SOLAR ENERGY IN CHINA

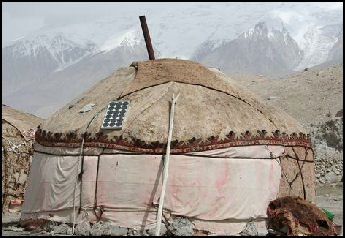

Solar-powered yurt Solar power was China's fourth-largest source of electricity at the end of 2020 — after coal, hydropower and wind — accounting for about 3 percent of total power generation, roughly half that of wind energy. In 2018, solar power accounted for roughly 3 percent of China's electricity generation and 9 percent of China's power capacity. China gets 18 percent of its electricity from renewable sources other than hydropower (percent of total installed capacity (2017 est.), 46th in the world. [Source: Chinese Climate Policy; CIA World Factbook, 2022]

China had 43 gigawatts of solar capacity in 2014, when solar energy accounted for 0.7 percent of power generation. Grid issues meant that electricity from some projects was wasted. According to Bloomberg: The nation began to see the issue of idled capacity crop up in 2015 with power generated from solar farms in the northwest. The situation was the most severe in Gansu with an idle rate of 31 percent, followed by Xinjiang. [Source: Bloomberg News, August 24, 2016]

Solar power is the fastest-growing electric generation source in China. Net generation in 2018 was 178 Terrawatt hours, 51 percent higher than in 2017. Inadequate transmission capacity has curtailed some solar generation from reaching the grid. As with wind projects, the government is setting policies to limit new solar projects in regions that have low utilization and high curtailment rates. China has been reducing the subsidies for solar power investments since 2016, especially in utility-scale projects, to alleviate some of the current overcapacity. In December 2018, a 500 MW solar project in Qinghai became the first in China to sell electricity for less than the benchmark price for electricity from coal. [Source: U.S. Energy Information Administration country analysis briefs, September 30, 2020]

According to Associated Press: Beijing has spent tens of billions of dollars on building solar farms to reduce reliance on imported oil and gas and clean up its smog-choked cities. China accounted for about half of global investment in solar in 2020. Still, coal is expected to supply 60 percent of its power in the near future. [Source: Joe McDonald, Associated Press, April 24, 2022]

Electricity: from other renewable sources: 18 percent of total installed capacity (2017 est.), 46t in the world. [Source: CIA World Factbook, 2022]

Adam Minter of Bloomberg wrote: In its impatient drive to become a leader in renewable energy and conservation, China often underinvests in the infrastructure needed to realize its ambitions. Much of the energy generated by China's solar energy never reaches consumers because the electric grid lacks the capacity to transmit it. A significant amount of new capacity isn't even hooked up to the grid. In sunny, vast Xinjiang Province, more than half the solar power generated simply goes to waste. [Source: Adam Minter, Bloomberg, March 2, 2017]

See Separate Articles: SOLAR POWER: PHOTOVOLTAIC CELLS, WATER HEATERS, HIGH COSTS AND SUNSIDIES factsanddetails.com ENERGY IN CHINA: GROWTH, INEFFICIENCY AND CONSERVATION factsanddetails.com; RENEWABLE ENERGY AND GREEN TECHNOLOGY IN CHINA factsanddetails.com; DAMS IN CHINA: HYDROPOWER AND BIG PROJECTS AND DISASTERS factsanddetails.com; WIND ENERGY IN CHINA factsanddetails.com; Articles on ENERGY IN CHINA factsanddetails.com ; U.S. Energy Information Administration Report on Energy in China eia.gov/international/analysis ; China Sustainable Energy Program efchina.org ; Suntech suntech-power.com ; Wikipedia article on Wind Power in China Wikipedia ; Solar and Alternative Energy Products made-in-china.com ; Articles on Renewable Energy in China martinot.info ; New York Times Article on China’s Leadership in Clean Energies nytimes.com

