RARE METALS, CHINA AND JAPAN

electric car battery Japan is dependent in China for rare metals. It gets 93 percent of its barium, 91 percent of its rare earths, 67 percent of its antimony, 79 percent of its tungsten, 59 percent of its indium, 59 percent of its Germanium, 52 percent of its bismuth, 42 percent of its strontium, 28 percent of its molybdenum, and 20 percent of its vanadium from China.

Indium is used in the liquid crystal panel electrodes. Its price rose 850 percent between 2002 and 2007, rising from $70 per kilogram in March 2003 to $1,000 a kilogram in March 2005. Tungsten is used in drills and cutters. Its price rose 450 percent between 2002 and 2007. Vanadium is used in special steels. Its price rose 600 percent between 2002 and 2007. Molybdenum is used in automobile steels. Its price rose 600 percent between 2002 and 2007.

Japan gets other important rare metals’such as nickel (used in stainless steel), cobalt (used in permanent magnets), platinum (used in batteries and catalytic convertors) and manganese (used in special steels) — from Africa and Russia. The value of these have risen between 200 percent and 700 percent between 2002 and 2007. In 2007 global production of platinum was only 204 tons. Ninety percent of the world’s reserves are in South Africa.

All of these metals are essential in industry and technology. Their high prices are the result of increased competition between industrialized countries and emerging countries like China and India to obtain secure supplies of these metals. Some have said that the Japanese government has not done enough to make sure supplies of these material are secured, insisting it should adopt “rare-metal diplomacy” to make sure supplies are secured and help finance projects in develop rare metal mines and offer technological assistance in return for supplies. There is also some discussion of buying up huge supplies and stockpiling them.

Japanese companies and the Japanese government are going through great lengths to secure sufficient supplies of rare metals, which refers to palladium, platinum, lithium, and other metals typically used in core part of cell phones and other high tech products. In many cases these materials are only available from a few places in a small number of countries, namely China and a handful of countries in southern Africa.

The Japanese government is aiming to secure supplies of rare metals by helping countries in southern Africa — where reserves of rare metals seem most likely to be found — find new sources. It has a deal with Zambia to look for potential mining sites and hopes to establish similar deals with Namibia and Mozambique. The Japan Oil, Gas and Metals National Corporation (JOGMEC) has acquired mining rights for a platinum mine in Botswana. It also supplies information to private Japanese companies about rare metals and is engaged in exploration and drilling of potential sources. China is also buying up rare metal rights overseas.

Nippon Mining will open a pilot plant in 2010 to develop technology to extract rare metal from used lithium-ion batteries for mobile phones and personal computers and then open a commercial scale operation to extract cobalt, nickel, lithium, manganese and other materials in 2011 using the same technology . Mitsui Mining is engaged in trying to secure from cell phones.

In July 2010, Japan signed a deal with Kazakhstan to obtain rare metals such as tungsten.

Japan Creates First Artificial Rare Metal

Lanthanum In December 2011, the Yomiuri Shimbun reported: “In a world first, Japanese researchers have produced a new alloy similar to the rare metal palladium, a breakthrough that could help alleviate the nation's dependence on other countries for this resource. The alloy was produced with nanotechnology and has properties similar to those of palladium, a rare metal located between rhodium and silver on the periodic table of the elements.” [Source: Yomiuri Shimbun, December 31, 2010]

Led by Prof. Hiroshi Kitagawa of Kyoto University, the research team also produced alternatives to other kinds of rare metals. Rhodium and silver molecules usually do not mingle, and remain separated like oil and water even after melting at high temperatures. To mix the elements, Kitagawa focused on a technique that produces ultramicroscopic metal particles.His team created a solution containing equal quantities of rhodium and silver, turned the solution into a mist and mixed it little by little with heated alcohol to produce particles of the new alloy. Each particle is 10 nanometers in diameter and atoms of the two metals are equally mixed.

The new alloy has the same properties as palladium, which is used as a catalyzer to cleanse exhaust gas and absorbs large quantities of hydrogen, the researchers said.Rhodium, palladium and silver have 45, 46 and 47 electrons, respectively, numbers that determine their chemical characterizations. "The orbits of the electrons in the rhodium and silver atoms probably got jumbled up and formed the same orbits as those of palladium," Kitagawa said.

