SONY’S DECLINE

In June 2012, Malcollm Foster of AP wrote: "Widely admired in the 1980s as an innovative power, Sony fell behind when digital music players and flat TVs became hits. Its gadgets have lost popularity as consumers flock to products from Apple such as the iPhone and iPod. It's also lost out in the TV market to South Korea's Samsung and other Asian competitors. In 2010, Sony stopped Japanese production of its Walkman, which sold 220 million units worldwide."[Source: Malcolm Foster, Associated Press, June 4, 2012]

“Sony once hit home runs, but now it’s lost its touch,” Akihiko Jojima, an analyst and author of the book “Sony’s Sickness” told the New York Times.’sony still makes competent products but they’re all just boring ground balls.”

Hiroko Tabuchi wrote in the New York Times,”In the last few years, its position as a consumer electronics titan has been usurped by more nimble competitors.The iPod from Apple dominates digital music players. In gaming, both the PlayStation 3 and its PlayStation Portable consoles from Sony trail the competing Wii and DS machines from Nintendo — and the DS is about to get a 3-D upgrade. Samsung Electronics leads in the global flat-panel TV market, a traditional stronghold of Sony.” Sony’s pioneering e-book reader lost its early lead to the Kindle from Amazon.com..” In the meantime Sony has also “failed to leverage the wealth of content at its music and cinema arms to the advantage of the wider company.” [Source: Hiroko Tabuchi, New York Times, March 28, 2010]

Sony Shock in the Early 2000s

Sony has endured its share of trouble since the 21st century began. In 2000 it began cutting 17,000 workers, 10 percent of its workforce, and reduced factories and facilities by 20 percent. In October 2003, Sony announced it was cutting 20,000 jobs by 2006. It also announced it would cut the component lines for traditionally television from 17 to five in the same period.

Sony’s attempt to get into the cell phone market has been a struggle. In 2001, it recalled 1.1 million cell phones over worries that the battery could melt the plastic case and because the phones had a software flaw that made them incompatible with the NTT DoCo Mo network. In the end it lost $360 million and was forced into a joint venture with Ericsson. Sony was also a late comer to the flat screen television market and had to make a deal with Samsung to get a piece of the action.

In 2001, Sony announced some its first quarterly losses ever, much it due to a slump in sales of electronic products, which accounts for three fourths of Sony's business. In fiscal 2001-2002, Sony squeaked by with a profit of $118 thanks mainly to strong sales of PlayStation 2. In fiscal year 2001-2002, electronic made up the bulk of its sales but brought in profits of only $125 million, compare to $579 million in games, $203 million in music, $147 million in film and $91 million in insurance.

After Sony announced a $927 million loss in the first three months of 2003, its stock plunged 24 percent in two days and the company lost $3.8 billion of its value. Sony blamed the loss on restructuring costs, sluggish sales and a lack of a hit movie. Other factors included competition from cheaper foreign competitors of basic audio and video equipment and delays its it Internet projects.

The “Sony shock” sent shudders around the globe. Moody dropped Sony’s credit rating. Investors began examining Sony’s short term results more closely. Afterward Sony CEO Idei said that maybe Sony could learn something from competitors like Dell and Samsung.

Sony Rebounds

Profits for fiscal year 2003-2004 were about $800 million and $1.5 billion in 2004-2005, mainly due to success in its movie and division, which produced Prince’s “Musicology” and popular films like “ 50 First Dates, Big Fish” and especially “Spiderman 2". Sales of digital cameras and flat screen televisions rose but sales of traditional goods such as audio equipment were down. PlayStation 2 was also down.

The successes seem to bear out that Sony’s effort to diversify was a sound business strategy. The financial services, especially the insurance wing, was doing well. The joint venture with Ericsson was paying off. There were also down sizing efforts.

Sony managed to make a profit of $605 million in 2005. Sales of Bravia felt-screen televisions and PlayStation video game consoles and a good performance by the financial sector put the company in the black after the company had projected its first loss in 11 years a few months before.

Flaming Laptops and Other Problems for Sony in the Mid 2000s

In recent years Sony has been hurt by increased competition, falling electronics prices, and several expensive and humiliating recalls.

In August 2006, Dell recalled 4.1 million batteries used in the laptop computers because of risks they could overheat and cause a fire. It was the largest recalls ever in the electronics industry. Ten days later Apple recalled 1.8 million batteries used in Mac laptops. Both recalls involved lithium-ion batteries made by a Sony subsidiary that introduced small metal particles in the manufacturing process that could can cause computers to short circuit or catch fire.