RECOMMENDED BOOKS: “Wind and Solar Energy Transition in China” by Marius Korsnes (2019) Amazon.com; “China's Wind and Solar Sectors: Trends in Deployment, Manufacturing, and Energy Policy” by Iacob Koch-Weser, Ethan Meick, et al. (2015) Amazon.com; “China's Green Energy and Environmental Policies” by U.S.-China Economic and Security Review Commission (2010) Amazon.com; “Energy, Environment and Transitional Green Growth in China” by Ruizhi Pang, Xuejie Bai, et al. (2020) Amazon.com; “Energy Policy in China” by Chi-Jen Yang (2017) Amazon.com; “China’s Electricity Industry: Past, Present and Future” by Ma Xiaoying and Malcolm Abbott (2020) Amazon.com; “The Politics of Nuclear Energy in China” by X. Yi-chong Amazon.com

Solar Power Industry in China

China is the world’s largest manufacturer of solar panels. Chinese companies have a 30 percent cost advantage over American and European firms in producing solar technology according to Goldman Sachs. China lags behind Europe. the U.S. and Japan in terms of instillation. Even after tripled its instillation of solar cells in the early 2010s it still trailed behind Germany, Italy, United States and Japan . The Chinese government has said it will pay up to 70 percent of the cost for new solar power systems. The aim is boost China’s solar industry. The state-rim China Development Bank agreed in 2010 to lend as much as $17 billion to the large solar companies Yingli, Suntech and Trina for development. They ultimately suffered under the huge debt they accrued.

The solar energy industry in China is fragmented but quite large. According to Caijing, there were around 1,000 solar-related firms in China in the early 2010s and they employed about 400,000 people. The industry employed 250,000 people, about an eight of all those employed in China’s renewable energy industry, in the 2000s. At that time seven of the world's top 10 solar panel makers were Chinese.

China’s share of the solar module industry grew from 7 percent in 2005 to 25 percent in 2009. The entrance of China into the solar power industry has had wide and rapid global consequence and helped to significantly reduce the cost of solar power. According to the California Solar Initiate, only 2 percent of the roof top module used in 2007 were Chinese. In the forth of quarter of 2009, according to Nathaniel Bullard of New Energy Finance, the figure was 46 percent. [Source: The Economist, April 2009]

Not only have Chinese solar companies done well in their own right. Many foreign companies have outsourced production to China. Marc Pinto of Applied technology told The Economist in 2009 half the world’s production capacity is already in China, with two thirds of growth in capacity in 2010 expected to be in China.

Growth of the Chinese Solar Energy Industry

Solar power in Xinjiang China's solar industry took off around 2000 with generous support from the central and local governments wanting to get in on ther ground floor of a industry ready to take off. One of the first big Chinese solar companies, Suntech Power Co., was established in 2001 with money from a government-linked company in Wuxi, Jiangsu Province and financial support for technological development from the central government. [Source: Yasushi Kouchi, Yomiuri Shimbun, October 30, 2012]

Solar power generation spread rapidly after Germany adopted a system in 2000 in which the government purchased renewable energy at fixed prices. Low-priced Chinese products drove many German firms out of the market. Q-Cells AG, a major German solar panel maker, went bankrupt in April 2012. A similar thing happened In the United States where domestic solar panel makers have collapsed one by another, again mainly as a result of being outpriced by Chinese manufacturers. When the California Solar Initiative started in 2007 only 2 percent of the models sold were Chinese. In the first quarter of 2009 the figure was 46 percent according to New Energy Finance.

According to NPD Solarbuzz, a U.S. solar market research company, the production capacity of Chinese solar panel firms accounts for about 60 percent of the world market in 2011. It is believed that about 80 percent of the products made in China are exported to Europe and about 10 percent to the United States, with only a few percent being sold domestically.

According to Caijing, an influential Chinese magazine, other Chinese solar companies have received preferential government treatment, such as exemptions in fees related to securing factory sites. The Chinese solar industry remained strong until 2011 when many leading panel makers started posting deficits, primarily due to price wars with other Chinese companies that had increased production. Supply outstripped demand, and the industry was also hit when Germany lowered the prices it offered for renewable energy.

