ELECTRIC CARS

Sanyo HEV car battery An electric vehicle (EV) is a vehicle powered by an electric motor. Notable examples in Japan are Nissan Motor Co.'s "Leaf" and Mitsubishi Motors Corp.'s "i-MiEV." EVs are environmentally friendly because they do not consume gasoline or emit carbon dioxide. They also can serve as batteries during an emergency. For example, if the power is cut during an earthquake, EVs can be used as a power source for lighting equipment and rice cookers. [Source: Yomiuri Shimbun, June 26, 2012]

Because of their limited range electric cars are widely seen as vehicles limited to daily commutes or for running errands and doing shopping. A fully charged EV runs for about 100 to 200 kilometers. According to a fiscal 2010 survey by Japan's Land, Infrastructure, Transport and Tourism Ministry, the average daily travel distance of an ordinary family car is 22.99 kilometers and that of business car is 35.27 kilometers--both easily covered by Evs.For long trips hybrids are more practical. Aomori Prefecture is exploring the use of a system that hooks into a car’s navigation system that shows drivers which rechargers are being used and which are available.

The Economist reported in October 2010: “The first mass-market electric cars are now arriving in showrooms in America, Europe and Japan. They come in three flavours. Pure electric vehicles like Nissan’s Leaf can be driven for 150km or so before they need to be recharged for six to eight hours. Range-extenders like GM’s Volt (the Ampera in Europe) are powered by an electric motor that can be recharged either from the mains or by an on-board internal-combustion engine. Then there are familiar hybrids like the Toyota Prius, now being adapted to take a charging cord and with a longer electric-only range. [Source: The Economist, October 7, 2010]

In electric vehicles (EVs) the battery generally accounts for about half the vehicle’s cost. The performance of the battery generally decides the performance of the vehicle. Most of the production costs for EVs derive from battery cells being mounted within the vehicles. These costs can be cut significantly through large scale production.

Electric charges for an electric car are about one third of the price per kilometer as gasoline for a gas-powered cars. According to Nissan projections if their electric car is driven 1,000 kilometers a month it would pay for itself over six years with electricity charges adding up to ¥86,000 as opposed to ¥580,000 that would spent on gasoline for a gas-powered car. The Nissan Leaf EV can reach speeds of 140 kph and travel 160 kilometers on a single charge.

Carlos Ghosn, head of Renault-Nissan, believes that by 2020 one in ten new cars in Europe will be electric, while hybrids, such as the Prius, will have a similar share of the market. Government subsidies are key to getting potential buyers into the show rooms. American buyers, for example, can get up to $7,500 towards the purchase of an electric car. Mr Ghosn told The Economist he reckons incentives will be needed for another four years or so. He thinks electric cars will compete without subsidies against conventional cars only when production reaches about 500,000 per model. [The Economist, Op. Cit]

In 2009, the Japanese government started a program of subsidies for consumers who purchased an environmentally friendly vehicle, which added momentum to the popularization of electric vehicles. The Japanese government is expected to offer subsidies of ¥770,000 to ¥1.4 million for the purchase of an electric car.

Electric Car Technology in Japan

“In 2004, Japanese companies developed a new electric motor known as the “in wheel motor” which brought the electric vehicle much closer to realization. Japanese car companies have worked closely with electronics companies to make batteries for cars. Toyota has a joint venture with Panasonic. Mitsubishi and the battery maker GC Yuasa plan to build a battery factory together.

Electric cars introduced in the 2010s have improved lithium batteries and cost below ¥2 million. They will be able to travel about 200 kilometers per charge. Prius currently use heavy nickel-hydrogen batteries. Lithium-ion batteries are lighter and more efficient. Electric cars using batteries based on new materials capable of traveling 500 kilometers per charge — or about the same distance as gasoline-powered cars — are expected to appear on the 2020s. By 2030 they want to mass produce electric cars with batteries that cost 1/40th the cost of current versions. Because the research and development costs are so high, many companies are collaborating with their rivals to reduce costs.

