post, “History shows that diamond sales tend to mirror general consumer spending on luxuries. When hard times come along, diamonds are among the first items scratched from a shopping list. After the market spasms of 2008, diamonds had their worst year in decades, and even the resilient bridal market suffered. Total sales reportedly plunged 20 percent in the United States, and this spring, De Beers slowed work at its mines. [Source: Tom Zoellner, Washington Post , July 4, 2010]

This isn't the first time that a recession spurred some reconsideration of the diamond ethos among consumers. The Asian currency crisis of 1997 tore a hole in the Japanese diamond market: Nearly every bride in that nation used to go to the altar wearing a diamond engagement ring. That's no longer the case today.

Bad press on humanitarian issues seems to have had a lesser effect, though. Even after the December 2006 release of the movie "Blood Diamond," a Leonardo DiCaprio action-adventure that paints a harrowing portrait of the African diamond trade, jewelers reported a reasonably good Christmas season.

Diamond Market in the Early 2010s

diamonds classified forshipment

On the diamond market in 2011, the Economist reported: “For a start, supply is tight. All the world’s big deposits are thought to have been discovered already. Old mines are growing tired. Total annual output will probably fall. At the same time, demand is roaring in China, India and the Gulf, where the new rich love ostentatious adornment. By 2015 these countries could be buying as many diamonds as America, which currently accounts for two-fifths of global demand. To add to the cheer, demand is growing rapidly in America, too. Diamond prices have risen by over 50 percent this year. [Source: The Economist, November 12, 2011]

“AFP reported in 2011: “Prices for rough diamonds jumped by over a third in the first half to well above pre-crisis levels but fell sharply in the last five months of the year as investors fled luxury goods, prompting a drop despite a dearth of new mines, low inventories and rising Asian demand that have been lifting diamonds.

“Reuters reported: “In the early 1900s, diamonds became a popular means of ensuring that if a man broke off an engagement, the woman would have financial compensation for any damage to her reputation. Later, as Americans become more wealthy, engagement rings got bigger and more expensive. But that is changing fast. "Men are still buying diamonds for women, but they're not as expensive as they used to be," said Salmon Partners analyst Raymond Goldie. Add to the mix an aging population, fewer marriages and an uncertain financial outlook, and the traditional market for diamonds is losing traction. In January, Tiffany & Co said holiday season sales had weakened markedly in the United States and Europe.

“Despite supply curbs, analysts don't see any imminent rally in rough diamond prices, in part because of the current global economic environment. Indeed, Bank of America Merrill Lynch expects a 7 percent pullback in prices in 2012. Rough diamond prices crashed during the economic crisis as luxury spending waned, but then regained lost ground. Prices turned down again in mid-2011 as cutting houses faced credit issues and lower-quality material flooded the market. [Source: Julie Gordon, March 13, 2012]

Reuters reported: “But in Asia, it's a different story. Polished diamond demand rose 25 percent in China in 2010, while demand in India climbed 31 percent, according to BMO Capital Markets data. That same year, 18 percent of Tiffany & Co's retail sales were in the Asia-Pacific region excluding Japan, compared with 51 percent in the Americas. The luxury retailer's 2011 results and geographical sales mix are due later this month. The growth in new markets is expected eventually to make up for slowing or stagnant demand elsewhere, according to analysts. [Source: Julie Gordon, March 13, 2012]

See China, Japan

Diamond Supply

The rough diamond market, before the stones are polished and cut, was worth about $15.2 billion in 2011, and could drop some 10 to 13 percent in 2012. Reuters reported: “There are new sources of lower quality diamonds, mainly from Zimbabwe, but high-quality projects are small, with big operational challenges. To mine the Gahcho Kué project in Canada's Northwest Territories, for example, parts of a 793 hectare (2,000 acre) lake must be drained, and then refilled after mining is over. The project, owned by De Beers Canada and Mountain Province Diamonds, is expected to cost at least C$550 million to build and production is not likely before 2016. [Source: Julie Gordon, March 13, 2012]

"Economic diamond deposits are just very, very difficult to find," said BMO Capital Markets analyst Edward Sterck. "I do see some growth in supply going forward," he added. "But we're coming from a depressed base after the global financial crisis when a lot of production was shuttered.”