Solar Panel Glut Strains the Chinese Solar Industry

In 2012, the New York Times reported: Though worldwide demand for solar panels has grown rapidly since the mid 2000s, China’s manufacturing capacity has soared even faster, creating enormous oversupply and a ferocious price war. The result is a looming financial disaster, not only for manufacturers but for state-owned banks that financed factories with approximately $18 billion in low-rate loans and for municipal and provincial governments that provided loan guarantees and sold manufacturers valuable land at deeply discounted prices. [Source: New York Times, December 4, 2012]

“China’s biggest solar panel makers are suffering losses of up to $1 for every $3 of sales this year, as panel prices have fallen by three-fourths since 2008. The outcome has left even the architects of China’s renewable energy strategy feeling frustrated and eager to see many businesses shut down, so the most efficient companies may be salvageable financially. In the solar panel sector, “If one-third of them survive, that’s good, and two-thirds of them die, but we don’t know how that happens,” said Li Junfeng, a longtime director general for energy and climate policy at the National Development and Reform Commission, the country’s top economic planning agency.

“GTM Research, a renewable energy consulting firm in Boston, estimates that Chinese companies have the ability to manufacture 50 gigawatts of solar panels in 2012, while the Chinese domestic market is on track to absorb only 4 to 5 gigawatts. Exports will take another 18 or 19 gigawatts.

“The enormously expensive equipment in solar panel factories needs to be run around the clock, seven days a week, to cover costs. To reduce capacity, foreign rivals have clamored for China to subsidize the purchase of more solar panels at home, instead of having Chinese companies rely so heavily on exports. But the government here is worried about the cost of doing so, because the price of solar power remains far higher than for coal-generated power. The average cost of electricity from solar panels in China works out to 19 cents per kilowatt-hour, said Mr. Li. That is three times the cost of coal-fired power. But it is a marked improvement from 63 cents per kilowatt-hour for solar power four years ago.

Solar Industry in China Picks Up in the 2010s with Government Support

In the early 2010s, China began doing more to promote domestic use of solar energy. Bloomberg reported: “China is promoting both large solar farms in remote areas and smaller, rooftop systems within cities, and domestic demand for panels is climbing. In November 2014, China set a target of getting as much as 20 percent of its energy from clean sources by 2030. That goal will rely heavily on its rapidly growing solar industry, which controls about 70 percent of the global market. [Source: Bloomberg, January 19, 2015]

China became the world’s biggest solar market in 2013 and accounted for about a quarter of global solar additions in 2014, according to Bloomberg New Energy Finance. Its total solar installations surged almost 10-fold in the past three years to about 33 gigawatts. Most of China’s solar farms have been built since 2012, when the nation started boosting domestic demand, in part to aid manufacturers as orders from Europe started to slow.

In 2015, flaws were found in some Chinese solar panels that could significantly reduce their efficiency and ability to generate electricity. Almost a third of 425 utility-scale solar farms surveyed by the Beijing-based China General Certification Center from 2012 to 2014 had flaws of some sort, according to an official at the center who asked not to be identified because he isn’t authorized to speak publicly on the matter.

Tarriffs and Lawsuits Aimed at the Chinese Solar Industry

In the 2010s, solar and other renewable energy technology emerged as an irritant in U.S.-Chinese trade. The two governments had pledged to co-operate in development but accused each other of violating free-trade pledges by subsidizing their own manufacturers.In October 2011 seven American solar panel makers filed a trade case against China accusing the Chinese solar industry of receiving unfair government subsidies and dumping its products in the United States at below cost. The companies that filed the complaint said massive subsidies by the Chinese government enable Chinese producers to drive out U.S. competition, and asked for tough trade penalties on Chinese solar imports. In 2012, the U.S. government has decided to impose antidumping tariffs on Chinese solar panels and the European Union launched an antidumping probe into Chinese solar panel manufacturers. [Source: New York Times, AP]

The issue caused a split in the solar industry. US solar panel makers had asked the government to impose steep tariffs on Chinese imports as they are struggling against stiff competition and lower prices from China. A majority of US solar panel installers opposed the tariffs, arguing that less expensive imports have helped make solar panels more affordable for US customers and this helped promote rapid growth of a clean-energy industry.,