The biggest obstacle for electric cars is the high cost of lithium-ion batteries and the challenge of creating street-based facilities to charge batteries. Even with the government shouldering part of the cost of electric vehicle purchases under a subsidy system, EVs are still more expensive than ordinary gasoline vehicles. More people probably would consider buying an EV if the cost came down a little. There are handful of recharging stations for electric vehicles in Japan, including two in Tokyo. Tokyo Electronic is developing a fast charger able to charge a battery to 80 percent of its capacity in 15 to 30 minutes. It hopes to introduce the chargers to shopping malls and other facilities.

Limitations and Problems with Electric Cars

The Economist reported in October 2010: “The showroom patter will be misleading, for two reasons. First, although electric cars are nippy, stylish and as easy to drive as conventional vehicles, electric motoring has some distinct disadvantages. Second, they are not really as green as their promoters claim.” [Source: The Economist, October 7, 2010]

“Carmakers are taking different approaches to these limitations. The Nissan Leaf or Renault Fluence are powered only by a battery. Once they have travelled 160km (100 miles) or so, the battery needs recharging, which can take some eight hours. By contrast, the Chevrolet Volt’s battery has less than half that range, but it carries a petrol generator which gives the car another 480km. Micro cars with just two seats and ranges of only around 50km are also coming: they will charge quickly and work well in crowded cities. But for a combination of cheapness and efficiency, a petrol-powered car is hard to beat.”

“And what of electric cars’ environmental credentials? Electric cars are being hugely subsidised by taxpayers — £5,000 ($7,940) in Britain and up to $7,500 in America — on the ground that they are zero-emission vehicles. Makers of electric cars claim that this is an efficient way to reduce greenhouse-gas emissions. Road transport accounts for a tenth of such emissions worldwide; the sorts of biofuels currently in use are not much greener than petrol; and next-generation biofuels are proving slow to come to the market.”

“A further problem, which government subsidies have not entirely eliminated, is “sticker shock”. Electric cars are expensive. BMW reckons they will be a premium product, which is why it plans to launch a light electric citycar with a fancy composite body in 2013. Renault is trying to hold down prices by separating the cost of the battery from its new electric car, the Fluence. In Britain the car will cost around £18,000 ($28,660) after a £5,000 government subsidy — about the same as a diesel-powered equivalent. Buyers will lease the battery for about £80 a month. Renault believes drivers who are used to paying regularly for fuel will tolerate this charge. Leasing the battery should also alleviate concerns about its reliability. GM is responding to the same concern by guaranteeing the battery in its Volt for eight years or 100,000 miles.”

“One issue that is important to many buyers is how the value of electric cars will hold up in the second-hand market. The answer will not become clear for several years. Some in the industry think that a shortage of cars could drive up prices, at least at first. But they could plummet if the batteries cause problems or users find the range of the vehicles too limiting.”

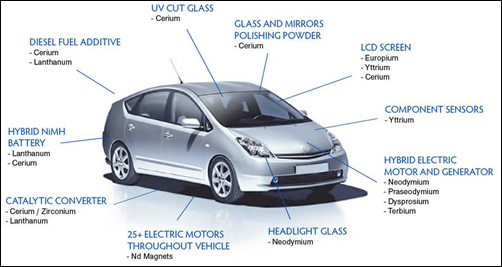

Rare earths used in a Prius

Range Anxiety of Electric Cars

One of the biggest limitations of electric cars is “range anxiety” The Economist reported in October 2010: “Drivers are not used to thinking precisely about how far they will drive before returning home. Electric cars (at least the ones without petrol engines to top up the battery) demand that they do. And some tests have suggested that manufacturers’ claims about the ranges of their vehicles are optimistic. A car that is full of passengers and running the heating or air-conditioning will drain the battery more quickly. Yet the manufacturers believe these concerns can be overcome.” [Source: The Economist, October 7, 2010]

“The idea of recharging an electric car at home for only a few dollars and never again having to visit a filling station is enticing. For most journeys, the limitations of battery capacity are irrelevant. As salesmen will be quick to point out, 99 percent of the time people do only short runs — the daily commute, trips to the shops and to pick up the children — all of which are well within the range of most electric cars.”

“But that final 1 percent of journeys presumably includes the summer holiday when people pile into the car and head off for the coast. Hopping on the train laden with suitcases and children may not be an attractive alternative. And even the relatively short ranges that salesmen advertise may be optimistic. On a cold, wet night when lots of electrical systems are running and the vehicle is laden with passengers and luggage, a car may lose around a third of its supposed range.”