The recall ended up affecting almost every major maker of laptop computers, which were all using Sony batteries. In all 9.6 Sony million batteries, most of them in 7.74 million laptop computers made by Dell, Apple, Lenovo, IBM, Toshiba Hitachi, Fujitsu and Sharp, were recalled. Toshiba recalled 830,000 computers and was contemplating suing Sony over decline in sales and impairment to its brand image. Hewlett Packard and Gateway computers used the Sony batteries but were not involved in the recall because the batteries were configured in such a way there was no risk of overheating.

The problem first surfaced when someone video-taped a computer catching on fire at conference in Osaka in the spring. Sony was aware of the problem several months before that but didn’t act. The video of the fire was widely circulated on the Internet. Altogether there were 10 reports of computers with Sony batteries overheating. The recall cost Sony around $500 million and badly damaged its reputation.

In August 2007, Sony recalled 66,000 digital cameras to fix a defect in the adhesive strength of their bottom that cold cause minor hand injuries. In September 2008, 440,000VAIO TZ series laptops were recalled to repair a defect that could cause overheating. According to Sony, seven people in Japan and abroad had been burned due to overheating, In October 2008, Sony recalled 100,000 of its lithium ion batteries used Helwett-Packard, Dell, Acer, Lenovo in laptop computers due to overheating concerns. On top of that Sony was overtaken by Apple in portable music and Sony, Fuji film and Maxell were fined $110 million for forming a cartel to fix the price of videotape sold in Europe.

Sony was caught off guard and it reputation as an innovator was tarnished by Apple’s release of the iPod and iPhone and Nintendo’s release of Wii. Some complain that Sony products have become over-engineered, and too complicated and expensive, scaring off ordinary consumers. In 2007, Sony ranked 41st on Fortune’s list of most admired companies, much lower than it had ranked before.

Sony Recovery

Sony recorded losses in its game divisions despite good sales in late 2006 because of PlayStation 3's high production costs. The loss offset gains made by good sales in consumer electronics like televisions and digital cameras and hit movies such as “Casino Royale”, “The Da Vinci Code” and “Spider Man 3".

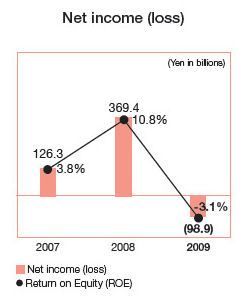

Sony returned to annual profitability in fiscal 2007-2008 for the first time in three years. The company posted record high net profit of ¥369.4 billion on record high sales of ¥8.87 trillion.Cost cutting and shedding peripheral businesses seem to work. Since 2005 Sony had exited or downsized 15 product categories, reducing 10,000 global workers and shutting down 11 manufacturing sites.

Sales and profits rose in late 2007 as flat screen televisions, digital cameras and consumer electronics began selling well and PlayStation 3 started to sell well and become profitable after a price cut. Stock prices drops over concerns over a strong yen in the beginning of 2007 but rose towards the end of the year when a Dubai fund bought a substantial chunk of the company.

Cyber-shot cameras and Vaio personal computers sold very well. The sales of Bravia LCD televisions picked up but the television business remained in the red because price declines amid global competition.

In June 2008, Stringer said the top priority for Sony was returning the gaming and television divisions to profitability by the end of fiscal year 2008-2009. He outlined a strategy for Sony to regain its lead in televisions, return the gaming industry to profitability and release movie service for Internet users.

Sony and the Economic Crisis in 2008 and 2009

Sony post $2.27 billion in losses in fiscal 2008-2009, the first annual loss in 14 years and the largest loss ever, as a result of the global financial crisis. The electronics division was particularly hard hit as consumer spending dried up.

In December 2008, Sony announced a major restructuring plan to deal with global economic crisis that included 1) cutting 16,000 jobs worldwide (about 8,000 regular workers (5 percent of its workforce) and 8,000 temporary workers), 2) reducing the number of manufacturing sites to five or six by March 2010, 3) cutting purchasing costs by 20 percent by halving the number of parts suppliers, and 4) cutting investment in the electronics division by 30 percent in fiscal 2009. The measures helped Sony reduce costs by more than $1.1 billion in fiscal 2009. In April management was reshuffled in the unprofitable game and television businesses.

The job cuts were among the largest made by an Asian company in the crisis. Many analysts thought the move did not go far enough to streamline the company and felt a lack of investment jeopardized Sony ability to remain competitive in the future.

In February 2009 it was announced that Sony President Ryoji Chubachu would step down and be replaced by Stringer who would serve as both company chairman and president. To make up for losses in sales Sony raised money through the sale of $2.2 billion worth of bonds in the largest bond sales ever. In May 2009, Moody lowered Sony’s debt rating to A, citing the slumping electronics market and intensifying competition.

Sony Ericsson lost $245 million in the third quarter of 2009. In September 2009, Sony announced it was going to sell its LCD and television plant in Mexico to a Taiwan firm.

