RARE EARTHS

lanthanum Rare earths are a group of 17 “lanthanide” elements — including lanthanum, terbium, cerium, neodymium, yttrium and dysprosium — that have properties that make them essential for a number of uses in the electronics and clean energy industries. They are indispensable for producing high-tech goods, including hybrid cars, light-emitting diode-screen TVs and cell phones.The global rare earth market is small by mining standards — just $1.5 billion in 2009 — but its value is rising as demand and export restrictions push up rare earth prices.

Rare earths. were discovered beginning in the late 18th century as oxidized minerals — hence "earths." They're actually metals, and they aren't really rare; they're just scattered. The misleading name also dates back to the 18th century when they did indeed seem “rare.” Most soil samples contain small amounts, maybe a few parts per million, of the elements. Cerium, a rare earth element, is more abundant in the Earth's crust than copper or lead. The rarest rare earth is nearly 200 times more abundant than gold. But deposits large and concentrated enough to be worth mining are indeed rare. In addition, mining for rare earths is difficult, time-consuming and expensive and produces highly toxic by-products. The elements are usually found scattered in small fragments among rocks and must be separated and then processed. [Source: Tim Folger, National Geographic, June 2011; Tiffany Hsu, Los Angeles Times, February 20, 2011]

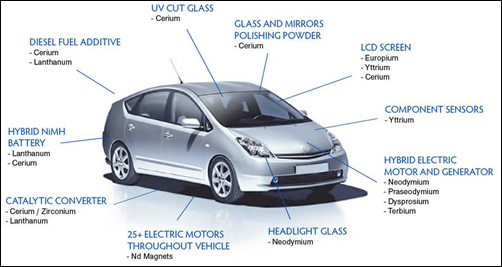

Howard Schneider wrote in the Washington Post: “There are 14 rare earth minerals commonly used in industrial applications. The elements are difficult to find in concentrations that can be commercially exploited. They provide, for example, the illumination in night-vision goggles. A fraction of a gram of elements such as dysprosium or Europium provide the colors that light up the screen of a smartphone. A hybrid car might contain 40 pounds or more of rare earth magnets — lighter and more powerful than traditional iron-based magnets — in the battery-based power chain or small motors that run power windows, seats and other accessories. [Source: Howard Schneider, Washington Post, October 26, 2012]

Good Websites and Sources on Rare Earths: New York Times Article on Chinese Control of Rare Earths nytimes.com ; China Rare Earth Holdings creh.com.hk ; Rare Earth Products made-in-china.com ; Wikipedia article on Rare Earths Wikipedia ;

Supply and Demand and Uses of Rare Earths

Neodymium

Mixed with metals, rare earths can improve the longevity and heat resistance of materials. The clean-tech and high-tech industries rely heavily on rare earths. Rare earths are essential for hybrid cars, wind turbines, low-energy light bulbs, fluorescent lights, superconductors and other high tech stuff essential for low-energy and low-greenhouse-emission technology. They are also essential for the production of liquid crystal display televisions, personal computers, and cell phones; and are used in making hard disks, miniaturized electronics, display screens, missile guidance systems and pollution control catalysts.

Rare earths are processed into phosphors, ceramics and magnets that can be up to 10 stronger than conventional ones. Rare earths are commonly used to boost the power of magnets. One kind, for example, is used to strengthen the magnetism of permanent magnets in hybrid vehicle motors. Battery-powered vehicles such as the Nissan Leaf and the Chevrolet Volt use rare earth magnets that are more compact than other options. Some have called rare earths the key materials for the electronic industry and many predict they will replace silicon as the key materials for advanced electronics.

Tim Folger wrote in National Geographic, “The list of things that contain rare earths is almost endless. Magnets made with them are much more powerful than conventional magnets and weigh less; that's one reason so many electronic devices have gotten so small. Rare earths are also essential to a host of green machines, including hybrid cars and wind turbines. The battery in a single Toyota Prius contains more than 20 pounds of the rare earth element lanthanum; the magnet in a large wind turbine may contain 500 pounds or more of neodymium. The U.S. military needs rare earths for night-vision goggles, cruise missiles, and other weapons.”