The new alloy will be difficult to produce commercially, but Kitagawa intends to use the production method to develop other alloys for use as alternative rare metals. Kitagawa has begun joint research with automakers and other companies, but said he could not disclose any information because of patents and other reasons. Rare metals exist only in small quantities and are economically difficult to mine or extract. Because adding just a small quantity of rare metals can change or improve the properties of other materials, rare metals are called the "vitamins" of industry.

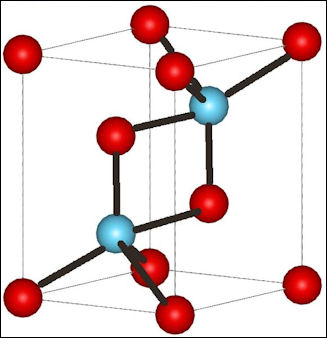

Lithium-Ion Cells Created Without Rare Metals

La2O3 structure In October, 2011 a Japanese research group has developed lithium-ion batteries without using rare metals.Lithium-ion batteries are used in computers and mobile phones. Cobalt, which is a type of rare metal used in the batteries, is produced in a limited number of countries and its price fluctuates significantly. The researchers, including Osaka University Associate Professor Yasushi Morita and Osaka City University professor Takeji Takui, used trioxotriangulene, an organic material produced from petroleum, instead of cobalt.

“The group says the new batteries can store nearly double the amount of electricity compared with existing models.Their discharge capacity will be reduced by about 30 percent after using about 100 times. But the production method is less costly and the new batteries are lighter at the same time. Associate Professor Morita says the new batteries could pave the way for the development of lighter devices such as smart phones for longer use. He adds that he hopes to apply the method to car batteries and make improvements through cooperation with companies.

Lithium, China, South Korea and Japan

Japan imports 15,000 tons of lithium annually, with about 85 percent coming from South American countries.

The largest deposits of lithium — increasingly becoming a vital resource as lithium ion batteries expand from electronics into electric vehicles — are in the high-altitude deserts of southwest Bolivia. Already Japan and China are staking claims there to make sure they have enough to meet their needs. Both countries are looking for promising mining sites, making deals with mining companies and getting on the good side of the Bolivian government by offering technology that will help develop the sites. Sumitomo and JOGMEC are working with the Bolivian government to develop lithium resources there.

The acquisition of a 40 percent stake in the development of a lithium deposit in Nevada by Japan Oil, Gas and Metals National Corporation (JOGMEC), announced in June 2010, was regarded as a major coup for Japan. The joint venture aims to produce 10,000 tons of lithium a year, 10 percent of the world’s total.

Japan is trying hard to get a major stake in the salt lakes of Uyuni in southwest Bolivia, which are estimated to contain 5.4 million tons of lithium, half of the world’s reserves. Mitsubishi, Sumitomo, and JOGMEC have formed to partnership to battle against Chinese and South Korean rivals to obtain a major stake in developing deposits there.

In February 2010, Japan sent a delegation of 70 officials to Bolivia to work out a deal. Bolivia has insisted that it wants to develop the deposits independently but already there are reports that a South Korean firm is conducting feasability studies with Bolivian government, raising fears among the Japanese that maybe they have been left behind.

Rare Earths, China and Japan

Chinese rare earth mine Japan imports of rare earths from China accounted for about 82 percent of Japan's imports of rare earths in 2010.The Economist reported: “Japan imports more rare earths than any other country. Its electronics, fine-chemicals and car industries rely on them. A disruption of supply could paralyse the Japanese economy as much as an oil embargo or food blockade. And because Japan dominates some of the technological processes that use rare earths’such as polishing hard-drive platters with cerium oxide — interrupted access would be felt worldwide. [Source: The Economist, January 20, 2011]

Japan is the largest consumer of rare earths. It uses a fifth of the world’s supply. It is predicted to face a rare shortage of 11,300 tons in 2011. China’s rare earth exports (50,000 tons in 2009); 1) Japan (56 percent); 2) the United States (17 percent); 3) France (6 percent); 4) Others (21 percent) [Source: Japan’s Economy, Trade and Industry Ministry]

Japan gets 90 percent of its rare earths from China. Hiroko Tabuchi wrote in the New York Times, “Japanese companies generally avoid discussing their mineral holdings. But experts say that some manufacturers have been stockpiling rare earths, building inventories ranging from a few months’ to a year’s worth. In September 2010 the Japanese trade minister, said the government was considering starting a stockpile of rare earths as a buffer against trade interruptions. [Source: Hiroko Tabuchi New York Times, October 4, 2010]

Rare Earths

Rare earths are a class of minerals — which include cerium, neodymium, lanthanum, yttrium and dysprosium — that have properties that make them essential for a number of uses in the electronics industry. The rare earth market is now estimated at $1 billion a year but is expected to get much bigger in the future.

