CHINESE BUSINESS

Billboard in Shanghai The private sector now accounts for around 65 percent of GDP and 70 percent of tax revenues. Purely private firms accounted for 50 percent of China's GDP in the early 2000s and 20 percent in the late 1990s. There are tens of thousands of new private and quasi-private enterprises. According to one study 99 percent of new businesses in 2000 were private. They contributed 60 percent of China’s total output and export volume and employed 75 percent of the workforce. China surpassed Japan in trademark patent filings in 2009.

Stock and bond markets are just developing. Banks are the primary source of financing. Most investment is in the form of bank loans. In 2007, China passed a bankruptcy law to protect both creditors and workers and companies listed on the Chinese stock exchanges adopted international accounting standards as part of an effort to root out corruption and attract foreign investors.

In terms of capitalization China is home to some of the largest business entities in the world such as PetroChina, valued by some measures at $1 trillion, and Commercial Bank of China But it is often difficult to accurately determine the true value of Chinese companies their corporate structure and holdings are difficult to unravel and shares tend to be mostly in government hands.

Articles on CHINESE BUSINESS, TOURISM AND TRADE factsanddetails.com BUSINESS CUSTOMS IN CHINA Factsanddetails.com/China ; ECONOMICS AND STATISTICS factsanddetails.com ; WEALTHY IN CHINA: NUMBERS. HISTORY AND HOW THEY GOT RICH factsanddetails.com

Websites and Sources: U.S. China Business Council uschina.org ; Asian Development Bank adb.org ; World Bank China worldbank.org ; International Monetary Fund (IMF) on China imf.org/external/country/CHN ; U.S. Commerce Department on China: commerce.gov ; China’s National Bureau of Statistics stats.gov.cn/english Huang Yasheng, who teaches at the SloanSchool of Management at the Massachusetts Institute of Technology and is an expert on Chinese entrepreneurs.

Chinese Companies

Yang, Huiyan, China's richest person in 2007

Chinese companies are still developing. A study by IBM and Fudan University released in 2006 found that “Most Chinese companies remain small by global standards...Many Chinese manufacturers still compete on low-coast labor and aggressive pricing, rather than on innovation, branded products and services with higher profit margins. Companies picked as likely to succeed in the international market included the main oil companies, the telecommunications company Huawei, appliances makers Harier and Glaaz, the auto parts company Wamxi Group and carmakers Chery and Geely.

China’s top 500 manufacturing enterprises generate one third of the revenues generated by the country’s 250,000 enterprises. As of 2006, only 14 Chinese enterprises had revenues of more than $15 billion. The United States has ten times more.

China has had difficulty developing widely recognized brands. The only two are Haier and Lenovo. Unlike Japan and South Korea that spend a considerable amount of time developing their own companies China relies on companies from abroad to generate trade and growth.

A tradition of state-ownership and easy funding from state banks has produced inefficient companies. These days state-run companies can still gain access to government and bank funds while private companies are often denied access to these sources and must finance growth with their own earnings.

In 2006, the government announced it would help nurture 50 state-owned companies to help them become globally competitive while retaining control over therm because the were involved in strategic sectors such as defense, telecommunications, coal, civil aviation, and shipping.

Large Companies in China

China had seven companies on the Forbes list of the world’s leading companies in 2010, with the Industrial and Commercial Bank of China ranked No.5. By contrast only three Japanese companies made the list. In 2010, 71 Chinese companies made it into the Forbes list of Asia’s 200 top small and mid-size companies, down from 78 the previous year. By contrast Japan had two, South Korea had 20 and India had 39.

Two of the four biggest banks in the world are Chinese. Two of the ten biggest oil companies in the world are Chinese. The 34 Chinese companies on the Fortune 500 list basically operate in China only.The world's three biggest banks are Chinese, but none is among the world's top 50, ranked by the extent of their geographical spread.

China ranked fifth behind the United States, Japan , France and Germany on the Fortune 500 list of top global companies in 2009 with 37 companies making the list, compared to 140 in the United States, 68 in Japan and 49 in France. Sinopec (a Chinese oil company) was in the top 10. A third of the companies on Forbes list of the 50 large and profitable firms in the Asia-Pacific region are Chinese. Among them are Anhui Conch Cement, Agile Property Holdings, Digital China Holdings and Tencent Holdings.