"They're all around you," Karl Gschneidner, a senior metallurgist with the Department of Energy's Ames Laboratory in Ames, Iowa, told National Geographic . He has studied rare earth elements for more than 50 years. "The phosphors in your TV — the red color comes from an element called europium. The catalytic converter on your exhaust system contains cerium and lanthanum. They're hidden unless you know about them, so most people never worried about them as long as they could keep buying them."

a number of fare earths are used in hybrids

About 125,000 tons of rare earths are mined a year with 120,000 tons coming from China in 2009. In 2010 consumption exceeded production by about 10,000 tons with the difference coming from stockpiles. Demand is expected to reach 180,000 tons in 2012 and 250,00 tons by 2015. An additional 40,000 tons is expected to come form non-Chinese sources in coming years.

The amount of rare earths that are mined and consumed is small compared to almost 1 billion metric tons for iron ore mined each year. “In terms io volume it is tiny, but we are just as addicted to rare earths as we are to hydrocarbons. But we don’t know it,” one mining analyst told the New York Times. “The variations of applications of rare earths is remarkable and expanding, especially in the high-technology area.”

World demand for rare earths is about 110,000 tons a year, with China accounting for about 75 percent of demand and most of the remainder split among Japan, the United States and Europe.

Different Rare Earths and Their Uses

Cerium Cerium is an essential material for automotive catalytic conservators. It is also used in polishing semiconductor wafers and sometimes used as a catalyst for self-cleaning ovens. LCD screens use Europium, Yttrium and Cerium. Ultraviolet cut glass uses Cerium. Diesel fuel additives need Lanthanum and Cerium. Catalytic convertors need Lanthanum, Zirconium and Cerium.

Hybrid electric motor and generator use Neodymium, praseodymium, dysprosium. There are more than dozen electric motors in a typical hybrid use Neodymium magnets are the strongest-know type of permanent magnet.

Niobium is used in alloys such as stainless steel for oil and gas pipelines. It increases heat resistance and durability. Brazil accounts for 80 percent of the global production.

Neodymium powers very small magnets used in devices like disc drives, tools and headphones. It is also used make powerful magnets for hybrid cars. It and dysprosium are used in motor magnets in the Nissan all-electric Leaf, the Toyota Prius and the Honda Insight hybrid. Neodymium is also a critical ingredient in wind turbine magnets. Dysprosium is also used in laser materials and computer hard drives. About 9,000 kilograms of ore, rock, soil and sand needs to be excavated to produce one kilogram of dysprosium. [Source: Japanese Environmental Ministry]

Lanthanum is used to make electrodes that are efficient and inexpensive. It is also a vehicle fuel catalyst used in hybrid cars. The battery of a Toyota Prius hybrid car uses 10 to 15 kg (22-33 lb) of lanthanum. About 6,800 kilograms of ore, rock, soil and sand needs to be excavated to produce one kilogram of tantalum. [Source: Japanese Environmental Ministry]

Rare Metals in China

rare earth oxides

In the early 21st century China became an important producer and exporter of rare metals needed in high-technology industries. It also controls the world’s supply of gallium and germanium.

China is a major global supplier of: 1) barium, used in personal computer monitors; 2) antimony, used in lead storage batteries; 3) tungsten, used on cemented carbide and lamp filaments; 4) indium, used in liquid crystal displays, televisions and solar batteries; 5) Germananium, used in plastic bottles; 6) bismuth, used in automatic fire extinguishers and fuses; 7) strontium, used in cathode ray tubes; 8) molybdenum, used in heat resistant stainless steel; and 9) vanadium m used in high-tension, specialty steel.

Japan is dependent in China for rare metals. It gets 93 percent of barium, 91 percent of its rare earth, 67 percent of its antimony, 79 percent of its tungsten, 59 percent of its indium, 59 percent of its Germananium, 52 percent of its bismuth, 42 percent of its strontium, 28 percent of its molybdenum, and 20 percent of its vanadium from China.

China is buying up rare metal rights overseas. One overseas Chinese project caused resentment after locals at the site were replaced by Chinese workers.

China and Rare Earths

China has one-third of the world’s reserves or rare earths but accounts for over 90 percent of current production, having squeezed out other suppliers with low prices in the 1990s. In 1992 Chinese leader Deng Xiaoping predicted that China would be to rare earths what the Middle East is to oil, saying “There is oil in the Middle East, there is rare earth in China.” In 2012 Chinese output accounted for more than 90 percent of the global supply of rare earths such as neodymium, used in magnets, and lanthanum, which refiners use to help separate crude oil into gasoline and other products.