Rare earths are processed into phosphors, ceramics and magnets that can be up to 10 stronger than conventional ones. They are essential for the production of liquid crystal display televisions, personal computers, and cell phones; and are used in making hard disks, miniaturized electronics, display screens, missile guidance systems and pollution control catalysts. Some have called them the key materials for the electronic industry and many predict they will replace silicon as the key materials for advanced electronics. .

Cerium is an essential; material for automotive catalytic conservators. Neodymium powers very small magnets used in devices like disk drives, tools and headphones. Lanthanum is use to make electrodes that are efficient and inexpensive. .

Japan has relied on China for almost its entire annual dysprosium imports of about 500 tons to 600 tons. Dysprosium is used to produce high-performance magnets in motors. In a part of Jiangxi Province, China, a major mining site of the rare earth dysprosium the local government has decided to stop production by the end of this year. The current dysprosium inventory for Japanese-affiliated companies is expected to last for about two years, but shortages in supply may become more severe afterward. An official of major manufacturer Showa Denko K.K. said, "There are moves to develop mines in Vietnam and some other countries, but it would take four to five years until supplies from those nations began."

Japanese industry is in somewhat of a panic over China’s dominance in and has urged the Japanese government to exert diplomatic pressure on the issue and help in other ways. The rare earth issue has the potential of setting off a trade war or worse between China and Japan.

See China

China Bans Rare Earth Exports to Japan

rare earth mine In early September 2010, when a major diplomatic row broke out between Japan and China over a group of disputed islands after a Chinese trawler collided with two Japanese Coast Guard, China effectively imposed a ban on the export of rare earths and silicon — materials critical in the electronics and automobile industry and of which China is one of the sole suppliers — by initiating customs procedures such as requiring documents to be in Chinese, a deviation from usual practices, that halted the shipments. All 31 Japanese companies involved in the rare trade said their businesses had been hampered by the Chinese export restrictions.

Customs restrictions in rare earths remained in place even after the captain of the Chinese ship at the center of the dispute was released. An industry official said, though a trickle of shipments seemed to be seeping out as a result of uneven enforcement of the ban by customs officers at various ports. China has allowed exports of Chinese-made rare earth magnets and other rare earth products to Japan, but not semi-processed rare earth ores that would enable Japanese companies to make products. Finally, about five days after the captain was released China began to back down. The rhetoric was toned down. Customs procedures returned to normal and shipments or rare earths and materials resumed. [Source: Hiroko Tabuchi New York Times, October 4, 2010]

Paul Krugman wrote in the New York Times, “Even before the Then came the trawler event. Chinese restrictions on rare earth exports were already in violation of agreements China made before joining the World Trade Organization. But the embargo on rare earth exports to Japan was an even more blatant violation of international trade law...Oh, and Chinese officials have not improved matters by insulting our intelligence, claiming that there was no official embargo. All of China’s rare earth exporters, they say — some of them foreign-owned — simultaneously decided to halt shipments because of their personal feelings toward Japan. Right.” [Source: Paul Krugman New York Times, October 17, 2010]

Hiroko Tabuchi wrote in the New York Times, The cutoff has caused hand-wringing at Japanese manufacturers, from giants like Toyota to tiny electronics makers, because the raw materials are crucial to products as diverse as hybrid electric cars, wind turbines and computer display screens. Japan’s trade minister, Akihiro Ohata, said he would ask the government to include a “rare earth strategy” in its supplementary budget for this year. [Source: Hiroko Tabuchi New York Times, October 4, 2010]

“So what are the lessons of the rare earth fracas?” Krugman asked. “First, and most obviously, the world needs to develop non-Chinese sources of these materials. There are extensive rare earth deposits in the United States and elsewhere. However, developing these deposits and the facilities to process the raw materials will take both time and financial support. So will a prominent alternative: “urban mining,” a k a recycling of rare earths and other materials from used electronic devices.” [Krugman, Op. Cit]