China’s biggest and most powerful companies are largely controlled by sovereign wealth finds. China National Petroleum Corporation, China Mobile and Industrial and Commercial Bank of China are controlled by SASAC, China’s Assets Supervision and Administration Commission

As of 2006 there were 19 Chinese companies listed on the Fortune 500, up from three in 1995. The oil company Sinopec, China’s largest company, was ranked highest at 23rd. China has declared that it wants to have 50 companies in the Fortune 500 by 2010. To meet those goal the government is offering generous tax breaks, state-owned banks are offering cheap loans and diplomats are trying to use their political leverage to gain contacts abroad.

By 2007, seven of the 25 largest companies by market value in the world were Chinese See PetroChina an Exxon.

Liu Bolin, China’s Invisible Man artist

and his take on advertising

Insurance and Advertising in China

China’s insurance market expanded by 14.4 percent on 2006. Demand for insurance is increasing as the government has cut welfare and health benefits. There is a lot of potential for growth. As of 2008, only 4 percent of China’s 1.3 billion people had insurance,

In 2004, the insurance market in China was valued at $50 billion and was growing a rate of 20 percent a year, with 54 insurance companies. But overall it isn’t very profitable. As of 2003, the per-capita insurance premiums in China were $36 compared $227 in Malaysia.

Foreign insurance company began setting up shop in China in the early 1990s. China’s admittance to the WTO has meant that it has had to open its insurance markets further to foreign companies.

China Life is China’s No. 1 life insurer. It underwrites half the life insurance policies in China. When it debuted on the New York Stock exchange in December 2003, the company raised $3 billion and saw its stock jump 25 percent. In 2007, it recorded profits of $5.5 billion on strong growth in premiums and investments.

Ping An insurance is the China’s second largest insurer. It raised $5 billion with an IPO in February 2007. China Pacific Insurance is China’s third largest and fast growing insurer. It earned $4.1 billion and its stocked surged 61 percent when it debuted on the Shanghai Stock market in December 2007.

Lloyds of London was given permission to operate in China in 2005.

Advertising, See Media, Arts, Media and Sports

Government and Military Businesses in China

Chinese government agencies and the military were big players in the market economy in the early years of the Deng reforms. The People's Liberation Army was part owner of Shanghai's most popular disco; the State Security Ministry ran a bakeries and dry cleaning establishments that catered to foreigner in Beijing; and the Public Security ministry ran shops selling night sticks and cattle prods.

Chinese government agencies and the military were big players in the market economy but more behind the scenes, helping to arrange sweetheart deals with developers and contractors and finding niche businesses for themselves.

The Communist Party frequently has seats on boards of directors and keeps veto power over personal decision..

See Macroeconomic; See Military

Prime real estate in Pudong in Shanghai

Powerful Chinese Businessmen

See Rich, Society, People and Life

By the mid 2000s a powerful group of Chinese-born investment bankers — most of whom who had grown up in the Cultural Revolution — exerted a great deal of influence on investment strategies. All the major American investment banks — Goldman Sachs, Morgan Stanley and Citigroup — had their own Chinese-born stars, some of whom were paid $10 million a year for their expertise.

Among these were Erhfei L:iu of Merrill Lynch, who played a role behind the scenes in the Lenovo-IBM deal; and Charles Li of J.P Morgan and Fang Fenglei of Goldman Sachs who were involved in Cnooc’s attempt to takeover Unocal. It is not clear how much they are valued for their banking skills or for their ability to navigate through the Chinese bureaucracy.

Some have made killlings. Andre Yan and Jung Huang of Softbank Asia Infrastructure invested $40 million in an online gaming company in Shanghai called Shanda in 2003. In January 2005, they sold their stake for $500 million.

Chinese Companies Dominate Forbes Asia’s “Best under a Billion” 2011 List

Chinese and Hong Kong companies steal the limelight on Forbes “Asia’s Best Under a Billion‟ in 2011 Forbes reported. Out of 200 companies on the list, 65 companies from these markets showed exceptional sales and earnings growth. The list ranks public companies in the Asia Pacific region with annual revenue between $5million and $1 billion. They are also screened for return on equity. [Source: Forbes, September 8, 2011]

Tim Ferguson, editor of Forbes Asia, said: “Essentially these are our picks of the companies that have best managed through the economic volatility that began in 2008. Most navigated the global credit crunch with little to no debt on their balance sheets. On average, the companies on the list have a 13 percent debt-to-equity ratio, and 67 of these companies carry no debt at all.” 21 of the 65 Chinese and Hong Kong companies on the list are returnees from last year. On average sales among them grew 43 percent over the last 3-year period; earnings per share grew 50 percent over the same time.