According to the Los Angeles Times: “A close look at the U.S. solar industry suggests that the tariffs may actually be a job killer because the vast majority of positions in the sector aren't on the assembly line. Instead, upward of 70 percent of U.S. solar employment is in installation, sales and distribution — and companies that hire those workers argue solar cells must get significantly cheaper to remain competitive with other energy sources. [Source: Ken Bensinger, Los Angeles Times, April 23, 2012]

In the end the The United States dealt a blow to U.S. manufacturers of solar panels and helped U.S. solar installers — and Chinese solar companies — by setting "surprisingly low" China solar panel duties of less than 5 percent on imports from China. After that the U.S. and Europe pursued the issue through anti-dumping complaints and investigation through the World Trade Organization (WTO) and other organizations. [Source: Reuters, March 20, 2012]

Polysilicon and Dangerous Chemicals From Solar Manufacturing

Polysilicon, technically known as Polycrystalline silicon, or multicrystalline silicon, is a high purity, polycrystalline form of silicon and the main raw material for solar panels and photovoltaic (PV) cells. It is produced from metallurgical grade silicon by a chemical purification process, called the Siemens process. This process involves distillation of volatile silicon compounds, and their decomposition into silicon at high temperatures. Polysilicon is the key resource in the crystalline silicon based photovoltaic industry and used for the production of conventional solar cells. Since 2006, over half of the world's supply of polysilicon has been used in PV manufacturing. The solar industry was suffered a severe blow in 2007 when a polysilicon shortage forced the industry to idle about a quarter of its cell and module manufacturing capacity. Only twelve factories were known to produce solar-grade polysilicon in 2008; however, by 2013 the number increased to over 100. [Source: Wikipedia]

Solar-energy magnate Zhu Gongshan told the Wall Street Journal that the shortage of polysilicon threatened China's burgeoning solar-energy industry in 2007. After that polysilicon prices soared, hitting $450 a kilogram in 2008, up tenfold in a year. Foreign companies dominated production and were passing those high costs onto China. Beijing's response was swift: development of domestic polysilicon supplies was declared a national priority. Money poured in to manufacturers from state-owned companies and banks; local governments expedited approvals for new plants. [Source: Jason Dean, Andrew Browne and Shai Oster.Wall Street Journal, November 16, 2010]

In the West, polysilicon plants take years to build, requiring lengthy approvals. Mr. Zhu, an entrepreneur who raised $1 billion for a plant, started production within 15 months. In just a few years, he created one of the world's biggest polysilicon makers, GCL-Poly Energy Holding Ltd. China's sovereign-wealth fund bought 20 percent of GCL-Poly for $710 million. By 2010, China made about a quarter of the world's polysilicon and controlled roughly half the global market for finished solar-power equipment.

See Villagers Protest Chinese Solar Factory Pollution Under ENVIRONMENTAL PROTESTS IN CHINA factsanddetails.com

Large Solar Farms in China

Huanghe Hydropower Hainan Solar Park, China was ranked the second largest farm solar in the world in 2021, with 2,200 MW. Located in Qinghai Province of China and developed by Huanghe Hydropower Development, state-owned utility company, it went online in September 2020. The long term plan for this project is for its capacity to reach am incredible 16 GW. The plant also includes 202.8 MW/MWh of storage capacity. [Source: YSG Solar]

Tengger Desert Solar Park was ranked the fifth largest solar farm in the world in 2021, with 1,547 MW. Located in Ningxia, it occupies 1,200 square kilometers of the 36,700 square kilometers Tengger Desert. The project is owned by China National Grid and Zhongwei Power Supply Company. It went online in 2017 and supplies power for over 600,000 homes.

Datong Solar Power Top Runner Base was ranked the ninth largest solar farm in the world in 2021, with 1,000 MW. Even thought it is far from finished itis already one of the biggest solar farms in the world in terms of capacity. An additional 600 MW is currently under construction and the long-term plan is for its total capacity to reach 3 GW.