“So far, BMW has carried out the biggest test of electric motoring. It leased 600 electric Mini Es to drivers in Britain, Germany and the United States. Before getting their cars most drivers said they expected the 150km range to be restrictive. But the driving patterns of Mini E users in Berlin turned out to differ only slightly from those in ordinary Minis. Even in California, land of freeways and long commutes, Mini E drivers clocked up 48km a day, not far behind the American average of 64km. Most Mini E users recharged their cars at home, and some did so only two or three times a week rather than every night. BMW concludes from these tests that electric cars are suitable for most people and that range anxiety fades as drivers get used to them.”

“Another study, by Deloitte, a consultancy, found that three-quarters of Americans would not consider buying an electric car unless it had a range of 300 miles. But the carmakers do not have to convince everyone at the outset. In Deloitte’s survey, those who were inclined to buy tended to be early adopters of new technologies. They were typically young with a much higher-than-average household income. They were living in an urban or suburban area — commonly southern California — and had a garage with electrical power where they could recharge the car. Such drivers would probably treat electric vehicles as second cars, and prize them for their green show-off value. Mr Ghosn sees electric drive as “a complementary technology.”

Electric Cars Not as Green as They Claim

The Economist reported in October 2010: “Although electric cars may not themselves produce greenhouse gases, generating the electricity they use does. How green they are depends on the fuel mix at the power plants in the country in which they are driven. An electric car in Britain today, for instance, produces around 20 percent less in CO2 emissions than a car with a petrol engine. Even if the generating mix gets greener, electric vehicles are so expensive to produce, that they will still be a relatively costly way of abating CO2 emissions. Sceptics therefore doubt that the subsidy is a good use of public money.” [Source: The Economist, October 7, 2010]

According to Richard Pike, chief executive of the Royal Society of Chemistry, replacing all of Britain’s cars with subsidised electric cars would cost the taxpayer £150 billion and, with Britain’s current fuel mix, cut CO2 emissions from cars by about 2 percent. For the same money, Britain could replace its entire power-generation stock with solar cells and cut its emissions by a third.

“The only efficient way to cut greenhouse-gas emissions is to impose a carbon tax. If electric cars are a good way of reducing emissions, a carbon tax will enable them to flourish. Taxes, of course, are not as popular as subsidies. But subsidies are almost always a waste of public resources. At this particular time, throwing more taxpayers’ money at the car industry seems a daft thing to do.”

Advances in Electric Cars

The Economist reported in October 2010: “Electric cars are evolving quickly. Although he refuses to reveal figures, Mr Ghosn says the cost per kilowatt-hour (kWh) of battery capacity for Renault-Nissan cars has fallen by half in four years. Earlier this year Boston Consulting Group estimated that electric cars will not be fully competitive until costs fall to about $200 per kwh. That would substantially reduce the cost of the 24 kwh battery used by the Nissan Leaf. According to industry rumors, Renault-Nissan has got its costs down to below $400 per kwh, so if it can continue this progress its cars will become much more competitive.” [Source: The Economist, October 7, 2010]

“Other technical improvements are on the way, including systems that could charge a battery in as little as five minutes. Such developments should make electric cars more usable and increase their popularity. But that will cause another problem: early adopters may find that technology changes so rapidly that their shiny new electric cars soon seem old-fashioned.”

International Competition, Risks and Uncertainties with Electric Vehicles

Hiroko Tabuchi wrote in the New York Times that as “the car industry does shift toward electric vehicles, analysts say Japan’s auto industry could face new rivals overseas, and from industries and regions beyond those traditionally associated with car making. China has emerged as a front-runner in electric vehicles, with a flurry of small companies producing simple, cheap plug-in cars. And in Silicon Valley, the start-up Tesla has sold luxury battery-powered sports cars since 2008.” [Source: Hiroko Tabuchi, New York Times, November 2, 2010]

“Nor is it clear what technologies will eventually dominate — gas-electric hybrids, plug-in hybrids, pure electric vehicles or even fuel-cell cars — or whether gasoline cars will ever become obsolete. Even big auto makers seem reluctant to bet on one technology. Nissan, which will introduce what it says will be the first mass-produced all-electric vehicle next month, on Tuesday expanded its gas-electric hybrid lineup with its new Infiniti M.”

