NATURAL GAS IN CHINA

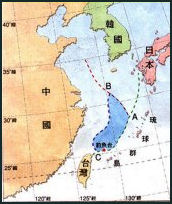

Senkaku Islands map, areas claimed

by Japan and China China has a huge appetite for natural gas and this hunger will no doubt increase no matter what the prices are. To meet demand China has invested billions of dollars in pipelines, liquid natural gas terminals and other natural-gas related infrastructure. It is also taking measures to conserve energy so it doesn’t have to buy so much imported natural gas. But demand for natural gas is surging as it is seen as a clean energy source and alternative to dirty, climate-change-gas-producing coal. In places where gas infrastructure has been set, people are being urged to switch from coal to natural gas for heating to reduce smog.

The government controls natural gas prices and has kept them artificially low through subsidies. Raising prices is very risky politically. This policy has created shortages by giving domestic companies and suppliers incentive to sell natural gas abroad at high international prices rather than sell them at home at artificially low prices.

Natural gas fulfilled 8.3 percent of China’s energy requirements in 2019, up from 3.0 percent of China’s energy requirements in 2004. Electricity: from fossil fuels: 62 percent of total installed capacity (2016 est.), 124th in the world. Japan was the largest importer of LNG (liquid natural gas) in the world in 2020 but was expected to be surpassed by China in 2022. [Source: Library of Congress, International Trade Administration, CIA World Factbook, 2022]

China consumed 280 billion cubic meters of natural gas in 2018, making up 7.4 percent of the world's total demand. China's natural gas demand is expected to rise by more than 300 billion cubic meters (bcm) between 2018 and 2035, or 30 percent of global volume growth, pushed in part by China’s shift from coal to cleaner fuels.[Source: Chen Aizhu, Reuters, October 30, 2019]

Natural gas:

Production: 145.9 billion cubic meters (2017 est.), sixth in the world.

consumption: 238.6 billion cubic meters (2017 est.), third in the world.

exports: 3.37 billion cubic meters (2017 est.), 35th in the world.

imports: 97.63 billion cubic meters (2017 est.), third in the world.

proved reserves: 5.44 trillion cubic meters (1 January 2018 est.), ninth in the world.

[Source: CIA World Factbook, 2022]

See Separate Articles: OIL IN CHINA: CONSUMPTION, PRODUCTION, HISTORY, GROWTH factsanddetails.com; CHINA AND FOREIGN OIL: IMPORTS, SOURCES, DEALS, SANCTIONS AND POLITICS factsanddetails.com; CHINESE OIL COMPANIES: PETROCHINA, SINOPEC AND CNOOC factsanddetails.com

RECOMMENDED BOOKS: “China's Biggest Natural Gas Pipeline: Challenges and Achievements” (2008) by Liu Jing Amazon.com; “China’s Energy Security and Relations With Petrostates: Oil as an Idea” by Anna Kuteleva (2021) Amazon.com; “Energy Policy in China” by Chi-Jen Yang (2017) Amazon.com; “China's Petroleum Industry In The International Context” by Fereidun Fesharaki (2019) Amazon.com; “China, Oil and Global Politics” by Philip Andrews (2011) Amazon.com; “Oil in China: from Self-reliance to Internationalization” by Taiwei Lim (2009) Amazon.com “China’s Electricity Industry: Past, Present and Future” by Ma Xiaoying and Malcolm Abbott (2020) Amazon.com; “Globalisation, Transition and Development in China: The Case of the Coal Industry” by Rui Huaichuan (2004) Amazon.com

Growth of Natural Gas Use in China

Natural gas was a relatively minor source of energy. Output grew rapidly in the 1960s and 1970s. owing largely to the discovery and exploitation of vast deposits in Sichuan Province during the late 1950s and early 1960s By 1985 production was approximately 12 billion cubic meters--about 3 percent of China's primary energy supply. In 1986, output increased by 13 billion cubic meters. [Source: Library of Congress, 1987]