“BHP Billiton, one of the world's largest diversified miners, has put its capital to work elsewhere. It has put its remote Ekati diamond mine in Canada's Northwest Territories up for sale and sold its stake in the Chidliak diamond project, on the Arctic's Baffin Island, to Peregrine Diamonds Ltd.

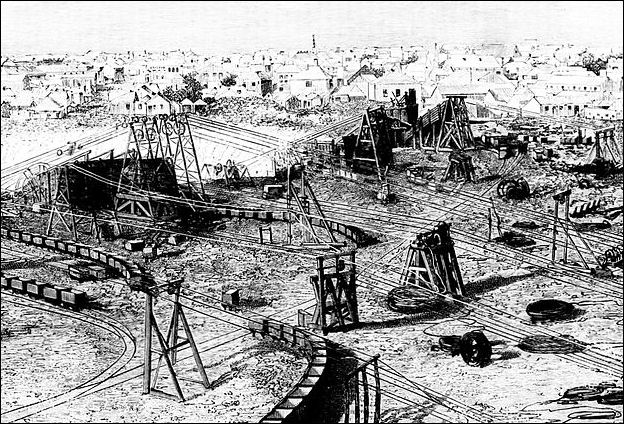

South African diamond mine

Recycled Diamonds

Julie Gordon of Reuters reported: “Sabrina Thompson, a 30-something restaurant manager from Toronto, says she turned to Craigslist to sell her diamond engagement ring after her relationship ended. An embittered Thompson, who wants C$1,800 ($1,800) for the half-carat ring, says the cash will help her move on with her life. "He said I could keep it, but I wouldn't have given it back anyways," she told Reuters. "If it doesn't sell in the next month, I'm probably just going to go to a pawnshop." [Source: Julie Gordon, Reuters, March 13, 2012]

Experts say a growing cadre of people, especially in North America, are thinking along the same lines. Rather than hanging on to memories of a failed relationship or departed relative, they are opting to "recycle" their diamonds. "You have no money to pay your medical insurance, you have no money for your mortgage," said Chaim Even-Zohar, a consultant with Israel's Tacy Ltd. "So you take your jewelry and your diamonds to the pawn shop.”

“Anecdotal evidence signals that something is afoot. Russell Oliver, a Toronto jeweler known for camp TV spots where he waves fistfuls of cash at the camera, said more diamonds than ever are passing through his shop. "I can't tell you if there's more divorces, or more people are handing over their inheritances," said Oliver, who calls himself "The Cash Man." "I can't tell you why, but in the last year, 2011, I bought so many diamonds." By his estimate, Oliver bought 30 percent more diamonds last year than in years past. Cash-for-gold operations like Oliver's buy rings, remove the diamonds, melt down the gold and sell the materials to wholesalers. They ship the diamonds to cutting houses for polishing and recutting, and the gems go back on the market.

Impact of Recycled Diamonds on the Diamond Industry

Julie Gordon of Reuters reported: “It's a trend that is sending ripples through the gem industry at a time when high-quality rough diamonds have become more difficult to find, and more expensive to mine. The growing influx of "used" gems means prices could stagnate over the long term despite the supply restraints, Even-Zohar said. To be sure, analysts were already expected a short-term dip in prices as a weak global economy cuts disposable income in Europe and North America. But the forecast by Even-Zohar, a respected expert, seemed to confirm a nagging fear that recycling could hurt explorers and miners for years. [Source: Julie Gordon, Reuters, March 13, 2012]

The numbers already point in that direction, he says. The rough diamond market, before the stones are polished and cut, was worth about $15.2 billion in 2011, and could drop some 10 to 13 percent in 2012. At the same time, Even-Zohar expects $1 billion worth of recycled diamonds to be put back into the market this year.

“Even when the global economy recovers, recycling could remain an issue, warns Even-Zohar. As more consumers decide to cash in their memories, the industry could struggle to keep prices high enough to sustain the investment in new mines. Up to $1 trillion worth of "used diamonds" are locked away in safe deposit boxes and jewelry cases, and many gems could find their way onto the market, according to Even-Zohar's data. "We have a problem with diamonds," he joked. "The problem is diamonds last forever.”