“Meanwhile, auto parts makers have surrendered a central part of the electric car, batteries, to the electronics industry. Even top automakers are working with electronics companies to develop and produce the powerful and complex batteries required for electric vehicle power trains. Toyota, for example, is working with Panasonic, while General Motors is working with a unit of LG Corporation of South Korea. “The industry map is being redrawn,” said Mr. Nakajima of the Shizuoka Economic Research Institute. “In that turmoil, winners can become losers, and losers, winners.”

Electric Vehicle Shock

Takeshi Nagata and Yoichiro Kagawa wrote in the Yomiuri Shimbun: “Demand for electric vehicles, hybrid cars and other eco-friendly cars is expected to grow in coming years. However, the spread of these vehicles is not necessarily good news for car parts makers. In summer of 2010, officials of Teikoku Piston Ring Co., a Tokyo-based car parts maker, had furrowed brows after they disassembled a Prius, the signature hybrid model of Toyota Motor Corp.” An official of Teikoku Piston Ring said, "The car had fewer parts than a gasoline-powered car, so we think our orders will decrease." [Source: Takeshi Nagata and Yoichiro Kagawa, Yomiuri Shimbun, December 14, 2010]

“Electric cars, which do not have engines, have even fewer parts. The Chugoku region is home to many parts makers that have business ties with Mazda Motor Corp. Although the companies excel at producing parts for gasoline-powered cars, only a fraction of them can make key components for electric vehicles, such as motors and inverters.” "Even if eco-friendly cars become popular, we won't benefit," an executive of a parts maker said.

Reporting from Hamamatsu, another major car parts making area in Japan, Hiroko Tabuchi wrote in the New York Times, “People here refer to it as “electric vehicle shock.” Sooner or, more likely, later the electric car could render thousands of companies superfluous here in the heart of Japan’s auto parts region. No more engines. No call for exhaust pipes. Spark plugs? Gone with the electric-car wind. Or so, in essence, warns a recent widely circulated study that predicts the eventual demise of much of Hamamatsu’s gasoline engine economy. Spurred by that study and a general sense of foreboding, carmakers, parts factories and local governments in this sprawling industrial town are joining forces to prepare for a future of electric vehicles.”[Source: Hiroko Tabuchi, New York Times, November 2, 2010]

Hamamatsu is home to an estimated 2,000 auto parts makers and they make up two-thirds of its 3 trillion yen ($37 billion) manufacturing economy and supports almost 100,000 jobs. “Some experts in Japan warn that Hamamatsu is a microcosm of a wider challenge facing Japanese car manufacturing,” Tabuchi wrote, “which consists of a web of manufacturers like Toyota and Honda supported by thousands of companies that turn out engine blocks, exhaust pipes and hundreds of other parts specific to gas power.”

“According to a study published in August 2010 by the Shizuoka Economic Research Institute, almost 30 percent of sales in Japan’s 34.6 trillion yen ($430 billion) auto parts industry comes from parts that could be rendered obsolete by electricity-powered vehicles. In Shizuoka, the region surrounding Hamamatsu that is known for its strengths in engine technology, that number jumps to 48 percent, the institute says. “Japan has always prided itself in developing the best engines, the best auto technology,” said Hisashi Nakajima, senior managing director at the institute and the author of the report. “If we don’t do something now, Japan’s strength could turn out to be its weakness.”

Responding to Electric Vehicle Shock

Suzuki Motor, based in Hamamatsu, helped found a regionwide alliance in October 2010 that will help parts makers develop new automotive technologies geared toward electric cars, and even other industries. “We are in the midst of an industrial revolution,” Osamu Suzuki, the automaker’s 80-year-old president, said. “Our suppliers need to start studying how they can transform their businesses.” [Source: Hiroko Tabuchi, New York Times, November 2, 2010]

For the last 40 years, Harada Seiki has honed its precision metal-cutting technology for automobile engine parts: spark plugs, crankshafts and piston rings. Now, Harada Seiki wants to participate in the regionwide alliance to study whether its production processes would be applicable to electric-vehicle motors. “Electric cars will have far less of the kind of parts that we’ve always manufactured,” said Hirotoshi Harada, the parts maker’s president. “But they may require parts that never existed before,” he said. “That’s what we want to find out.”