In 2008 Sony posted its largest ever annual loss, $3 billion. Sony posted a loss of ¥63.4 billion in the first half of fiscal 2009 (April-September).In late 2009, Sony said it probably wouldn’t return to profitability until 2013 and predicted that 3-D products will earn the company ¥1 trillion in annual revenue by that time.

Sony Cell Phone and Smart Phone Blunder

Norihiko Fujita, a former Sony executive who is now a lawmaker in Japan’s governing party, told the New York Times that Sony’s biggest mistakes was to misread the importance of mobile phones and fail foresee to fast-growing smartphone market, important engines for future growth. What is even worse is Sony can’t even tap into to some of best technology as enters these markets today. Under a 2001 deal that spun off its mobile phone operations into a joint venture with Ericsson, Sony has been prevented from offering cellphones that draw heavily on its own other technologies. [Source: Hiroko Tabuchi, New York Times, March 28, 2010]

In 2001, when Sony spun off its cellphone business into the joint venture, “There was the sense that mobile phones were weighing down the company,” Fujita, who helped negotiate the deal, told the New York Times. “My heart still hurts to think about it.”

Hiroko Tabuchi wrote in the New York Times, “With Sony’s mobile engineers dispatched to the venture — and an agreement that forbids Sony from competing in the business — the company found it difficult to work on multipurpose handsets that drew heavily on its other technologies. For example, Sony’s video games arm was prevented from developing a PlayStation phone, according to a person with knowledge of the situation.”

In February 2010, at the Mobile World Congress in Barcelona, Spain, Stringer said that cellphones are now “the world’s most ubiquitous computer” and indicated that Sony would somehow get back in the game. “We are building a new network service that will connect many more network-enabled products,” he said. “We are committed to extending that service to Sony Ericsson mobile phones.”

Eiichi Katayama, a technology analyst at Nomura Securities in Tokyo, told the New York Times that Sony needs to focus on building one blockbuster multifunction device. “It needs to build a network, but it also needs to make sure consumers have a ticket to play.”

Sony Plays Catch Up with Apple

Despite creating the market for portable music with the Walkman, Sony has largely missed the shift to digital music-players. Between August 2002 and July 2010, Ipods outsold in personal music devices in Japan. In August 2010, Sony finally regained the No. 1 position in portable music players in Japan.

The iPod from Apple dominates digital music players. The iPad dominates smartphones and the iPad dominates tablets. Even in Japan between August 2002 and July 2010, Ipods outsold in Sony’s personal music devices. In smartphones and tablets Sony is now a bit player. Compared to Apple, Sony seems to have lost its touch for coming up innovative products that people crave for and have to have. Plus it also seems to have lost its ability to effectively market the innovative products it has produced.

Reporting from a new Sony store in Nagoya, Hiroko Tabuchi wrote in the New York Times, “The airy new Sony store in this central Japanese city has floor-to-ceiling windows, sleek white counters and friendly employees, called stylists, who offer advice and tailored counseling on Sony gadgets... Some visitors found the similarity to Apple’s retail outlets notable. The store’s copycat design, although more hip and up-to-date than the company’s traditional Sony Style retail outlets, is emblematic of Sony’s struggle to regain its footing against Apple.” “It’s just like the Apple store,” laughed Yuka Hara, 23, a publishing company employee, told the New York Times. She was one of thousands of visitors on the store’s first day of business this month. [Source: Hiroko Tabuchi, New York Times, March 28, 2010]

“Sony quality has always been the best,” Yusuke Takagi, 20, a design student in Nagoya, told the New York Times. He owned a PlayStation 3, a PlayStation Portable and a CyberShot camera but said he was also intrigued by the iPad tablet. “I think Sony can make a global comeback,” Yoshio Kamiya, a university lecturer in computing, told the Times. “I’m hoping that soon Sony and Apple can finally play sumo.”

New Strategies, and Sony Coming Back?

One of Sony’s main strategies is to integrate is hardware and software businesses and utilize the Internet to do this. Although video game hardware and software sales have declined globally, the PlayStation Network — a system that links gamers worldwide in live play — is a key initiative for the electronics company, which brings in an estimated $500 million in annual revenue. The network — which allows users to upgrade and download games and other content’serves both the PlayStation video game machines and Sony's Qriocity movie and music services.

With increased competition in North America and Europe, namely from Samsung, Sony has accelerated market development efforts in emerging markets in countries like India and China, where price competitiveness is crucial and every effort must be made to cut costs, This focus was behind, for example, Sony’s decision to pull of making LCD screen with Sharp in Japan.