Diamond Cutting and Polishing Business in Belgium

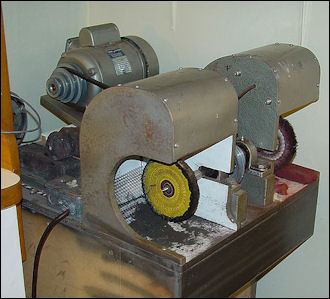

Diamond polisher

Antwerp is still regarded as world's diamond trading and cutting capital for big stones. One third of De Beers buyers are found here and they reportedly account for 60 percent of all diamond transactions. The diamond trade accounts for $4 billion a year and 6 percent of Belgium's total exports. In the 1990s about 16.8 percent of all polished diamonds imported into the United States came from Belgium by weight of carats and 27.4 percent by value in dollars

Antwerp accounts for over 40 percent of the world's diamond cutting and polishing and 60 percent of the trading of large diamonds. Many of the diamonds that originate in southern Africa pass through here on their way from the mines to the jewelry stores; arriving here as raw and uncut stones and leaving as marvelous multi-faceted gems.

The first documented diamond deal in Antwerp was recorded in 1447 but the industry didn't take hold into the 19th century when Ashkenazi Jews arrived from Central Europe and built up the city's diamond exchange. The Jewish population of Antwerp dropped from 50,000 to 800 during the Holocaust. The trade for rough and polished stones revived after World War II but the crafts of cutting and polishing moved from Belgium to India, Thailand and Israel. The number of diamond workers declined from 19,000 in 1968 to less than 3,500 today.

Most of the world's uncut stones are traded from diamond exchanges in London and Antwerp. Hasidic Jews and dealers from India, South Africa, Zaire and Lebanon walk the streets on Antwerp. The Diamond Exchange in Antwerp has vaulted ceiling windows because before the advent of fluorescent lamps “diamantaires” only trusted natural light.

Antwerp is also known as the center of the diamond black market. Thieves often come here to sell their stones. Buyers purchase them as off the books investments. The appeal of diamonds is that they small, easy to conceal — you can walk around with a million dollars in the your pocket and that much money in diamonds is much easier to hide and more difficult to trace than cash. [Source: Fred Ward, National Geographic, January 1979 []

Diamond cutters in Antwerp specialize in cutting stones with odd shapes. Belgian craftsman are known for their unsurpassed skill and the largest diamonds in the world have been cut in Antwerp. Cutters use diamond dust and olive oil on their saws.

P.N. Ferstenberg was honored with the title "Dean of the Diamond Industry" by the Belgian Government, the diamond industry and the diamond workers. As the title clearly indicates he gets on well with most every one. Still he caries a large automatic weapon in his pocket. "With diamonds" he said, "you can not be too careful.*

Retail Diamond Sales

The United States is the biggest market for diamond jewelry accounting for roughly half of the total market. Each year 1.7 million American men buy diamond rings.

The United States is the biggest market for diamond jewelry accounting for roughly half of the total market. Each year 1.7 million American men buy diamond rings.

Diamond jewelry accounted for half the $59.4 billion in jewelry — which includes watches and costume pieces’sold by retailers in the United States in 2005.

Zales is the largest diamond retailer in the U.S. It operates 1,500 stores and an additional 800 kiosks

The Internet diamond trade is surprisingly robust. The online sales company Blue Nile is a big success, with little overhead it can sell diamond for 35 percent less than even large chains like Zales. The average diamond it sells is $5,500, compared to an industry average of $2,700. It has been so successful that it has put many jewelers out of business and cut the profit margins of large retailers.

Harry Winston

Harry Winston is one of the most famous diamond retailers. It was founded by Harry Winston, the son of a New York jeweler, who was born in 1896 and founded his own brand in 1932. The company owes its success to its focus on cutting the largest possible diamonds from rough stones and designing jewelry that looks good on a woman’s skin. In the 1953 film “Gentlemen Prefer Blondes”, Marilyn Monroe sang, “Talk to me, Harry Winston, Tell Me all about it!” Among the stones that Harry Winston brought into the United States was the Hope Diamond. After Winston’s death in 1978, his stores and company were taken over by a mining company.

The Hope Diamond is believed to have been mined in India. It had a reputation of being cursed because it was said that every one who owned it came to a disastrous ending. The demand Harry Winston purchased it in 1949 and traveled with it often, without any misfortunes. He donated it to the Smithsonian in 1958, where it is now rests in the Harry Winston Gallery.