The winning companies include 361 Degrees International, which manufactures sporting goods, Alibaba.com, the business-to-business e-commerce technology company, Changchun Faway Automobile Components, and China Donxiang Group, maker of sports apparel, footwear and accessories. Three Chinese companies outgrew the list from last year: branded sport-wear maker, Anta Sports Products, Web-service provider, Baidu, and knitwear manufacturer, Shenzhou International Holdings.

A 10th century peddler

Chinese Entrepreneurial Spirit

According to Global Entrepreneurship 14 percent of the population was involved in starting business in the previous 48 months compared to 2 percent in Japan and 12 percent in South Korea.

China lead the world in trademark applications. In 2007, China’s trademark office received 780,000 registrations, the most in the world for a sixth consecutive year,

The entrepreneurial spirit of the Chinese displays itself in modest ways in the countryside. One National Geographic reporter met a young boy and his grandfather who bought baby ducks in Chongqing in Sichuan Province for about nine cents a piece then walked for three months to the grandfather's hometown of Chengdu, with the ducks growing fat eating what they could find along the roadside. When the boy and the grandfather arrived in Chengdu they sold the ducks for ten times what they paid for them in Chongqing. To pay for their expenses along the way, they sold eggs. Cracked or broken eggs were eaten by the boy and his grandfather.

Even the men who clean the rest rooms are looking for business opportunities. Some ideas haven’t panned out such as one in which someone suggested combining a plastic surgery clinic with tailor shop that make alterations on the clothes of patients who have just had operations.

Budding entrepreneurs have difficulty securing loans from banks and thus rely on borrowing money from relatives and friends to start up businesses. Many men have borrowed money from a relative to buy a small truck and charged people for hauling stuff around. With that money they purchase bigger trucks and with that money more trucks and drivers until they have a small trucking company.

Describing the Chinese entrepreneurial spirit Michael Dunne, an automotive consultant told The New Yorker, “The Chinese are a little like Americans. They want the touchdown, They want the home run...But I don’t see the patience and perseverance. It’s more like, we can leapfrog.”

In a speech in March 2004, Chinese President Hu Jintao promised to cut red tape for entrepreneurs.

10th century market

Entrepreneurial Successes and Failures in China

In 1989, two brother in Guiyang took a $1,200 loan and threw into a beef jerky business. By 1998, the business had sales of $6 million and employed 250 people.

Success often comes through hard work. A man who made a fortune in the furniture business in Xinjiang told National Geographic, "I am in the confused generation." He bragged about his plans to build apartment buildings and the complained, "I work all the time. I do not have time for anything but work."

Guangdong Investment Ltd., a China-based enterprise, was worth $5 million in 1987 and $1 billion in 1997.

Shi Yuzhu made a killing after he invented software that easily wrote and edited Chinese characters. With his profits he diversified into a number of businesses almost of all of them lost money. Particularly devastating was an investment to build a 72-floor skyscraper. Shi later told the Los Angeles Times, “Westerners used a couple of hundred years to practice and perfect capitalism...In terms of experience we have only graduated from kindergarten.

One small time liquor manufacturer spent $39 million for a prime time advertising slot following the CCTV news. The price tag was more than six times the revenue of his company. Orders pouring but the company couldn’t keep up with demand so it repackaged cheap wine. When scheme was uncovered, buyers stopped buying and the company collapsed.

See Rich

China’s Lack of Brand Power and Innovation

John Pomfret wrote in the Washington Post: “Quick: Think of a Chinese brand name. Japan has Sony. Mexico has Corona. Germany has BMW. South Korea? Samsung. And China has . . . “ If you're stumped, you're not alone. And for China, that is an enormous problem. No big marquee brands means China is stuck doing the global grunt work in factory cities while designers and engineers overseas reap the profits. Much of Apple's iPhone, for example, is made in China. But if a high-end version costs $750, China is lucky to hold on to $25. For a pair of Nikes, it's four pennies on the dollar. [Source: John Pomfret, Washington Post, Tuesday, May 25, 2010]

"We've lost a bucketload of money to foreigners because they have brands and we don't," Fan Chunyong, the secretary general of the China Industrial Overseas Development and Planning Association, told the Washington Post. "Our clothes are Italian, French, German, so the profits are all leaving China. . . . We need to create brands, and fast."