In March 2010, the New York Times reported, Sony unveiled a new retail concept in Nagoya, which the company plans to introduce worldwide if it is successful. The Apple-store-like stores are an effort by Sony to showcase its entire network of products. Displays at the store show how various gadgets can work together: a camcorder, Blu-ray player and TV, for example, or a camera, Vaio laptop and digital photo frame. The store got off to a flying start. More than 300 people lined up for the March 17 opening of the sleek space, designed by the architect Tadao Ando. A line quickly formed in front of Sony’s new 3-D televisions.

In May 2011 The Economist reported: in 2011 “Sony has unveiled new smartphones, along with a clever strategy to persuade developers to produce video games for them. The firm has designed innovative tablet computers that could compete with Apple’s iPad. Sony’s Vaio notebook computers offer an alternative to Apple’s laptops. The hardware is important because it is a gateway to online services, where Sony’s future is thought to lie. That is one reason why the cyberattacks hurt the company so much.” [Source: The Economist, May 26, 2011]

Sony Loses a Record $5.8 Billion in Fiscal 2011 as Stock Dips below $10 for First Time since 1980

In May 2012, Jiji Press reported: “Sony Corp. said it logged a record group net loss of 456.66 billion yen ($5.8 billion) in the fiscal year ending in March 2012, due to the poor performance of its television operations, the effects of the strong yen and widespread flooding in Thailand. The loss also stemmed from appraisal losses on deferred tax assets in the United States. However, it was smaller than the 520 billion yen loss projected by the electronics maker last month. The company had a net loss of 259.59 billion yen in the previous year. The company recorded an operating loss of 67.29 billion yen, down from the previous year's profit of 199.82 billion yen, as sales fell 9.6 percent to 6.49 trillion yen. [Source: Jiji Press, May 11, 2012]

“In June 2012, Malcolm Foster of Associated Press wrote: “Sony's stock price fell below 1,000 yen for the first time since 1980 in a symptom of weak global markets and the company's decline after huge success with the Walkman three decades ago. Sony's shares dipped to 990 yen on the Tokyo Stock Exchange and closed at 996 yen.The company said it was first time that its stock price had traded below 1,000 yen since August 1980 — the year after it introduced the iconic Walkman portable cassette player to the world in 1979. The stock had peaked at 16,950 yen in March 2000. [Source: Malcolm Foster, Associated Press, June 4, 2012]

“Battered by competition from Apple Inc. and Samsung Electronics Co., Sony has lost money for four straight years — and for eight years in its core television business. A strong yen, which erodes overseas income, and natural disasters at home and in Thailand, a key manufacturing hub, have added to its woes.

“Hiroko Tabuchi wrote in the New York Times: “The losses underscore — the grave challenges facing Kazuo Hirai, who succeeded Howard Stringer at Sony’s helm this month. Once a much-emulated and coveted darling of the technology industry, Sony is a shadow of its former self, its problems mirroring a wider decline in the Japanese consumer electronics industry. But the fall has been most spectacular at Sony, which has long lost its dominance in portable music players, unable to translate its Walkman success into the modern era. Sony’s television business, which has not been able to recover from a delay in developing flat-panel models and has more recently been badly hurt by price competition from rivals, has not posted a profit in years. [Source: Hiroko Tabuchi, New York Times, April 10, 2012]

“2011 has been a painful year for Sony, with much of its troubles caused by misfortune. It was forced to halt production at 10 factories in the aftermath of Japan’s earthquake and tsunami in March, including a Blu-ray disc plant completely overrun by waves. A few weeks later, a massive computer hacking attack that compromised more than 100 million accounts on the PlayStation Network exposed embarrassing weaknesses in the company’s online defenses, forcing the company to shutter the popular video game service for more than a month. [Source: Hiroko Tabuchi, New York Times, November 2, 2011]

Sony Hacker Attacker in 2011

In April 2011, Sony revealed that its PlayStation Network and Qriocity online services had been the victim of a hacker attack and personal data — including name, e-mail address and birth dates and possibly credit card information — from 101.6 million accounts was taken. Some of data contained credit card numbers, debit card numbers and expiration dates, but not the three digit security code on the back of credit cards, from old records of customers in Austria, Germany, the Netherlands and Spain.

The incident represented one of the largest Internet security break-ins ever and was widely covered in the media. Illegal access took place at Sony’s San Diego-based PlayStation Network for online games and Qriocity movie and music distribution services from April 17 to 19. Sony has a three-layer defense system in its database, yet hackers were able to take advantage of a flaw in the application server that operated the server. The hackers broke into the server by making it appear they had an authorized access.

