JAPANESE AUTOMOBILES INDUSTRY AND AUTOMOBILES ABROAD

Toyota Corolla Automobile sales are a key to keeping the Japanese economy going. More than 50 percent of the vehicles made in Japan are exported. Exports of vehicles and vehicle parts reached about $180 billion in 2007, accounting for roughly 20 percent of Japan exports. Among Japanese exports in 2010, transportation equipment including automobile-related products accounted for the highest portion of about 23 percent.

The high value of the yen, high corporate taxes and increased competition at home has forced many Japanese automakers to transfer production overseas. In 2010, Mitsubishi and Nissan said they were building large plants in Thailand, where production costs are 20 percent to 30 percent lower than in Japan.

Japanese carmakers have been suffering globally even though they have until recently enjoyed high market shares around the world. According to FOURIN, Inc., a global automotive market research and publishing company, the share of Japanese cars in the global market plunged from 32.2 percent in 2008 to 28.6 percent in 2010. In addition to effects of the March 11 disaster and the recent Thai flooding, a host of other challenges--hyper appreciation of the yen, a high domestic corporate tax rate, delay in trade liberalization, labor regulations, measures to combat global warming and an electricity crisis--hang over Japan. “However, this does not mean Japanese cars have lost their appeal. "Including the fuel efficiency of hybrid and gasoline-engine cars, Japan's environmental technology is at the world's highest level. No country can surpass Japan easily," Toru Sakuragi of SC-ABeam Automotive Consulting, a research and consulting firm for automotive clients, told the Yomiuri Shimbun. [Source: Yomiuri Shimbun, December 7, 2011]

Nine of the top rated cars in 10 categories rated by Consumers Reports in 2010 were Japanese. Six were Toyotas. Two were Hondas. One was a Nissan. In a March 2005 Consumer’s Report ranking Japanese cars finished first as “top picks” in 9 out of 10 categories and completed a clean sweep on the list of 21 vehicles that Consumer reports said it can recommend because they earned “very good” or “excellent” scores in all the areas they were tested.

According to a Consumer Report survey of 580,000 vehicle owners, the ten most reliable 1987-93 vehicles and seven of the ten best buys under $10,000 were built by Toyota, Nissan, Honda and Mitsubishi. The best buys included the 1991 Acura Integra, 1990 Honda Accord, 1992 Honda Civic, 1991 Mitsubishi Gallant, 1990 Nissan Maxima, 1991 Toyota Camry and 1992 Toyota Corolla.

Luxury Japanese cars like Honda's Acura, Toyota's Lexus and Nissan's Infiniti were hugely successful in the decade after they were introduced in the 1980s but struggled in the mid-1990s.

Japanese Automobile Companies in the United States

Unloading Toyotas

in New Orleans

in the 1970s Japanese carmakers have had great success in the United States. Japanese cars sell well because of their quality, reliability, value and fuel efficiency. In 2003, seven of the top cars rated by the EPA for fuel efficiency were Japanese. Gasoline costs are roughly three times higher in Japan than in the United States.

In July 2008, total sales on a monthly basis by the eight Japanese automakers active in the United States exceeded that of the American Big Three — GM, Ford and Chrysler — for the first time. The Japanese automakers had an 43 percent market share while that of the Big Three held a 42.7 percent share.

Japanese carmakers had a 34 percent share of the U.S. market in 2004, up from 32.6 in 2003 and 31.2 percent in 2002 and many of them made the lion share of their profits there. In 2001, Toyota, Honda and Nissan had a combined profit of $11.64 billion while Ford, General Motors and Chrysler collectively lost $5.4 billion.

The first big-selling Japanese cars were small fuel-efficient cars introduced during the Energy Crisis in the 1970s. By the 2000s, Japanese carmakers were making their biggest profits from large cars and gas guzzling SUVs.

Nissan, Honda and Toyota produce cars in the United States. They also make cars in Mexico for the domestic market and export.

Japanese cars are the most attractive among car thieves in the United States. Honda Accords and Toyota Camrys have traditionally been the most favored by thieves because they are sought after in foreign markets and provide the best market for stolen parts.

Not surprisingly Japanese cars sold well in the U.S. “Cash for Clunkers” program in 2009. Toyota topped sales with 19.4 percent of the 690,000 cars sold and Honda was in forth with 8.7 percent. Four of the top five models bought with the “clunkers” rebate were from Japan: Toyota’s Corolla, Prius and Camry and the Honda Civic.

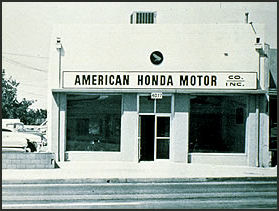

History of Japanese Automobile Companies in the United States

1959 Honda Store In July 2006, Japanese carmakers for the first time produced more cars outside of Japan than they did in Japan. The 12 car and truck makers produced 10.93 million vehicles in overseas factories and 10.89 million in Japanese factories. Most of vehicles built outside of Japan were produced in U.S. factories.