Longyangxia Dam Solar Park was ranked the 11th largest solar farm in the world in 2021, with China 850 MW. Located at the Longyangxia Dam hydropower station on the Yellow River in Gonghe County, Qinghai province, it was built in a series of phases, beginning with 320 MW in 2013. This solar farm works in conjunction with the hydroelectric power station located at the same site. The dam was commissioned in 1992. The solar project covers 9.16 square kilometers of land and forms part of the one of the largest hybrid hydro-solar PV power stations in the world. Construction by the solar plant began in March 2013 and was completed within nine months. Construction of phase II commenced in August 2014 and was completed in late 2015, raising the capacity to 530 MW. It was ranked as the worlds’ fourth largest solar plant in 2016. Golmud Solar Park is a 560MW photovoltaic park also located in the Qinghai Province, China. The site was built in 2009 and commissioned in October 2011. It was ranked as the worlds’ fifth largest solar plant in 2016. [Source: imeche.org, May 4, 2016]

The Sungrow Huainan Solar Farm was once the world's largest floating solar plant. Located five kilometers km southwest of Nihe Town, Huainan city in Anhui province, the array floats on an artificial lake, created on the site of a former coal mine, and has a capacity of 40 MW. The array consists of 166,000 panels and was built by Sungrow Power Supply. It produces enough energy to power 15,000 homes. The benefits of floating solar arrays include: lower temperatures boosting power efficiency; the lack of dust meaning it can stay clean longer; using the water to clean the panels; and reducing water evaporation. [Source: Wikipedia]

Top Solar Companies in China

Suntech solar panels JinkoSolar is a holding company that produces solar cells, modules and other materials related to solar energy. It is among the top producers of solar panels globally by gigawatts (GW) delivered. Jinko produces a wide range of solar and storage products for use in projects of all sizes. Jinko Solar shipped 3.79-4.51 gigawatts (GW) in 2015, 6-6.5 gigawatts in 2016, 11.4 gigawatts in 2018 and 14.2 gigawatts in 2019. The company serves customers in China, the U.S., Europe, the Middle East, and South America. It has opened a manufacturing location in Jacksonville, Florida to help meet U.S. demand its their products. In 2020 its revenues were $4.6 billioni; ts net income was $163.1 million and its market cap was $909.9 million. [Source: Wikipedia; Energy Sage; Investopedia]

Trina Solar produces solar products for residential, commercial, and utility-scale projects. Founded in 1997, it has a total shipment capacity of 9.0 GW. Its products include a 210mm silicon cell panel and a solar tracking devise for large-scale installations. Trina Solar shipped 4.55-5.79 gigawatts in 2015, 8.1 gigawatts in 2018 and 9.7 gigawatts in 2019.

Yingli Green Energy Holding Co. is a holding company that conducts research, designs, builds, and sells photovoltaic modules through its subsidiaries. Launched in the late 1990s, it began making solar cells in the early 2000. Yingli Solar shipped 2.35-2.4 gigawatts in 2015. In 2020 its revenues were $1.2 billion and lost $496 million.

GCL-Poly Energy Holdings is a Hong Kong-based company that manufactures polysilicon for use in solar power products. The company also operates cogeneration plants in China. In 2020 its revenues were $2.8 billioni; ts net income was -$32.6 million and its market cap was $756.9 million. GCL System Integration Technology shipped 4.1 gigawatts in 2018 and 4.8 gigawatts in 2019.

Chinese Xinyi Solar Holdings mainly involved in manufacturing solar glass. Engaging in R&D, manufacturing, technical sales, and similar services, Xinyi is a holding company that operates globally and provides its products and services through subsidiaries, In 2020 its revenues were $1.2 billion; its net income was $368.5 million and its market cap was $10.5 billion.