Credit card details of some 27,000 gamers in the Middle East may have been breached by thieves who hacked into the online gaming network. A Dubai-based PlayStation spokesperson said the online gaming network had stored details of around 14,000 credit card holders in the UAE, 12,500 in Saudi Arabia and 500 in Kuwait. Many gamers used pre-paid PSN cards rather than credit cards to access the service. The online gaming network has 1,093,000 account holders in the Middle East with the majority — 650,000 — based in Saudi Arabia.[Source: Reuters, May 7, 2011]

A Sony spokesman denied a report that a group tried to sell millions of credit card numbers back to Sony. He said while user passwords had not been encrypted , they were transformed using a simpler function called a hash that did not leave them exposed as clear text. Masai Horibe, an expert on information law at the University of Maryland, told the Yomiuri Shimbun, “Many companies have become targets if cyber-attacks and my impression was that even Sony’s security had been broken.” Companies must inform users of the possibility of information leaks quickly.”

Kim Zetter wrote in Wired, Sony first discovered evidence of the breach on its PlayStation Network last April 20, but waited until the 26th to notify PSN customers. The company said it notified customers the day after forensic investigators told it that the intruders had hacked its network and obtained the personal information of more than 75 million customers. This was followed by another breach at Sony Online Entertainment, which compromised an additional 25 million customers, and still more breaches at Sony Pictures and Sony BMG. [Source: Kim Zetter, Wired, October 12, 2011]

Sony Comeback in 2012?

Malcolm Foster of Associated Press wrote: “The company is aiming for a comeback under Kazuo Hirai, appointed president earlier this year, who has headed the gaming division and built his career in the U.S. Sony forecast a return to profit for the fiscal year through March 2013 at 30 billion yen ($375 million), banking on the growing smartphone and tablet businesses. Sony also plans to cut 10,000 jobs, or about 6 percent of its global work force. [Source: Malcolm Foster, Associated Press, June 4, 2012]

“Jiji Press reported: “For the current year that started last month, Sony expects to log a net profit of 30 billion yen, its first profit in five years. The company expects to see the operating loss in its TV operations narrow to 80 billion yen from 208 billion yen. It expects to post an operating profit of 180 billion yen. Sales are expected to rise 14 percent to 7.4 trillion yen as the company took full control of its mobile phone operations earlier this year. [Source: Jiji Press, May 11, 2012]

“Despite losses in that division, Hirai remains committed to TVs, and promised to cut costs to turn a profit in the division in the next two years. Sony also plans to seek new growth in emerging markets such as India and Mexico.

“Yu Toda and Etsuo Kono wrote in the Yomiuri Shimbun: “Under the current turnaround plan, Sony has abandoned the expansion strategy it set in November 2009 under its midterm business plan. The strategy had called for obtaining a 20 percent share in the global TV market and sales of 40 million units by the end of fiscal 2013. Sony has lowered the sales target to 20 million units for fiscal 2011. [Source: Yu Toda and Etsuo Kono, Yomiuri Shimbun, November 4, 2011]

Changes and Cuts at Sony in 2012

In April 2012, the Yomiuri Shimbun reported: “Sony Corp. has announced a new management plan including about 10,000 job cuts and reinforcement of its strengths in the electronic sector with TVs, games and cell phones, but there is no assurance it can bounce back from the company's worst deficit ever.The new focus is a major shift from Sony's past strategy, with the TV sector as the main profit-earning pillar. The company aims to rejuvenate the TV business by drastically reducing its number of models. [Source: Yomiuri Shimbun, April 14, 2012]

“President Kazuo Hirai proclaimed loudly, "Now is the time for Sony to change" at the beginning of his explanation of the new management strategy. "Rebuilding our electronics sector is our top priority and greatest duty," he said, emphasizing the company's mission to reestablish itself as a leader in the category.

“Once known for its innovative technology, Sony started to focus on the "soft" technology sector, such as movies, after Nobuyuki Idei, who formerly worked in sales, assumed the presidency in 1995. The firm then tended to turn away from its prior emphasis on manufacturing activities, an analyst said. In the TV field, Sony was a late adopter in moving from cathode-ray tube TVs to liquid crystal display TVs. In the field of mobile music players, Sony products are far behind Apple Inc.'s iPod series.

“Previous President Howard Stringer, who hailed from the entertainment industry, reduced funding for research and development. Sources say many engineers left the company during the Stringer presidency. Hirai emphasized Sony would review the company's R&D arrangement thoroughly. However, Hirai failed to present a clear vision for how to bolster the R&D field. Sony has long been unable to introduce hit products like the Walkman series and the Trinitrom TV lineup. "We will develop and market innovative products that symbolize Sony's revival," Hirai stressed, but was unable to communicate what kind of products the company is planning.