China’s natural gas production has been steadily rising during the past several years as the country tries to fill the growing need for natural gas. China’s national oil companies produced an estimated 6.3 trillion cubic feet (Tcf) of natural gas in 2019, 8 percent higher than in 2018. [Source: U.S. Energy Information Administration country analysis briefs, September 30, 2020]

As of 2003, natural gas supplied only an estimated 2.6 percent of the country's energy. However, with proven reserves totaling an estimated 53.3 trillion cubic feet. In 2000, total national production reached 960 billion cubic feet. By 2003, that figure had risen to an estimated 1.21 trillion cubic feet. A pipeline to transport natural gas from the Xinjiang province in the west to Shanghai increased supply and distribution, [Source: Worldmark Encyclopedia of Nations, Thomson Gale, 2007]

China got three percent of electricity and two percent of it energy from natural gas in the mid 2000s. The government aimed to double that figure by 2010 and to increase natural gas's share of total energy supplies to 8 percent by 2020. China’s demand for natural gas has more than quadrupled since 2000. Between 1985 and 2004, annual natural gas consumption tripled from 13 billion cubic meters to 31 billion cubic meters. Natural gas consumption was around 45 billion cubic meters in 2005. All of it was produced in China. Consumption was expected to rise to 117 billion cubic meters by 2010.

China got 8.7 percent of it energy from natural gas in 2020. The rise is usage is largely attributed to the replacement of dirty coal with cleaner natural gas for heating, in part to reduce air pollution. In the early 2010s, demand for natural gas was satisfied mostly by domestic fields. Since then imports have increased significantly. China was building two medium-size, natural-gas-fired power plants a week, adding a capacity comparable to the entire annual power production of the United Kingdom. That is more than double what it was building in the mid 2000s.

During the 2010s, China’s natural gas demand increased rapidly by about 13 percent per year, making it the world’s third-largest natural gas consumer behind the United States and Russia. Although most natural gas consumption comes from industrial users, including mining and oil and natural gas extraction (accounting for more than 40 percent in 2018), the shares of natural gas consumption in the electric power and transportation sectors have risen during the past decade. [Source: U.S. Energy Information Administration country analysis briefs, September 30, 2020]

Production of Natural Gas in China

Although still in its early phase of development, China’s shale gas production rose substantially by 14 percent from 2017 levels to about 365 billion cubic feet (Bcf) in 2018.35 China’s 13th Five Year Plan targets natural gas production to reach 6 Trillion cubic feet for conventional gas, 1.1 Trillion cubic feet for shale gas, and less than 0.6 Trillion cubic feet for coalbed methane by 2020. Source: U.S. Energy Information Administration country analysis briefs, September 30, 2020]

To promote domestic upstream development of unconventional natural gas, China introduced financial incentives for producers. The government reduced the resource tax on shale gas production from 6 percent to 4.2 percent starting in April 2018 through March 2021. In addition, China extended subsidies on all unconventional production through 2023 and, for the first time, included tight gas (low-permeability natural gas found in reservoir rocks) as an unconventional natural gas source eligible to receive subsidies. China’s national oil companies accelerated their investments in upstream natural gas developments to respond to the government’s call in 2018 to ease future natural gas shortages and to make China more self-sufficient in natural gas resources.

Natural Gas Producing Areas of China

Sichuan Province possesses a large portion of China's natural gas reserves and annual production. There is also significant natural gas at the Daqing and Shengli northeastern oil fields. Other gas-producing areas include the coastal plain in Jiangsu, Shanghai, and Zhejiang; the Huabei complex in Hebei Province; and the Liaohe oil field in Liaoning Province. The Chinese hoped for a major discovery in the Zhongyuan Basin, a 5,180-square-kilometer area along the border of Henan and Shandong provinces. Major offshore reserves have been discovered. If successfully tapped, these could increase gas output by 50 percent. The largest unexploited natural gas potential is believed to be in Qinghai and Xinjiang. [Source: Library of Congress, 1987 *]