Diamond Producers

Hope DiamondThe opening of new mines in the Northwest Territories has made Canada one of the world largest producers of diamonds. While South Africa is famous for diamonds, particularly big ones, it produces far less small gem-quality and industrial diamonds than other countries. About 60 percent of the world’s rough diamonds come from Africa.

Estimated diamond production in 2010 and 2011 (thousands of carats): 1) Botswana (25,000 carats in 2010 and 25,000 in 2011); 2) Russia (17,800 and 17,800); 3) Angola (12,500 and 12,500); 4) Canada (11,773 and 11,800); 5) Congo (5,500 and 5,500); 6) South Africa (3,500 and 3,500); 7) Namibia (1,200 and 1,200); 8) Guinea (550 and 550); 10) Ghana (300 and 300); 11) Central African Republic (250 and 250); 12) Sierra Leone (240 and 240); 13) Brazil (200 and 200); 14) Guyana (144 and 144); 15) China (100 and 100); 16) Australia (100 and 100): 17) Tanzania (77 and 77). [Source: geology.com, based on USGS data]

Diamond producers (mine production in carats in 1997): 1) Australia (40,200,000); 2) Russia (19,100,000); 3) Botswana (16,000,000); 4) Congo (15,000,000); 5) South Africa (10,170,00); 6) Namibia (1,500,000); 7) Angola (1,234,000); 8) China (1,130,000); 9) Brazil (900,000); 10) Ghana (700,000); 11) Central African Republic (500,000); 12) Zimbabwe (450,000); 13) Guinea (200,000); 14) Sierra Leone (200,000); 15) Liberia (150,000); 16) Venezuela (150,000); 17) Rest of the World (386,000).

Major diamond producing countries (supply in millions of carats in 1995): 1) Australia (38.5); 2) Russia (21.9); 3) Zaire (19); 4) Botswana (15.6); 5) South Africa (11); 6) Angola (4.4); 7) Brazil (2.3); 8) Ivory Coast (1.5); 9) Namibia (1.3). Major diamond producing countries (value in millions of dollars in 1995): 1) Botswana and Russia (1,300); 3) South Africa (1,200); 4) Zaire (696); 5) Angola (606); 6) Namibia (375); 7) Australia (346); 8) Brazil (120); 9) Ivory Coast (115). [Source: Terraconsult BVBA and Time magazine]

Argyle Field in West Australia was the world's richest diamond producing area. In 1983 the field yielded over 6.2 million carats. Few of the diamonds, however, were of gem quality. According to local Aboriginal folklore, the Argyle mine was formed when a barramundi fish jumped through the net of three local hunters. The diamonds are its scales glinting in the sun and the pink ones are the fish's heart.

The last big kimberlites to be discovered were found in the Northwest Territories of Canada in the early 1990s. They are now being mined. Some large mines, like those in Argyle, Australia, are reaching the end of their lifespan. Some think that the last of the great diamond sources have been discovered and diamond production may someday die and be replaced by synthetics.

“The Soviet Union was a diamond mining giant, producing an estimated $1.5 billion in diamonds annually. The Russian government doesn't reveal how much it makes from diamond production.

Russian Diamond Monopoly

Russia is the world’s third largest diamond producer. Russian mines produce about 20 percent of the worlds diamonds, or ten million carats annually, of which 25 to 30 percent are gems. They are world's second largest producer of diamond gens after Democratic Republic of the Congo (Zaire). Most of the natural stones come from Siberia. The Russians also manufacture at least 15 million carats of synthetic diamonds.

“During the Soviet era, gold and diamonds were tightly controlled by the state. Even today the state is actively involved in both sectors.

Alrosa is the Russian diamond monopoly and the second largest diamond producer in the world. It is jointly owned by Far Eastern Yakutia region and the Russian states. The CEO of the company from its founding in 1992 until 2002 was Vyacheslav Shtyrov, a former high-level Communist official who became the governor of Yakutia and later the President of the Sakha Republic.

“In the early 1990s, De Beers entered into a joint venture with Alrosa to develop a promising deposits near Arkhangelsk in Russia’s far north. In the end Alrosa used De Beers as long as it needed them and then muscled them out. The move Now helped make Alrosa into a major international diamond firm in its own right.