Japan Responds to Chinese Rare Earth Quotas

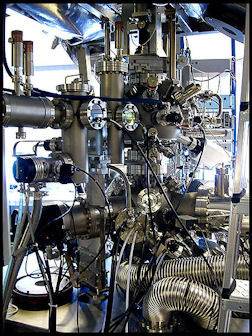

vacuum chamber used to study

rare earth surfaces The Economist reported: “Two decades of economic impotence have convinced many observers that Japan is cautious and slow to change. But the country can move quickly when sufficiently provoked?...for example by... “China’s hoarding of rare earths. Since shipments of rare earths were cut off over the island dispute in September 2010 Japan Inc has sprung into action. [Source: The Economist, January 20, 2011]

“The big trading houses such as Sojitz, Sumitomo and Mitsubishi are securing alternative supplies, supported by state financing. Companies such as Toyota, Hitachi, Nidec and TDK are working to reduce or eliminate the rare-earth elements needed in devices. Recycling programmes are being studied. The government earmarked $1 billion from a stimulus package in November to secure supplies, including funding university research and projects such as robotic deep-sea mining.”

“A national stockpile of the kind that already exists for rice, cereals and petrol has been mooted. There is even talk of creating a generously funded agency to acquire stakes in non-Chinese producers, possibly using the country’s vast foreign-exchange reserves (at $1 trillion, the world’s largest after China’s). Japan’s prime minister has met his Vietnamese and Mongolian counterparts to discuss new production.”

“Japan has been suddenly spurred to action before. The environmental crisis in the 1960s, the oil shocks of the 1970s and the strong yen in the 1980s rallied bureaucrats, politicians, business leaders, the media and the public. High energy prices forced Japan to become one of the world’s most energy-efficient countries....Japan will remain dependent on Chinese rare earths for some time. The country’s resource mandarins say they have no specific target for reducing this dependency, though they reaffirm an earlier goal that Japan should control 50 percent of its mineral needs, including rare earths, by 2030. “

Japanese Government Response to China’s Cuts Rare Earth Exports

Gadolinium In September 2011, Japan sent a delegation of business leaders to Beijing to urge China to ensure a stable supply of rare earths to Japan and to convey concern about Beijing's plan to reduce its rare earth export quota. The delegation — led by Toyota Motor Corp. Chairman Fujio Cho and Japan Business Federation (Keidanren) Chairman Hiromasa Yonekura — conducted talks on the issue with Chinese Vice Premier Li Keqiang, expected to be China’s next prime minister. [Source: Yomiuri Shimbun, September 2011]

In exchange for a stable supply of rare earths, the Chinese government has demanded that Japanese companies manufacturing products using rare earths move their plants to China. The Japanese government is apparently facing a tough decision, because companies in the nation that manufacture products using rare earths would run the risk of leaking their technologies if they moved production to China. Li requested that Japan offer China technical cooperation related to the rare earths industry. "I expect cooperation between our countries over the use of rare earths," he told the Japanese delegation. "Japan possesses excellent technology related to the exploration and use of rare earths.”

The Japanese Ambassador to China Uichiro Niwa visited the Inner Mongolia Autonomous Resion, a major producer of rare earths. A local government official told Niwa that Japanese investment in the region has been small, and the region would welcome the entry of Japanese manufacturers and other rare earth-related industries into the region.

The Japanese government provided $500 million in subsidies for about 230 projects and paid firms to curb their rare earth use. For example, it will supply about $3.75 million in the form of a subsidy to major motor manufacturer Nidec Corp. and lensmaker Hoya Corp. three other firms that are working to reduce the use of rare earths. The move also aims to prevent domestic companies from moving their manufacturing bases to China to secure rare earths. Nidec is planning to introduce motor-manufacturing equipment that does not use the rare earth dysprosium. Hoya also plans to install cutting-edge equipment for making optical lenses to reduce the use of high-grade lanthanum, also a rare earth. [Source: Yomiuri Shimbun, September 21, 2011]

Japanese Companies’ Response to China’s Cuts Rare Earth Exports

Some Japanese companies have already taken steps to strengthen their production capabilities in China. Doing so secures rare earth supplies and exempts the rare earths they use from China's export quota. Showa Denko raised in July the output capacity of its plant in Jiangxi Province. Hitachi Metals Ltd. is also considering setting up a production plant in China.

Hitachi Ltd. has developed a technology to extract and recycle rare earths used in personal computer hard discs and air conditioners. It has also developed high-performance motors using no rare earths.