Hiroko Tabuchi wrote in the New York Times, “Mr. Harada and other executives point to challenges. For one, it is not clear how fast the shift toward electric vehicles will occur. The research company J. D. Power estimates that by 2015, hybrid gas-electric and all-electric vehicles will surpass three million units a year, or about 3.4 percent of global light-vehicle sales. But after that, adoption depends greatly on factors like government policies, the price of gas and how fast the infrastructure for batteries and recharging can be set up, analysts say.

“Meanwhile, many parts makers here, especially smaller ones, may see their research and development capabilities or financial resources stretched too thin to develop parts for electric vehicles while also keeping up with developments in gasoline-car production. Indeed, many small factories in Japan are already struggling to survive, weighed down by a sluggish economy and a strong yen. The Japanese currency has surged to 15-year highs in recent months, punishing manufacturers by making their products more expensive overseas.”

“The question is: Where do they spend their limited resources?” said Oliver Hazimeh, director at PRTM Management Consultants, based in Waltham, Mass., and a leader of the firm’s clean transportation work. He told the New York Times, “Do they focus on something that’s going to happen 10 or 15 years out, or do they keep on developing for gasoline cars? They still have time, but they need to think about what is their long-term strategy.

“If history is a guide, the region’s parts makers have shown an ability to adapt to change,” Tabuchi wrote. “ASTI, another Hamamatsu-based parts maker, had its roots in making piano connector parts and wire harnesses for Yamaha pianos and organs. When Yamaha’s business shifted to engines and motorbikes in the 1970s, ASTI adapted its wire harness for automotive use. Now ASTI says it faces its biggest challenge yet: to develop wiring and cables that will withstand the greatly increased electricity needs of an electric car.” A wire harness for conventional cars carries about 12 volts, says Masashi Terada, a director in charge of technical engineering at ASTI. In purely electric vehicles, some cables would need to channel more than 10 times that, he said. “We want to figure out what automakers are looking for as they move towards zero-emissions cars,” Mr. Terada said. “Or even better, we ourselves want to take the lead and tell automakers what they need.”

Hiroshi Tsuda, a former president at Suzuki who now leads the local alliance that will help parts makers evolve into electric vehicle suppliers, is optimistic. He told the New York Times. “By acting now, both parts makers and car makers can stay ahead of the curve. Japanese industry has always adapted with the times,” he said. “This is not a crisis. It’s a big opportunity.”

Electric Cars in Japan

Toyota EV prototype Toyota and Nissan plan to introduce electric vehicle in 2012. Toyota plans to begin selling electric cars in 2012. At the Tokyo Auto show in 2009, it unveiled the FT EV-11, a 2.7-meter-long electric vehicle which is more compact than the iQ car

TEPCO (Tokyo Electric Power), Nissan, Mitsubishi and Fuji Heavy Industries are working together to standardize infrastructure such as battery chargers for electric vehicles. In August 2009, the Lawson’s convenience store chain began installing electric-car chargers. In January 2010 Family Mart opened it first eco-friendly store with electric car chargers and said it hoped to have 200 such stores by 2012.

In July 2009, Fuji taxi, a taxi company in Matsuyama became the first to put a fleet of electric cars — Mitsubishi i-MiEVs — into service. Electric cars are expected to be used soon in Kyoto, Osaka and Niigata.

Different Japanese Electric Car Models

Toyota unveiled an electric verison of its RAV4, with Tesla’s battery system, at the Los Angeles Auto Show in November 2010 and said it would start selling an electric version of the IQ car in 2012. The RAV4 has a range of about 160 kilometers per charge. The Toyota I-Real single-person electric vehicle went into service at Chiba airport in June 2009. Resembling a futuristic wheelchair, it is used by security teams. It has three wheels and an can reach speeds of 15 kph although it is designed to mainly cruise around at about 6 mph. It has a range of 30 kilometers per charge and deputed at the Tokyo Motor Show in 2007.