A lot of China's natural gas is in remote locations — particularly Xinjiang and Inner Mongolia — and require expensive pipelines to bring it to users. There are large reserves of natural gas in the Chuandongbei gas field near Chongqing in Sichuan. A $400 million pipeline was built there to carry the gas to central China. Beijing is currently getting natural gas from Shanxi. There are an estimated 28 billion cubic meters of natural gas in Xinjiang, 100 billion cubic 19 meters in Sichuan, and 200 million cubic meters in Inner Mongolia, as well as substantial natural gas reserves offshore. [Source: Library of Congress, August 2006]

China’s offshore natural gas production increased 10.5 percent from 2018 to 335 billion cubic feet in 2019, mostly from growth in the South China Sea. Natural gas is produced in the Yacheng gas field, 100 kilometers off the coast of Hainan Island. CNOOC, China’s major offshore producer, plans to commission the country’s second deepwater natural gas field, Lingshui 17-2, and the newly explored large Bozhong 19-4 natural gas and condensate field in the Bohai Bay in northeastern China by 2022.

Since July 2018, Chinese national energy producers have been expanding exploration and development both onshore and offshore, leading to several major discoveries such as conventional gas deposits in the Tarim basin in the northwest and shale gas prospects in Sichuan basin in the southwest. [Source: Chen Aizhu, Reuters, October 30, 2019]

Consumption of Natural Gas in China

China’s government anticipates boosting the share of natural gas as part of total energy consumption from almost 8 percent in 2019 to 10 percent by 2020 and 14 percent by 2030 to alleviate the elevated levels of pollution resulting from the country’s heavy coal use. Although natural gas is still a small contributor to China’s overall energy portfolio, it is swiftly becoming an important fuel source, and China is now one of the fastest-growing natural gas markets in the world. [Source: U.S. Energy Information Administration country analysis briefs, September 30, 2020]

China’s natural gas consumption rose by 9 percent in 2019 to 10.8 trillion cubic feet from 9.9 trillion cubic feet in 2018. Several factors have contributed to robust growth in natural gas consumption during the past few years. Poor air quality, particularly in urban areas of northeastern China, where excessive coal use in the winter causes smog and dangerous levels of pollution, prompted the government to enforce fuel switching from coal to natural gas for industrial use, power generation, and residential and commercial heating. Strict environmental targets set by the central government in 2017 created a surge in natural gas demand by northern cities during peak demand use in the winter months in 2017 and 2018. Other demand drivers were low natural gas prices, higher natural gas use in the transportation sector, and the expansion of natural gas infrastructure to relieve supply bottlenecks and to transport natural gas to demand centers.

China relaxed its coal-to-gas switching program at the end of 2018 to alleviate natural gas shortages that occurred in the winter of 2017–18, particularly in northern cities. This policy shift and slower economic growth caused the pace of China’s natural gas demand growth in 2019 to decelerate from significantly higher growth in 2017 and 2018.

Natural gas is generally more expensive than coal and continues to face supply constraints because of insufficient storage, import terminals, and pipeline capacity. The rate of demand growth in the next few years is expected to depend on China’s environmental policies in the power sector and increased coal-to-gas switching for households and industries. The rate of demand growth also likely depends on the pace at which China can build its natural gas infrastructure. The response to the COVID-19 pandemic is expected to adversely affect China’s natural gas demand growth, especially for the industrial, commercial, and transportation sectors, in the first part of 2020.

China’s Switch from Coal to Natural Gas

China is currently in the process of reducing its greenhouse gas and carbon dioxide emmission and shifting its economic model to emphasize services and local consumption rather than manufacturing and heavy industries to propel growth. Part of this process involves a switch from coal, which currently accounts for more than 60 percent of the country’s energy mix and a large chunk of its carbon dioxide emission, , to natural gas, viewed as a cleaner and more environmentally friendly fuel. Beijing is also taking steps to stimulate the consumption of gas. In 2015, it reduced gas prices twice in order to encourage users to make the switch. As of the mid 2010s there was a healthy demand for gas, supported by continuing government measures, such as incentives for gas-fueled power plants and price cuts. [Source: Irina Slav, Oilprice.com, April 22, 2016]