RenaSola shipped 2.69 gigawatts in 2015. In August 2009, it was awarded a deal to develop a $700 million, 150-megawatt solar power plant near the city of Wuzhong in Ningxia in northern China. The move was particularly important for ReneSola, because it allowed the company to move from being a manufacturer of solar wafers, cells and modules into a scheme developer. Analysts at Goldman Sachs singled out ReneSola, formally based in the British Virgin Islands but with all its manufacturing operations in China, as an attractive investment. Renesola acquired rival JC Solar in 2009 and after that ramped up its annual polysilicon production capacity, which reached 2,900 in 2010 compared to 400 to 500 tons in 2009. [Source: Terry Macalister, The Guardian, August 20, 2009]

Top Solar Panel and Cell Makers in China

JA Solar produces budget solar panels Founded in 2005 and based in Fengxian, China, where its main manufacturing hub is located, its half-cell technology falls into the mid-range for efficiency but they do outperform most of their mid-range competitors. JA Solar shipped 3.38-3.93 gigawatts in 2015, 5.2-5.5 gigawatts in 2016, 8.8 gigawatts in 2018, 10.3 gigawatts in 2019 and 10.8 gigawatts in 2020..

LONGi Solar is one of the world’s largest manufacturers of high-efficiency monocrystalline solar cells and panels. Headquartered in Xian, it was was founded in 2000.Longi Solar shipped 7.2 gigawatts in 2018, 9 gigawatts in 2019 and 14.7 gigawatts in 2020.

Tongwei Solar is one of the largest crystalline silicon solar cell production companies in the world. Founded in 2009, it has four locations in China and is a subsidiary of the large agricultural product company Tongwei Group. They manufacture both polycrystalline and monocrystalline solar cells and panels, shipping 12.1 GW in 2020.

Aiko Solar specializes in the manufacturing of PERC solar cells and makes three primary products: 210 millimeter (mm), 182mm, and 166mm PERC cells. It has capacity of 10.5 GW.

Zhongli is a large Chinese technology conglomerate that owns Talesun Solar, a leading global photovoltaic manufacturer. Talesun produces both bifacial and monofacial solar modules. Its total shipment capacity is 7.4 GW.

Risen Energy shipped 1.24 gigawatts in 2015, 4.8 gigawatts in 2018 and 7 gigawatts in 2019. SFCE (Shunfeng International Clean Energy Limited) shipped 2.28 gigawatts in 2015, 3.3 gigawatts in 2018 and 4gigawatts in 2019.

Suntech

SunTech (SunTech Power) once dominated the Chinese solar industry. Founded in 2000, these days it mainly produces high-powered solar modules designed for large commercial, industrial, and utility-scale installation projects. Its total shipment capacity is 6.3 GW

Suntech was once the world’s leading producers of silicon photovoltaic solar cells. It was valued at $9 billion in 2007, up 300 percent from its public stock offering in December 2005. Its owner Shi Zhengrong, was listed as the seventh richest man in China on the Forbes list in 2006, with a fortune estimated at $1.43 billion.

Shi founded Suntech in Wuxwi near Shanghai in 1992 after earning a Ph.D. in engineering in Australia. By coming up with and developing, in the words of the Wall Street Journal, “first world technology at developing world prices,” he quickly forged Suntech into one of the top four solar cell manufacturers in the world along with Sharp and Kyocera in Japan and BP.

Shi told the New York Times he owesdhis success to Chinese provincial government subsidies and his reliance on low-tech labor rather than high tech machines to make his cells. Suntech cell produced energy at about $4 per watt in 2010. The goal was to reach $2 per watt by 2015. In 2010, roughly 90 percent of the company’s business was abroad but as prices were poised to come down in China it was is ready to expand quickly there.

Bill McKibben wrote in National Geographic in 2011, “New employees are added weekly” at SunTech, “and on their first day on the job they watch Al Gore in An Inconvenient Truth. The young tour guide showing me around the company's headquarters in Wuxi, near Shanghai, paused by the photos of solar panels at base camp on Mount Everest and the portrait of her boss, Shi Zhengrong, named by Time as one of its "heroes of the environment." "It's not only a job," she said, a tear welling in her eye. "I have a mission!" Of course, that tear might have come in part from the air. Wuxi was among the dirtiest cities I'd ever visited: The 100-degree-Fahrenheit air was almost impossible to breathe. The solar array that forms the front of the Suntech headquarters slanted up to catch the sun's rays. Because of the foul air, it operated at only about 50 percent of its potential output.” [Source: Bill McKibben, National Geographic, June 2011]