In the 1970s and 80s American car companies called for limits on Japanese car imports. The Japanese car makers responded with voluntary limits and a drive to open factories in the United States and produce more cars there. This move ultimately worked against Detroit in favor of the Japanese car companies, who were able to manufacture more cars in the United States than they would be able to ship there, in the process reducing their transportation costs.

As of 2004, about 70 percent of the Japanese automobiles sold in North America were manufactured in the United States. About 400,000 people, including those working at dealership and parts factories, are on Japanese carmaker payrolls. Many more people are employed by steelmakers and shopowners and businesses linked to the Japanese carmakers.

Rather than cutting prices and offering new incentives, Japanese carmakers have emphasized building a loyal customer base and then investing their profits into higher quality and technologies like low-pollution and fuel-efficient engines, In mid 2000s when American carmakers were offering “employee discounts” to ordinary customers Japanese carmakers were raising prices

As Detroit began to sputter and decline and lay off thousands of workers even the governor of Michigan — the home of Detroit — began wooing Japanese automakers. In July 2005, Michigan governor traveled to Toyota’s offices in Nagoya and said she would welcome a Toyota plant in her state.

Japanese Automobile Companies in Europe and the Rest of the World

Increasingly the Japanese are making and marketing cars with customers in the developing world in mind. Japanese automakers control 85 percent of the market in Thailand, Southeast Asia fastest growing market.

Japanese carmakers hold about a 13.1 percent share of the European market (2004). In the late 1990s and early 2000s they invested $3.5 billion into a dozen auto plants in Europe. In 2000, Toyota, Nissan, Honda, Mitsubishi and Mazda all lost money in Europe. Japanese carmakers have been hit hard in Europe by unfavorable currency exchange rates, frumpy styling and competition in the small car market.

By the mid 2000s thing were looking better. Japanese car makers began choosing designs that appealed to European car buyers and brought in European designers to improve their designs and made more diesel vehicles.

The strong Euro and diesel engines helped the Japanese carmakers increase their market share in 2002, 2003 and 2004. Toyota, Nissan and Honda all had success with models designed for the European market. Japanese carmakers sold a record 1.91 million units in Europe in 2004 Japanese automakers produce about half the cars sold in Britain.

See China

Japanese Used Cars in Russia

Used foreign cars are greatly in demand in Russian. About half million were sold a year in the early 2000s, accounting for about a third of the overall car sales market. In the west, German models dominate the market. In the east, Japanese models rule.

Used Japanese cars are sought after because the good quality and relatively affordable. Even people who never owned a car before could get one. A decent quality used Toyota goes for around $5,000, a forth of the price of a new Zhiguli. The fact they are right-hand drive and Russian roads are left had drive doesn’t seem t matter.

By the early 2000s, Russia was the world’s largest importer of Japanese cars. About 200,000 cars were exported from Japan to Russia in 2001. There is night market in Vladivostok for used cars brought from Japan. There is a similar market in Khabarovsk.

It is not very far from Japan to Vladivostok, where most of the cars arrive. In some cases they are driven from there 800 kilometers to Khabarovsk or even farther a field. Drivers are paid $50 for the trip. In Khabarovsk buyers from all Russia come to buy cars. Those that end up in Moscow or St. Petersburg or elsewhere further west are shipped by train. Buyers from Yakutia and other places in the north buy the cars in the long winter and drive them home on tracks built on frozen rivers.

Japanese Automobile Industry and China

Japanese automakers are increasingly designing their cars with Chinese buyers in mind. Nissan, for example, has designed the Teana sedan with conservative but upscale look and relatively low price tag with Chinese middle class auto consumers as the primary target, and unveiled the car at the Beijing Auto Show in 2010. Nissan CEO Carlos Ghosn told AP, “The Teana is a Chinese product. Without any doubt, the Chinese consumer now is becoming a big target for a lot products that we are developing.”

The Japan Automobile Manufacturers Association (JAMA) is starting become more concerned about fake cars such as Chinese-made Nissan lookalikes with “NiSSAi” logos and vehicles with a front end that looks a Toyota Corolla and another with a rear end like a Honda Fit. Not only are these car is appearing more and more in China they are also starting to show up in other countries.

The problem of fake parts is even more widespread. According to a 2008 JAMA survey Japanese car parts and car makers lost ¥1.12 billion to fake products. Many think the real figure is maybe ten times that amount.