“Alrosa did $1.6 billion worth of business in the early 2000s. It owns half the Catoca mine in eastern Angola with the Angolan government and is interested in mining in Antarctica, which is now prohibited. It has also checked out sites in Namibia and South Africa.

small Williamson mine in Tanzania

Diamond Mines in Siberia

Most of Russia’s diamond mines are in north central Russia. One mine is on the White Sea north of Moscow. There are believed to be 500 frozen diamond-yielding kimberlite pipes in Yakutia, Siberia. Mines in the remote Siberian province of Yakutia, officially known as Sakha since the end of communism, produce 13.6 million carats a year (25 percent of the world's rough diamonds in dollars).

“The source of many of the Yakutai diamonds are the massive open-pit Mirny (Peace) and Udanchni (Lucky) mine, which has yielded the 232-carat Star of Yakutia and the 342-carat XXVI Party Congress (a joking reference to the fact the diamond is "huge and formless"). Both of the gems are in a class case in the Kremlin national treasures and may not be sold.

“Mining the pipes in Siberia can be very expensive. They often need huge processing plants, large work forces and special technology to deal with the -70̊C temperatures (cold enough to crack steel). Investments of over $1 billion have been needed to fully exploit the mines.

“The Mir diamond mine in northern Siberia consists of a large pit that spirals 2,000 feet deep into the ground. Opened in 1957, it was Russia's first diamond mine and gave birth to an entire city. At the time the mine closed in 2001, trucks took 90 minutes to carry their loads from the ore-bearing areas to the surface.

“Workers at the Mir wear felt boot and fur hats and use pneumatic drills to hack through 1,400 feet of permafrost. Vertical refrigeration pipes keep the shafts frozen and stable as warm air rises from the mine below the permafrost.

Russian Diamond Stockpile

Russian is said to have a huge diamond stockpile. The amount and quality of the diamonds in the stockpile is a closely guarded secret. Since the quality of the leaked diamonds from Russia in 1995 was relatively low, some diamond experts believe that means the supplies at that time were getting low.

“In 1996, Yeltsin sold a large chunk of Russia’s diamond stockpile to pay for his reelection campaign.

A diamond smuggling network operating in Angola and throughout Africa is reportedly run by a former Soviet translator.

large Ekati diamond mine in Canada

De Beers and Russia

The relationship betwee De Beers and Russia go way back. In 1958, when news of diamond discoveries in Siberia caused de Beers stock to plummet 25 percent, Oppenheimer sent representatives to Moscow to work out a deal. Despite their reluctance in dealing with a classic imperialist monopoly in country with a racist government, the Kremlin made a long-term agreement with De Beers, who promised to buy Russia's entire production of rough diamond and guaranteed high prices. The negotiations were held in secret and transactions were conducted by front companies in Luxembourg and Switzerland.

“After the collapse of the Soviet Union in 1990, the new cash-starved government demanded a better deal. The result was a five-year contract in which De Beers promised to buy 95 percent of Russia's rough diamond production for the astronomical sum of $1 billion annually.

Russia Diamond Leaks

The Russia-DeBeers agreement held firm until 1992, when Russia's Communist Party dissolved and the control by Committee of Precious Metals (CPM, the government body responsible for overseeing the diamond industry) of the remote areas, including the diamond-producing regions in Siberia, disintegrated and the Siberian diamond producing mines and the local governments began acting on their own. Local Russian governments sought diamond export for themselves and local mines began selling diamonds directly to cash markets, bypassing De Beers.

“Diamonds from the mines in Yakutia began leaking into the open market in 1993. The leak became a flood estimated at $1 billion a year in 1994 and $800 million in 1995. The source of the leaked stones was believed to be a top-secret cache, stockpiled since the Soviet era. In 1996, the head of CPM was dismissed for his involvement in the leakage and the loss of $178 million worth of gold, diamonds and other valuables that disappeared without prepayment on the way to San Francisco.

“In 1996, Russia reportedly earned between $2 billion and $3 billion from contract sales and leakages. Several De Beers "sightholders" lost their invitations for buying leaked Russian diamonds on the open market.