Honda has said it would start selling an electric version of the Fit car in 2012. It has a range of about 160 kilometers per charge. Honda started leasing an EV-neo electric scooter in December 2010. Developed for delivery businesses it has a range of about 34 kilometers and costs about $5,000. A $450 charger can charge it in three hours. A $1,400 charger can charge it in 30 minutes with a 200-volt power source.

A professor at Keio University has developed an eight-wheel electric car that carries eight people and goes 300kph and can travel 300 kilometers after an hour of recharging. Known as a KAZ, the car is 6.7 meters long and 1.95 meters wide. It has lithium-ion batteries and doesn't need a transmission because it has a motor on each wheel.

In August 2007, a car developed by Osaka Sangyo University and Matsushita Electrical Industry, powered by 1992 AA Oxyride batteries, recorded as speed of 122 kph, a record recognized by the Guinness Book of Records.

Mitsubishi i-MiEV

iMiev The Mitsubishi i-MiEV us electric vehicle developed with Tokyo Electric Power Co. Production began in June 2009 with sales to companies and government agencies at a price of $45,900, more than twice the price of a Prius. The electricity costs are about ¥2 per kilometer,

The i-MiEV was launched in Japan in April 2010. Production of European models began on October 2010, including versions for France’s PSA group, which will sell the cars as a Peugeot iOn or Citroën C-ZERO. In the summer of 2011, Mitsubishi introduced a cheaper version of the i-Miev, selling for under ¥2 million.

Slightly over five feet high and less than five feet wide, the i-MiEV is cozy, to say the least, and at just 2,400 pounds it is relatively light. Its battery, the size of a tatami mat and weighing about 400 pounds, is under the floor, which helps give the car a lower center of gravity. The vehicle can be charged overnight with a 200-volt home electric outlet. Fast-charging stations can replenish batteries to 80 percent of capacity within 30 minutes. Standard 100-volt outlets can also be used, but the recharge then takes more than 12 hours.

The i-Miev is powered by a 200-kilogram lithium ion battery that can be charge with a household power supply. It can go 130 kilometers per hour and has a range of 160 kilometers. Mitsubishi promised by the “mid 2010s” to the cut the price of the i-Miev to less than $20,000 with the help of government subsidies and tax breaks. Charging it with a 120-volt charge takes 14 hours, with 200-volts, 4 hours, and 30 minutes with a special charger.

In January 2012, the i-MIEV, Mitsubishi Motors Corp.'s electric vehicle, won the top position in Norway's small car market. Norwegian motorists are offered a range of incentives to drive electric vehicles and environmentally conscious customers flocked to buy the car.

Nissan Electric Cars

Nissan insist that the real money is in electric cars. It hopes to introduce an all-electric car with no emissions in 2010 and sell them globally by 2012 — turning a profit quickly. Nissan plans to introduce different models for different regions at competitive, affordable prices.

Nissan is developing a zero-emission electric car made with smaller, lighter next-generation batteries using lithium ion technology like that used in laptop batteries. It has developed a plug on hybrid that can be plugged into an ordinary electric outlet at a person’s home.

In August 2008, Nissan unveiled prototypes for an all-electric car and a gas-electric hybrid that it planned to begin selling in the United States in 2010. The Hypermini EV is a two seat electric car up to aimed for the American market that gets 100 miles on a single charge.

Nissan makes lithium ion batteries with NEC in Japan. Nissan is investing $700 million in battery plants in Britain and Portugal to make batteries for electric cars. It received a $1.6 billion loan from the U.S. government to modify its Smyrna, Tennessee plant to produce electric vehicles and batteries to power them with production beginning in 2012.

Nissan electric cars have a lithium battery under the floorboards so the amount of space inside the car is not compromised. The breaking system recharges the battery so a range of 160 kilometers can be achieved.

Nissan plans to introduce its electric vehicles in Japan and the United States in late 2010 and begin marketing them globally in 2012. Ghosn thinks customers will need some time to adopt electric cars and that gasoline-powered cars will continue to dominate the market for many years to come. He has predicted that electric cars will only have about 10 percent share of the car market in 2020.