China is the world's largest energy consumer and biggest emitter of climate warming greenhouse gases. It has vowed to bring its total carbon emissions to a peak before 2030 and to be carbon neutral by 2060. Natural gas is expected to be a key bridge fuel in the 2020s and 2030s. In April 2016, OilPrice.com reported: Sinopec, one of China’s top energy companies, received the first LNG cargo at its new import terminal in Beihai. The company is now moving full speed ahead with plans for three more terminals across the country in a major shift from coal to gas. The LNG will be re-gasified at the new terminal and then supplied to household consumers in the regions of Guangdong and Guangxi, in southern China. The facility has an annual processing capacity of three million tons of LNG. The first cargo, from Australia-Pacific LNG, was 160,000 cubic meters. Beihai is the second LNG import terminal of a total of five terminals Sinopec plans to build across the country. The first started operations last year, at the port on Qingdao, and the other three will be built at Tianjin, Jiangsu and Zhejiang.

In June 2021, an official at China National Petroleum Corp (CNPC) said China plans to cut its coal use to 44 percent of energy consumption by 2030 and 8 percent by 2060 with a large portion of the reduction coming from the use of more natural gas to achieve its climate change goals. China is expected to increase the use of natural gas in its primary energy mix to 12 percent in 2030 from 8.7 percent in 2020, said Zhu Xingshan, senior director, Planning Department CNPC. He added that the share of natural gas in energy consumption is expected to increase "significantly" from 2030 to 2035. The energy giant expects coal to make up 44 percent, petroleum at 18 percent, natural gas at 12 percent and non-fossil fuel to make up 26 percent of the total energy mix in 2030. The estimates for 2060 were coal at 8 percent, petroleum at 6 percent, natural gas at 11 percent and non-fossil fuel at 75 percent of the total energy mix. China lowered the share of coal use in its primary energy mix to 56.8 percent in 2020, from around 68 percent at the beginning of the previous decade and expects this share to fall to below 56 percent in 2021. [Source: Reuters, June 24, 2021]

Competition Between Coal and Natural Gas in China

According to Reuters: The huge growth potential of natural gas still faces stiff competition from coal as a fuel for power generation and heating as China advances low-emission, or so-called "clean-coal" technology, said Ling Xiao, a vice president of China's top oil and gas producer, addressing an industry gathering in Singapore. [Source: Chen Aizhu, Reuters, October 30, 2019]

“Meeting part of that demand surge, gas from Russia's Siberia fields is due to start arriving at the Chinese border from December. That supply, however, is more costly than the domestic wholesale benchmark, meaning PetroChina as the contractual buyer of the gas will incur losses in marketing the fuel, said Ling. "It's slightly cheaper than central Asian gas but PetroChina will still be making a loss as it (the price) exceeds that of domestic city-gate benchmark rates," Ling told Reuters.

Natural Gas Imports by China

To fill the widening gap between China’s domestic natural gas production and demand, the industry has relied on an increasing amount of pipeline imports and liquefied natural gas (LNG) trade. In 2019, China, the largest natural gas importer in the world, imported 4.6 Trillion cubic feet, 7 percent higher than 2018 levels. LNG imports account for 62 percent of the total, and pipeline imports, mostly from Turkmenistan, account for 38 percent. [Source: U.S. Energy Information Administration country analysis briefs, September 30, 2020 ++]

China began importing LNG in the mid 2000s and was importing 20 million tons within five years. China surpassed South Korea and became the second-largest LNG importer after Japan in 2017. LNG imports climbed to 2.9 Trillion cubic feet in 2019, rising 13 percent from 2018 levels. LNG imports have sharply accelerated each year since 2015 as a result of lower global LNG prices and China’s coal-to-gas switching policies.

China's total natural gas imports increased by 19.9 percent year on year in 2012, with pipeline gas imports rising more than 22 percent year on year and LNG imports growing more than 18 percent year on year, according to General Administration of Customs data.

