SHORTAGES AND HIGH PRICES OF RARE EARTHS

rare earths are used

in precision -guided bombs As China has cracked down on illegal rare-earth mining operations that have cropped up because of high demand, shipments of the materials have dwindled and prices have soared. Cerium, for example, jumped more than 600 percent , from less than $10 a kilogram to nearly $70 in 2010. Tim Folger wrote in National Geographic, “Fears of future shortages have sent prices soaring. Dysprosium,used in computer hard drives, now sells for $212 a pound, up from $6.77 eight years ago. Over just two months last summer, prices on cerium jumped more than 450 percent. [Source: Tim Folger, National Geographic, June 2011 ]

World demand will probably exceed supply before the end of 2011, says Mark A. Smith, president and CEO of Molycorp, an American company that reopened a rare earth mine at Mountain Pass, California. "We're in a supply crunch right now, and it's a pretty severe one," says Smith. "This year the demand will be 55,000 to 60,000 tons outside of China, and everyone's best guess right now is that China will be exporting about 24,000 tons of material. We'll survive because of industry inventories and government stockpiles, but I think 2011 will be a very, very critical year in terms of supply and demand."

Rare earth shortages could cause companies already weakened by the recession to shrivel or stall, industry officials say. "The use of these materials has really skyrocketed, with demand outstripping supply literally overnight," Smith told the Los Angeles Times . "We've got some serious issues in this industry.” The supply squeeze has raised tensions in the delicate relationship between the U.S. clean-tech industry and its Asian counterpart. The U.S. trade representative's office has said that if China continues to rebuff requests to ease export limits on rare earths, it may take the dispute to the World Trade Organization.

Japan's Showa Denko group has a rare earth materials processing plant in the the Baotou region of Inner Mongolia. Prices of rare earths are now higher than silver, Takahito Moriya, president of the group's Chinese arm, told the Yomiuri Shimbun in late 2011. Silver is priced at about 80,000 yen per kilogram. "In this plant, they [rare earths] are stored separately under strict watch to prevent theft," he said. [Source: Yomiuri Shimbun, December 19, 2011]

Exports and China Cuts Quotas of Rare Earths

used in energy-saving

lightbulbs China’s rare earth exports (50,000 tons in 2009): 1) Japan (56 percent); 2) the United States (17 percent); 3) France (6 percent); 4) Others (21 percent). [Source: Japan’s Economy, Trade and Industry Ministry]

China's rare earth exports in 2010 decreased by 40 percent from a year before to about 30,000 tons. Exports were cut, in effect, by a further 20 percent in 2011. As a result, domestic Chinese companies have been able to procure rare earths at relatively low prices despite the rapid increase of global prices. Tim Folger wrote in National Geographic, China “rattled global markets in the fall of 2010 when it cut off shipments to Japan for a month during a diplomatic dispute. Over the next decade China is expected to steadily reduce rare earth exports in order to protect the supplies of its own rapidly growing industries, which already consume about 60 percent of the rare earths produced in the country. [Source: Tim Folger, National Geographic, June 2011 ]

Between 2006 and 2009 China cut export quotas of rare earths by five to 10 percent a year. In September, 2009, China said that it would limit exports of rare earths to boost prices and conserve supplies and consolidate and merge mines to make them more efficient and presumably easier to control. Earlier in the year China dramatically reduced its export quotas for rare earths. These moves are also expected to give Chinese manufacturers easier access to rare metals and this give them a edge over foreign competitors.

Yoichi Saito, head of the rare earth division at Mitsui trading, told the Times of London, Beijing has a two-fold strategy: 1) to give Chinese high-tech industries an advantage over rivals; and 2) to encourage foreign high-tech companies to set up research facilities and manufacturing centers in China to circumvent quotas — both of which will help the Chinese economy, create jobs and give China more technological know-how.