"Moving forward another 10 years," Kenneth J. DeWoskin, chairman of Deloitte's China Research and Insight Center, told the Washington Post. "It's hard to see how viable Chinese companies will be if they just stay in China." The problem is exacerbated by China's lack of successful innovation and its reliance on stitching and welding together products that are imagined, invented and designed by others. A failure to innovate means China is trapped paying enormous amounts in patent royalties and licensing fees to foreigners who are.

“China also faces enormous challenges to creating globalized firms,” Pomfret wrote. “Studies of Chinese executives show that they spend far more time with government officials — who in China are the key to their profits — than with customers, who are the key to international success. "Chinese executives like me need to spend a generation outside China to learn how business is done around the world," said Hua Dongyi, who chairs a massive Chinese mining company in Australia but has also built roads in Algeria and infrastructure in Sudan. That's definitely true for Hua. In April, he was forced to apologize to his Australian workers after he told Chinese media that the workers were money-grubbing and lacked the "loyalty and sense of responsibility existing in many Chinese enterprises."

Innovators Stymied in China: Why is There bo Steve Jobs in China

After the death of Apple’s Steven Jobs, Li Yuan wrote in the Wall Street Journal: Millions of Chinese flooded the popular micro blogging site Sina Weibo to tweet their condolences on the death of Steve Jobs over the past two days. They also raised the question: Why isn't there a Steve Jobs in China? The tone of the resulting discussion was almost unanimously pessimistic. As is always the case on the Chinese Internet, the discussion quickly moved to talk about the problems in China's political, economic and legal systems. Wang Wei, chairman of the Chinese Museum of Finance, tweeted, "In a society with an authoritarian political system, monopolistic business environment, backward-looking culture and prevalent technology theft, talking about a master of innovation? Not a chance! Don't even think about it." [Source: Li Yuan, Wall Street Journal, October 8, 2011]

China may be the manufacturer of the world, but many are frustrated that Chinese companies are better at knocking off others' original work than coming up with innovative ideas. The commemoration of Mr. Jobs' genius highlighted the dilemma. Chinese companies themselves will perform as well as Apple Inc., but their products won't match up, Kai-Fu Lee told his eight million followers on Weibo. "Chinese companies can be expected to have the market valuation and business model like Apple's within a decade, but it will be difficult to expect any type of Apple-like innovation," he tweeted.

The former head of Google China and founder of a start-up incubator Innovation Works said by phone that Chinese schools focus too much on memorization and don't encourage critical thinking. "It's not that Chinese are not smart or don't have the potential. Look at Jerry Yang of Yahoo Inc. and Steve Chen of YouTube," he said, referring to the two Internet entrepreneurs who were both born in Taiwan and migrated to the U.S. at young ages.

Chen Zhiwu, a finance professor at Yale University, tweeted that in Chinese schools, "The first thing the teachers do is to rub down the edges of those students who are different from the crowd." One of the most popular postings on Mr. Jobs' legacy came from scholar Wu Jiaxiang. "If Apple is a fruit on a tree, its branches are the freedom to think and create, and its root is constitutional democracy," he wrote. "An authoritarian nation may be able to build huge projects collectively but will never be able to produce science and technology giants." On that, Wang Ran, founder of a boutique investment bank China eCapital Corp., added, "And its trunk is a society whose legal system acknowledges the value of intellectual property."

Chinese Government’s Response to a Lack of Brand Power and Innovation

John Pomfret wrote in the Washington Post, “China's government has responded in typically lavish fashion, launching a multibillion-dollar effort to create brands, encourage innovation and protect its market from foreign domination. Through tax breaks and subsidies, China has embraced what it calls "a going-out strategy," backing firms seeking to buy foreign businesses, snap up natural resources or expand their footprint overseas. [Source: John Pomfret, Washington Post, Tuesday, May 25, 2010]

Domestically, it has launched the "indigenous innovation" program to encourage its companies to manufacture high-tech goods by forcing foreign firms to hand over their trade secrets and patents if they want to sell their products there.