As of late 2019, China had 21 LNG regasification terminals with a combined capacity of 3.5 Trillion cubic feet. China is quickly building various terminals along its entire coastline, and another 1.9 Trillion cubic feet is under construction and slated to come online by 2023. China’s rapidly growing natural gas demand during the past few years has opened up opportunities for independent or non-national oil company Chinese energy companies to operate in the LNG space. Several local state-owned municipalities, natural gas distributors, and power developers own stakes in existing LNG terminals. In 2019, the government renewed an initiative in 2014 to allow access rights to third-party companies for supplying natural gas to LNG terminals, providing more supply opportunities for firms involved along the entire LNG supply chain, from the upstream natural gas procurement to the downstream distribution. CNOOC has signed several LNG third-party access deals with various independent companies since late 2018, and it released third-party access bids on the Shanghai Petroleum and Gas Exchange in early 2019. ++

Sources of China’s Natural Gas Imports

China imports liquified natural gas from Australia, Russia, the U.S., Indonesia and the Middle East. The first shipments came from Australia and were handled at facilities in Guangdong. Another terminal was built in Jilian to take in imports from Indonesia. In 2007, construction began on a large natural gas terminal outside Shanghai. It is expected to be operational in 2009. About two dozens similar facilities are either under construction or proposed in 2010.

In August 2009, PetroChina signed a $41 billion natural gas deal with Australia to buy gas from the Gorgin gas field off Australia’s far northwest coast. In October 2009, China and Russian decided that the price of gas coming from Russia would be based on the price of oil on the Asian market. Russia’s Gazprom and the China National Petroleum Corporation agreed that China would be supplied with 70 billion cubic meters of gas a year. Gazprom had wanted to charge China the same market-based prices that had caused such hardship in Europe. China bargained hard to get the deal it got.

According to S&P Global Commodity Insights: Australia was still China's largest natural gas supplier, sending 31,343 million metric ton of LNG in 2021, which accounted for 39.3 percent of the country's total LNG imports, down from 43.3 percent in 2020. Meanwhile, LNG imports from US saw the biggest year-on-year jump, rising 187.4 percent to 9.21 million metric tons in 2021, which accounts for 11.6 percent of China's total LNG imports in the year, up from 4.8 percent in 2020. China's natural gas imports from Russia rose 50.5 percent year on year in 2021, with pipeline gas volume surging 154.2 percent year on year to 7.54 million metric tons while LNG imports fell 9.9 percent year on year to 4.58 million mt, according to the data. [Source: S&P Global Commodity Insights. January 20 2022]

China has diversified its LNG suppliers during the past few years. Australia was the largest supplier, at 46 percent, in 2019. Purchases from new natural gas liquefaction projects in Australia began in 2016. LNG imports from the United States grew rapidly in 2017 and 2018, reaching an average of 5 percent of China’s total LNG imports. However, U.S. imports slowed significantly after September 2018 when China imposed a 10 percent tariff on U.S. LNG shipments as part of the trade dispute between the two countries. [Source: U.S. Energy Information Administration country analysis briefs, September 30, 2020]

Natural gas pipeline imports fell slightly in 2019 to 1.7 Trillion cubic feet, most of which are from Turkmenistan. In April 2006, China and Turkmenistan signed a multi-billion deal for China to develop gas concessions and for Turkmenistan to sell natural gas to China and China would help Turkmenistan build a pipeline to deliver it. China has been invited to develop Bolivian gas fields.

Natural Gas in Waters Between Japan and China

Senkaku Islands map There are large undersea natural gas fields in waters claimed by both China and Japan in the East China Sea about halfway between Okinawa and the Chinese mainland. The Chunxiao and Tianwaitian natural gas fields lie in China’s exclusive economic zone. The Chunxiao field covers 8,500 square miles and holds up to 9 trillion cubic feet of gas, enough to meet China’s needs for seven years.

The area is near a group of disputed islands claimed by Japan and China known as the Senkaku to the Japanese, Diaoyu to the Chinese and Tiaoyutai to the Taiwanese. The actual line of demarcation of the boundary of the exclusive economic zones (EEZ) between China and Japan is a matter of dispute. Japan wants to make a deal but China seems more intent and trying to get away with as much as it can without actually violating international law. China so far has drilled only waters in its EEZ but it has angered Japan because these areas are so close to the disputed border.