China accounts for about 90 percent of the materials shipped because of cheap drilling and refining costs. A single mine in northern Inner Mongolia produces half of the world’s rare earth with most of the rest coming from smaller mines in southern China. About 75 percent of China’s rare earth production comes from Inner Mongolia. Rare earths are also mined in Jiangxi and Guangdong Provinces and other regions of China.

Chris Buckley of Reuters wrote, "China's rare earths resources can be likened in importance to the Middle East's oil. They have immense strategic significance and we must certainly deal with rare earths issues with care, unleashing the advantages they bring."

China is not only dominant in mining rare earths it also dominate in processing and applying them. Many worry about the strategic advantage that this gives China over the United States and other countries in some important military and commercial technologies. Some companies such as magnet maker Shin-Etsi Chemical in Japan are dependent of China for rare earth. They suffered when China briefly cut off their supply when the government failed to issue the company an export licence.

China has invested heavily in mining and processing rare earths. As applications of the materials develop China could become the center of the industry the same way Silicon Valley was a center for chip development. Users of these material are already moving research facilities to China. Thus far China has not allowed foreign enterprises to participate in the development of rare earths.

The rare earth supply in Inner Mongolia is largely controlled by the state-owned Bautou Iron and Steel group and Bautou Rare Earth Group. Chinese demand for rare earth has surge in recent years as foreign makers of computers, mobile phones and other devises that use them are being made in China.

China has the world’s largest reserves of rare earths. According to U.S. government data China hold 36 percent of the world’s 99 million tons of commercially viable rare earths. China mined about 120,000 tons of rare earths in 2008 and produced 97 percent of the global supply in 2009. Some worry that Chinese supplies could run out by 2025. Chen Zhanheng, director of the academic department of the Chinese Society of Rare Earths, said China's present dominance of the market is not in its own long-term interests. "This situation is obviously not sustainable," he noted, "for China's rare earth industry and for the world's high-tech industry."

Chinese rare earths were once said to be "cheaper than Chinese cabbages," and the low prices effectively ended production in the United States, Australia and other countries. When Chinese rare earths came to dominate the global market, the Chinese government curbed exports of what it calls "strategic natural resources." As a result, rare earth prices surged. [Source: Mamoru Kurihara, Yomiuri Shimbun, December 19, 2011]

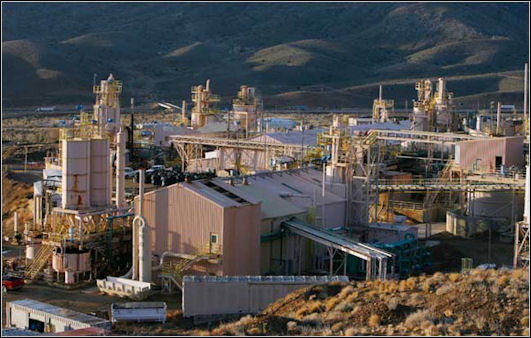

How did China become the world’s leading producer of rare earths. Paul Krugman wrote in the New York Times, “This relative abundance, combined with low extraction and processing costs — reflecting both low wages and weak environmental standards — allowed China’s producers to undercut the U.S. industry. Mark A. Smith, CEO of American rare earth producer Molycorp, told the Los Angeles Times, "Bottom line, we fell asleep as a country and as an industry...We got very used to these really low prices coming out of Asia and never really thought about it from a supply chain standpoint."

Baotou, "Middle East" of Rare Earths

Inner Mongolia Baotou Steel Rare-Earth Hi-Tech Co. is China’s biggest rare earth producer. The rare earth reserves at the Bayan Obi mine in Inner Mongolia are thought to be the largest in any single location in the world.