Japanese Automobile Industry and Thailand

Takeshi Nagata and Yoichiro Kagawa wrote in the Yomiuri Shimbun: “Stung by a triple whammy of the strong yen, high corporate tax rate and Japan's tardiness in signing economic partnership agreements, Japanese automakers are increasingly manufacturing compact cars in emerging countries.”[Source: Takeshi Nagata and Yoichiro Kagawa, Yomiuri Shimbun, December 14, 2010]

In December 2010, “Mitsubishi Motors Corp. became the latest automaker to follow this trend when it started construction of a new plant in Thailand. Many Japanese automakers have been constructing plants in Thailand, which some observers have called “the Detroit of the East.” These days, Thailand has become an automotive industry center, ranked alongside China. Nissan Motor Co., which began producing its March compact car in a Thai plant, said vehicle quality is already equal to that of cars made in Japan.”

“Thailand has attracted many Japanese manufacturers due to the all-out preferential treatment given to corporations. Thailand's corporate tax rate is 30 percent, considerably lower than Japan's effective rate of more than 40 percent. Furthermore, Thailand exempts automakers producing fuel-efficient cars from corporate tax for up to eight years. Thailand is a member of the Association of Southeast Asian Nations and has signed free trade agreements with Australia and other countries.”

“Construction of automotive production centers in Thailand offers carmakers the great advantage of exporting vehicles to Australia and emerging markets such as Southeast Asian countries without paying customs tariffs. Furthermore, production costs are about 20 percent to 30 percent lower than a comparable plant in Japan. Exports of the compact cars to Japan are increasing satisfactorily, the company said.”

Japanese Automobile Industry and Free Trade

Takeshi Nagata and Yoichiro Kagawa wrote in the Yomiuri Shimbun: “Japan's automobile production seems doomed to fall if the government continues to dillydally over trade liberalization negotiations. South Korean automakers will be fearsome rivals for Japanese makers, and were given a leg-up when South Korea signed a free trade agreement with the United States on Dec. 3. In the huge U.S. market, import tariffs on South Korean cars, which are now 2.5 percent, will be eliminated in five years.” [Source: Takeshi Nagata and Yoichiro Kagawa, Yomiuri Shimbun, December 14, 2010]

“If Japan does not liberalize trade with the United States by, for example, joining the Trans-Pacific Partnership, Japanese cars exported from the nation will be at a distinct disadvantage compared with cars made by South Korean firms.”

Japanese Automakers Losing Ground Overseas

Hajime Yamagishi and Taro Koyano wrote in the Yomiuri Shimbun, “Japanese automakers are struggling in overseas markets, especially the United States and China, weighed down by reduced production after the March 11 disaster and the appreciation of the yen. Their South Korean and European rivals have performed better, rapidly narrowing the gap with Japanese automakers. South Korea's Hyundai Motor Co. in particular has increasingly gained a reputation for its technology and designs.” [Source: Hajime Yamagishi and Taro Koyano, Yomiuri Shimbun, August 5, 2011]

According to U.S. research firm Autodata, Toyota Motor Corp.'s new car sales in the United States in July declined 22.7 percent to 130,802 units from a year earlier, the third significant drop in as many months. Toyota's share in the U.S. market recovered to 12.3 percent in July, but the combined share of Hyundai and its affiliate Kia Motors Corp. rose to 9.9 percent, pulling within 2.4 percentage points of Toyota. Toyota plans to go on the offensive by launching such promotions as subsidies and no-interest loans for some of its brands marketed in the United States.

In China, Nissan Motor Co. prioritized parts supply and saw sales increase 18.1 percent in the first half of 2011 compared with the previous year. But other Japanese automakers posted year-on-year drops in sales. According to the China Association of Automobile Manufacturers, Japanese companies held a 17.8 percent market share for passenger car sales in the first half of the year, a 0.8 percentage point drop from the January-March period. But German automakers boosted their market share by 1.6 percentage points to 16 percent during the same period. South Korean firms' share of the market also rose, 0.6 percentage point to 7.8 percent, thanks to upbeat sales of Hyundai's compact car Verna, sport-utility vehicle IX35 and other models.

Japanese automakers traditionally maintained their competitiveness through low-cost production and advanced technologies. Concerns have grown, however, as foreign rivals catch up with them in this regard. "There are vehicles as good as ours on the market in terms of quality, cost and performance," Toyota Director Takahiko Ijichi said.

Furthermore, the Japanese economy has battered domestic automakers with the soaring yen, delays in trade liberalization and power shortages. Major companies reportedly intend to improve their earnings through such steps as using imported parts in Japan and expanding the use of local parts in their overseas operations. Some people fear Japanese automakers could wage a fierce battle against each other in overseas markets after they boost production in autumn. "As soon as we recover from our supply shortages, each company is expected to implement promotional measures," said Fumihiko Ike, Honda's senior executive officer. "Competition likely will intensify."