See Separate Article SENKAKU-DIAOYU ISLANDS DISPUTE BETWEEN JAPAN AND CHINA factsanddetails.com

Domestic Natural Gas Pipelines in China

Natural gas pipelines: 76,000 kilometers (2018). [Source: CIA World Factbook, 2022]

China had 22,664 kilometers (14,083 miles) of pipeline for natural gas as of 2005. It planned to lay 150,000 kilometers (93.205 miles) of oil and gas pipelines between 2008 and 2020 to make sure energy supplies got to where they were needed. The Shaan–Jing pipeline is a natural gas pipeline which runs from Jingbian County to Beijing and Tianjin. The Zhongxian–Wuhan Pipeline is a natural gas pipeline, which connects Sichuan and Chongqing gas fields with users in Hubei and Hunan provinces. [Source: Wikipedia]

The $5.2 billion, 2,486-kilometer (1,544-mile) -long oil pipeline between Xinjiang and Shanghai began operating in September 2004. The pipeline runs from Pugang gas field in Dazhou, Sichuan Province, to Qingpu District of Shanghai. Shell and Exxon and the Russian’s gas giant Gazprom have stakes in it. It follows parts of the Silk Road and crosses the Yellow and Yangtze Rivers. The Sichuan–Shanghai gas pipeline is 1,702 kilometers (1,058 miles) long. An 842 kilometers (523 mile) long branch line connects Yichang in Hubei with Puyang in Henan Province. Two shorter branches are located near the Puguang gas field and one near Shanghai.

The West–East Gas Pipeline is a group of natural gas pipelines which run from the western part of China to the east. The construction of the West–East Gas Pipeline started in 2002 and was put into trial operation in October 2004. Full commercial supply of natural gas began in January 2005. The pipeline is owned and operated by PetroChina West–East Gas Pipeline Company, a subsidiary of PetroChina. Originally, it was agreed that PetroChina would have owned 50 percent of the pipeline, while Royal Dutch Shell, Gazprom, and ExxonMobil had been slated to hold 15 percent each, and Sinopec 5 percent. However, in August 2004, the joint venture framework agreement was terminated.

China’s domestic pipeline infrastructure is undergoing significant development, and the government’s goals are to increase the country’s natural gas pipeline coverage and to improve market competition along the value chain of natural gas sales. The government created a national oil and natural gas pipeline company, PipeChina, in December 2019. In the next few years, China is set to separate the national oil companies’ upstream, midstream, and downstream pipeline sectors and allow open access to companies on the national pipeline. In addition, in 2019, China began to allow foreign companies to invest in city natural gas distribution pipelines to facilitate greater investment levels and faster infrastructure development. [Source: U.S. Energy Information Administration country analysis briefs, September 30, 2020]

Pipelines Bringing Imported Natural Gas to China

The Central Asia–China gas pipeline (known also as Turkmenistan–China gas pipeline) is a 1833-kilometer (1,139-mile) -long natural gas pipeline between Turkmenistan and Xinjiang in western China via Uzbekistan and Kazakhstan. It opened in December 2009 and was expected to reach full annual capacity of 40 billion cubic meters by 2012-2013. Before the pipeline Turkmenistan gas was largely controlled by Russia. The Turkmenistan pipeline connects Turkmenistan to China’s domestic grid, making it possible to transport gas some 7000 kilometers from Turkmenistan to Shanghai. More than half of Turkmen natural gas exports are delivered to China through the pipeline.

Sino-Myanmar pipelines refers to the oil and natural gas pipelines linking Myanmar's deep-water port of Kyaukphyu (Sittwe) in the Bay of Bengal with Kunming in Yunnan province of China. In November 2007, China and Kazakhstan agreed to construct a natural gas pipeline in 2008-2009 that would connect with the Turkmenistan pipeline and bring Caspian Sea gas to China. Before Kazakhstan and Turkmenistan relied on pipelines controlled by the Russian Gazprom monopoly, to get their gas to China. .