Collapse of Suntech

But then it all went wrong for SunTech and the company went bankrupt in 2013 partly by being unable to pay back huge loans that helped it grow so fast.. The Economist reported: “Under a charming and tech-savvy founder, Shi Zhengrong, Suntech was a pioneer. It was the first Chinese solar firm to go public, in 2005. Buoyed by official credit and subsidies, it briefly became the world’s largest solar-panel manufacturer by volume. Now Suntech has become a dirty word among sun-worshippers. On March 15th it missed a payment on $541 million-worth of convertible bonds. On March 18th local banks holding the firm’s debt lost patience and sued it. Shortly afterwards a local court declared it bankrupt and ordered debt restructuring to begin. [Source: The Economist, March 30, 2013]

According to Bloomberg: Suntech began the slide “into insolvency in 2009 when customers linked to the founder couldn’t pay their bills and the company booked the sales as revenue anyway, regulatory filings show. Seven buyers backed by an investment firm funded by Suntech and its founder, Shi Zhengrong, accounted for 29 percent of Suntech’s uncollected bills as 2009 ended, according to correspondence between the solar company and the U.S. Securities and Exchange Commission. Those customers hadn’t yet received enough money to proceed with their projects and Suntech (STP) gave them more time to pay, the letters show. [Source: Bloomberg, Linda Sandler, April 3, 2013]

According to The Economist: Suntech stumbled because it ran ahead of the pack. Jenny Chase of Bloomberg New Energy Finance (BNEF), a research firm, argues that solar technology is advancing so quickly that it creates a “last-mover advantage”. She calculates that new photovoltaic (PV) manufacturing plants become obsolete within five years. Another advantage for upstarts is that they can exploit the collapse in global silicon prices, the most important raw material for solar panels. Older firms like Suntech had no choice but to pay $400 or more per kilogram in 2008. Many signed long-term fixed-price contracts. When prices recently touched just $16 per kg, they were as sore as a sunburnt neck.Solar kit keeps getting cheaper and more efficient. So Suntech’s younger Chinese rivals, such as Jinko and Hareon, report much lower costs. They also appear to be less heavily indebted. In theory, as firms with unprofitable and outdated assets go under, leaner ones should flourish. But such consolidation has yet to happen.

Chinese Solar Water Heaters

Solar power in Xinjiang China is a leader in the manufacturing and sale of solar water heaters — relatively unsophisticated, mattress-size, stainless steel devices that use the sun rays to heat water and cost about $220. Used for household purposes such as showering. washing dishes and washing, the device consists of an angled row of cola-colored glass tubes that absorb heat from the sun. The most common models are filled with cold water. As the solar heater is heated, the water rises into an insulated tank where it can remain hot for days. [Source: David Pierson, Los Angeles Times, September 2009]

In Kunming and other places people are installing solar water heaters on the roofs of their homes and apartments, negating the need to burn coal for electricity and heating water. Army outposts have installed solar panels to provide electricity and heat offices and barracks. The energy is especially appreciated in remote border outposts. Solar has helped cut coal consumption by 127,000 tons a year in Tibet.

Models produced by Dezhou-based China Himin Solar Energy Group cost between $190 and $2,250 in 2009 and work even when temperatures are below zero and the skies are filled with clouds or smog. Unlike solar panels that use expensive technology to produce electricity the solar water heaters consist of a row of sunlight-capturing glass pipes angled below an insulated water tank. Sunlight travels freely through the glass, generating heat that is trapped in a central pipe where the heat is transmitted to water. The secret to operating in cold temperature is the vacuum separating the inner tube with its energy-trapping coating from an outer tube.

As of 2009 more than 30 million homes in China had solar water heaters, accounting for two thirds of the world’s solar water heating energy and preventing more than 20 million tons of carbon dioxide from entering the atmosphere. Christopher Flavin of the Washington-based Worldwatch Institute told the Los Angeles Times, “China absolutely dominates the global market and they have done it relatively quietly and without a lot of fanfare. It’s an interesting example of their ability to take technology that was developed elsewhere and adapt it to their market on a scale no one had conceived of.”