“To rehabilitate the company, Sony has set a target of increasing sales in the electronic field for the year ending in March 2015 to 6 trillion yen and the operating profit to 300 billion yen. It will appropriate 70 percent of the total development budget to three core business fields: digital imaging, games and mobile technology. Sony still has a competitive edge in game consoles and image sensors used for digital cameras, but Apple and Samsung Electronics Co. have major shares in the mobile field such as cell phones and tablet devices. Sony plans to regain lost ground in the mobile field.

“Meanwhile, Sony will lay off about 10,000 employees, 30 to 40 percent of them in Japan. It will sell or withdraw sections and subsidiary companies' sections that have less synergy with core businesses or have proved unprofitable. However, with decisive products for its revival still unknown, the company may fall into a spiral of "diminishing equilibrium," an analyst said.

“In the ailing TV business, Sony revealed it will seek business alliances with other companies with organic electro luminescence TVs and other next-generation TVs. Hirai said the turnaround for the TV business is in sight. However, price and technology wars have been intensifying in the TV business, with heavy competition from foreign companies, including those in South Korea. If Sony sticks to maintaining its brand image and cannot steer completely away from the TV business, the new management strategy of "selection and concentration" will likely prove insufficient.

“The New York Times reported: “Hirai has rebuffed suggestions that Sony’s insistence on making many of its own televisions and other gadgets, instead of outsourcing to less-expensive manufacturers, was a strategy the company could now ill afford. Sony still makes some televisions in high-cost Japan.” TVs remain a core Sony business, and their manufacture continues to require high-level technological expertise,” Mr. Hirai said. “It is Sony’s DNA,” he said. “If we outsource everything overseas, we will lose that.”

Challenges for Sony in 2012

Hiroko Tabuchi wrote in the New York Times: “One important challenge will be how much Sony will be able to reduce its bloated work force.It employs 168,200 people worldwide, most of them in Japan, where cuts are difficult under strict labor law and deep-rooted expectations for lifetime employment. A top executive involved with Sony’s last round of cuts, in 2008, which sought to eliminate 16,000 jobs, said he had been surprised to find that many of those supposedly taken off the company payroll had eventually bounced back to positions at the company or at subsidiaries. [Source: Hiroko Tabuchi, New York Times, April 10, 2012]

“Chief financial officer Masaru Kato said that any job cuts would include positions from a liquid crystal display unit and small chemical business, which are being spun off from Sony. But the Nikkei business daily, which first reported the larger job-cut figure, said that jobs were likely to go from Sony’s money-losing TV business.

“Another challenge will be reaping the benefits of a long-elusive strategy at Sony of bringing together its entertainment properties — which include the music of the late Michael Jackson, the blockbuster Spiderman movie franchise and popular video game titles like Gran Turismo — and its electronics. Company executives have long said that strategy would help differentiate Sony gadgets in an increasingly commoditized industry.

“But Sony has stumbled on its online networks, the crucial link between its software and hardware offerings, falling far behind companies like Apple in offering content over the Internet.

Analysts also point out that Sony needs to focus its resources on its strengths, like its entertainment and video games units, and abandon areas, like televisions, in which it is no longer competitive. But Mr. Hirai has previously denied that Sony would go so far, saying the company was not prepared to give up on such a central and time-honored business.

Sony to Cut Workforce by 10,000

In April 2012, Reuters and the Financial Times reported: “Sony is preparing to cut its workforce by 10,000, or six per cent of its global headcount, as part of a restructuring initiated by its new chief executive that has seen it sell two divisions and drastically scale back its television production plans. It will be the third significant round of staff reductions at the Japanese electronics and entertainment group since 2005. [Source: Jonathan Soble, Financial Times, Reuters, April 10, 2012]

“Roughly half the cuts are the result of deals that have already been made public — Sony’s sale last month of a chemicals subsidiary to the Development Bank of Japan, a state-backed lender; and its decision last year to spin off production of small liquid crystal displays into a joint venture with Hitachi and Toshiba. Together, the two businesses employ about 5,000 people; the jobs themselves will mostly remain after the sales, but the workers will no longer be on Sony’s payroll.

“The rest of the reductions are expected to come from Sony’s chronically unprofitable television division, which is undergoing an overhaul that analysts say will be crucial to restoring the company’s financial health. Stringer implemented two major rounds of job cuts during his seven years as chief executive — 10,000 positions were eliminated over two years beginning in 2005 and a further 8,000 as the global financial crisis deepened in 2008.