The Leaf electric car was unveiled to the public at the Tokyo Auto Show in October 2009. A hatchback that produces zero emissions, it will go on sale in Japan, Europe and the United States in 2010,

Nissan also plans to introduce a fully electric Infinity luxury car. The Land Glider is a concept electric car that tilts at a 17 degree angle when is goes around sharp curves using wheel segments that move separately from the car body. GM and the Renault-Nissan alliance are making the biggest push into the mass market. The latter will launch four Nissan and four Renault electric models in the next two years.

Tiny Electric Car Released by Toyota

In July 2012, Jiji Press reported: “Toyota Auto Body Co. released a small electric vehicle that has only one seat and can travel up to 50 kilometers on a single charge. The COMS single-seater is suitable for shopping and sightseeing, said officials at Toyota Auto Body, a unit of automobile giant Toyota Motor Corp. Convenience store chain Seven-Eleven Japan Co. said the same day it will use the COMS for a new free delivery service that will begin in August. [Source: Jiji Press, July 3, 2012]

“Seven-Eleven Japan hopes to have 200 of the small vehicles operating by September. The retail chain, a subsidiary of Seven & i Holdings Co., plans to expand its COMS fleet after evaluating the vehicle's effectiveness. "We would like to raise the number to about 300 units within one to two years," Seven-Eleven Japan President Ryuichi Isaka said.

“A license to drive four-wheeled vehicles is required to drive the COMS, which can be charged from a household power outlet. It travels at a maximum speed of 60 kilometers per hour and will retail for between 668,000 yen and 798,000 yen.

Japanese Electric Car Batteries and Motors

It is estimated the prices of lithium batteries should fall by one seventh of their 2006 prices by 2015 and one fortieth by 2030. Even after a Leaf is ready to be scrapped, its battery is likely to have 80 percent of its capacity. The flood of used batteries could result as the life span of a battery is longer than an electric vehicle's.

Sanyo is set to supply lithium ion batteries to six Japanese and foreign automakers, including Suzuki, Audi and Toyota. Toshiba will supply Ford with motors for hybrid cars starting in 2012 and build a ¥4 billion plant to make them. Toshiba and MMC are working together to develop a rechargeable lithium ion battery system in electric vehicles.

Nissan is working on systems to recharge the Leaf with solar power. Ap reported that in the new charging system, demonstrated to reporters in July 2011, electricity is generated through 488 solar cells installed on the roof of the Nissan headquarters building in Yokohama...Four batteries from the Leaf had been placed in a box in a cellar-like part of the building, and store the electricity generated from the solar cells, which is enough to fully charge 1,800 Leaf vehicles a year, according to Nissan. Toyota Motor Corp. and Honda Motor Co., are working on similar projects, such as linking hybrids with solar-equipped homes as part of energy-efficient communities called "smart grids."

Electric Cars Used After the Earthquake and Tsunami in 2011

Ken Belson wrote in the New York Times: “With deep-tread tires and ample ground clearance, a rugged 4-wheel-drive Hummer or Jeep might seem the best choice for navigating through the wrecked cities of northeastern Japan. The areas pummeled by the earthquake and tsunami in March would surely be inhospitable for an electric vehicle. Yet in the days and weeks after the horrific one-two punch of natural disasters, wispy battery-electric cars — engineered for lightness and equipped with tires designed for minimal rolling resistance — proved their mettle.” [Source: Ken Belson, New York Times, May 6, 2011]

“These welterweight sedans, including models from Mitsubishi and Nissan, turned out to be the vehicles that got through — not because of any special ability to claw their way over mountains of debris, but because they were able to “refuel” at common electrical outlets. With oil refineries out of commission and clogged roadways slowing deliveries, finding gasoline had become a challenge. Shortages were so acute that Japan’s Self-Defense Forces had to truck in gasoline; donations of diesel fuel were accepted from China.”

“Yet in Sendai, about 250 miles northeast of Tokyo, and other cities ravaged by the earthquake, electricity returned within days. Taking stock of the situation, the president of Mitsubishi Motors, Osamu Masuko, offered dozens of his company’s egg-shaped i-MiEV (pronounced “eye-meeve”) electric cars to affected cities. Despite their image as light-duty runabouts best suited for trips to a nearby shopping mall, the electric vehicles were immediately put to use. They were pressed into service ferrying supplies to refugee centers, schools and hospitals, and taking doctors, city workers and volunteers on their rounds.”