Since 2007, thousands of Chinese businessmen have attended government-sponsored seminars on "going out," learning everything from how to do battle with domineering Americans and Britons during conference calls to why a Chinese boss should think twice about publicly humiliating his wayward foreign workers — as he'd do to his staff at home.

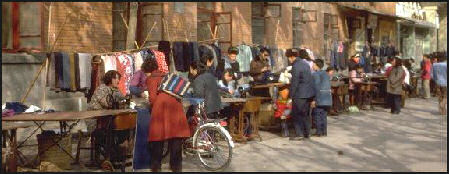

Small sewing businesses

Small Businesses in China

There are at least 10 million private business owners. Many of them worked for the state at one time and used their life savings to buy stakes in their companies when they were privatized or started up new businesses. There are millions more independent traders, merchants and street hawkers.

Small and middle-size enterprises account for 99.6 percent of all Chinese enterprises, creating about 60 percent of the nation’s output and 75 percent of the urban and new jobs.

Small businessmen tend to be supportive of the Communist Party because of the stability it brings. They spend a great deal of time cultivated good relationships with local party officials and one their biggest expenses is entertaining them.

In the cities people can start businesses with little interference or oversight from the government. Raising financing can be a problem Small businesses have problems getting loans because they have little credit history, or appropriate collateral and the banking system is set up primarily to help large state-run companies. Many take out loans form pawn shops.

See Self Employment. Labor

Budding entrepreneurs have tried Amway, selling old phone cards through direct marketing and raising leeches in shallow ponds. In cities you can find many businesses with English names such as Gold Haircut, Well-Off Restaurant, Current Bathroom. [Source: New Yorker]

Door-to-Door Sales in China

China banned direct door-to-door sales in 1998 because unscrupulous sellers and pyramid schemes. In 2005, after a seven year ban, door-to-door sales was allowed.

Businesses that relied on door-to-door sales such as Amway, Avon, Tupperware and Mary Kay did very well in the 1990s. In 1998, Amway had 92,000 sales representatives that brought in almost $100 million in sales.

After 1998, Amway sales plummeted 50 percent but later it recovered. Amway spent $29 million on stores in China and invested $200 million in a Guangzhou factory, It used its sales force of 180,000 to bring people to the stores. Amywyt recorded $2 billion in sale sin 2004.

Avon opened up 5,700 stores. It sellers shrunk from 250,000 to 20,000 and sales declined.

See Avon, Beauty, People and Life

Family Style Chinese Businesses

In his book The Spirit of Chinese Capitalism, Gordon Redding wrote, "The Chinese family business...is peculiarly effective and a significant contributor to the list of causes of the East Asia miracle." Chinese-owned companies are often family run and have family members, other relatives or family friends in all the management positions. This contrasts with Western corporation which generally rely on professional managers. One Chinese businessman told the Washington Post, "We mostly hire people because he family knows them, or because they're introduced by a family member. That way you can find someone you can trust. Chinese find it not so easy to trust other people."

Many Chinese companies are run by old patriarchs backed up by Western-educated sons and daughters. The Chinese family system is much more effective in simple organizations like shipping, real estate and the production of low-market goods such as shoes and electronic but is not as effective in sophisticated organization that spend a lot on research and development and design high-tech products.

Confucian thought adapts itself very well to the hierarchical management style. One of the key components of a Chinese family-run business is trust. The Chinese have a reputation of distrusting people outside their clan or circle. The advantages of the Chinese family system of business are that it keeps management size down and allows quick decisions to be made without lengthy meetings, which in turn allows companies to move quickly into profitable markets. The disadvantages of the Chinese family system of business are that favoritism keeps talent out and family feuds can bitterly divide a company especially after a patriarch dies.

Modest Chinese businesses like noodle restaurants and small shops. are run by husband and wife teams, with children providing labor. Women often play an important role in organizing the finances. Explaining how such a business gets started one Asian businessman told Stanley Karnow in Smithsonian magazine: "Americans make big investment, hire manager, technicians.” Asians “cannot afford that, but wife and children all work hard. At first I keep old job while wife and friend take care of store; later I quit to run business full time. Until last year we are here seven days a week, sometimes until 2 in the morning. Now we are doing OK, so we take Sunday off."

There are critics of the the Chinese family business model. One Chinese businessmen said that many Chinese businessmen suffer from the “Chinese restaurant syndrome” in that “they are contents with small-scale enterprises; they are happy to making a living. But Jewish people want to be the best and make a huge company.”