“Baotou, a city of 1.8 million people in Inner Mongolia (an autonomous region of China), is regarded as the world's “capital of rare earths.” Located about 650 kilometers (404 miles) west of Beijing, Baotou's mines hold about 80 percent of China's rare earths, Chen Zhanheng, director of the academic department of the Chinese Society of Rare Earths in Beijing told National Geographic. But Baotou has paid a steep price for its supremacy. Some of the most environmentally benign and high-tech products turn out to have very dirty origins indeed. [Source: Tim Folger, National Geographic, June 2011 ]

Chris Buckley of Reuters wrote, “Baotou wants to remake itself as a crucible of China's ambitions to turn its rare earths into green-tinged gold. The city has a rare earths high-tech zone, a shiny Rare Earths Tower for officials and investors, and Rare Earths Street. The city's Rare Earths Park features carvings of scientists and leaders who pushed China to turn its reserves into an engine for economic growth, including Deng Xiaoping, the revolutionary veteran who guided the nation to market economic reforms. "The Middle East has oil, and China has rare earths," a carving records Deng as saying.” [Source: Chris Buckley, Reuters, November 4, 2010]

“The Baotou Steel Rare-Earth Group is at the heart of China's ambitions to turn rare earths into a lucrative ingredient of growth. It dominates rare earths production in Inner Mongolia, where most of the ores come out of the ground mixed with iron ore, which is the parent company Baotou Steel's main business. China wants enough rare earths for its expansion into clean technology, especially advanced wind turbines, hybrid and electric vehicles and other innovations. Minutes from the mines of Bayan Obo north of Baotou city, hundreds of wind turbines just above the grasslands, their three blades and parts using rare earths in compounds that give them strength and lightness.”

Mining and Production of Rare Earths in Baotou

The mining of rare earths is difficult, time-consuming and expensive and produces highly toxic by-products. The elements are usually found scattered in small fragments among rocks and must be separated and then processed. The procedure is rarely eco-friendly, creating hundreds of gallons of salty wastewater per minute, consuming huge amounts of electricity, requiring toxic materials for the refining process and occasionally unearthing dirt that is radioactive.

Production costs in China for rare earth are about $5.59 per kilogram. High mining costs and damaging techniques pushed most rare earth mines outside of China out of business in the early 1990s. Only China kept its mines going, positioning itself for the ensuing high-tech boom and the resulting rare earth-hungry products. [Source: Tiffany Hsu, Los Angeles Times, February 20, 2011]

Rare earth production and processing is dirty and primitive. Separating out the minerals is usually done by dousing the rare earths in acids and other chemicals. Separating rare earths is not easy to do because they're chemically so similar. Reporting from the Huamei plant in Baotou, Chris Buckley of Reuters wrote, “China's quest for a green future built on rare earths metals seems a world away from Ren Limin as he casts lumps of one of the metals in a chemical-spattered shed thick with acrid fumes. Ren tends cauldrons of sputtering acid, additives and ore in a shed in north China's Inner Mongolia region, smelting lanthanum, one of the 17 rare earths that Beijing hopes will power the nation up the clean technology ladder.” [Source: Chris Buckley, Reuters, November 4, 2010]

Molycorp mine

“Yet Ren and a workmate use few safety protections as they stir and poke the red-hot cauldrons. Holes in the roof and windows act as main ventilation. "This place doesn't have anything but it's got mines. We live off the rare earth mines," Ren, who gave his age as 32 but looked years older, told Reuters journalists who visited Baotou. "It's not that dangerous. You get used to the smells, but there's also the heat," he said. "We sell it on. That's all I know. I'm not sure who buys it or what it's for," he said of a pile of lanthanum bricks lying on the floor, among discarded cotton gloves and scrap.”

“Ren worked without a mask but wrapped a towel around his face and donned a visor when pouring the molten compound into molds. He said they made 1,100 yuan ($165) a metric ton, working 12-hour days, with a few days off every two weeks. The plant he works in lies in a northern corner of Baotou, a city and surrounding expanse of Inner Mongolia that produces more than half of the world's rare earths, especially the lighter ones, from the fenced-off Bayan Obo mines.

“The government says it wants to end unfettered exploitation of rare earths, and has been shutting unlicensed mines and smelters. But China's biggest producers still pollute at levels far beyond what would be allowed in the United States, Australia and other countries now looking to ramp up production as Beijing curbs exports.