The Altai gas pipeline (also known as Power of Siberia 2) is a proposed natural gas pipeline to export natural gas from Russia's Western Siberia to North-Western China. There are proposals for pipelines than can deliver natural gas to northern China from Siberia. China was expected to enter the Sakhalin Island gas project in Russia.

In November 2014. Russian President Vladimir Putin and Chinese leader Xi Jinping signed a memorandum of understanding for the pipeline, which is slated to make China the biggest consumer of Russian gas. The new supply line comes in addition to the “eastern” route, through the “Power of Siberia” pipeline, which will annually deliver 38 billion cubic meters of gas to China. Work on that pipeline route has already begun after a $400 billion deal was sealed in May 2014. [Source: rt.com, November 9, 2014]

China began importing natural gas from Russia through the Power of Siberia pipeline in December 2019. According to 2014 deal China will import an average of 1.3 Trillion cubic feet per year of natural gas from Gazprom’s East Siberian fields for 30 years. Russia expects to ramp up supplies during the next few years and send 530 million cubic feet by 2022. Russia’s portion of the pipeline project to the Chinese border came online at the end of 2019. China plans to expand its side of the pipeline, which will deliver natural gas to Beijing and other demand centers, in late 2020. This new supply of natural gas from Russia will compete with the LNG imports into northern China and diversify China’s natural gas supply.

LNG will also encounter more competition from Line D, the fourth pipeline of the Central Asia-China Pipeline system, in the next several years. This pipeline is slated to add another 1.1 Trillion cubic feet of capacity and increase the amount of natural gas from Turkmenistan to 2.3 trillion cubic feet per year (Trillion cubic feet per year). Line D is scheduled to come online as early as 2022, but it has encountered several delays in the past few years. China extended another contract with Kazakhstan and doubled the amount of imported natural gas to 350 billion cubic feet per year until 2023.56

Russian gas giant Gazprom was slated to supply China about 5 billion cubic meters of gas in 2020 via the 'Power of Siberia' project, but the full ramp-up to the designed annual capacity of 38 billion cubic meters will depend on the cost of gas and how affordable that is to Chinese consumers. [Source: Chen Aizhu, Reuters, October 30, 2019]

Natural Gas Disasters in China

Gas explosion at Xuanhan in Sichuan

In December 2003, an explosion of a natural gas well near Chongqing in Sichuan in central China, killed 198 people and produced poisonous fumes that caused 40,000 to be evacuated from their homes. Most died from inhaling the poisonous fumes, mainly hydrogen sulfide gas. The explosion was described as the worst industrial accident in China’s history.

Many of the dead were elderly people and children. In some cases entire families died. More than 9,000 people were treated for gas poisoning after inhaling hydrogen sulfide leaking out the well, which workers had great difficulty capping. Survivors said the gas smelled like rotten eggs and caused their eyes to burn as if someone had thrown hot pepper in them.

A “death zone” of 10 square miles was created around the well that exploded. The gas itself was heavier than air and thus stayed close the ground where its was most dangerous to people when it spread. Visitors to the area described dead people lying face down in front of their homes and dead livestock everywhere, many with white foam coming out their nostrils. One survivor said she grabbed her 5-year-old daughter and ran as fast as she could from the site but the child stopped breathing by the time they reached safety.

The disaster occurred after a drilling accident and was made worse by the remote location of the well. Six gas company workers were blamed for negligence and were given prison terms of between three and six years. To prevent the spread of toxic fume the gas was set on fire. The capping was done by men in earthmover equipment, dressed in protective suits and respirators, who poured concrete and mud down the well.

In 1997, a gas explosion in a gas field in Kaiching in Sichuan killed 11 people. A similar accident in September 1992 in Hebei killed six people.

Image Sources: University of Washington; Landsberger Posters http://www.iisg.nl/~landsberger/

Text Sources: New York Times, Washington Post, Los Angeles Times, Times of London, National Geographic, The New Yorker, Time, Newsweek, Reuters, AP, Lonely Planet Guides, Compton’s Encyclopedia and various books and other publications.

Last updated June 2022