Maoist Management Classes

Some young businessman are studying Maoism and incorporating its ideas about military strategy and leadership into operating their business. One 29-year-old entrepreneur told the China Daily Mao Zedong helped him set directions in life and run a business. “I grew up in a rich family. Money was never an issue, but I lacked motivation,” he said. “I learnt from Chairman Mao's personal experience that pursuit of excellence.” [Source: Wang Wei, China Daily, July 20, 2010]

According to the China Daily, “Since the credit crunch in 2007 in the United States and the following worldwide financial crisis, courses such as Western economics and Western management have become a rare thing at business schools and, instead, Maoism is back on the books.

Peking University, Beijing Huashang Institute of Management (BHIM) and Jucheng China all offer courses in Maoism. Each class of 60 to 200 second generation of entrepreneurs normally goes to Jinggangshan, where Mao established the People's Liberation Army of China to study and experience the hardship of the beginning of Chinese revolution.

When Chairman Mao was establishing the People's Liberation Army of China, he was short of talent, money and experience, putting him in a somewhat similar situation to many entrepreneurs trying to set up their own companies, said Yuan Qingpeng, director of BHIM, which was the first school in Beijing to introduce Maoism management classes.

He said Mao made great achievements because he believed in unity of thought, executive ability, democratic management, scientific organization structure and cultivating talent, all of which are applicable to successfully operating a company. “If a company wants to develop in China, it has to adapt to the country's culture. Mao's thought is deeply rooted in Chinese people's mentality and culture,” he said.

Mao's military tactics and philosophy are also useful for a company's development, according to Yuan. Changbaishan Wine Group attempted to penetrate into first-tier cities in China such as Beijing and Shanghai, but failed, said Yuan. Then the company switched its focus to second-tier cities such as Qinhuangdao and Chengde. The alcohol was well-accepted in the small cities and eventually won customers in big cities. “It is similar to Mao's theory: using the rural areas to encircle the cities,” he said. “If you can't directly conquer clients in major cities, take an alternative way.”

Shady Business Practices in China

See Business Customs

Business Scams in China

Guangdong International Trust and Investment Corporation (GITIC) was China's premier investment firm. It declared bankruptcy in 1999 with assets of $2.58 billion against debts of $4.35 billion. It was the biggest bankruptcy since the Communists took power in 1949. The bankruptcy was largely blamed on diverting money into investment scam, property schemes and an overvalued stock market.

In an effort to quadruple beer production, the Tsingtao Brewery raised $190 million by selling stocks then used the half the money for investment not plant expansion — which was why they were given the money — and failed to give an explanation to stock holders.

In February 2007, a businessman named Wang Zhendng, was sentenced to death for swindling 36,000 investors in 12 towns in northeastern Liaoning Province out around $1,300 each on boxes of ants. The ants, it was claimed, could be made into valuable medicines and wines, but in reality were only worth about $25. Using a pyramid scheme arrangement Wang promised investors a 40 percent annual return if they took care of the ants properly and was able to collect $440 million.

Pyramid schemes are a big problem in southern China. In 1995, the Chinese government passed a law against them after the state lost $380 million to a pyramid scam in central Wuxi. In April 2007, 14 people were arrested for swindling people in a pyramid scheme that took in over $200 million. The suspects who worked for a wood company, promised investors high returns on investments on the sale of woodlands.

See Tsingtao.

The novelist Lu Liang jailed for convincing investors to invest $241 million in China Venture Capital, a company touted as a high-tech sure-thing. The company was hyped by the media, causing its shares to rise from about $2 a share to $10 a share. Liang was jailed and the investors lost their shirt when the company turned to be a money-losing chicken breeder.

Image Sources: 1) CNTO; 2) Johomaps; 3, 4, 6) University of Washington; 4) Huron Report; 7) Nolls China website http://www.paulnoll.com/China/index.html ; Liu Bolin, China’s Invisible Man artist, Global Times Chinese: photo.huanqiu.com http://photo.huanqiu.com/creativity/unlimited/2010-11/1254288.html

Text Sources: New York Times, Washington Post, Los Angeles Times, Times of London, National Geographic, The New Yorker, Time, Newsweek, Reuters, AP, Lonely Planet Guides, Compton’s Encyclopedia and various books and other publications.

Last updated April 2012