In Rizhao, a seaside city in Shandong Province with 2.8 million people, 99 percent of the households use solar water heaters. The devices used there have improved so much over the years some don’t need direct sunlight and function on cloudy or smoggy days. Advanced models have electrical water heaters that switch on during frigid cold days. The heating of water typically accounts for a quarter of the energy used in a building. The use of water heaters is so high in Rizhao because the local government there requires solar water heaters to be installed in all homes and subsidizes their cost. For many families that installed the devices it was the first time they ever had reliable hot water. In Dezhou, another city known for energy conservation, 90 percent of the household and streets are lit with solar-powered lights.

The solar water heater market in China is very competitive. More than 5,000 companies manufacture water heaters there. The president of Gold Giant, one of 150 manufacturers in Rishao, told the Los Angeles Times, “The market is huge but the competition is fearsome.” Another water heater maker has had success with the slogan that his water heater will “take the feathers off a chicken.” The largest in China, Himin Solar Energy Group, got a $50 million investment from Goldman Sachs. Some are looking for export market abroad. The American market, where people use an average of 400 liters of water daily, will be difficult to crack because the heaters don’t heat that much water.

Himin Solar Energy and Its Solar Water Heaters

Himin Solar Energy Group is (or was) the world's biggest producer of solar water heaters, as well as a pioneer in niche products such as sun-warmed toilet seats and solar-powered Tibetan prayer wheels. The company claims to have installed more renewable energy than any other company on Earth. It also opened a low-carbon five-star hotel and Utopia Garden, a gigantic, eco-friendly luxury apartment complex — both with solar-heated pools. [Source: Andrew Higgins, Washington Post , May 17, 2010]

Huang Ming, boss of the company, is known to many as the "sun king," but he said, "I prefer to be called solar madman." "Renewable energy doesn't mean people have to be uncomfortable," Huang told the Washington Post in an interview at his Dezhou corporate headquarters, the Sun-Moon Mansion, a fanlike structure studded with photovoltaic cells and sun-collecting vacuum tubes.

Andrew Higgins wrote in Washington Post: “Huang, an oil industry engineer turned solar energy tycoon, is driving one of China's boldest efforts to promote, and profit from, green technology. A member of China's parliament, he first started tinkering with solar water heaters in the early 1990s after the birth of his daughter, which he said got him thinking about the environment. At the time, he was working in a petroleum research institute and "felt guilty." He later quit the institute and set up his own company. He said he realized that clean energy would work only if the profit motive kicked in: "If it can't make money, this experiment will be a big failure."

“His heating devices, which use vacuum tubes to absorb sunlight, get rave reviews, particularly from re-housed farmers who had no hot water before. "We used to go to bed covered in dust," recalled Wang Fang, a former village resident who lives in a six-story Dezhou apartment block. Instead of going to a communal bathhouse a couple of times a month, she and her family take hot showers at home three times a week.”

Bill McKibben wrote in National Geographic, “Huang estimates that it's erected more than 160 million square feet of solar water heaters. "That means 60 million families, maybe 250 million people altogether — almost the population of the United States," he said. Huang, sells some of the best solar-thermal systems in China, but even he admits that it's fairly simple technology. He says that the key to his company's success has been opening people's minds, which it's done with revival-style marketing campaigns that storm one city at a time. "We do road showing, lecturing, PowerPointing," he said. And now they're harnessing the power of sightseeing too: The Sun-Moon Mansion is merely the anchor of a vast solar city that will soon include a solar "4-D" cinema, a solar video-game hall, a huge solar-powered Ferris wheel, and solar-powered boats to rent from a solar marina.” [Source: Bill McKibben, National Geographic, June 2011]

Image Sources: Wiki Commons, Mongabey; Environmental News; Suntech

Text Sources: New York Times, Washington Post, Los Angeles Times, Times of London, National Geographic, The New Yorker, Time, Newsweek, Reuters, AP, Lonely Planet Guides, Compton’s Encyclopedia and various books and other publications.

Last updated June 2022