“While the i-MiEVs could not help out with tasks like hauling building materials or towing stranded vehicles, the assistance from Mitsubishi was much appreciated. In all, 89 i-MiEVs went to the recovery effort, including 34 to Miyagi Prefecture, 33 to Fukushima Prefecture and 18 to Iwate Prefecture.” “There was almost no gas at the time, so I was extremely thankful when I heard about the offer,” said Tetsuo Ishii, a division chief in the environmental department in Sendai, which also got four Nissan Leaf electric cars. He told the New York Times. “If we hadn’t received the cars, it would have been very difficult to do what we needed to.”

“Mr. Ishii and other officials in Sendai assigned the cars strategically,” Belson wrote. “Two were used to bring food and supplies to the 23 remaining refugee centers in the city, while two others served doctors. Education officials have been using another two vehicles to inspect schools for structural damage. Others helped deliver supplies to kindergartens around the city or were loaned to volunteer groups. Once the most pressing needs are met, the city may use the cars to help in the cleanup of damaged homes, as fuel shortages still limit the availability of trucks. For now, though, the cars are driven an average of 30 to 45 miles each day, about half the distance that they can be driven on a full charge. “One charge is perfect for us, because it allows us to drive around during the day with no trouble,” Mr. Ishii told the New York Times, “We’re not that big of a city.” Most of the cars, he said, returned each night to city hall, where they were recharged at 200-volt outlets.

The cars’ unexpected sturdiness and utility has pleased Mr. Masuko, who, like other automobile executives, has been battling skeptics who see electric vehicles as expensive and impractical. “I am most impressed when I hear the words, “I felt electric vehicles were unreliable at first, but now, the vehicles are being integrated into daily life,” he wrote in an e-mail. “I am so glad I heard that our electric vehicles are contributing to the recovery of the affected areas.”

Japanese Electric Race Cars

Yasuaki Kobayashi and Kohei Nakashima wrote in the Yomiuri Shimbun: “Japanese automakers are entering electric race cars in events overseas, hoping that victories will boost sales of the passenger vehicles the race cars are based on. Car races provide world-class venues to showcase the performance of Japan-made electric vehicles, and automakers are scrambling to develop high-performance electric cars that can compete. [Source: Yasuaki Kobayashi and Kohei Nakashima, Yomiuri Shimbun, June 13, 2012]

“The i-MiEV Evolution , based on Mitsubishi's i-MiEV electric hatchback, can go from zero to 100 kph in less than four seconds. The Evolution did well in the Pikes Peak International Hill Climb in July 2012, an annual race to the 4,300-meter Colorado summit. Former rally driver Hiroshi Masuoka, who drove the car, said one advantage of the Evolution is its transmission-free engine, which allows it to quickly reach top speed. Five of the seven electric vehicles that entered the race were made Japanese teams. Toyota Motorsport GmbH EV P001, with Fumio Nutahara behind the wheel, raced to the top of the mountains in an impressive 10 minutes, 15.380 seconds. That was fast enough to place 6th overall and clinch the top spot in the electric class.

“Automakers hope to show in the Pikes Peak race that the biggest weakness of electric vehicles’ shorter cruising distances than gas-driven cars — has been overcome. Through this they aim to boost sales of electric vehicles in general, as well as improve business opportunities for auto parts makers. The biggest challenge in making electric cars for racing has been trimming the weight of the battery, said to be the heaviest part in an electric vehicle, while at the same time increasing power-storage capacity.

Image Sources: 1) 10) Osaka Gas 2) Sanyo 3) 5) 6) 7) Toyota 4) Mitsubishi 8) 9) 11) Honda 12) Nissan 13 Mazda

Text Sources: New York Times, Washington Post, Los Angeles Times, Daily Yomiuri, Times of London, Japan National Tourist Organization (JNTO), National Geographic, The New Yorker, Time, Newsweek, Reuters, AP, Lonely Planet Guides, Compton’s Encyclopedia and various books and other publications.

Last updated October 2012