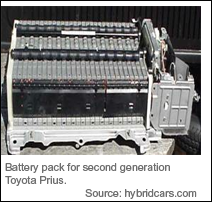

prius battery In September 2010 — during a major diplomatic row that occurred after a Chinese trawler rammed into two Japanese Coast Guard vessels in waters near islands claimed by Japan and China — China imposed an effective ban on the exports of rare earths by initiating customs procedures such as requiring documents to be in Chinese, a deviation for usual practices, that halted the shipments.All 31 Japanese companies involved in the rare trade said their businesses had been hampered by the Chinese export restrictions.

In October 2010, China said it would cut rare earth quotas in 2011 but only by a small amount after slashing them in 2010. The Chinese government said the decision was base on environmental concerns. The real reason though analysts was to give a boost domestic companies that use the minerals

In October 2010, China halted the shipment of some are earths to the United States, according to the New York Times, that appeared to be a retaliation over a U.S. investigation into alleged Chinese subsidies into he green technology sector. Full shipments of rare earths were resumed in late October without official acknowledgment from Beijing or any explanation for customs agents at China’s ports. The exports had been suspended since September 21 for Japan and October 18 for the United States and Europe.

China Cuts Quotas of Rare Earths by 35 Percent in 2011

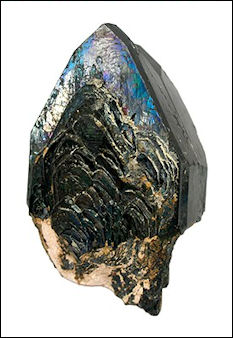

Manganotantalite China cut rare earth quotas by 35 percent in 2011 from the previous year. In the first round of permits issued for 2011, 14,446 metric tons of rare earths was allocated and split among 31 companies, of which nine are non-Chinese, including two that are Japanese. In April 2011, China upped the rare earth tax by over 10 times from 3 yuan a ton to between 30 yuan ($4.50) and 60 yuan per ton. Although China has enough rare earths to meet world demand many times over it is expected to only export 38,000 tons — less than the quantity that Japan alone needs — in 2011.

Experts said China did this to maximize profit, strengthen home-grown high-tech industries and force other nations to help maintain the global supply. Nigel Tunna of the market-analysis firm Metal-Pages told AFP. “They’re realizing they need the things themselves and there is not as great a value in exporting raw materials as there is in putting added value into them within China...That has been the main driver behind the whole process.”

Some Chinese felt that in the past China had been “selling gold to foreigners at the price of Chinese radishes.” In December 2010, January hiked the rare earth duty to 25 percent. The same month the United States said it would lodge a complaint with the WTO if China refused to eliminate export restraints on rare earths.

In February 2011 as part of its five-year development strategy China promised to “reasonably set annual quotas for production and export” but gave no details as the amounts involved. It also said it would tighten environmental controls, block unauthorized production, encourage mines to increase production and “establish the healthy development of the rare earths industry with appropriate development orderly production, high utilization and technological advancement.”

High Rare Earths Prices

China’s tariffs and quotas have curtailing global supplies, forcing prices to rise eightfold to fortyfold.

Prices of rare earths have surged. Between May 2010 and August 2011 the price of neodymium, which is used to produce magnets, rose more than 10-fold to about $460 per kilogram. Cerium, which is used as an abrasive agent, soared 28-fold to about $140 per kilogram.

Keith Bradsher wrote in the New York Times, “Hedge funds and other speculators have been buying and hoarding rare earths this year, with prices rising particularly quickly through early August, and dipping since then as some have sold their inventories to take profits, said Constantine Karayannopoulos, the chief executive of Neo Material Technologies, a Canadian company that is one of the largest processors in China of raw rare earths. “The real hot money got into the industry building neodymium and europium inventories in Shanghai warehouses,” he said. [Source: Keith Bradsher, New York Times, September 15, 2011]

Impact of High Rare Earths Prices

Soaring rare earth prices have affected a number of industries. “The high cost of rare earths is having a significant chilling effect on wind turbine and electric motor production in spite of offsetting government subsidies for green tech products,” Michael N. Silver, chairman and chief executive of American Elements, a chemical company based in Los Angeles, told the New York Times. It supplies rare earths and other high-tech materials to a wide range of American and foreign businesses. [Source: Keith Bradsher, New York Times, September 15, 2011]

The taxes and quotas China had in place to restrict rare earth exports caused many companies to move their factories to China from the United States and Europe so that they could secure a reliable and inexpensive source of raw materials.