Pollution from the Production of Rare Earths

Tim Folger wrote in National Geographic, “Villagers near Baotou reportedly have been relocated because their water and crops have been contaminated with mining wastes. Every year the mines near Baotou produce about ten million tons of wastewater, much of it either highly acidic or radioactive, and nearly all of it untreated. [Source: Tim Folger, National Geographic, June 2011 ]

Near Baotou city, where Baotou Steel Rare-Earth Group processes the metals on a vast scale, villagers said the resulting toxins were poisoning them, their water and air, crops and children. At least one official has backed that claim. "If we take into account the resource and environmental costs, the progress of the rare earths industry has come at a massive price to society," Su Wenqing, a Baotou rare earths industry official wrote in a study published last year. [Source: Chris Buckley, Reuters, November 4, 2010]

Chris Buckley of Reuters wrote, “At the heart of Baotou's rare earths smelting, those environmental aspirations are blighted by pollution that can cut visibility around the main plants to a few dozen meters. The outer walls of the Huamei plant proclaim its ambitions to become the "mother ship" of Chinese rare earths production. But villagers near the rare earths plant live in a blanket of fumes, a constant reminder of how much China still allows near-unfettered industrial growth.”

rare earth processing in China

The tailings from Huamei and other nearby metals plants — that includes acids and other chemicals used to separate out the minerals — end up at a 10 square kilometer dam.The reservoir can hold 230 million cubic meters of the dark, acrid waste. That, according to a sign on its banks, is equal to 92,000 Olympic-sized swimming pools.

“The residents of Xinguang village said the chemicals from the dam have been seeping into the underground waters that feed their wells, crops and livestock, including fluoride. They complained of nausea, dizzy spells, arthritis, migraines, wobbly joints and slow-healing injuries.” "The pollution is too much for even our crops to grow, and a lot is from the rare earths plants," Wu Leiji, a ruddy-faced farmer, told Reuters. "It's not getting any better. In fact, it's worse...Look at the kids. They're the worst off. What will all this pollution do them?"

A report last month in a Chinese newspaper, the Yangcheng Evening News, cited experts supporting the villagers' complaints of damaged health from rare earths and other smelting pollution. "When we boil the water to drink, this white scum forms on top and it tastes bitter," said Guo Gang, a 58-year-old farmer. "We used to grow vegetables, but now all we can grow is corn, and even the crops for that are far smaller than 10 years ago."

Rare earth mines often also contain radioactive elements, such as uranium and thorium. While rare earths themselves are not radioactive, they are always found in ore containing radioactive thorium and require careful handling and processing to avoid contaminating the environment. Su Wenqing, the Baotou industry official, wrote that companies there had dumped tailings, including mildly radioactive ore scrap, into local water supplies and farmland and the nearby Yellow River, "creating varying levels of radioactive pollution."

Molycorp mine

Chinese Government Efforts to Clean Up the Production of Rare Earths

Chen Zhanheng, director of the academic department of the Chinese Society of Rare Earths in Beijing told National Geographic that the Chinese government is making an effort to clean up the industry. "The government has already made strict regulations to protect the environment and weed out the backward techniques, equipment, and products," Chen wrote in an email. "Those factories without abilities of environmental protection will be closed or merged with bigger companies." [Source: Tim Folger, National Geographic, June 2011 ]

Tim Folger wrote in National Geographic, “The Chinese government may eventually be able to regulate the large rare earth mining industry around Baotou. But some of the smaller mines in southern China will be more difficult to control — because they're operating outside the law to begin with. Violent criminal gangs run dozens of heavily polluting — and profitable — rare earth mines in Jiangxi and Guangdong Provinces. Xinhua, the official Chinese news agency, has reported that criminals smuggled 20,000 tons of rare earths from the country in 2008, nearly a third of the total rare earth exports for that year. If you own a smart phone or a flat-screen television, it may contain contraband rare earths from southern China.”

"People don't understand how totally corrupt the system in China is, with local party people aiding and abetting criminals in a very substantial way," Alan Crawley, CEO of Pacific Ores Metals & Chemicals, a trading company in Hong Kong, told National Geographic. Crawley speaks from experience. One of his colleagues was murdered 11 years ago by Guangdong gangsters. "The Hong Kong police can't do anything," he says. "The killers fled back to the mainland."

Image Sources: Wikipedia, Molycorp, New York Times, YouTube, Wiki Commons

Text Sources: New York Times, Washington Post, Los Angeles Times, Times of London, National Geographic, The New Yorker, Time, Newsweek, Reuters, AP, Lonely Planet Guides, Compton’s Encyclopedia and various books and other publications.

Last updated January 2013