De Beers Fights Back Against the Diamond Leaks

In retaliation for the keals, De Beers moved to plug the leaks on the supply side and cutting prices by 11 percent of smaller-sized gems, which made up most of the leakages, costing cost the Russians tens of millions of dollars. Cartel executives in Moscow hammered out revised purchasing agreements with Russia, arguing that without De Beers, the long-tern value of Russia's diamond resources would sink. [Source: Steve Coll, Washington Post, March 22, 1994]

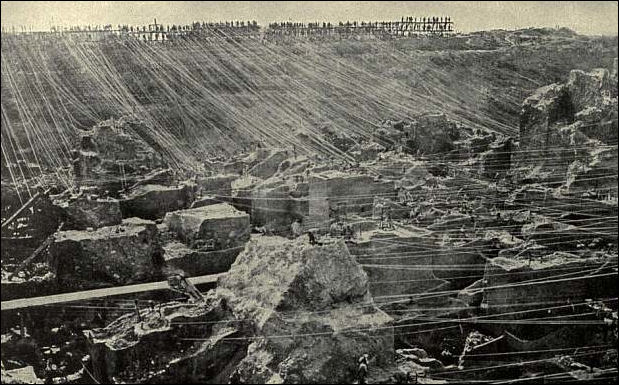

Old Kimberly diamond mine

“By the time the 1990 agreement expired in December, 1995, Russia and De Beers were highly distrustful of another and limped along, extending their agreement in a month-by-month basis. De Beers stopped negotiating with the government and conducted most of its business through the Russian mining conglomerate ARS. Russia repeatedly asked for a $5 billion a year deal.

“One diamond businessman in Antwerp told Time, "Russia doesn't have to stay with De Beers but De Beers cannot operate as a monopoly without Russia...De Beers has much more to lose than Russia. You never see countries go bust." Another expert said, "The question for de Beers is 'Are they are buddies, Do we give them money, or do we starve them. In the short term, De Beers could run Russia over like tank. In the long term, they will have problems if they run Russia over. That is the strategic problem.”

Diamonds in Angola

Angola contains perhaps the world’s's largest and least exploited diamond reserves. Before the civil war there war Angola was the world's forth largest diamond producer. The first diamonds in Angola were harvested in northeastern Angola in 1912. Portuguese and Belgian diamond companies dominated the trade in the colonial period. By 1971, Angola was producing 2.4 million carats a year. The industry almost collapsed in the mid 1970s after the civil wars started.

“The Cuango Valley in the northeast is Angola richest diamond-producing region. Most of Angola diamond are extracted from diamond-rich alluvial riverbeds. The country’s alluvial reserves have been estimated between 40 million and 130 million carats. An estimated 600 volcanic pipes called kimberlites, hold an estimated 180 million carats. The alluvial diamonds originally came form these pipes, which are mostly undeveloped.

“During the Angolan civil war in the 1970s, 80s and 90s diamonds we extracted in large quantities by peasant laborers. So many diamonds flowed out of Angola there were concerns that the diamond market might collapse. DeBeers spent up to $40 million a week to stave off collapse by buying up Angolan diamonds. Winnie Mandela, wife of Nelson Mandela, got into trouble for hiring a jet to go on a diamond buying spree in Angola.

“In 1992 production reached 1.24 million carats but slumped to 46,000 carats in 1993 due to trouble in Cuango Valley. In the mid-1900s, Endiama, the Angolan state diamond company, allowed companies authorized by the government to mine for diamonds. Production estimates for this period were about $700 million a year.

“The Angolan government seems determined to keep DeBeers at arms length and has made agreement with Russian and Brazilian companies to mines its kimberlites. A South African company wants to search for offshore diamonds.

“UNITA — the rebel group head by Jonas Savimbi that fought the Angolan government in the civil war — derived about $100 million a year from diamond mines in territories it controlled in northeastern Angola. The diamonds were smuggled into Zaire (Democratic Republic of the Congo) and sold to DeBeers through brokers. Savimbi held the diamond mining regions for a while. Under UNITA it was a Wild West kind of place filled with armed scavengers, South African mercenaries and fortune hunters. After the overthrow of Sese Mobutu Zaire’s leader in the late 1990s the Angolan governments launched attacks on UNITA position in the diamond mining areas. Savimbi eventually gave up the diamond mining region.

Image Sources: Wikimedia Commons

Text Sources: New York Times, Washington Post, Los Angeles Times, Times of London, The Guardian, National Geographic, The New Yorker, Time, Newsweek, Reuters, AP, AFP, Wall Street Journal, The Atlantic Monthly, The Economist, Global Viewpoint (Christian Science Monitor), Foreign Policy, Wikipedia, BBC, CNN, NBC News, Fox News and various books and other publications.

Last updated May 2018