Impact of High Rare Earths Prices on Light Bulbs

In September 2011, Keith Bradsher wrote in the New York Times, “In the name of fighting pollution, China has sent the price of compact fluorescent light bulbs soaring in the United States. By closing or nationalizing dozens of the producers of rare earth metals — which are used in energy-efficient bulbs and many other green-energy products — China is temporarily shutting down most of the industry and crimping the global supply of the vital resources. [Source: Keith Bradsher, New York Times, September 15, 2011]

General Electric, facing complaints in the United States about rising prices for its compact fluorescent bulbs, recently noted in a statement that if the rate of inflation over the last 12 months on the rare earth element europium oxide had been applied to a $2 cup of coffee, that coffee would now cost $24.55. An 11-watt G.E. compact fluorescent bulb — the lighting equivalent of a 40-watt incandescent bulb — was priced at $15.88 on Wal-Mart’s Web site.

Wal-Mart, which has made a big push for compact fluorescent bulbs, acknowledged that it needed to raise prices on some brands lately. “Obviously we don’t want to pass along price increases to our customers, but occasionally market conditions require it,” Tara Raddohl, a spokeswoman, said. The Chinese actions on rare earths were a prime topic of conversation at a conference here on Thursday that was organized by Metal-Pages, an industry data firm based in London.

But with light bulbs, especially, the timing of the latest price increases is politically awkward for the lighting industry and for environmentalists who backed a shift to energy-efficient lighting. In January 2012, legislation signed into law in 2007 will begin phasing out traditional incandescent bulbs in favor of spiral compact fluorescent bulbs, light-emitting diodes and other technologies. The European Union has also mandated a switch from incandescent bulbs to energy-efficient lighting.

Over-Production of Rare Earths in China

Allanite with rock In August 2011, the Japanese newspaper the Yomiuri Shimbun reported, “The Chinese government has stepped up efforts to further restrict rare earth production and plans to have mining and refining firms in the nation adhere to a government-set production schedule. According to Japan’s Economy, Trade and Industry Ministry, China's planned production of rare earths in 2010 was 89,200 tons, but the actual volume was estimated at between 120,000 tons and 130,000 tons--about 30 percent to 40 percent more. [Source: Yomiuri Shimbun, August 30, 2011]

The Chinese government has instructed rare earth-producing companies to conduct on-the-spot inspections to facilitate accurate accounting of the government's output quotas, sources said. Companies that exceed the government-set limit will face punishments, such as being ordered to halt production or have their facilities confiscated, sources said. By increasing its control of rare earths production, which are also considered strategic goods, the Chinese government aims to keep prices high. Some rare earth companies have downsized their production systems, observers said.

In a part of Jiangxi Province, a major mining site of the rare earth dysprosium, which is used to produce high-performance magnets in motors, the local government has decided to stop production by the end of this year. The current dysprosium inventory for Japanese-affiliated companies is expected to last for about two years, but shortages in supply may become more severe afterward. An official of major manufacturer Showa Denko K.K. said, "There are moves to develop mines in Vietnam and some other countries, but it would take four to five years until supplies from those nations began."