“In June 2010, Associated Press reported: “Honda said it will start recycling rare earth elements and other key materials in hybrid auto batteries this year — a key innovation in the Japanese automaker's effort to be green. Honda officials said the company was targeting September or October to begin its recycling of rare earth elements. They said it would be a first for the auto industry. Honda President Takanobu Ito said, "In the long term, we hope to move to renewable energy sources that won't harm the environment," he said at headquarters in Tokyo. [Source: Yuri Kageyama, Associated Press, June 21, 2012]

In the autumn of 2011, Mitsubishi Electric Corp. announced it would raise prices of new models of air conditioners, and Panasonic Corp. hiked prices for its fluorescent lights. Industrial analysts said production of electric vehicles and hybrid vehicles will also be affected. “President Carlos Ghosn of Nissan Motor Co., which leads the auto industry in the field of electric vehicles, said in October 2011 countries other than China would expand production of rare earths. He said this would stabilize prices of rare earths at reasonable levels. [Source: Mamoru Kurihara, Yomiuri Shimbun, December 19, 2011]

Japan Seeks Alternative Source of Rare Earths

Rare earth magnet

and Ferro fluid The fallout over the Chinese fishing boat in waters of the disputed Senkaku islands in September 2010 and the blocking of rare earth exports, accelerated Japan’s quest for alternative sources of rare earths and development of technologies that didn’t need rare earths so it wasn’t so dependant on China for them.”

Days after the effective export on rare earths from China to Japan was imposed the Japanese Economy and Trade Minister Akihiro Ohata established a new rare earth policy aimed at diversifying Japan supply and stockpiling the materials. Ties were firmed up with Kazakhstan, the world’s second largest producer of rare earths after China, and Vietnam and Mongolia, two other large rare earth producers. Kazakhstan was told to send representatives to Japan as soon as possible to negotiate and expand its rare earth deal with Japan.

In November 2010, Sojitz, a large Japanese conglomerate, announced a deal with Lynas, an Australian mining company, to secure rare earths through 2020s. According to the agreement Sojitz would receive 70 percent of Lynas’s annual 22,000 ton annual rare earth capacity. In March 2011, a consortium of Japanese and South Korean companies — including Nippon Steel and JFE Steel of Japan and POSCO of South Korea’said they were buying a 15 percent stake in Companhia Brasileira de Meltalurgiae Mineracao (CBMM) — a major rare earth mining firm and producer of niobium in Brazil for about $1.7 billion. Sojitz is also negotiating the rights to a rare earth mine in Vietnam. The industrial conglomerate Sumitomo plans to work with Kazakhstan’s government to recover rare earth elements from uranium ore residues.

The Japanese companies Mitsui and Sumitomo Corp., are exploring the possibility of mining rare earths from deposits in Siberia that weren’t expected to be exploited until 2030. The company talked with government officials in Yakutia — an area of northeastern Russia the size of India with frigid winters and only about 1 million people “about mining deposits of niobium and scandium. [Source: Bloomberg]

Geoff Bedford of the rare-earth-processor Neo Technologies, told AFP, “We do not have a customer in Japan whose research and development group is not working overtime to figure out how to reduce, or eliminate, rare earths in their products.”

Japan has budgeted $1.25 billion — equal to the total annual rare earth market value — in 2011 to secure non-Chinese supplies. In October 2010, Japan and the United States agreed to cooperate to diversify suppliers after China announced it was going to curb exports. In February 2011, the Japanese government decided to give $360 million to 169 projects to encourages firms to cut their use of rare earths,

Japan Seeks Recycled Rare Earths from Urban Mining

The National Institute for Materials Science, a government-affiliated research group, says that used electronics in Japan hold an estimated 300,000 tons of rare earths. Though that amount is tiny compared to reserves in China, tapping these urban mines could help reduce Japan’s dependence on Chinese sources. Reporting from Kosaka, Japan, Hiroko Tabuchi wrote in the New York Times, “Two decades after global competition drove the mines in this corner of Japan to extinction, Kosaka is again abuzz with talk of new riches. The treasures are not copper or coal. They are rare-earth elements and other minerals that are crucial to many Japanese technologies and have so far come almost exclusively from China, the global leader in rare earth mining. This town’s hopes for a mining comeback lie not underground, but in what Japan refers to as urban mining — recycling the valuable metals and minerals from the country’s huge stockpiles of used electronics like cellphones and computers.” “We’ve literally discovered gold in cellphones,” said Tetsuzo Fuyushiba, a former land minister on a visit to Kosaka’s recycling plant.” [Source: Hiroko Tabuchi New York Times, October 4, 2010]