Hirai Takes Over Sony

Kazuo Hirai took over as president and chief executive of Sony in April 2012. After taking over the position he said one of his main goals will to be make the company's sluggish TV business profitable in two years. "We will start by further improving the functions and performance of hot-selling liquid-crystal display models to differentiate them from other companies' products in terms of resolution and sound quality...The TV business is still an important field for the company, as it greatly contributes to sales. Sony cannot easily quit it, because the TV business, in a sense, also represents Sony's commitment to customers." [Source: Yomiuri Shimbun, February 11, 2012]

“The Yomiuri Shimbun reported: “Hirai also indicated his desire to expand smartphone development and medical-related businesses. He said Sony's smartphone development will accelerate as it will take sole ownership of its joint venture with Sweden's Ericsson. The company will develop models incorporating Sony's strengths, such as cameras and games, he added. Hirai also said Sony's image processing and other technologies--where it enjoys competitive advantages--can be effectively used in medical-related business.

“Hirai, who has spent a long time in the company's entertainment division, stressed that Sony is "a company that makes things." "We will continue to value our manufacturing technology and make products in Japan," he said, showing his determination to maintain domestic production as much as possible even under the yen's historic appreciation.

“At an inaugural news conference, Hirai, 51, acknowledged that Sony's worsening performance is serious. "Japan's electronics industry is sluggish, and Sony is no exception. We feel a serious sense of crisis," Hirai said. Sony has already taken a step in the right direction in reducing costs for procuring display panels by dissolving its joint venture with Samsung. But Shiro Mikoshiba, a senior analyst at Nomura Holdings Inc., pointed out Sony's review of its procurement costs is not enough to rebuild the company. "The company needs to undergo drastic organizational restructuring by slashing its sales workforce, as well as its research and development section," he said. [Source: Yu Toda, Yomiuri Shimbun, February 4, 2012]

“Hirai also expressed his intention to concentrate the firm's investment in its camera, game and smartphone businesses, while further promoting structural reforms for its TV business. He also plans to develop its medical business as one of Sony's core businesses. Hirai said the firm will conduct a strict review of other money-losing products and businesses, and will consider collaborations with other companies.

“As for Hirai as a person, the Yomiuri Shimbun reported: “Hirai, who has spent about 20 years living in the United States since he was a child, speaks fluent, native-level English. His dashing appearance while presenting new products at overseas news conferences gives the impression that he is "cool." However, he is also a hot-blooded man. When he was president of one of Sony's game industry subsidiaries, he often held meetings with young employees and engaged in thorough discussions until everyone present was fully satisfied. After meetings, he often went out for drinks with employees.

“When appointed to the post of executive deputy president last year, Hirai made a swift decision to dissolve the joint venture with Samsung for LCD panels, and people around him highly praised his leadership. Though he was involved in the game division for a long time and has a little experience handling Sony's TV business, he emphasized the importance of rationality when carrying out reforms.

“Stringer speaks very highly of Hirai's personality, strong will and leadership. Hirai's ability to make a swift judgment and take actions will be put to test, observers say. Hirai, whose wife, son and daughter currently live in the United States, enjoys cycling on his days off.

EU Approves Sony's Acquisition of Part of EMI

In April 2012, Associated Press reported: “The European Union's competition regulator approved a deal by Sony/ATV and other investors to buy part of the famous British music company EMI Group Ltd. Sony/ATV, a joint venture between Sony Corp. and the Michael Jackson estate, and several investment funds including United Arab Emirates-based Mubadala Development Co. jointly offered $2.2 billion in November for EMI Music's publishing businesses. EMI's publishing arm manages the rights to songs of popular artists such as Amy Winehouse, Regina Spektor and Rihanna. [Source: Gabriele Steinhauser, Associated Press, April 19, 2012]

“Universal Music Group has a pending deal to buy the rest of EMI, which became famous for recording The Beatles and is also home to Coldplay and Katy Perry. EMI was put up for sale by Citigroup last summer, after the bank foreclosed on private-equity firm Terra Firma, which bought the music company in 2007. To get approval for the deal from the European Commission, the Sony-led investor group promised to sell the publishing rights to several music catalogues as well as the works of 12 artists, including Ozzy Osbourne, Robbie Williams, and Ben Harper. During its review of the deal, the Commission found that without the sale of those rights, Sony/ATV would have been able to control the online licensing of Anglo-American chart hits in Europe.

“Sony/ATV chairman and CEO Marty Bandier, who spent 17 years building up EMI's publishing assets earlier in his career, hailed the approval. But he acknowledged that other regions including the U.S. also had to sign off on the purchase. "Today is not only an important milestone on the path to final approval, but a very special day for me, personally," he said in a statement.

“The combined publishing assets of Sony/ATV and EMI would also be No. 1 in the world with a 31 percent market share, according to The New York Times, which cited a document presented to investors in January. Rivals such Warner Music and smaller independent music labels have warned that the deal would make Sony and Universal Music overly dominant players in the music industry. The combination of Universal and EMI would create the top recorded music company by far with about a 40 percent market share in the U.S.