China’s Advantage in Rare Earths Declines

In October 2012, Howard Schneider wrote in the Washington Post: “Two years after China limited its exports of “rare earth minerals,” unnerving developed countries that depended on them for industrial uses, production is expanding at sites outside China. And as new sources of rare earth minerals have appeared, that has meant new jobs — including in the tiny town of China Grove, N.C., where Japan’s Hitachi Metals is planning to produce high-tech magnets from rare earth minerals. [Source: Howard Schneider, Washington Post, October 26, 2012]

The Hitachi plant and its 70 new manufacturing jobs are a small example of how market forces can sometimes undercut China’s trade clout. In recent years, China has dominated the production of these magnets, in part because the country has had a virtual monopoly on the mining and refining of the rare earth elements used in their production. Hitachi Metals produces magnets that it hopes to sell to the makers of hybrid and electric cars. “Just like any other supplier, we are trying not to be dependent on Chinese sources,” said Koshi Okamoto, executive director of New York-based Hitachi Metals America. “Reliable sources of supply are clearly one of the top priorities.” North Carolina Secretary of Commerce J. Keith Crisco said.

Colorado-based Molycorp, along with firms in Australia and elsewhere, were reshaping the landscape. Molycorp reopened a rare earth mine in Mountain Pass, Calif., that had been shuttered a decade ago because the supply of the minerals coming from China was so cheap. Molycorp President Mark A. Smith said the company, which has scaled up employment at the mine from 55 to 420 in recent years, aims to produce as much as 40,000 metric tons a year by 2013, accounting for about 30 percent of projected world supply. As important, he said, the company recently acquired China-based Neo Materials and with it the technology needed to provide the more purely refined rare earth oxides used in computer, defense and telecommunications equipment.

At the peak of China’s influence on the market, he said, companies could get rare earth materials about 40 percent cheaper there than elsewhere. China used that advantage to recruit firms to the industrial regions near the source of the materials. Smith said the Chinese price and the world price have now nearly converged, and he predicted more announcements like Hitachi’s. “As you see that diversity of supply, you’ll see R&D come back, and you’ll see manufacturing come back,” Smith said.

China Orders Even Tighter Controls on Rare Earths for Environmental Reasons

-240684.jpg)

Cerium ore In September 2011, China ordered even tighter controls on rare earths.Keith Bradsher wrote in the New York Times, “China says it is cutting rare earth production to improve pollution controls in a notoriously toxic mining and processing industry. China says it has largely shut down its rare earth industry for three months in 2011 to address pollution problems. [Source: Keith Bradsher, New York Times, September 15, 2011]

Chinese officials said the government was worried about polluted water, polluted air and radioactive residues from the rare earth industry, particularly among many small and private companies, some of which operate without the proper licenses. Most of the country’s rare earth factories have been closed since early August, including those under government control, to allow for installation of pollution control equipment that must be in place by Oct. 1, executives and regulators said.

The government is determined to clean up the industry, said Xu Xu, chairman of the China Chamber of Commerce of Metals, Minerals and Chemicals Importers and Exporters, a government-controlled group that oversees the rare earth industry. “The entrepreneurs don’t care about environmental problems, don’t care about labor problems and don’t care about their social responsibility,” he said. “And now we have to educate them.”

Beijing authorities are creating a single government-controlled monopoly, Bao Gang Rare Earth, to mine and process ore in northern China, the region that accounts for two-thirds of China’s output. The government is ordering 31 mostly private rare earth processing companies to close this year in that region and is forcing four other companies into mergers with Bao Gang, said Li Zhong, the vice general manager of Bao Gang Rare Earth.

The government also plans to consolidate 80 percent of the production from southern China, which produces the rest of China’s rare earths, into three companies within the next year or two, Mr. Li said. All three of these companies are former ministries of the Chinese government that were spun out as corporations, and the central government still owns most of the shares.

China Cuts Rare-Earths Mine Permits 41 Percent to Boost Control

In September 2012, Bloomberg reported: “China reduced the number of permits to mine rare earths by 41 percent, tightening production of the metallic elements used in batteries and magnets. China issued 67 mining licenses for rare earths and 10 exploration permits, the Ministry of Land and Resources said in a statement. The nation previously had 113 mining licenses, said Wei Chishan, a Shanghai-based analyst at SMM Information & Technology Co. [Source: Bloomberg, September 14, 2012]

“The goal appears to be to gain greater control over the production of rare earths by putting that production largely into the hands of companies that are large enough to not have any real incentive to cheat on their production or export quotas,” Jonathan Hykawy, a Toronto-based analyst at Byron Capital Markets Ltd., said in an e-mail.