“In Kosaka, Dowa Holdings, the company that mined here for over a century, has built a recycling plant whose 200-foot-tall furnace renders old electronics parts into a molten stew from which valuable metals and other minerals can be extracted. The salvaged parts come from around Japan and overseas, including the United States. Besides gold, Dowa’s subsidiary, Kosaka Smelting and Refining, has so far successfully reclaimed rare metals like indium, used in liquid-crystal display screens, and antimony, used in silicon wafers for semiconductors. The company is trying to develop ways to reclaim the harder-to-mine minerals included among the rare earths — like neodymium, a vital element in industrial batteries used in electric motors, and dysprosium, used in laser materials.”

“Various players have tried to recycle rare earths and metals in Japan. Last year, Hitachi began to experiment to extract rare earths from magnets in old computer hard drives, though the company said the project was not expected to go into operation until 2013. But it is Dowa, the company that has mined in Kosaka since 1884, that has emerged as the field’s early leader. And it could not come a moment too soon for this town of 6,000, which is littered with the remnants of its old ore mines: tunnels overgrown with weeds, old railroad tracks, and an abandoned bathhouse where miners once sponged off the grime from their long days underground. The mines operated up to 1990, until a surging yen and international competition drove operations out of business. Now, portions of the old red-brick ore processing factories serve as part of Dowa’s recycling plant, which started fully operating two years ago.”

“It is important for Japan to actively tap its urban mines,” Kohmei Harada, a managing director at the National Institute of Materials Science, told the New York Times. He is an enthusiastic supporter of recycling efforts like the one in Kosaka. Apart from rare metals and earths, Mr. Harada estimates that about 6,800 tons of gold, or the equivalent of about 16 percent of the total reserves in the world’s gold mines, lie in used electronics in Japan. “Japan’s economy has grown by gathering resources from around the world, and those resources are still with us, in one form or another,” he said.

“But this form of recycling is an expensive and technically difficult process that is still being perfected. At Dowa’s plant, computer chips and other vital parts from electronics are hacked into two-centimeter squares. This feedstock then must be smelted in a furnace that reaches 1,400 degrees Celsius before various minerals can be extracted. The factory processes 300 tons of materials a day, and each ton yields only about 150 grams of rare metals. Though Dowa does not disclose the finances of its Kosaka recycling operations, the company says that after a year of operating at a low capacity, the factory now turns a profit. Over all, net income at Dowa Holdings, which deals in industrial metals and electronic materials, almost tripled in the quarter ending June 30, to 6.52 billion yen, or $78.2 million, as global industrial production rebounded.”

Utaro Sekiya, the manager of Dowa’s recycling plant, said, “It’s about time Japan started paying more attention to recycling rare earths...If we can become a leader in this field, perhaps China will be the one coming to us to buy our technology.” Tabuchi wrote: “As Dowa has turned its attention to rare earths, a priority is developing ways to render neodymium, which is used in powerful magnets. Its extraction has proved costly. Neodymium is found only in tiny quantities in parts used in the speakers of cellphones, for example, making it a challenge to collect meaningful amounts, said Sekiya... Finding enough electronics parts to recycle has also grown more difficult for Dowa, which procures used gadgets from around the world. A growing number of countries, including the United States, are recognizing the value of holding onto old electronics. And China already bans the export of used computer motherboards and other discarded electronics parts.”

Japan and the Development of Rare Earths in Other Countries

In November 2011 leaders of Japan and Vietnam agreed to accelerate preparations toward the joint development of rare earths in Vietnam. Both nations have agreed to cooperate in wider fields, including securing exploration and refinement operations in the Dong Pao rare-earth deposit; development of human resources in resource exploration; and a joint study on the separation, refinement and practical utilization of rare earths. [Source: Yomiuri Shimbun, November 2, 2011]

“Japan has also agreed with Kazakhstan to cooperate in the development of rare earths and other resources. Japan’s Economy, Trade and Industry Minister Yukio Edano visited Kazakhstan and signed an agreement with Kazakh Industry and New Technologies Minister Aset Isekeshev to cooperate on the development of rare earths and other important minerals. In line with these talks, JOGMEC, Sumitomo Corp. and Kazakhstan's state-owned resource company Kazatomprom JSC are set to agree to jointly develop dysprosium, which is essential mainly for electric vehicle motors, and other resources. Sumitomo Corp is trying to extract rare earths from the permanent a uranium mine in Kazakhstan. The firms plan to recover the mineral from uranium residue and export 20 tons to 30 tons of dysprosium to Japan this year and 60 tons next year. Toyota Tsusho Corp. has rights to drill for in India and Vietnam.