Sony Likely to Form Tie-up with Olympus

In June 2012, the Yomiuri Shimbun reported: “Sony Corp. has become a likely candidate to form a tie-up with scandal-tainted Olympus Corp. after Panasonic Corp., which also showed interest in a business alliance with Olympus, got cold feet about the investment, sources said. Olympus, which is undergoing corporate restructuring, is likely to receive an investment of about 50 billion yen ($636 million) mainly from Sony. If the two-way alliance is realized, Sony will become Olympus' largest shareholder with an about 10 percent stake in the company. [Source: Yomiuri Shimbun, June 23, 2012]

“Olympus also has been in investment negotiations with such companies as Fujifilm Holdings Corp. and Terumo Corp. Sony and Panasonic manufacture image sensors, an essential component of endoscopes, in which Olympus enjoys the largest global market share. Olympus, therefore, is believed to have thought an alliance with Sony or Panasonic would be the most suitable for its medical business. Panasonic posted its biggest-ever group net loss in fiscal 2011 due to slumping sales of flat-panel TVs, the company's main product. Since Panasonic plans to prioritize energy- and environment-related businesses, the company apparently now feels it is not the time to invest in Olympus. If it fails to reach an agreement with Sony, Olympus may start negotiations with Terumo or other firms.

Sony Ericsson Officially Becomes Sony

In February 2012, Sony announced that it bought out Ericsson's 50 percent stake in Sony Ericsson. As a result, of the transaction, Sony Ericsson becomes a wholly-owned subsidiary of Sony and will renamed to Sony Mobile Communications. Anton Shilov of Xbit wrote: “Sony will further integrate the mobile phone business as a vital element of its electronics business, with the aim of accelerating convergence between Sony’s lineup of network enabled consumer electronics products, including smart phones, tablets, TVs and PCs. [Source: Anton Shilov, Xbit, February 15, 2012]

“During the past ten years the mobile market has shifted focus from simple mobile phones to rich smartphones that include access to Internet services and content.The transaction gives Sony an opportunity to rapidly integrate smartphones into its broad array of network-connected consumer electronics devices — including tablets, televisions and personal computers - for the benefit of consumers and the growth of its business. The transaction also provides Sony with a broad intellectual property (IP) cross-licensing agreement covering all products and services of Sony as well as ownership of five essential patent families relating to wireless handset technology.

“Sony Ericsson has been losing market share for some time now and it will continue to as the popularity of higher-end feature phones is declining while the popularity of Xperia smartphones remains low. Sony also has dropping market shares in its media player, consumer camera and some other businesses, where application-specific smartphones could help to fight back the revenue from smartphones like Apple iPhone. In general, under Sony's roof the former SE will have better ability to compete than as a joint-venture.

Sony Sells LCD Venture Stake to Samsung for $940 Million

In December 2011, Reuters reported: “Sony Corp has agreed to sell its nearly 50 percent stake in an LCD joint venture with Samsung Electronics to the South Korean company for $940 million, as it struggles to reduce huge losses at its TV business. The seven-year-old venture cut its capital by 15 percent in July and industry sources had said Sony was negotiating an exit, aiming to switch to cheaper outsourcing for flat screens for its TVs while Samsung pushes ahead with next-generation displays. [Source: Reiji Murai and Hyunjoo Jin, Reuters, December 26, 2009]

“In terms of direction it is a positive (for Sony)," said Keita Wakabayashi, an analyst at Mito Securities in Tokyo, about the deal. "But if they are making a loss on the sale, one could ask why they didn't make this decision sooner. Their biggest problem is that they are not making a profit even though they don't have many plants," he said. "Sony may shift to Taiwanese LCD makers should they offer cheaper prices," Song Myung-sup, an analyst at HI Investment & Securities, said in Seoul.

“Launched in 2004, Sony's panel venture with Samsung, S-LCD, was established to secure stable supplies for Sony's flat-screen TVs at a time of shortages. The venture expanded its production facilities in line with growing demand for LCD televisions. Sony invested 130 billion yen in the project and received around half of the venture's LCD output.

“Once a symbol of Japan's high-tech might, Sony has sold off TV factories in Spain, Slovakia and Mexico in the past few years and outsources more than half of its production to companies including Hon Hai Precision Industry, the contract electronics maker that also counts iPhone maker Apple Inc as a key customer. Sony retains four TV plants of its own -- in Japan, Brazil, China and Malaysia.

Image Sources:

Text Sources: New York Times, Washington Post, Los Angeles Times, Times of London, Yomiuri Shimbun, Daily Yomiuri, Japan Times, Mainichi Shimbun, The Guardian, National Geographic, The New Yorker, Time, Newsweek, Reuters, AP, Lonely Planet Guides, Compton’s Encyclopedia and various books and other publications.

Last updated October 2012