China’s eastern province of Jiangxi, which focuses on the production of so-called mid-to-heavy rare earths, had the most number of mining licenses withdrawn, Cai Hongyu, a Hong Kong- based analyst with China International Capital Corp., said. The cut would benefit rivals including Xiamen Tungsten Co. and Rising Nonferrous, she said.

Rare-earth prices surged in 2011 after the Chinese government said it would restrict exports. Since then prices have dropped as users work through stockpiles, Byron Capital’s Hykawy said. Neodymium oxide produced in Inner Mongolia has dropped 63 percent between September 2011 and September 2012 to 425,000 yuan ($67,130) a metric ton, according to data from Shanghai Steelhome Information. Lanthanum oxide fell 55 percent to 62,500 yuan. China said in July 2010 that it would cut rare-earth export quotas to allow it to close polluting and inefficient mines while continuing to meet domestic needs.

Rare Earth Production Cuts in Inner Mongolia

Mamoru Kurihara, “China has a near monopoly in the global production of rare earths, and the Inner Mongolia Autonomous Region of China produces most of the country's rare earths. One city in the region, Baotou, which has a population of about 2.7 million, calls itself "a city of rare earths." The city hosts 75 related companies, including China's biggest rare earth-producing firm, Baotou Iron & Steel (Group) Co. Numerous luxury cars and skyscrapers can be seen in the city, which at night is bathed in light from neon signs. [Source: Mamoru Kurihara, Yomiuri Shimbun, December 19, 2011]

The area was once known as a production center of such rare earths as neodymium, which is essential for the manufacture of small magnets for motors. However, the Chinese government has strictly limited production of rare earths in the area since 2008, citing such reasons as environmental protection. As a result, industrial complexes of material-processing companies that use rare earths have been struggling to procure supplies.

An Sihu, assistance director of the Administration Committee of the Baotou National Rare-Earth Hi-Tech Industrial Development Zone, said, "We have stopped production because mining companies are unable to meet environmental standards. Their facilities will be improved in a year or two to meet the standards." An's statement suggests the committee has no plans to soon increase production at the mine.

Rare Earth Production is Suspended in Inner Mongolia

In October 2012, Joe McDonald of Associated Press wrote: China's biggest rare earths producer has suspended production in an effort to shore up plunging prices of the materials used by makers of mobile phones and other high-tech products. State-owned Baotou Steel Rare Earth (Group) Hi-tech Co. said that it suspended production to promote "healthy development" of rare earths prices. It gave no indication when production would resume. [Source: Joe McDonald, Associated Press, October 25, 2012]

Beijing is tightening control over rare earths mining and exports to capture more of the profits that flow to Western makers of lightweight batteries and other products made of rare earths. It also is trying to force Chinese rare earths miners and processors to consolidate into a handful of government-controlled groups. Baotou Steel Rare Earth announced a similar one-month halt to production in October 2011, also in an attempt to push up prices by reducing supplies.

The global economic slowdown has hurt demand, pushing down rare earths prices. Some manufacturers have been prompted by the Chinese controls to switch to alternative materials. Beijing's trading partners complain its export controls push up rare earths prices abroad and give buyers in China an unfair advantage. The price of one rare earth, lanthanum oxide, fell 65 percent on global markets between January and October 2012 year to $15 per kilogram, according to Lynas Corp., an Australian miner. But that still is nearly double price of $9 per kilogram paid by buyers in China. Other rare earths have shown similar price declines and a wide margin between prices in China and abroad.