Major trading company Sojitz Corp. plans to import a large amount of rare earth minerals from Australia, starting as early as February 2012, according to company sources. Sojitz hopes to initially import 3,000 to 4,000 tons annually, equivalent to about 10 percent to 20 percent of domestic demand. The firm aims to raise annual imports to 9,000 tons in 2013, which would account for about 40 percent of domestic demand.

The rare earth minerals will come from the Mount Weld mine owned by Lynas Corp., an Australian natural resource firm. Sojitz and Lynas have a deal for Lynas to provide rare earths to Japan for 10 years in return for loans and investments worth $250 million dollars. Industry sources said the rare earths to be imported from Australia will be limited to cerium and a few other kinds for the time being. As a result Japan will have to continue to rely on imports from China to support domestic industries.

Japan, India Reach Rare Earth Deal

In May 2012, Takeo Miyazaki wrote Yomiuri Shimbun, “Japan and India reached a basic agreement to jointly develop rare earths and supply Japan with about 14 percent of its rare earth needs. Indian Rare Earth Ltd., a company affiliated with India's Atomic Energy Department, and Toyota Tsusho Corp. will complete a plant in Orissa, India, by the end of June to extract rare earths from uranium residue and start production of the minerals in August. [Source: Takeo Miyazaki, Yomiuri Shimbun, May 2, 2012]

“Rare earths to be produced include lanthanum, which is used for hydrogen battery electrodes; cerium, used in catalytic converters on gasoline engine exhaust systems; and neodymium, used in hybrid car motor electrodes. Full-scale production at the plant will supply about 4,000 tons of rare earths each year to Japan, enough to meet 14 percent of the nation's annual consumption.

“According to Japan Oil, Gas and Metals National Corporation, India has 1.1 million tons of rare earths, the world's fifth-largest reserves. However, its annual production is no more than 2,700 tons. Japan's technology is expected to promote rare earth production in resource-rich India and improve its recovery efficiency.

Large Rare Earth Deposits Discovered in Waters off Japan

In June 2012 the Yomiuri Shimbun reported: “Large and rich rare earth deposits, equaling at least 220 times the country's annual consumption of about 30,000 tons, have been discovered near Minami-Torishima island in the Ogasawara Islands, a research team has said. This is the first time large rare earth deposits have been discovered in the country's exclusive economic zone. The team led by Prof. Yasuhiro Kato of the University of Tokyo found the deposits after analyzing samples of seafloor sediment taken from a depth of 5,600 meters near Minami-Torishima. [Source: Yomiuri Shimbun, June 30, 2012]

“Mud containing a large deposit of rare earth elements was nearly 10 meters deep, judging from samples taken about 300 kilometers southwest of the island. The team also confirmed large rare earth deposits in mud about 500 kilometers north and about 500 kilometers southeast of the spot. The southeast location is outside the EEZ. There are few differences in seafloor sediment across wide expanses in ocean areas such as the one near Minami-Tori-shima, meaning it is likely that similar deposits are distributed over a wide area, according to the team.

“The rare earth density has been confirmed to average 1,070 parts per million, easily topping rare earth deposits currently available for mining on land. The deposits are spread over an area of at least 1,000 square kilometers and are estimated to be about 6.8 million tons, according to the team. The mud contains "heavy rare earth elements," which are among the most important of the 17 rare earth elements. For instance, the team estimates the deposits contain dysprosium, which is used in hybrid car motors, equaling more than 400 years of the nation's annual consumption amount.

See Nature and Science, Environment, Recycling

Image Sources: 1) Osaka Gas 2) Jun from Goods from Japan 3) Sanyo 4) 5) Wikipedia 6) TEPCO 7) Bank of Japan 8) Greenpeace

Text Sources: New York Times, Washington Post, Los Angeles Times, Daily Yomiuri, Times of London, Japan National Tourist Organization (JNTO), National Geographic, The New Yorker, Time, Newsweek, Reuters, AP, Lonely Planet Guides, Compton’s Encyclopedia and various books and other publications.

Last updated October 2012