Seven Japanese automakers, except for Mitsubishi Motors Corp., posted losses or lower profits in the quarter. Toyota saw a first-quarter operating loss for the first time in two years, while Honda incurred losses for the second consecutive quarter as sales in its core four-wheel business dropped in all regions. Meanwhile, Hyundai's sales in the April-June period swung up to 20.09 trillion won (about 1.48 trillion yen), a 19.1 percent increase from a year earlier, while its net profit soared 37.3 percent to 2.31 trillion won (167.7 billion yen) and operating profits rose 21.7 percent to 2.13 trillion won (154.5 billion yen). In the first half of 2011, Germany's Volkswagen sold a record 4.09 million units on brisk sales in North and South America, Asia and Europe, and its consolidated operating profit also rose to a record high of 6.1 billion euros (673.1 billion yen).

South Korean Cars Threaten Japanese Automakers

While Japanese automakers saw their market share in the American market decline after the March 2011 earthquake and tsunami South Korean car makers saw their share rise, much at the expense of Japanese companies. The Yomiuri Shimbun reported: “New car sales in the United States have been steady despite the nation's slowing economy. The U.S. market share of Hyundai and its affiliate Kia Motor Corp. rose from 7.7 percent in February to 8.8 percent in October. Production cuts among Japanese automakers due to the Great East Japan Earthquake contributed to the situation, but have not been the sole cause of Hyundai's growth. [Source: Yomiuri Shimbun, December 7, 2011]

“According to U.S. survey company Autodata Corp., Hyundai's market share of new car sales in the United States, which includes that of its subsidiary Kia Motors Corp., was 8.9 percent in 2011. This is above Nissan Motor Co.'s 8.2 percent and is closing in on Honda Motor Co.'s 9 percent and Toyota Motor Corp.'s 12.9 percent.

Motor journalist Naotsugu Mihori argues the quality of a Hyundai luxury sedan is comparable to its Japanese counterparts. "I felt it was very smooth and comfortable to ride in. If you were driving blindfolded you wouldn't be able to tell the difference between Japanese and Hyundai sedans," he said.

“South Korean car companies have also used innovative marketing strategies. In 2009, after the Lehman shock, Hyundai started a "Lose your income, return your car" campaign for customers who were reluctant to buy a car due to fears over losing their jobs. Under the deal, the owner of a new Hyundai car can return the vehicle to the dealer and cancel all remaining loan repayments if their employment is terminated within 12 months of the car's purchase. In addition, Hyundai subsidized clients who were struggling with rising fuel prices by offering gasoline at a fixed price of 1.49 dollars a gallon in its Hyundai Assurance Gas Lock promotion program. Hyundai paid for the difference in gas prices. "Hyundai took an offensive strategy to change the crisis into an opportunity," Prof. Nam Myung Hyun at Hannan University of South Korea said. The strategy was appealing to U.S. citizens, the former Hyundai Motor director said.

“Hyundai is also slowly penetrating the Japanese market. Hyundai is not displaying any passenger cars at this year's Tokyo Motor Show, but the Impreza, a small car displayed by Fuji Heavy Industries Ltd., is equipped with rear light components produced by a Hyundai-affiliated parts maker. It is the first time that a Hyundai-affiliated maker has supplied large parts for the Japanese automaker. "Now, South Korean parts are our most serious threat," an official at a Japanese autoparts maker said.

Japanese Automakers Form Alliances and Focus on Emerging Markets

Toshiyuki Kanayama, senior market analyst at Monex Securities, told AFP Japanese automakers cannot ignore India, Indonesia and Russia, where the size of the middle class is expected to balloon. 'But there is no way they can beat India's Tata Motors in terms of prices,' Mr Kanayama said, referring to the ultra-cheap Nano model, which can be had for less than US$3,000 (S$3,800).

“Maruti Suzuki is strong in India and (Toyota's) Daihatsu is strong in Indonesia.

“The Yomiuri Shimbun reported: “Most of the world's automakers have been speeding up efforts to form business partnerships with other companies to cover their weak points in the development of next-generation eco-friendly cars. Only a few of them, such as Honda Motor Co. and Germany's BMW AG, maintain independent business strategies. Uwe Dreher, a BMW official in charge of EV brand market strategy, said it did not form such an alliance so it could maintain independence in management decisions.

Image Sources: 1) Suzuki 2) Nissan 3) 6) 8) Honda 4) 5) Toyota 7) Mitsubishi

Text Sources: New York Times, Washington Post, Los Angeles Times, Daily Yomiuri, Times of London, Japan National Tourist Organization (JNTO), National Geographic, The New Yorker, Time, Newsweek, Reuters, AP, Lonely Planet Guides, Compton’s Encyclopedia and various books and other publications.

Last updated October 2012