WTO Action Against China on Rare Earths

Monazite Keith Bradsher wrote in the New York Times, “By invoking environmental concerns, China could potentially try to circumvent international trade rules that are supposed to prohibit export restrictions of vital materials. But the moves also have potential international trade implications and have started yet another round of price increases for rare earths, which are vital for green-energy products including giant wind turbines, hybrid gasoline-electric cars and compact fluorescent bulbs. [Source: Keith Bradsher, New York Times, September 15, 2011]

In July, the European Union said in a statement on rare earth policy that the organization supported efforts to protect the environment, but that discrimination against foreign buyers of rare earths was not allowed under World Trade Organization rules. Even before this latest move by China, the United States and the European Union were preparing to file a case at the W.T.O. this winter that would challenge Chinese export taxes and export quotas on rare earths.

China promised when it joined the W.T.O. in 2001 that it would not restrict exports except for a handful of obscure materials. Rare earths were not among the exceptions. But even if the W.T.O. orders China to dismantle its export tariffs and quotas, the industry consolidation now under way could enable China to retain tight control over exports and continue to put pressure on foreign companies to relocate to China. The four state-owned companies might limit sales to foreign buyers, a tactic that would be hard to address through the W.T.O., Western trade officials said.

Japan, E.U. and the U.S. File a WTO Suit Again China on Rare Earths

In March 2012, the Yomiuri Shimbun reported: Japan, the European Union and the United States will jointly file complaints against China's export restrictions on rare earths with the World Trade Organization on Tuesday, arguing such controls violate the world trade body's rules, sources have said. The complaint argues that companies in their countries are placed in an unfair competitive environment in comparison with Chinese companies, which are able to procure rare earths cheaply. [Source: Akihiro Okada, Hideyuki Ioka, Yomiuri Shimbun, March 14, 2012]

About 30 target items in the complaint will also include rare metals such as tungsten and molybdenum. China has been reducing its rare earth exports annually, causing prices of rare earth materials to rapidly increase. The Japanese government has been demanding the Chinese government lower its export controls. China reportedly started to regulate its rare earths exports to Japan after a September 2010 incident in which a Chinese fishing boat collided into Japan Coast Guard ships off the Senkaku Islands in Okinawa Prefecture.

As a reason for controlling its exports, China has argued that excessive mining would exhaust its rare earths reserves. It also has said environmental problems such as water contamination near mining sites are also causing it to restrict production.However, investigations by the Japanese government and others have led the three parties to judge these reasons alone cannot explain why the Chinese government gives preferential treatment to Chinese corporations, according to the sources.

The WTO's appeals panel in January upheld an earlier ruling that China restricted rare metal exports to protect domestic manufacturers. The export restrictions were brought to the WTO by the EU, Mexico and the United States. The ruling finalized China's loss in the appeal. This fact has pushed the three countries to take the joint action, the sources explained.

It seems likely that China will express strong opposition to the planned complaint, observers said. China is believed to argue its export controls do not violate WTO rules, saying they are aimed at preventing its rare earth resources from being depleted and conserving the environment around mines.

Trade dispute cases filed with the WTO are reviewed by a dispute settlement panel and an appellate body in a two-stage system. If the dispute is brought to the second stage, it will likely take about one year before a final conclusion is drawn. If China loses the case and the WTO recommends lifting export controls, the country--as a WTO member--is obliged to lift export restrictions in nine to 15 months. If China fails to correct export controls, its trade partners will be allowed to take retaliatory steps such as raising tariffs on imports from China.

As for rare metals whose exports had also been restricted by China, the WTO issued a report in late January recommending China lift restrictions. This makes it difficult for China to maintain its control of rare metal exports.

China Faces WTO Scrutiny over Exports of Rare Earths

The United States, the European Union and Japan have challenged China's rare earth quotas in the World Trade Organization as a violation of its free-trade commitments. Howard Schneider wrote in the Washington Post: “Alarmed over Chinese restrictions on rare earth exports, the United States, the European Union and Japan filed a World Trade Organization complaint alleging that China was using its monopoly over the minerals as a political and economic weapon — for instance, to punish Japan over its claims to contested islands in the South China Sea and to entice companies to relocate factories inside China by offering a cheaper supply of rare earth materials. Beijing has defended its controls as necessary to safeguard a scarce resource and minimize environmental damage from mining. [Source: Howard Schneider, Washington Post, October 26, 2012]

In July 2012, Jiji Press reported: “The World Trade Organization's Dispute Settlement Body decided to set up a panel to scrutinize China's measures to hold down its rare earth exports. Japan, the United States and the European Union have jointly submitted a proposal to set up the panel. It is the first time Japan has brought a case against China at the WTO. [Source: Jiji Press, July 24, 2012]

The three parties are critical of China's export duties on rare earths, tungsten and molybdenum, and its export quotas on them. They argue China has broken a pledge made when it joined the WTO to remove export taxes in principle. The Chinese measures cannot be regarded as exceptions, although export restrictions for environmental and resources protection are allowed under certain conditions, they said.

As China dominates global supplies of rare earths, which are used in a wide range of high-tech products, its export curbs are being blamed for a surge in international rare earth prices. During talks with the troika in April, China insisted the restrictions are for the protection of resources and sustainable development. The new panel will examine whether China's measures violate WTO rules. It is expected to draw up a report next year. In a similar rare earth case brought by the United States, the EU and Mexico in 2009, a higher WTO panel issued a ruling against China in January this year.

China Sets up Rare Earths Industry Group

In April 2012, Elaine Kurtenbach of AP wrote: China has set up a rare earths industry association to fend off trade complaints and help regulate the sector that is critical to global high-tech manufacturing. The Ministry of Industry and Information Technology announced the group's founding, saying it would coordinate mining, smelting and processing and seek to form a "reasonable price mechanism" for the materials, used in many high-tech applications. [Source: Elaine Kurtenbach, AP, April 10, 2012]

It said the group would help coordinate China's response to rare earth trade disputes such as a complaint alleging unfair market manipulation that was filed last month by the U.S., EU and Japan at the World Trade Organization. Beijing has imposed limits on rare earths production and exports, citing a need to impose order on an unruly domestic market and to reduce environmental damage, raising protests from Japan, the U.S. and other countries that rely on supplies from China. A key aim is to rein in wide swings in prices, said Heng Kun, a rare earth analyst at Essence Securities, based in Beijing. "The whole industry should just avoid price volatility. It does harm to all," he said.

Officials have denied accusations Beijing is using its quasi monopoly on the resources as a diplomatic bargaining chip, or to manipulate prices. "Many countries in the world have rare earth reserves, you cannot rely on China alone to provide all the supplies," the official Xinhua News Agency quoted the newly appointed head of the industry group, Gan Yong, as saying.

The rare earths association includes 155 companies, including state-owned giants like Aluminum Corp. of China and China Minmetals Corp., the ministry said in a statement on its website. Typically for China, central government policies aimed at curbing unlicensed mining and processing of rare earths had often gone unheeded by local level officials focused on maximizing tax revenues and creating jobs.

The new group could help regulators indirectly impose more "self-discipline" on the industry, Heng said. The MIIT said the new industry group aims to consolidate smaller companies into large corporations, promote the industry's restructuring and "strictly enforce the mandatory production plan." The newspaper China Business News reported Monday that only 56 of more than 350 rare earths producers had met environmental standards. It cited officials in Jiangxi province, where much of the mining is concentrated, as saying that the estimated costs for environmental repair, at 38 billion yuan ($6 billion), were much higher than profits earned over many years.

Image Sources: Wikipedia, Molycorp, New York Times, YouTube, Wiki Commons

Text Sources: New York Times, Washington Post, Los Angeles Times, Times of London, National Geographic, The New Yorker, Time, Newsweek, Reuters, AP, Lonely Planet Guides, Compton’s Encyclopedia and various books and other publications.

Last updated January 2013